Are you looking to dive into the dynamic world of online trading right here in the United Arab Emirates? Whether you are a seasoned financial professional or just starting your journey, navigating the online trading landscape requires a reliable partner and a clear understanding of the local environment. Exness UAE stands out as a premier choice for traders in the Emirates, offering a robust platform, diverse instruments, and unparalleled support tailored to your needs.

The UAE has rapidly emerged as a global financial hub, attracting investors and traders from all corners of the world. With its forward-thinking regulations and vibrant economy, it provides an exciting backdrop for online trading activities. This guide will walk you through everything you need to know about trading with Exness in the UAE, ensuring you have all the essential information to make informed decisions and optimize your trading experience.

We understand that choosing the right broker is a critical step. You need a platform that is secure, user-friendly, and offers the tools necessary to achieve your financial goals. Exness brings years of global experience to the UAE market, providing a seamless and efficient trading environment. From currency pairs to commodities and indices, discover how Exness empowers you to explore numerous trading opportunities from the comfort of your home or office in the Emirates.

- Why Exness Stands Out for Traders in the UAE

- Is Exness Regulated in the UAE? Understanding Compliance

- Exploring Exness Account Types Tailored for UAE Traders

- Why Account Type Matters for UAE Traders

- Comparing Key Account Features

- How to Open an Exness Account in the UAE: A Simple Walkthrough

- Gather Your Essentials: What You Need for Verification

- Your Step-by-Step Journey to Trading

- Managing Funds with Exness UAE: Deposits and Withdrawals

- Depositing Funds with Exness UAE

- Withdrawing Your Profits from Exness UAE

- Exness Trading Platforms: MT4, MT5, and Exness Terminal for UAE Clients

- MetaTrader 4 (MT4): The Industry Standard for Forex

- MetaTrader 5 (MT5): The Next Generation Platform

- Exness Terminal: Intuitive Web-Based Trading

- Understanding Spreads, Commissions, and Leverage on Exness UAE

- Spreads: The Cost of Doing Business

- Commissions: When They Apply

- Leverage: Magnifying Your Market Power

- Advantages of Using Leverage:

- Disadvantages and Risks of Leverage:

- A Wide Range of Instruments Available on Exness for UAE Traders

- Exness Customer Support: Dedicated Assistance for UAE Users

- How Exness Delivers Exceptional Support

- Connect with Exness Support

- Mobile Trading Experience with Exness Apps in the UAE

- Advantages of Trading with Exness Mobile Apps in the UAE:

- Educational Resources and Market Insights from Exness UAE

- What You’ll Discover in Our Educational Resources:

- Unlock Timely Market Insights:

- Exclusive Promotions and Bonuses for Exness UAE Clients

- What Kind of Bonuses Can You Expect?

- The Benefits of Utilizing Exness UAE Promotions

- Claiming Your Rewards: Simple Steps

- Security and Fund Protection Measures at Exness

- Our Commitment to Your Security

- Exness UAE vs. Competitors: What Makes it Better?

- Unmatched Trading Conditions

- Superior Withdrawal Process

- Customer Support That Cares

- Diverse Account Types and Instruments

- Regulatory Compliance and Trust

- Frequently Asked Questions

Why Exness Stands Out for Traders in the UAE

In the vibrant and rapidly growing trading landscape of the UAE, traders consistently seek brokers that offer reliability, cutting-edge technology, and favorable trading conditions. Exness has carved out a significant niche, becoming a preferred choice for many. What makes Exness truly stand out in a competitive market? It’s a combination of factors that cater specifically to the needs of modern traders, from beginners to seasoned professionals, ensuring a seamless and powerful trading experience.

Here are some core reasons why Exness captures the attention of traders across the Emirates:

- Competitive Trading Conditions: Exness is renowned for offering very competitive spreads on a wide array of instruments, including forex, cryptocurrencies, and indices. Low spreads directly impact profitability, making every trade more efficient for users.

- Flexible Leverage Options: Traders in the UAE appreciate the diverse leverage options available, which can be adjusted to match individual risk tolerance and trading strategies. This flexibility empowers them to manage capital effectively.

- Instant Deposits and Withdrawals: Speed and efficiency are paramount in trading. Exness excels in this area, providing instant processing for both deposits and withdrawals through various local and international payment methods. This means traders can fund their accounts and access their profits without unnecessary delays.

- Robust Platform Choices: Whether you prefer the industry-standard MetaTrader 4 (MT4) or the more advanced MetaTrader 5 (MT5), Exness offers both, along with its own user-friendly web terminal and mobile applications. These platforms provide powerful analytical tools, customizable charts, and secure trading environments.

- Excellent Customer Support: Professional, multilingual customer support is available around the clock, ensuring that traders in the UAE receive timely assistance with any queries or technical issues. This dedicated support significantly enhances the trading journey.

- Transparent and Reliable Operations: Trust is a cornerstone of online trading. Exness maintains a high level of transparency in its operations and is known for its consistent execution and reliable services. This builds confidence among its user base.

- Diverse Account Types: Exness offers a range of account types designed to suit different trading styles and capital sizes, including Standard, Raw Spread, and Zero accounts. Each type comes with unique features, allowing traders to choose one that perfectly aligns with their trading goals.

These features collectively contribute to a trading environment that is not only efficient and user-friendly but also highly adaptable to the specific demands of traders in the UAE. Exness consistently strives to enhance its offerings, making it a powerful ally for anyone looking to navigate the financial markets.

Is Exness Regulated in the UAE? Understanding Compliance

Navigating the world of online forex trading requires confidence, and a major part of that confidence comes from knowing your broker operates under strict regulatory oversight. For traders in the United Arab Emirates, understanding if a popular platform like Exness is regulated locally is a critical concern. Let’s dive into the specifics of compliance and what it means for your trading journey. The UAE is a rapidly growing financial hub, attracting a significant number of forex traders. To safeguard investors and ensure market integrity, the country has established clear regulatory frameworks. The primary body overseeing financial services and investment activities, including brokerage firms, is the Securities and Commodities Authority (SCA). The Central Bank of the UAE also plays a crucial role in broader financial stability. Any forex broker aiming to directly serve retail clients within the UAE with a physical presence and local licensing must comply with SCA regulations.So, where does Exness stand? Exness is a globally recognized forex broker known for its competitive trading conditions and diverse range of instruments. While Exness holds licenses from several top-tier global regulatory bodies, such as CySEC (Cyprus Securities and Exchange Commission) and the FCA (Financial Conduct Authority) in the UK for its various entities, it’s important to differentiate between global operations and specific local regulation within the UAE. As of now, Exness does not hold a direct SCA license for its primary international entity that typically serves UAE residents. This means that while they serve clients from the UAE, they do so under their international licenses, rather than a specific SCA license issued in the Emirates.

Exploring Exness Account Types Tailored for UAE Traders

Are you a forex trader in the UAE looking for the perfect trading environment? Choosing the right brokerage is crucial, and Exness stands out as a strong contender, offering a diverse range of account types designed to meet various trading styles and experience levels. Understanding these options is your first step towards optimizing your trading journey.

Exness has built a reputation for its competitive trading conditions, robust technology, and transparent approach, making it a favorite among traders in the United Arab Emirates. Whether you are just starting your trading career or you are a seasoned professional, Exness likely has an account that fits your specific needs.

Why Account Type Matters for UAE Traders

The type of trading account you choose directly impacts your trading costs, available instruments, and overall trading experience. For UAE traders, considering factors like minimum deposit requirements, spread types, commission structures, and execution speeds is vital. Exness offers a spectrum of accounts that cater to these diverse preferences, ensuring you can tailor your trading setup.

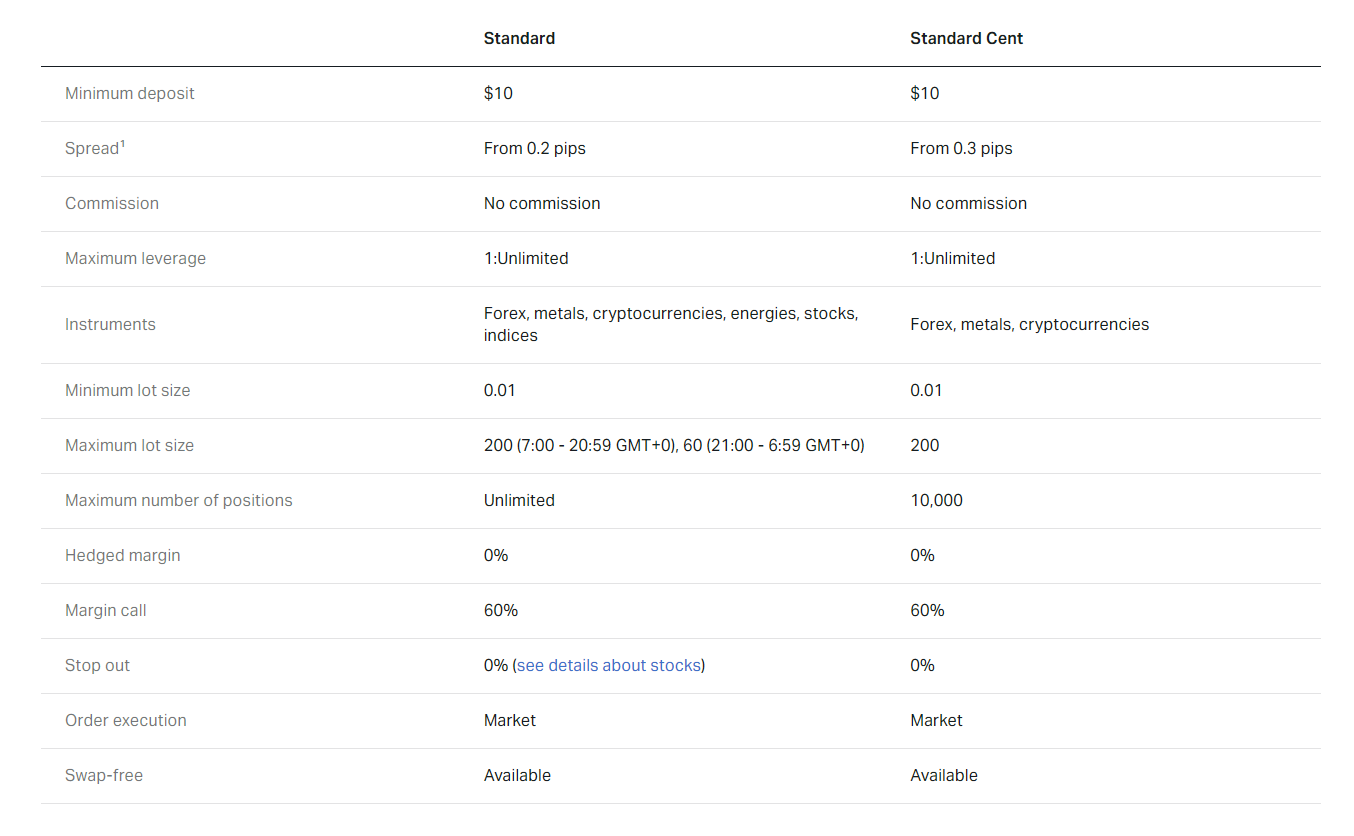

Let’s break down some of the popular Exness account types readily available for traders in the UAE:

- Standard Account: This is often the go-to choice for new traders and those who prefer a straightforward trading experience. It features stable spreads, no commissions, and a low minimum deposit. It’s an excellent entry point into the world of forex and CFD trading.

- Standard Cent Account: Ideal for beginners who want to test strategies with minimal risk. Trading in cents allows for smaller position sizes, providing a learning curve without significant financial exposure. It shares many characteristics with the Standard Account but focuses on micro-lot trading.

- Raw Spread Account: Designed for experienced traders who prioritize extremely low spreads, often close to zero. This account typically comes with a small, fixed commission per lot, offering a highly competitive cost structure for high-volume traders.

- Zero Account: As the name suggests, this account offers zero spreads on the top 30 trading instruments for 95% of the trading day. Like the Raw Spread account, it involves a commission, but the benefit of zero-pip spreads can be a game-changer for scalpers and automated trading systems.

When selecting your account, consider your trading volume, preferred instruments, and how sensitive you are to commissions versus spreads. Each Exness account type is crafted to serve different trading philosophies, ensuring a tailored fit for the dynamic UAE trading community.

Comparing Key Account Features

To help you decide, here’s a quick overview of what to consider:

| Feature | Standard Account | Raw Spread Account | Zero Account |

|---|---|---|---|

| Minimum Deposit | Low | Higher | Higher |

| Spreads | Stable, Variable | Raw (near zero) | Zero (on 30 instruments) |

| Commissions | None | Yes (per lot) | Yes (per lot) |

| Execution | Market Execution | Market Execution | Market Execution |

| Ideal For | Beginners, General Traders | Experienced, High-Volume Traders | Scalpers, Automated Systems |

Making an informed choice will significantly enhance your trading journey with Exness in the UAE. Take your time, evaluate your needs, and choose the account that best aligns with your trading ambitions.

How to Open an Exness Account in the UAE: A Simple Walkthrough

Ready to dive into the exciting world of forex trading from the United Arab Emirates? Opening an Exness account is simpler than you think. This guide walks you through every step, ensuring you set up your trading journey quickly and effortlessly. Many traders in the UAE trust Exness for its reliability and advanced trading conditions, making it a popular choice for accessing the global financial markets.

So, why do so many traders in the Emirates choose Exness? Here are a few compelling reasons:

- Exness offers competitive spreads and robust trading platforms, ideal for active forex market participation.

- They provide excellent customer support, which is a huge plus when you’re navigating online trading.

- Their commitment to transparency and secure fund management gives traders peace of mind.

Before you begin, ensure you meet the basic requirements. You must be at least 18 years old and a resident of the UAE with valid identification. Exness, like all regulated brokers, needs to verify your identity to comply with financial regulations and ensure a secure trading environment for everyone. This process protects both you and the broker from fraudulent activities.

Gather Your Essentials: What You Need for Verification

To successfully open your account and get verified, have these documents ready:

- Proof of Identity: A clear, valid copy of your Emirates ID, passport, or national ID card. Make sure it shows your full name, date of birth, and a recent photograph.

- Proof of Residency: A utility bill (electricity, water, internet) or a bank statement issued within the last three to six months, clearly showing your name and current UAE address. Mobile phone bills typically do not qualify.

Having these documents handy speeds up the verification process, getting you closer to placing your first trade.

Your Step-by-Step Journey to Trading

Opening your Exness account in the UAE involves just a few straightforward steps:

- Visit the Exness Website: Navigate to the official Exness website. Look for the “Open Account” or “Register” button, usually prominently displayed.

- Provide Basic Information: Fill out the registration form with your country of residence (United Arab Emirates), email address, and desired password. Choose a strong password to protect your account.

- Verify Your Email and Phone: Exness will send a verification code to your email and sometimes to your phone number. Enter these codes on the website to confirm your contact details.

- Complete Your Personal Profile: You’ll then enter more detailed personal information, including your full name, date of birth, and physical address in the UAE. Be accurate with these details, as they will be cross-referenced during verification.

- Upload Verification Documents: This is a crucial step. Upload the clear images of your proof of identity and proof of residency documents. Ensure all four corners of the documents are visible and the information is legible.

- Choose Your Account Type: Exness offers various account types, like Standard, Raw Spread, or Zero accounts. Each offers different features regarding spreads, commissions, and minimum deposits. Consider your trading style and capital before making a choice. You can also select a demo account to practice risk-free before trading with real money.

- Fund Your Account: Once Exness verifies your documents, you can deposit funds into your trading account. Exness supports numerous convenient deposit methods for UAE traders, including local bank transfers and e-payment systems.

After your deposit reflects, you can download your preferred trading platform (MetaTrader 4 or MetaTrader 5), log in with your account credentials, and begin your trading journey in the forex market. Remember to practice effective risk management as you navigate the markets.

Following these steps ensures a smooth and hassle-free process. Soon, you’ll be ready to explore the vast opportunities the global financial markets offer, right from the comfort of your home in the UAE.

Managing Funds with Exness UAE: Deposits and Withdrawals

Navigating the financial landscape of online trading requires a reliable broker with seamless fund management. For traders in the UAE, Exness stands out with its robust and user-friendly systems for both depositing and withdrawing funds. We understand that your capital is paramount, and efficiency in transactions directly impacts your trading experience. Exness UAE offers a suite of options designed for speed, security, and convenience, ensuring you can focus on market analysis rather than worrying about your money.Depositing Funds with Exness UAE

Getting your capital into your Exness trading account is straightforward. Exness offers a variety of popular deposit methods tailored to the needs of traders in the United Arab Emirates, ensuring you can fund your account quickly and start trading without unnecessary delays. Most deposit methods are instant, meaning your funds reflect in your account almost immediately after confirmation.Here are common deposit avenues:

- Local Bank Transfers: A trusted method for many, allowing direct transfers from your UAE bank account.

- Online Payment Systems: Solutions like Neteller and Skrill provide rapid and secure transactions.

- Debit/Credit Cards: Visa and Mastercard are widely accepted, offering instant funding.

- Cryptocurrencies: For those who prefer digital assets, Exness supports deposits via popular cryptocurrencies.

Exness prides itself on offering commission-free deposits, letting you maximize your trading capital. The platform also clearly displays minimum and maximum deposit limits for each method, giving you full transparency before you commit.

Withdrawing Your Profits from Exness UAE

Cashing out your profits should be as smooth as depositing, and Exness ensures this process is just as efficient. Getting your funds back into your hands is a critical part of the trading cycle, and Exness UAE prioritizes fast processing times for withdrawals. They generally encourage you to withdraw using the same method you used for depositing, adhering to international financial regulations for your security.Factors to consider for withdrawals:

| Aspect | Exness Approach |

|---|---|

| Processing Time | Often instant for many e-wallet options; bank transfers may take 1-7 business days. |

| Fees | Generally zero commission on withdrawals. |

| Verification | Account verification is a one-time process crucial for securing your funds and complying with regulations. |

As an experienced trader, you know the importance of reliable and fast financial transactions. Exness UAE excels in this area, offering a secure environment for all your funding needs. Their commitment to efficiency ensures you spend less time on administration and more time on seizing market opportunities.

“Seamless deposits and withdrawals are not just a convenience; they are a fundamental pillar of a trustworthy trading experience. Exness consistently delivers on this promise for traders in the UAE.” – A satisfied Exness Trader.

Exness Trading Platforms: MT4, MT5, and Exness Terminal for UAE Clients

Choosing the right trading platform is as crucial as picking the right strategy. For our valued UAE clients, Exness offers a robust suite of options designed to cater to every trading style and experience level. Whether you are a seasoned pro or just starting your journey into the dynamic forex market, you will find a platform that feels like home. Let’s explore the powerful tools at your fingertips: MetaTrader 4, MetaTrader 5, and the intuitive Exness Terminal.

Your platform choice significantly impacts your trading experience, from order execution speed to charting capabilities and the availability of analytical tools. Exness understands this, providing world-class platforms that integrate seamlessly with your trading ambitions, ensuring you have the control and information you need to make informed decisions in the fast-paced currency markets.

MetaTrader 4 (MT4): The Industry Standard for Forex

MetaTrader 4, or MT4, remains the undisputed champion for forex traders worldwide, and it’s a popular choice among UAE traders. Its enduring popularity stems from its reliable performance, user-friendly interface, and extensive customization options. Here’s why MT4 continues to be a go-to:

- Comprehensive Charting Tools: Analyze market trends with a wide array of charts and indicators.

- Expert Advisors (EAs): Automate your trading strategies with algorithmic trading capabilities.

- Customizable Interface: Arrange your workspace to suit your preferences, making it truly yours.

- Strong Community Support: Access a vast network of resources and fellow traders for insights and strategies.

Many traders appreciate MT4 for its stability and the wealth of historical data available, making backtesting strategies straightforward and effective. If you prioritize forex trading and require a stable, feature-rich environment, MT4 with Exness is an excellent choice.

MetaTrader 5 (MT5): The Next Generation Platform

For traders seeking more advanced features and access to a broader range of financial instruments, MetaTrader 5 (MT5) steps up as the modern successor to MT4. MT5 offers enhanced functionalities, making it ideal for those who trade beyond just forex, including commodities and indices. Here are some of the key upgrades you can expect:

| Feature | MT5 Advantage |

|---|---|

| Number of Timeframes | 21 (vs. 9 in MT4) |

| Analytical Objects | 44 (vs. 31 in MT4) |

| Economic Calendar | Integrated for real-time news |

| Order Types | Two additional pending order types (Buy Stop Limit, Sell Stop Limit) |

| Strategy Tester | Multi-threaded for faster optimization |

MT5 provides a more powerful environment for complex analysis and advanced trading strategies. Its multi-asset capabilities mean you can manage diverse portfolios from a single platform, an attractive feature for many sophisticated traders in the UAE market.

Exness Terminal: Intuitive Web-Based Trading

Beyond the MetaTrader ecosystem, Exness proudly presents its own proprietary web-based platform, the Exness Terminal. This platform is perfect for traders who prefer a sleek, intuitive interface without the need to download any software. Access your trades directly from your browser, anytime, anywhere. Its design prioritizes ease of use, making it incredibly accessible for beginners while still providing powerful tools for experienced traders.

As one trader shared, \”The Exness Terminal is incredibly user-friendly. I can log in from any device and manage my trades without any hassle. It’s fast and reliable, perfect for quick market reactions.\”

Key benefits of the Exness Terminal include:

- Web-Based Convenience: Trade directly from your browser without installations.

- Clean, User-Friendly Interface: Navigate markets with ease, designed for optimal clarity.

- Fast Execution: Benefit from lightning-fast order execution.

- Integrated Features: Access essential tools and market data directly within the platform.

The Exness Terminal is a fantastic option if you value simplicity, speed, and cross-device compatibility. It exemplifies Exness’s commitment to providing flexible and powerful trading solutions tailored to the diverse needs of its UAE clientele.

Understanding Spreads, Commissions, and Leverage on Exness UAE

Diving into the world of forex trading requires a solid grasp of key terms that directly impact your potential for profit and risk. On Exness UAE, understanding spreads, commissions, and leverage is not just academic; it’s fundamental to your trading strategy. These three elements form the bedrock of your trading costs and your market exposure. Let’s break them down clearly, so you can navigate the markets with confidence.

Spreads: The Cost of Doing Business

Every time you open a trade, you encounter the spread. Think of it as the difference between the buy (ask) price and the sell (bid) price of a currency pair. It’s essentially the cost you pay to your broker for executing your trade. On Exness UAE, spreads can be incredibly competitive and often variable, especially during periods of high market volatility. A tight spread means less cost per trade, which is particularly beneficial for active traders or those employing scalping strategies.

- Variable Spreads: These fluctuate based on market conditions, liquidity, and economic news. When the market is calm, spreads are typically tighter.

- Fixed Spreads: Less common in forex, but some instruments might offer them. They remain constant regardless of market volatility, offering predictability.

- No Hidden Fees: Exness UAE is known for transparent pricing, meaning the spread is your primary transaction cost on many account types.

Commissions: When They Apply

While spreads are a constant, commissions are a specific type of fee that applies to certain account types or trading instruments. Not all trades on Exness UAE incur a commission. Typically, commission-based accounts, like the Raw Spread or Zero accounts, offer incredibly tight or even zero spreads in exchange for a small, fixed fee per traded lot. This model appeals to professional traders and those with high trading volumes, as it can result in lower overall costs compared to wider spread accounts, especially for large positions.

Here’s a simple look at how commission might factor into your trading on Exness UAE:

| Account Type Example | Spread Characteristic | Commission Applied? |

|---|---|---|

| Standard Account | Variable, Wider | No |

| Raw Spread Account | Variable, Very Tight | Yes (per lot) |

| Zero Account | Zero (for 30 pairs) | Yes (per lot) |

Always review the specific account terms on Exness UAE to understand if and when commissions apply to your chosen trading setup.

Leverage: Magnifying Your Market Power

Leverage is a powerful tool that allows you to control a much larger position in the market with a relatively small amount of capital. Exness UAE offers some of the most flexible leverage options in the industry, even unlimited leverage under certain conditions. For instance, with 1:100 leverage, you can control $10,000 worth of currency with just $100 of your own money.

Advantages of Using Leverage:

- Increased Capital Efficiency: You don’t need a huge trading account to participate in the forex market.

- Higher Potential Profits: Even small price movements can translate into significant gains when you’re trading larger volumes.

- Flexibility: It opens up opportunities for various trading strategies that might require larger position sizes.

Disadvantages and Risks of Leverage:

- Magnified Losses: Just as profits are amplified, so too are losses. A small adverse market move can quickly wipe out your account balance.

- Margin Calls: If your equity falls below a certain level due to losses, your broker might issue a margin call, requiring you to deposit more funds or face automatic liquidation of your positions.

- Risk Management is Crucial: Using leverage without proper risk management strategies, like stop-loss orders, is extremely risky.

Exness UAE provides tools and resources to help you manage your leverage effectively. While tempting, always approach high leverage with caution and a robust risk management plan. It’s a double-edged sword that can significantly boost your returns or rapidly deplete your capital.

Mastering these concepts – spreads, commissions, and leverage – empowers you to make informed decisions and tailor your trading approach to your risk tolerance and financial goals on Exness UAE. Trade smart, trade confidently!

A Wide Range of Instruments Available on Exness for UAE Traders

As a seasoned trader with years of experience navigating the global markets, I can confidently say that the diversity of trading instruments is paramount to a successful strategy. For traders in the UAE, Exness truly excels in this regard, offering an expansive selection of assets that cater to every trading style and risk appetite. This means you’re not confined to a single market; instead, you unlock a universe of global opportunities right from your trading terminal.

The strategic advantage of having such a broad spectrum of trading instruments lies in your ability to implement robust diversification. Diversification is a critical component of risk management, allowing you to spread your capital across different asset classes. This approach can help mitigate potential losses from any single market downturn and, crucially, uncover unique profit avenues that might otherwise remain hidden. Whether you thrive on the rapid price swings of day trading or prefer the calculated moves of swing trading, the sheer breadth of instruments on Exness empowers your journey.

Exness understands the dynamic nature of financial markets and the diverse interests of traders. That’s why they meticulously curate an offering that includes some of the most sought-after asset classes. Let’s explore the primary categories of trading instruments you can access:

- Forex Pairs: Dive into the world’s largest and most liquid financial market. You can trade major currency pairs like EUR/USD, GBP/USD, and USD/JPY, known for their tight spreads and high liquidity. Beyond the majors, explore a range of minor and exotic pairs, offering unique trading opportunities based on regional economic developments.

- Cryptocurrencies: Embrace the future of finance by trading popular digital assets. Exness provides access to leading cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) against the US Dollar. This allows you to capitalize on the exciting volatility and growth potential of the crypto market.

- Commodities: Gain exposure to the raw materials that drive global industries. Trade precious metals like Gold (XAU/USD) and Silver (XAG/USD), often seen as safe-haven assets. You can also engage with energy commodities such as Crude Oil (WTI and Brent) and Natural Gas, responding to geopolitical shifts and supply-demand dynamics.

- Indices: Speculate on the performance of entire stock markets without buying individual shares. Trade popular global indices like the S&P 500 (US500), Dow Jones Industrial Average (US30), NASDAQ 100 (US100), FTSE 100 (UK100), and DAX 40 (DE40). This offers a broader perspective on economic health and market sentiment.

- Stocks: While Exness isn’t purely a stockbroker, it offers a selection of the world’s most prominent company shares. You can trade stocks of major corporations, allowing you to diversify your portfolio with equity exposure to industry giants across various sectors.

For UAE traders, this extensive selection translates into practical benefits. You can tailor your trading schedule to align with various global market openings, finding active trading periods that suit your lifestyle. If your focus is on specific sectors or assets, Exness likely offers the instruments you need. This platform truly recognizes the essential role of variety in a fast-paced trading environment.

My personal recommendation? Don’t limit your trading experience. Take the time to explore and understand different asset classes. Learn how various trading instruments react to economic news and global events. Exness provides the robust tools and diverse offerings; your informed strategy brings the success. Join the growing community of smart traders in the UAE who are already leveraging this comprehensive platform to achieve their financial aspirations.

Exness Customer Support: Dedicated Assistance for UAE Users

In the fast-paced world of forex trading, reliable customer support is not just a luxury; it’s a necessity. Traders in the UAE need quick and efficient assistance to navigate market changes, resolve technical glitches, or simply get answers to their account inquiries. Exness understands this critical need, offering dedicated support services tailored to its global client base, including our valued traders in the United Arab Emirates.

Exness support aims to provide a seamless trading experience by ensuring help is always at hand. Whether you are a seasoned investor or just starting your journey in the financial markets, knowing that professional assistance is readily available gives you peace of mind.

How Exness Delivers Exceptional Support

- 24/7 Availability: Forex markets operate around the clock, and so does Exness customer service. You can reach out for help any time of day or night, ensuring your trading activities are never interrupted for long. This continuous availability is a significant advantage for traders across different time zones, especially in the UAE.

- Multilingual Team: Understanding your queries and providing clear solutions requires effective communication. Exness employs a diverse team capable of assisting traders in multiple languages, including Arabic, catering specifically to the needs of the UAE region. This ensures you can explain your issue comfortably and receive an accurate response.

- Multiple Contact Channels: Exness provides various ways to connect with their support team, allowing you to choose the method most convenient for you.

Connect with Exness Support

Reaching the Exness customer support team is straightforward and efficient. They offer several convenient channels to ensure you get the assistance you need, when you need it.

| Support Channel | Description |

|---|---|

| Live Chat | Get instant answers to your questions. This is often the quickest way to resolve minor issues or receive immediate guidance directly from the Exness website or trading platform. |

| Phone Support | Prefer to speak with someone? Exness provides dedicated phone lines, allowing you to discuss complex issues directly with a support specialist. This personal touch can be incredibly reassuring. |

| Email Assistance | For detailed inquiries that might require sharing documents or extended explanations, email support is an excellent option. The team responds promptly with comprehensive solutions. |

No matter if you encounter a technical glitch with your trading platform, have a question about account verification, or need clarity on a specific trading condition, the Exness support team stands ready to assist. Their professional and knowledgeable staff receive extensive training to handle a wide range of inquiries, ensuring you receive accurate and helpful advice every time you reach out. This commitment to dedicated assistance reinforces Exness’s reputation as a trader-centric broker in the UAE and beyond.

Mobile Trading Experience with Exness Apps in the UAE

The world of financial markets never sleeps, and neither should your ability to trade. For active traders in the UAE, the Exness mobile apps offer unparalleled convenience and power, right at your fingertips. Imagine managing your positions, analyzing market trends, and executing trades from anywhere, whether you’re enjoying a coffee in Dubai Marina or taking a break from your office in Abu Dhabi. These robust applications transform your smartphone or tablet into a comprehensive trading terminal, ensuring you never miss a significant market movement.

Exness understands the dynamic needs of modern traders. Their commitment to technological innovation is evident in the intuitive design and rich features packed into their mobile platforms. You gain access to real-time quotes, advanced charting tools, and a seamless trading environment that mirrors the desktop experience, but with the added flexibility that only mobile can provide. This means instant access to global markets for a wide range of instruments, including popular currency pairs, commodities, and indices.

Advantages of Trading with Exness Mobile Apps in the UAE:

- Instant Access: Log in quickly and manage your accounts on the go, anytime, anywhere within the UAE.

- Full Functionality: Execute trades, set stop-loss and take-profit orders, and monitor your portfolio with a full suite of trading tools.

- Real-time Data: Stay informed with live price feeds and up-to-the-minute market news directly on your device.

- User-Friendly Interface: Navigate effortlessly through a clean, intuitive design, making it easy for both novice and experienced traders.

- Security: Benefit from robust security protocols designed to protect your funds and personal information.

- Seamless Deposits & Withdrawals: Manage your funds directly within the app, simplifying your trading experience.

For traders residing in the UAE, the Exness mobile trading experience is more than just a convenience; it’s an essential tool. It empowers you to react swiftly to volatile markets, manage risk effectively, and capitalize on opportunities as they arise, without being tethered to a desktop. The apps are optimized for performance, ensuring quick execution and a smooth user journey even during peak trading hours. This focus on accessibility and efficiency aligns perfectly with the fast-paced lifestyle prevalent across the Emirates.

“The agility provided by Exness mobile applications is a game-changer for traders in the UAE. It bridges the gap between market opportunities and busy schedules, ensuring you’re always connected and in control of your trading future.”

Whether you’re new to forex trading or a seasoned professional, integrating the Exness mobile app into your daily routine can significantly enhance your trading strategy. It provides the freedom to monitor your investments and make informed decisions, regardless of your location within the UAE. Embrace the power of mobile trading and elevate your financial journey with Exness.

Educational Resources and Market Insights from Exness UAE

Navigating the dynamic world of forex trading demands more than just capital; it requires knowledge, skill, and continuous learning. At Exness UAE, we understand that a well-informed trader is a confident and successful trader. That’s why we commit to providing comprehensive educational resources and timely market insights, empowering you to make sharper decisions and refine your trading strategies.

Our educational hub is designed for traders at all levels, from absolute beginners taking their first steps to seasoned professionals looking to deepen their understanding of advanced market concepts. We believe in practical, actionable information that you can immediately apply to your trading journey.

What You’ll Discover in Our Educational Resources:

- Forex Basics: Get a solid foundation with clear explanations of essential terms, currency pairs, and how the forex market operates. Master the fundamentals before you dive deeper.

- Trading Strategies: Explore a wide array of proven trading methodologies, including technical analysis, fundamental analysis, and various chart patterns. Learn to identify opportunities and manage risks effectively.

- Risk Management: Understand the critical importance of protecting your capital. Our resources cover position sizing, stop-loss orders, take-profit levels, and other vital risk control techniques.

- Platform Tutorials: Learn to navigate the Exness trading platforms with ease. Our step-by-step guides and video tutorials ensure you can execute trades, analyze charts, and manage your account seamlessly.

- Webinars and Seminars: Participate in live sessions led by industry experts. These interactive events offer invaluable insights, answer your burning questions, and provide a deeper dive into current market trends.

Beyond education, staying ahead in forex means keeping a finger on the pulse of global economic events and market movements. Our market insights are crafted to give you that crucial edge.

Unlock Timely Market Insights:

In the fast-paced forex market, information is power. Exness UAE provides a suite of tools and analyses designed to keep you informed and ready for action. Here’s how we help you stay on top of the game:

| Insight Category | Description and Benefit |

|---|---|

| Daily Market Analysis | Receive concise summaries of the day’s key economic releases and their potential impact on major currency pairs. Understand the forces driving market direction. |

| Economic Calendar | Never miss a high-impact event again. Our comprehensive economic calendar provides real-time data on upcoming announcements, helping you anticipate volatility. |

| Technical Analysis Reports | Access in-depth technical breakdowns of various instruments, identifying potential entry and exit points. Leverage expert analysis to confirm your own trading ideas. |

| Market News Feed | Stay updated with breaking news that could influence currency values. Our curated news feed brings you the most relevant headlines impacting the forex market directly. |

Our commitment is to foster a community of informed and successful traders. We continuously update our educational content and market insights to reflect the latest market dynamics and trader needs. Join Exness UAE and equip yourself with the knowledge and tools necessary to thrive in the exciting world of forex trading.

Exclusive Promotions and Bonuses for Exness UAE Clients

Are you trading with Exness in the UAE? Then get ready to unlock a world of incredible value! Exness often rolls out a fantastic array of exclusive promotions and bonuses specifically tailored for its clients in the United Arab Emirates. These offers are not just about extra funds; they are designed to enhance your trading journey, give you more leverage, and reward your loyalty. It is like having a secret weapon in your trading arsenal.

Every trader, whether a beginner or a seasoned pro, can benefit from these special incentives. Imagine boosting your initial capital, participating in thrilling contests, or earning rewards just for trading your favorite currency pairs. Exness understands the dynamics of the forex market and aims to provide its UAE community with an edge through these thoughtful programs.

What Kind of Bonuses Can You Expect?

Exness frequently offers a variety of exciting promotions. Here are some common types you might encounter:

- Welcome Bonuses: New clients often receive a warm welcome in the form of a bonus upon their first deposit, giving them an excellent head start in the market.

- Deposit Bonuses: Boost your trading power! These bonuses add a percentage of your deposit amount to your account, increasing your available margin for trades.

- Trading Contests: Put your skills to the test against other traders. Exness often hosts competitions with substantial cash prizes for top performers. It is a fantastic way to showcase your trading prowess.

- Loyalty Programs: The more you trade, the more you earn. Dedicated traders can benefit from tiered reward systems, earning points or cash rebates on their trading volume.

- Cashback Offers: Sometimes, Exness provides opportunities to get a portion of your trading commissions or spreads back, directly into your account, making your trading even more cost-effective.

The Benefits of Utilizing Exness UAE Promotions

Leveraging these special offers can significantly impact your trading experience. Look at the advantages:

| Benefit | Description |

|---|---|

| Increased Capital | Bonuses often provide extra funds, allowing you to open larger positions or diversify your portfolio more effectively. |

| Reduced Risk Perception | With bonus funds, you might feel more comfortable experimenting with new strategies or taking calculated risks. |

| Enhanced Learning | Participating in contests can sharpen your skills and teach you how to perform under pressure. |

| Higher Earning Potential | More capital and lower costs through rebates directly translate to better opportunities for profit generation. |

| Motivation and Engagement | Exclusive offers keep trading exciting and motivate you to continue refining your strategies. |

Claiming Your Rewards: Simple Steps

Accessing these promotions is usually straightforward. Exness designs its platforms for ease of use. Typically, you need to:

- Log in to your Exness Personal Area.

- Navigate to the ‘Promotions’ or ‘Bonuses’ section.

- Review the available offers and their specific terms and conditions.

- Follow the simple instructions to opt-in or claim your bonus, which might involve making a qualifying deposit or achieving a certain trading volume.

Always remember to read the fine print. Each promotion comes with its own set of rules, including minimum deposit amounts, trading volume requirements before withdrawal, or expiration dates. Understanding these terms ensures you maximize the value from every offer. Exness makes these details clear, empowering you to make informed decisions about participating.

Security and Fund Protection Measures at Exness

When you choose a forex broker, the safety of your funds and personal data is paramount. At Exness, we understand this completely. We are committed to providing a secure trading environment where you can focus on your strategies without worrying about the integrity of your investments. Our robust security framework is built on a foundation of strict regulatory compliance, advanced technological safeguards, and transparent practices designed to protect every aspect of your trading journey.

Here are some of the core measures Exness employs to ensure your peace of mind:

- Regulatory Oversight: We operate under the watchful eye of multiple global regulatory bodies. These licenses require adherence to stringent financial standards, capital requirements, and operational transparency, ensuring we maintain the highest levels of integrity and accountability.

- Segregation of Client Funds: A cornerstone of our fund protection strategy is the complete separation of client funds from company operational funds. Your deposits are held in separate bank accounts at top-tier banks, completely distinct from Exness’s own assets. This ensures that even in unforeseen circumstances, your capital remains safe and accessible.

- Advanced Encryption Technology: All data transmitted between your device and our servers is protected using state-of-the-art encryption protocols. This secures your personal information, trading activities, and financial transactions from unauthorized access, ensuring privacy and data integrity.

- Two-Factor Authentication (2FA): We offer and strongly encourage the use of 2FA for all account access and critical transactions. This adds an extra layer of security, requiring a unique verification code from your mobile device in addition to your password, significantly reducing the risk of unauthorized account access.

- Negative Balance Protection: Exness provides negative balance protection for all retail clients. This means your potential losses are limited to the funds in your trading account. You can never lose more than your initial deposit, effectively preventing your account from going into a negative balance due to market volatility.

Our Commitment to Your Security

We consistently review and enhance our security protocols to counter evolving threats. Our dedicated teams work tirelessly to implement the latest cybersecurity advancements, ensuring your trading environment remains impregnable. From secure deposit and withdrawal processes to the robust infrastructure supporting our trading platforms, every detail is designed with your security as the top priority.

For us, safeguarding your investments goes beyond mere compliance; it’s about building trust. We believe that a secure platform empowers you to trade with greater confidence, allowing you to seize market opportunities without unnecessary concerns. Your financial well-being is our utmost concern, and we remain dedicated to providing a secure, reliable, and transparent trading experience for all our clients.

Exness UAE vs. Competitors: What Makes it Better?

The forex trading landscape in the UAE is vibrant, with numerous online brokers vying for your attention. As a seasoned trader, you know the importance of choosing a broker that not only meets but exceeds expectations. So, when we talk about Exness UAE, what truly sets it apart from the competition? Let’s break down the key differentiators that give traders a noticeable edge.

Unmatched Trading Conditions

One of the first things experienced traders scrutinize is the trading conditions. Exness UAE stands out with its incredibly low spreads, often starting from 0.0 pips on major currency pairs. This isn’t just marketing hype; it translates directly into cost savings for you on every trade. Beyond spreads, the execution speed is paramount. Exness boasts fast execution, minimizing slippage and ensuring your orders are filled precisely when you want them to be. This reliability in execution is a huge plus for active forex trading strategies.

Superior Withdrawal Process

Ask any trader what matters most, and a swift, hassle-free withdrawal process will likely be high on their list. Many online brokers promise quick withdrawals, but Exness UAE consistently delivers. Their commitment to instant withdrawals, even on weekends for many payment methods, is a game-changer. This isn’t just about speed; it’s about trust and accessibility to your funds whenever you need them. You won’t find yourself waiting days for your money, a common frustration with less efficient competitors.

Customer Support That Cares

Imagine having a question or an issue at any time of day or night. With Exness UAE, you get 24/7 customer support available in multiple languages, including Arabic. This isn’t just about availability; it’s about the quality of service. Their support team is knowledgeable, responsive, and genuinely helpful, guiding you through any query regarding your account or the trading platforms. This level of dedicated support builds confidence and ensures a smoother trading journey.

Diverse Account Types and Instruments

Every trader has unique needs, and Exness UAE caters to this diversity with a range of account types. Whether you are a beginner taking your first steps or a professional looking for raw spreads and high leverage, there is an account designed for you. Beyond forex, you gain access to a broad spectrum of financial instruments, including cryptocurrencies, stocks, indices, and commodities. This variety allows for portfolio diversification and opens up more trading opportunities.

Regulatory Compliance and Trust

Operating in the UAE, Exness adheres to strict regulatory compliance standards, providing a secure and transparent trading environment. This regulatory oversight offers peace of mind, knowing your funds are segregated and protected. When choosing an online broker for your forex trading, trust and security are non-negotiable, and Exness delivers on this front with a strong global presence and a reputation for reliability.

In conclusion, while the forex market offers many choices, Exness UAE distinguishes itself through a combination of superior trading conditions, an efficient withdrawal process, excellent customer support, diverse offerings, and robust regulatory compliance. These factors collectively contribute to a more positive and profitable trading experience for traders in the region.

Frequently Asked Questions

Is Exness Regulated in the UAE?

Exness operates globally under various regulations. While it doesn’t hold a specific direct license from the Securities and Commodities Authority (SCA) in the UAE itself, its services are accessible to UAE residents through its international licenses from reputable bodies like CySEC and the FCA. These licenses ensure that Exness adheres to strict financial standards, offering a secure trading environment.

What Account Types Does Exness Offer for UAE Traders?

Exness provides a range of account types for UAE traders, including Standard Accounts (ideal for beginners with no commissions) and Professional Accounts (Raw Spread, Zero, and Pro) for experienced traders seeking tighter spreads and specific execution models. Each account type is designed to fit different trading strategies and experience levels.

How Can I Deposit and Withdraw Funds with Exness in the UAE?

Exness offers various convenient payment methods for UAE clients, including bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. A key advantage is the instant withdrawal system for many methods, allowing you to access your funds quickly, even on weekends.

Does Exness Provide Customer Support in Arabic?

Yes, Exness offers multilingual customer support, including dedicated assistance in Arabic for clients in the UAE. Support is available 24/7 through live chat, email, and phone, ensuring you can get help promptly and in your preferred language.

Are Islamic (Swap-Free) Accounts Available?

Yes, Exness provides Islamic (swap-free) accounts for traders in the UAE who need to comply with Sharia law. These accounts do not incur or pay rollover interest (swap fees) on overnight positions, making them suitable for traders who adhere to Islamic finance principles.