Are you a Thai trader looking for a reliable and powerful platform to elevate your financial journey? Exness stands as a beacon for countless traders worldwide, and for good reason. This guide dives deep into everything Exness offers specifically for our vibrant trading community in Thailand. Whether you are taking your first steps into the dynamic world of forex and CFD trading or you are a seasoned pro seeking a competitive edge, you’ve landed in the right place.

We understand the unique needs of traders and designed this ultimate guide to be your go-to resource. Discover how Exness empowers you with cutting-edge tools, favorable conditions, and robust support, all tailored to help you navigate the markets with confidence. Prepare to unlock strategies, insights, and practical tips that can transform your trading experience and propel you towards consistent success.

- Why Exness is Popular Among Thai Traders

- Exness’s Reputation and Reliability in Thailand

- Factors Contributing to Exness’s Reputation in Thailand

- What Thai Traders Say About Exness’s Reliability

- Is Exness Legal and Regulated for Thai Residents?

- Understanding Exness’s Licensing

- How to Open an Exness Thailand Trading Account

- The Exness Thailand Account Opening Process

- Essential Documents for Account Opening

- Exness Account Verification Process

- Exness Account Types for Thai Traders

- Standard Accounts: Perfect for Most Traders

- Professional Accounts: Designed for Experienced Traders

- Raw Spread Account

- Zero Account

- Pro Account

- Standard vs. Professional Accounts

- Standard Accounts

- Professional Accounts

- Deposit and Withdrawal Methods for Exness in Thailand

- Popular Deposit Methods

- Efficient Withdrawal Methods

- Key Considerations for Thai Traders

- Popular Local Payment Options

- Trading Platforms Offered by Exness Thailand

- MetaTrader 4 (MT4): The Industry Standard

- Key Advantages of MT4:

- MetaTrader 5 (MT5): The Next Generation Platform

- Why Choose MT5?

- Exness Terminal: Our Proprietary Web Platform

- Exness Terminal Features at a Glance:

- Mobile Trading: Trade Anywhere, Anytime

- MT4 and MT5 Capabilities

- MetaTrader 4: The Industry Standard

- MetaTrader 5: The Next Generation

- Range of Trading Instruments on Exness

- A Glimpse into Our Diverse Offerings:

- Exness Thailand Customer Support and Local Assistance

- How We Support You Locally:

- Our Direct Support Channels:

- Exness Promotions and Bonuses for Thai Traders

- What Kind of Bonuses Can Thai Traders Expect?

- How These Promotions Benefit You

- Claiming Your Bonuses: Simple and Transparent

- Understanding Exness Trading Conditions and Spreads

- What Are Spreads and Why Do They Matter?

- Mobile Trading with Exness Thailand Apps

- Key Advantages of Trading with Exness Mobile Apps:

- Accessibility and Performance

- What Traders Say:

- Risk Management and Security Features on Exness

- Exness’s Commitment to Security

- Essential Risk Management Tools at Your Fingertips

- Key Risk Management Features:

- Exness Educational Resources for Thai Traders

- Why Education is Your Strongest Ally

- Dive Into Our Comprehensive Learning Hub

- Explore a World of Knowledge:

- Tailored for Your Success

- Comparing Exness with Other Brokers in Thailand

- Exness Thailand Reviews and Testimonials

- Frequently Asked Questions

Why Exness is Popular Among Thai Traders

Exness has firmly established itself as a top choice for forex traders across Thailand, and for good reason. Its rise to prominence isn’t accidental; it’s a result of a strategic approach that genuinely caters to the specific needs and preferences of the local trading community. From beginners taking their first steps in the market to seasoned professionals seeking optimal conditions, Exness offers a compelling package that resonates deeply with Thai traders.

Here are the key factors driving its widespread appeal:

- Localized Payment Solutions: Exness understands the importance of convenient banking. They provide an array of popular local deposit and withdrawal methods, making transactions incredibly smooth and hassle-free for Thai users. This eliminates common frustrations related to international transfers.

- Competitive Trading Conditions: Traders consistently seek favorable conditions, and Exness delivers. They offer tight spreads on major currency pairs, competitive commission rates, and high leverage options, which are particularly attractive to those looking to maximize their trading potential. Fast execution speeds further enhance the trading experience.

- Reliable Customer Support: Access to effective support in the local language is a significant advantage. Exness provides dedicated customer service available in Thai, ensuring that queries are addressed promptly and clearly, building trust and confidence among its users.

- User-Friendly Platforms: The broker supports widely recognized platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are familiar to many traders worldwide. This familiarity, coupled with easy-to-navigate mobile apps, allows Thai traders to seamlessly manage their accounts and execute trades on the go.

- Transparent Operations: Transparency in trading conditions and fees is paramount. Exness maintains a clear fee structure and provides detailed information on its trading environment, fostering a sense of security and fairness that is highly valued by its client base in Thailand.

In essence, Exness has successfully built a bridge between global trading opportunities and the unique requirements of the Thai market, creating a strong, loyal following.

Exness’s Reputation and Reliability in Thailand

When it comes to online forex trading, a broker’s reputation and reliability are paramount. For traders in Thailand, Exness has steadily built a strong standing in the local market. Many Thai traders seek out a transparent and secure environment, and Exness has worked to meet these expectations through consistent service and a focus on user experience.

Exness’s commitment to reliability is often highlighted by its operational transparency and the security measures it implements. Traders want to know their funds are safe and that their trading activities occur on a stable platform. This is where Exness aims to shine, providing peace of mind to its diverse client base in Thailand.

Factors Contributing to Exness’s Reputation in Thailand

- Client Fund Security: Exness segregates client funds from its operational capital, a crucial practice that enhances trust. This means your investment is kept separate, adding a layer of protection.

- Withdrawal Efficiency: Thai traders frequently praise Exness for its fast and smooth withdrawal process. Quick access to your profits is a significant factor in building confidence in any broker.

- Localised Support: While a global broker, Exness offers support that caters to the specific needs of its Thai clientele. Access to relevant payment methods and customer service in local languages can make a big difference.

- Transparent Trading Conditions: The broker is known for publishing its trading conditions clearly, including spreads and commissions. This transparency helps traders make informed decisions without hidden surprises.

What Thai Traders Say About Exness’s Reliability

In the vibrant Thai trading community, Exness often surfaces in discussions as a dependable choice. Traders value platforms that perform consistently during volatile market conditions. Exness’s robust infrastructure aims to minimize slippage and ensure prompt order execution, contributing to a reliable trading experience. Many testimonials from Thai traders commend the platform’s stability, which is vital for both new and experienced participants in the forex market.

Consider these points when evaluating a broker’s reliability, which Exness strives to uphold:

| Reliability Aspect | Exness’s Approach |

|---|---|

| Platform Stability | Maintains high uptime and quick execution speeds. |

| Fund Safety | Employs segregated accounts and robust security protocols. |

| Customer Service | Offers multi-lingual support, including Thai, for prompt assistance. |

| Financial Transactions | Provides a variety of efficient deposit and withdrawal options popular in Thailand. |

Ultimately, a broker’s reliability is a reflection of its commitment to its clients. For traders in Thailand, Exness has worked hard to establish a strong reputation based on trust, efficient service, and secure trading practices. This makes it a frequently considered option for those looking to engage in online forex trading.

Is Exness Legal and Regulated for Thai Residents?

Many Thai traders wonder about the legal standing of international brokers like Exness. Thailand has specific regulations for local financial institutions. However, the situation for international forex brokers operates differently. Exness does not hold a local Thai license issued by the Bank of Thailand or the SEC, as it’s an international brokerage.

Here is the crucial point: it is completely legal for Thai residents to open accounts and trade with international forex brokers such as Exness. When you trade with Exness, you engage with their globally regulated entities, not a locally regulated Thai entity. This practice is common worldwide. Traders in many countries use international brokers who hold licenses from top-tier regulatory bodies.

Exness boasts a strong global regulatory framework. They hold licenses from multiple reputable financial authorities across different jurisdictions. These include bodies like the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Commission (FSC) in Mauritius, and the Financial Services Authority (FSA) in Seychelles, among others. These licenses ensure Exness adheres to strict financial standards, maintains client fund segregation, and provides transparent trading conditions.

What does this mean for you as a Thai trader? It means you can trade with confidence. Exness ensures its operations meet high global standards. Your funds receive top-tier security, as they keep client money separate from company funds. This offers a vital layer of protection. Moreover, Exness is transparent about its trading conditions, providing fair pricing and reliable trade execution. Their platforms are also accessible and user-friendly, catering to traders of all experience levels.

In summary, while Exness does not possess a local Thai regulatory license, it is entirely lawful for Thai residents to trade with them. You are trading with a globally regulated and reputable international entity. Your trading experience with Exness benefits from their robust global regulatory compliance and commitment to client safety.

Understanding Exness’s Licensing

When you choose a forex broker, one of the most critical factors you must consider is their licensing and regulatory status. This isn’t just a formality; it’s your primary safeguard in the volatile world of trading. A properly regulated broker operates under strict guidelines designed to protect your funds and ensure fair trading practices. For this reason, understanding Exness’s regulation is essential for any serious trader looking for a safe trading environment.

Exness, like many global brokers, operates with multiple broker licenses issued by various financial authorities around the world. This approach, often called “tiered licensing,” allows them to serve a diverse client base while adhering to different levels of regulatory oversight. Some of these regulatory bodies are stricter than others, offering varying degrees of investor protection. This multi-jurisdictional presence demonstrates the broker’s commitment to compliance and provides confidence to its clients.

So, why does broker licensing matter so much to you as a trader? Here are some key benefits:

- Fund Segregation: Regulated brokers keep client funds in separate bank accounts from their operational capital. This means your money stays safe, even if the broker faces financial difficulties, offering crucial investor protection.

- Fair Practices: Regulatory bodies enforce rules that prevent market manipulation and ensure transparent pricing, offering you a level playing field. They monitor all aspects of the broker’s operations.

- Dispute Resolution: If a conflict arises, licensed brokers provide access to independent dispute resolution services. This gives you an official avenue for recourse outside of direct negotiation with the broker.

- Capital Requirements: Financial authorities often require brokers to maintain a certain level of capital. This ensures they have sufficient financial stability to meet their obligations to clients, providing an added layer of security.

“A broker’s license is more than just a piece of paper; it’s a testament to their commitment to transparency, integrity, and client safety. Always prioritize regulation when making your choice to ensure a trustworthy broker.”

Identifying a trustworthy broker starts with verifying their licenses. Exness, for example, typically holds registrations with several reputable regulatory bodies across different jurisdictions. These financial authorities monitor their operations closely, from how they handle your deposits to the execution of your trades. This comprehensive oversight aims to provide a reliable and secure trading experience for all their clients.

When you select a broker, always visit their official website to confirm their regulatory status. Look for mentions of specific regulatory bodies and their license numbers. Cross-reference this information with the regulator’s own database. This simple step can save you from potential scams and ensure you trade with confidence, knowing your chosen partner operates within established legal frameworks. A robust regulatory framework is a hallmark of a truly trustworthy broker.

How to Open an Exness Thailand Trading Account

Ready to dive into the exciting world of online trading with Exness Thailand? Opening a trading account is your first step towards exploring the forex market and other financial instruments. Exness offers a user-friendly platform, making the registration process straightforward for new and experienced traders alike. Let’s walk through exactly how you can set up your Exness Thailand trading account and begin your journey.

The Exness Thailand Account Opening Process

Getting started with a live trading account is simpler than you might think. Follow these clear steps to complete your registration and prepare for your first trade.

- Visit the Official Exness Thailand Website: Always ensure you are on the legitimate Exness website to protect your personal and financial information. Look for the registration or sign-up button, usually prominently displayed.

- Begin Your Registration: You will need to provide basic information such as your country of residence (Thailand, in this case), email address, and a secure password. Choose a strong password to safeguard your account.

- Verify Your Email and Phone Number: Exness will send a verification code to your registered email and/or phone number. Enter these codes on the platform to confirm your contact details. This is a crucial security step.

- Complete Your Profile: You will then proceed to fill out more personal details, including your full name, date of birth, and residential address. Be accurate, as this information is vital for the next step.

- Verify Your Identity and Address (KYC): This is a standard regulatory requirement, known as Know Your Customer (KYC). You will typically need to upload clear copies of:

- A valid identification document (e.g., National ID card, passport, driver’s license).

- A proof of residence document (e.g., utility bill, bank statement, or residency certificate not older than six months).

- Choose Your Account Type: Exness offers various account types tailored to different trading styles and capital sizes. You might consider a Standard account for beginners or explore Professional accounts if you have specific needs. You can also open a demo account to practice your forex trading strategies risk-free before committing to a live account.

- Make Your First Deposit: Once your account is verified, you can deposit funds using a variety of convenient payment methods available for traders in Thailand. Exness supports local bank transfers, e-wallets, and other popular options. Your capital is now ready for online trading.

- Download the Trading Platform: Access your trading account through popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), available for desktop, web, and mobile devices. Log in with your new account credentials.

Essential Documents for Account Opening

To ensure a smooth and quick verification process for your Exness Thailand trading account, have the following documents ready before you start:

- Proof of Identity: Your National ID card, passport, or driver’s license. Make sure the document is valid and clearly shows your full name, date of birth, and photograph.

- Proof of Residency: A utility bill (electricity, water, gas), bank statement, or a residency certificate. This document must be recent (usually within the last six months) and display your name and address clearly.

By following these steps, you will quickly gain access to your Exness trading account and be ready to explore the vast opportunities in the financial markets. Welcome to the trading community!

Exness Account Verification Process

Getting your Exness trading account fully verified is a crucial step for every serious trader. It’s not just a formality; it secures your funds, ensures smooth transactions, and unlocks the full potential of your trading experience. Think of it as building a strong foundation for your financial activities. A verified account means higher deposit limits, faster withdrawal requests, and compliance with international financial regulations, which ultimately protects both you and the brokerage.

The verification process is straightforward and designed to be quick, allowing you to focus on what you do best: trading. Here’s a breakdown of the typical steps you will follow:

- Profile Completion: Start by logging into your Personal Area and ensuring all your personal details are accurate and up-to-date. This includes your name, date of birth, and contact information.

- Identity Verification: You will need to submit a clear, readable copy of a valid government-issued photo identification document. This could be your passport, national ID card, or driver’s license. Exness uses this to confirm your identity.

- Proof of Residency: To complete the address verification, you’ll need to provide a document showing your current residential address. Acceptable documents often include a utility bill (electricity, water, gas, internet) or a bank statement, usually issued within the last three to six months. Make sure your name and address are clearly visible on the document.

- Review and Approval: Once you upload your documents, the Exness team reviews them. This usually takes a short period. You will receive a notification once your documents are approved and your account is fully verified.

Completing your Exness account verification ensures a seamless trading journey, giving you peace of mind and full access to all the features and services available.

Exness Account Types for Thai Traders

Choosing the right trading account is a crucial step for any forex trader, and for our valued Thai traders, Exness offers a range of options designed to fit various styles and experience levels. Exness is renowned for its competitive conditions, reliable execution, and excellent support, making it a top choice in Thailand.

Before you dive into the markets, understanding the different Exness account types helps you tailor your trading experience. Whether you are just starting your journey or you’re an experienced pro looking for ultra-tight spreads, Exness has an account for you. Let’s explore the main categories and what each brings to the table.

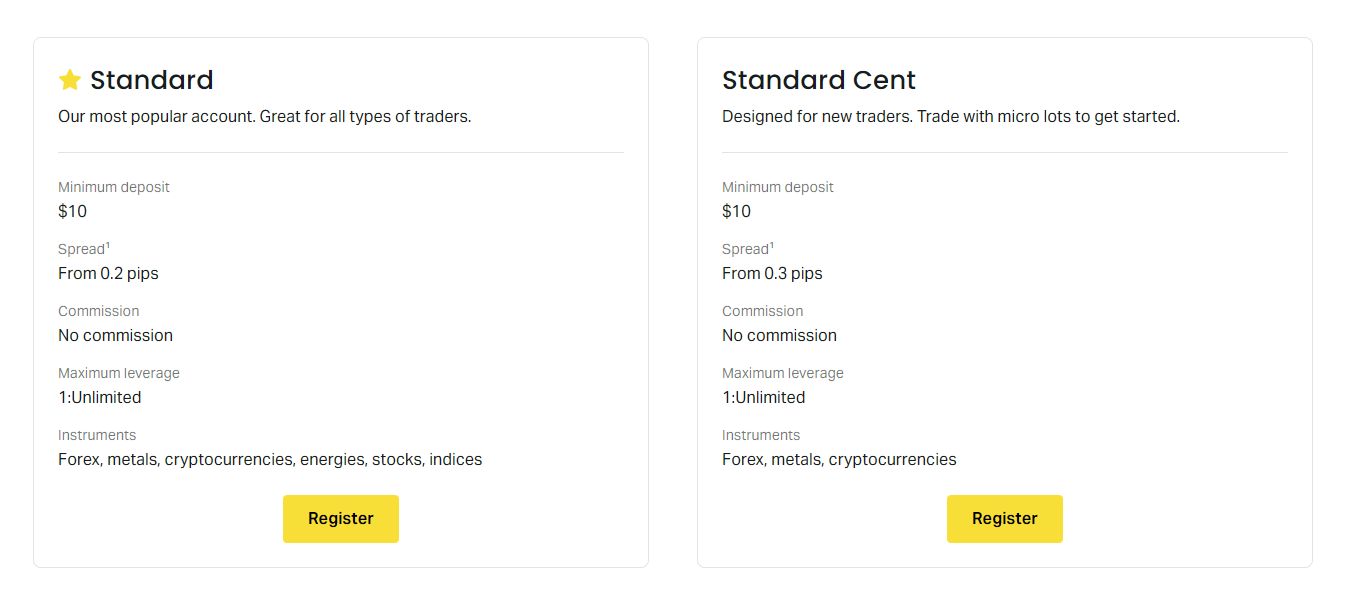

Standard Accounts: Perfect for Most Traders

The Standard Account is the most popular choice for a reason. It offers straightforward trading conditions without complex structures, making it an excellent starting point for beginners and a reliable option for seasoned traders alike. You get stable spreads, no commission per trade, and access to a wide variety of trading instruments.

Key Benefits of the Standard Account:

- Accessibility: Low minimum deposit, making it easy to get started.

- No Commissions: You only pay through the spread, simplifying cost calculation.

- Stable Spreads: Generally competitive and predictable spreads, even during volatile periods.

- Wide Range of Instruments: Trade forex, metals, cryptocurrencies, and more.

- Unlimited Leverage: Under specific conditions, you can access unlimited leverage, providing incredible flexibility.

This account type is truly a versatile option, allowing you to focus on your trading strategies without worrying about hidden fees or complicated terms. It’s user-friendly and provides a robust environment for everyday trading.

Professional Accounts: Designed for Experienced Traders

For those who demand the absolute best in trading conditions, Exness offers a suite of Professional Accounts. These are tailored for active traders, scalpers, and those employing expert advisors who require razor-thin spreads, minimal commissions, and lightning-fast execution. Each professional account type has its unique edge:

Raw Spread Account

As the name suggests, the Raw Spread Account provides incredibly tight, raw spreads on major currency pairs, often starting from 0.0 pips. This comes with a small, fixed commission per lot, making the total trading cost exceptionally low, especially for high-volume traders.

“The Raw Spread Account is ideal for traders who prioritize the lowest possible spreads and understand how commissions work.”

Zero Account

The Zero Account takes low-cost trading to another level. You get zero spreads on the top 30 trading instruments for 95% of the trading day. Like the Raw Spread Account, it involves a small commission, but the benefit of consistent zero spreads on popular pairs is a massive advantage for many strategies.

Pro Account

The Pro Account is unique among the professional offerings. It provides very low spreads starting from 0.1 pips with absolutely no commission. This makes it a fantastic choice for swing traders and those who prefer a commission-free environment but still require excellent pricing and instant execution. Its standout feature is immediate execution, ensuring your orders are filled without delay.

Comparison of Professional Accounts:

| Feature | Raw Spread Account | Zero Account | Pro Account |

|---|---|---|---|

| Spreads | Raw, from 0.0 pips | 0.0 pips on top 30 instruments | Low, from 0.1 pips |

| Commission | Yes, small fixed per lot | Yes, small per lot | No |

| Execution | Market Execution | Market Execution | Instant Execution |

| Best For | Scalpers, EA users, high-volume traders | Scalpers, EA users, zero-spread lovers | Swing traders, discretionary traders, no-commission preference |

As a Thai trader, you have the flexibility to choose an Exness account type that perfectly aligns with your trading goals and capital. Review your trading strategy, consider your preferred instruments, and then select the account that gives you the best edge in the market. Each account offers competitive leverage and robust support, ensuring a superior trading experience.

Standard vs. Professional Accounts

Choosing the right trading account is a crucial step for any forex trader. It’s not just about opening an account; it’s about aligning your trading style, capital, and risk tolerance with the features offered by your broker. Typically, you’ll encounter two main types: Standard and Professional accounts. Understanding the differences helps you make an informed decision that supports your trading journey.

Let’s break down the common characteristics of each:

Standard Accounts

Standard accounts are often the entry point for many new traders. They offer a balanced environment suitable for those starting out or with moderate trading capital. You usually find accessible minimum deposit requirements, making it easy to begin your trading experience.

- Accessibility: Low minimum deposit requirements.

- Leverage: Fixed or lower maximum leverage, often regulated.

- Spreads: Generally wider spreads compared to professional accounts.

- Commissions: Typically no commissions per trade, with the cost built into the spread.

- Market Access: Standard lot sizes (100,000 units of base currency) are common, though mini and micro lots are also available.

- Protection: Often come with regulatory protections for retail clients.

Professional Accounts

As the name suggests, professional accounts cater to experienced traders with substantial capital and a deeper understanding of market dynamics. These accounts often come with different regulatory classifications and offer more flexibility, but also higher risk. They are designed for traders who demand tighter pricing and more robust trading conditions.

| Feature | Description |

|---|---|

| Minimum Deposit | Significantly higher than standard accounts. |

| Leverage | Much higher leverage options, subject to meeting professional criteria. |

| Spreads | Extremely tight, often raw spreads. |

| Commissions | Commissions per trade are common, in addition to tight spreads. |

| Market Depth | Access to deeper liquidity and institutional pricing. |

It’s important to remember that becoming eligible for a professional account often requires meeting specific criteria set by regulators or brokers, such as trading volume, financial knowledge, or significant financial assets. These accounts come with less regulatory protection compared to standard retail accounts.

Before you commit, evaluate your trading experience, capital, and risk appetite. A standard account offers a safer learning ground, while a professional account unlocks more advanced features for the seasoned trader. Choose wisely to empower your trading journey.

Deposit and Withdrawal Methods for Exness in Thailand

As a forex trader in Thailand, having seamless deposit and withdrawal options is crucial for managing your capital efficiently. Exness understands this vital need, offering a robust suite of payment solutions tailored specifically for the Thai market. You want to focus on your trades, not worry about your funds getting stuck, and Exness ensures just that with their reliable and fast transaction processing.

Exness prides itself on providing convenient and secure methods for both depositing funds into your trading account and withdrawing your profits. They aim for instant or near-instant processing times for most popular local payment options, ensuring you have access to your money when you need it. Let’s explore the primary ways you can move your money with Exness in Thailand.

Popular Deposit Methods

Funding your Exness trading account in Thailand is straightforward. Exness supports various local payment gateways and international options, making it easy to get started:

- Online Banking Transfers: A highly popular choice, allowing direct transfers from your local Thai bank account using various online banking platforms. This method is often preferred for its familiarity and security.

- QR Payment Systems: Utilizing QR codes for swift and secure payments directly from your mobile banking app. This is an incredibly convenient option for quick deposits.

- e-Wallets: Several popular e-wallets that cater to the Thai market are often available, providing instant deposits and an added layer of privacy.

- Credit/Debit Cards: Visa and MasterCard are widely accepted for immediate funding, offering a familiar global payment solution.

Most of these deposit methods boast zero commission fees from Exness’s side, meaning more of your money goes directly into your trading capital. Transaction limits are typically generous, accommodating both new traders and those managing larger portfolios.

Efficient Withdrawal Methods

Withdrawing your profits from Exness is just as important as depositing funds. Exness offers an array of methods designed to get your money back into your hands quickly and securely. They prioritize fast processing, especially for local Thai options:

- Local Bank Transfers: This is a very common and reliable method, allowing you to withdraw funds directly to your Thai bank account. Processing times are usually very quick, often within minutes for popular banks.

- e-Wallets: Just like deposits, various e-wallet options are available for withdrawals, offering speed and convenience. Funds typically arrive instantly or within a few hours.

- Credit/Debit Cards: Withdrawals back to Visa and MasterCard are also an option, though processing times can sometimes be longer than local bank transfers due to international banking protocols.

Exness aims for instant withdrawals for many of its most popular methods, particularly local bank transfers and e-wallets, ensuring you can access your earnings without unnecessary delays. They also maintain a transparent policy regarding any fees, which are generally minimal or non-existent from Exness’s side for most common methods.

Key Considerations for Thai Traders

When choosing your deposit or withdrawal method with Exness in Thailand, keep these points in mind:

| Feature | Exness Approach |

|---|---|

| Processing Speed | Many methods offer instant deposits; withdrawals are often instant for local options. |

| Fees | Exness typically covers transaction fees, resulting in zero commission for most popular methods. |

| Security | All transactions are encrypted and processed through secure channels to protect your financial data. |

| Currency Conversion | Transactions are often processed in Thai Baht (THB) where applicable, minimizing conversion concerns. |

Ultimately, Exness provides a user-friendly and highly efficient financial ecosystem for its Thai traders. Their commitment to offering diverse, fast, and secure payment solutions means you can manage your trading capital with confidence and ease, allowing you to concentrate on mastering the markets.

Popular Local Payment Options

Navigating the global forex market requires seamless transactions, and for many traders, local payment methods offer unparalleled convenience. These options often provide faster processing times and lower fees compared to traditional international bank transfers. Understanding which local payment solutions are popular can significantly streamline your funding and withdrawal processes, allowing you to focus more on your trading strategies.

Here are some widely used local payment options you might encounter when trading forex:

- Bank Transfers: Many countries have robust local banking systems that facilitate quick and direct transfers. These are often preferred for larger sums and offer a secure way to move funds directly from your bank account to your trading platform.

- E-Wallets: Digital wallets like Skrill, Neteller, and PayPal are global, but they often integrate with local banking systems, offering fast deposits and withdrawals. Their popularity stems from their ease of use and instant transaction capabilities.

- Local Online Payment Gateways: Specific regions often have their own popular online payment services. For example, Ideal in the Netherlands, Sofort in Germany, or PayTM in India. These gateways connect directly to local bank accounts, making transactions straightforward and familiar for users in those regions.

- Mobile Payment Solutions: With the rise of smartphones, mobile payment apps have become a staple in many economies. Services like M-Pesa in Kenya or UPI in India allow for instant transfers directly from a mobile device, offering incredible accessibility for traders on the go.

- Prepaid Cards: Some traders prefer the control and security of prepaid cards. You load these cards with a specific amount of money, then use them for deposits, helping you manage your trading capital effectively.

Choosing the right local payment method often comes down to what is most prevalent and trusted in your region. Always check with your forex broker to confirm which local options they support, as availability can vary. Opting for a familiar and efficient payment method ensures your funds are always where you need them, when you need them, without unnecessary delays or complications.

Trading Platforms Offered by Exness Thailand

Choosing the right trading platform is crucial for your success in the dynamic forex market. At Exness Thailand, we understand that every trader has unique needs, which is why we provide access to a suite of robust and versatile trading platforms. Our goal is to empower you with the tools you need for seamless execution, comprehensive analysis, and efficient management of your trades. Whether you are a seasoned professional or just starting your journey, our platforms deliver an intuitive user interface and powerful features designed to enhance your trading experience.

MetaTrader 4 (MT4): The Industry Standard

MetaTrader 4 remains the most popular choice among forex traders worldwide, and it’s a core offering for our clients at Exness Thailand. MT4 is renowned for its stability, user-friendly design, and extensive functionalities, making it ideal for both manual and automated trading strategies.

Key Advantages of MT4:

- Comprehensive Charting Tools: Utilize a wide array of technical indicators, drawing tools, and multiple timeframes for in-depth market analysis.

- Expert Advisors (EAs): Automate your trading strategies with EAs, allowing you to trade 24/5 without constant manual intervention.

- Customization: Develop and integrate custom indicators to tailor the platform to your specific analytical needs.

- Large Community Support: Benefit from a vast online community for shared insights and resources, a testament to its enduring popularity.

MetaTrader 5 (MT5): The Next Generation Platform

For traders seeking advanced capabilities and broader market access, MetaTrader 5 offers significant enhancements over its predecessor. Exness Thailand provides MT5 to give you an edge with its expanded features and improved performance.

Why Choose MT5?

MT5 builds upon the strengths of MT4, introducing new features that cater to evolving trading demands:

- More Timeframes: Access 21 timeframes compared to MT4’s nine, offering granular analysis opportunities.

- Additional Indicators: Enjoy more built-in technical indicators and graphical objects for detailed market interpretation.

- Deeper Market Depth: View Level II pricing, giving you a clearer picture of market liquidity.

- Expanded Order Types: Benefit from more pending order types, providing greater flexibility in trade management.

- Multi-Asset Trading: While primarily known for forex, MT5 also supports trading in stocks, futures, and commodities, depending on availability.

Exness Terminal: Our Proprietary Web Platform

Alongside the MetaTrader suite, Exness Thailand offers the Exness Terminal, a powerful web-based trading platform designed for simplicity and efficiency. This proprietary solution ensures you can trade directly from your web browser without any software downloads, making it incredibly convenient for trading on the go.

Exness Terminal Features at a Glance:

| Feature | Benefit to Trader |

|---|---|

| No Download Required | Access your trading account from any device with an internet connection. |

| Intuitive Interface | Clean and user-friendly design for easy navigation and quick trade execution. |

| Integrated Trading Tools | Access essential charting, analysis tools, and real-time market data directly within the browser. |

| Seamless Integration | Connects seamlessly with your Exness account for a unified trading experience. |

Mobile Trading: Trade Anywhere, Anytime

Your trading journey doesn’t stop when you step away from your desktop. Exness Thailand ensures you have full control over your trades with our highly optimized mobile trading applications. Available for both Android and iOS devices, these apps bring the power of the Exness trading platform directly to your fingertips. You can monitor positions, open and close trades, manage your account, and conduct technical analysis, all while on the move. Fast execution speed and a responsive design make mobile trading with Exness truly efficient.

No matter your trading style or preferred device, Exness Thailand offers the robust trading platforms you need to navigate the markets confidently. Explore our options and find the perfect fit for your trading journey today.

MT4 and MT5 Capabilities

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the go-to platforms for millions of forex traders worldwide. These powerful trading terminals provide a robust environment for analyzing markets, executing trades, and automating strategies. While both are excellent, they offer distinct features that cater to different trading styles and needs.

MetaTrader 4: The Industry Standard

MT4 remains incredibly popular, especially among forex traders, due to its simplicity, reliability, and vast community support. Here’s what makes it a powerhouse:

- User-Friendly Interface: It’s intuitive and easy to navigate, even for beginners. You can quickly grasp its functions.

- Advanced Charting Tools: Analyze market movements with a wide range of customizable charts, timeframes, and analytical objects.

- Expert Advisors (EAs): Automate your trading strategies using EAs. The MQL4 programming language allows for custom indicator and EA development.

- Extensive Indicator Library: Access hundreds of technical indicators to help you identify trends and potential entry/exit points.

- Reliable Performance: MT4 offers stable execution and minimal requotes, ensuring your trades go through smoothly.

MetaTrader 5: The Next Generation

MT5 builds upon the success of MT4, offering more advanced features and access to a broader range of financial markets beyond forex. It’s a comprehensive multi-asset platform designed for serious traders:

Key enhancements you find in MT5:

| Feature | Description |

|---|---|

| More Timeframes | Enjoy 21 timeframes compared to MT4’s 9, offering finer granularity for analysis. |

| Additional Pending Order Types | Access Buy Stop Limit and Sell Stop Limit orders for more precise entry strategies. |

| Economic Calendar | Integrated calendar displays important economic news events directly within the platform. |

| Depth of Market (DOM) | View real-time market depth to understand liquidity and order flow. |

| MQL5 Language | A more advanced and powerful programming language for developing complex EAs and indicators. |

| Strategy Tester Improvements | Multi-threaded, multi-currency, and multi-asset backtesting capabilities for EAs. |

Choosing between MT4 and MT5 often depends on your trading assets and the level of analytical depth you require. Many forex brokers still offer both, giving you the flexibility to select the platform that best suits your trading journey.

Range of Trading Instruments on Exness

Exness stands out as a broker committed to empowering traders with a vast array of choices. When you join our platform, you gain access to an impressive selection of trading instruments designed to suit every strategy and market outlook. We understand that diversity is key to successful trading, allowing you to explore various global markets and capitalize on different opportunities as they arise. Whether you’re a seasoned professional or just starting your journey, the breadth of options available here ensures you’ll find instruments that align with your financial goals.

Our commitment to providing a comprehensive trading environment means you’re never limited to just one asset class. You can diversify your portfolio, manage risk effectively, and uncover new trading possibilities across the globe.

A Glimpse into Our Diverse Offerings:

- Forex Majors, Minors & Exotics: Dive into the world’s largest financial market. Trade popular currency pairs like EUR/USD, GBP/JPY, alongside a wide range of less common but potentially lucrative exotic pairs. The foreign exchange market offers unparalleled liquidity and round-the-clock trading.

- Precious Metals: Hedge against inflation or capitalize on price movements with gold, silver, platinum, and palladium. These valuable commodities often serve as safe-haven assets during economic uncertainty.

- Cryptocurrencies: Embrace the future of finance by trading popular digital assets such as Bitcoin, Ethereum, Ripple, and many others. The crypto market offers high volatility and exciting growth potential.

- Stock Indices: Gain exposure to broad economic sectors by trading major global indices like the S&P 500, Dow Jones, DAX, and FTSE 100. These instruments reflect the performance of entire national economies.

- Energies: Participate in the vital energy market by trading crude oil and natural gas. Prices in this sector are often influenced by geopolitical events and supply-demand dynamics.

- Stocks: Invest in the world’s leading companies. Access a wide selection of shares from global giants, allowing you to become part of the success stories of major corporations.

This extensive range means more than just a list of assets; it represents a universe of trading possibilities. You can switch between markets, react to global news events, and build a truly resilient trading portfolio. Exness provides the tools and flexibility you need to navigate these diverse markets with confidence. Your trading journey deserves variety, and we deliver it.

Exness Thailand Customer Support and Local Assistance

In the fast-paced world of forex trading, reliable support is not just a luxury; it’s a necessity. Imagine facing a crucial market moment or a technical glitch and having no one to turn to. That’s why Exness understands the paramount importance of robust customer service, especially for our valued traders in Thailand.

We pride ourselves on offering comprehensive Exness Thailand customer support, designed to address your queries and concerns swiftly and efficiently. Our dedicated team is ready to assist you, ensuring your trading journey remains smooth and uninterrupted. We know that every second counts in trading, and our support reflects that urgency.

How We Support You Locally:

- Multilingual Team: Our support staff includes Thai speakers, ensuring you can communicate comfortably and clearly in your native language. This local assistance removes language barriers, allowing for more precise problem-solving and understanding.

- 24/7 Availability: Forex markets never sleep, and neither does our support. Access assistance around the clock, any day of the week, whether it’s a weekend or a holiday.

- Multiple Contact Channels: Reach out to us through your preferred method. We offer several convenient ways to get in touch:

Our Direct Support Channels:

| Support Channel | Benefit for Thai Traders |

|---|---|

| Live Chat | Instant responses in Thai or English, perfect for quick questions or urgent issues during trading hours. |

| Email Support | Ideal for detailed inquiries or attaching screenshots. Our team provides thorough and thoughtful replies. |

| Phone Support | For direct, real-time conversations. Speak directly to a representative who can guide you through complex issues. |

Our commitment to local assistance goes beyond just language. We understand the specific trading environment and regulatory landscape in Thailand. This local insight allows us to provide more relevant and practical solutions, helping you navigate any challenge with confidence.

“Exceptional customer support is the backbone of a successful trading experience. We build trust by being there when it matters most.” – The Exness Team

Join Exness and experience the peace of mind that comes with knowing you have a professional, responsive, and locally-tuned support system always ready to assist you.

Exness Promotions and Bonuses for Thai Traders

Are you a Thai trader looking to maximize your potential with a trusted broker? Exness offers a range of enticing promotions and bonuses designed to give you an edge in the dynamic forex market. These incentives can significantly boost your trading capital, reduce your trading costs, and even reward your loyalty, making your trading journey even more rewarding.

What Kind of Bonuses Can Thai Traders Expect?

Exness frequently rolls out various types of promotions tailored to benefit both new and experienced traders. While specific offers can change, you often find opportunities like:

- Deposit Bonuses: Imagine adding funds to your account and receiving extra trading credit from Exness. These bonuses can increase your effective trading capital, allowing you to open larger positions or diversify your portfolio more easily.

- Trading Contests: Do you thrive on competition? Exness often hosts trading contests where traders can compete for substantial prize pools. These contests not only add excitement to your trading but also offer a chance to win significant rewards based on your trading performance.

- Loyalty Programs: Exness values its loyal traders. You might find programs that reward your consistent trading activity with exclusive benefits, lower spreads, or access to premium tools and services.

- Referral Programs: Share the benefits with your friends! If you introduce new traders to Exness, you could receive a bonus when they start trading. It’s a win-win situation for everyone.

How These Promotions Benefit You

Understanding the value of these promotions is key. They aren’t just extra cash; they are strategic tools that can enhance your trading experience:

“Exness promotions go beyond mere incentives; they are designed to empower traders, offering tangible advantages that can amplify your market presence and refine your trading strategy.”

Consider these advantages:

- Increased Trading Capital: Bonuses often mean more funds in your account, giving you greater flexibility in your trading decisions.

- Reduced Risk: Trading with bonus funds can sometimes cushion your own capital, allowing you to explore strategies with slightly less personal risk.

- Motivation and Engagement: Contests and loyalty programs add an exciting dimension to your daily trading, keeping you motivated and engaged with the market.

- Access to Premium Benefits: Some promotions can unlock better trading conditions or exclusive analytical tools, further refining your trading edge.

Claiming Your Bonuses: Simple and Transparent

Exness strives for transparency and simplicity when it comes to promotions. Typically, claiming a bonus involves a few straightforward steps: signing up or logging into your account, meeting specific deposit requirements, or participating in a stated competition. Always check the terms and conditions for each specific promotion to ensure you meet the eligibility criteria and understand the withdrawal rules. Exness makes it easy for Thai traders to access and benefit from these exciting opportunities.

Understanding Exness Trading Conditions and Spreads

Diving into the world of online forex trading demands a keen eye for detail, especially when it comes to a broker’s trading conditions and spreads. Exness stands out for offering a diverse range of options, but truly understanding these elements is crucial for any trader aiming for success. It’s not just about finding a broker; it’s about finding the right environment that aligns with your trading strategy and risk tolerance.

Trading conditions encompass various aspects that define your trading experience. Think of them as the rules of the game set by your broker. These can significantly impact your potential profits and overall trading costs. With Exness, you’ll encounter a variety of account types, each tailored with specific conditions to suit different trading styles, from scalping to long-term position holding. Understanding these nuances before you place your first trade is paramount.

What Are Spreads and Why Do They Matter?

At the heart of forex trading costs lies the spread. Simply put, it’s the difference between the bid (sell) price and the ask (buy) price of a currency pair. This small gap is essentially how brokers make their money. For you, the trader, a wider spread means a higher cost to enter and exit a trade, directly impacting your profitability, especially for high-frequency traders.

Exness is known for its competitive spreads, offering both variable and stable options depending on the account type. Variable spreads fluctuate based on market volatility, while stable spreads, often found in ECN-like accounts, tend to remain tighter. Knowing which type of spread applies to your chosen account is vital for managing your trading budget effectively.

- Variable Spreads: These change constantly. During major news events or times of low liquidity, they can widen significantly. You need to be aware of this potential for increased cost.

- Stable Spreads: Generally tighter and less prone to sudden fluctuations. Often associated with raw or zero-spread accounts where a small commission per lot is charged instead.

- Zero Spreads: Available on specific Exness accounts, offering spreads that are zero for a significant portion of the trading day on popular currency pairs. This makes them highly attractive to scalpers and high-volume traders.

Consider this simple truth: every pip saved on spread goes straight into your profit. This is why experienced traders obsess over understanding these costs. Exness provides detailed information about average spreads for all its instruments, allowing you to make informed decisions before committing your capital.

“Understanding your broker’s trading conditions and spreads is not just good practice; it’s a fundamental part of risk management and profitability. It empowers you to trade smarter, not just harder.”

Ultimately, choosing Exness means navigating its rich landscape of trading conditions and spreads. Take the time to explore their various account options, compare the spread types, and align them with your trading strategy. This meticulous approach will undoubtedly set you on a path to a more informed and potentially profitable trading journey.

Mobile Trading with Exness Thailand Apps

In the dynamic world of forex trading, staying connected to the markets is crucial. Thai traders, whether experienced or just starting out, need tools that offer flexibility and power at their fingertips. This is where mobile trading with Exness Thailand apps truly shines. Exness understands the demands of modern traders, providing robust and intuitive mobile solutions that allow you to manage your investments, execute trades, and monitor market movements from anywhere, at any time.

Gone are the days when you needed to be glued to your desktop. With the Exness mobile application, your trading desk fits right into your pocket. This convenience is a game-changer, ensuring you never miss a significant market opportunity, even when you’re on the go. The apps are specifically designed to cater to the needs of traders in Thailand, offering seamless access to a wide array of financial instruments.

Key Advantages of Trading with Exness Mobile Apps:

- Uninterrupted Market Access: Trade major currency pairs, commodities, indices, and cryptocurrencies anytime, anywhere.

- Intuitive User Interface: Navigating the app is simple and straightforward, making it ideal for both beginners and seasoned traders.

- Real-Time Data: Get instant access to live quotes, interactive charts, and critical market news to inform your trading decisions.

- Seamless Account Management: Easily manage your trading accounts, deposit funds, and withdraw profits directly from your mobile device.

- Advanced Trading Tools: Utilize a full suite of technical analysis tools, indicators, and drawing objects for in-depth market study.

Accessibility and Performance

The Exness mobile trading app is available for both Android and iOS devices, ensuring broad accessibility for the majority of Thai traders. You can download it directly from Google Play Store or Apple App Store. Performance is a top priority; the app is optimized for speed and reliability, minimizing latency even during volatile market conditions. This stability is essential when placing quick trades or managing open positions.

Imagine this: you’re enjoying your coffee, and suddenly, a major economic report hits. With the Exness forex trading app, you can instantly check your portfolio, analyze the impact, and adjust your strategy without skipping a beat. It provides the agility you need to react to fast-moving markets effectively. The app’s design focuses on delivering a smooth and efficient trading experience, which means less time fumbling with controls and more time focusing on profitable trades.

What Traders Say:

“The Exness mobile app has revolutionized how I trade. I can check my trades during my commute and execute orders with just a few taps. It’s incredibly reliable.” – A dedicated Thai trader.

“I appreciate how easy it is to deposit and withdraw funds directly from my phone. It’s secure and fast, which gives me peace of mind.” – Another happy Exness user.

Whether you are a scalper, day trader, or long-term investor, the Exness mobile app offers the flexibility and robust features required to succeed in the competitive forex market. It’s more than just an app; it’s your portable trading station, empowering you to stay in control of your financial journey.

Risk Management and Security Features on Exness

In the dynamic world of forex trading, protecting your capital and personal information is paramount. Every serious trader understands that robust risk management and ironclad security features are not just optional extras, but fundamental pillars for sustainable success. Exness, a leading global broker, places a strong emphasis on these critical aspects, empowering traders with peace of mind while they navigate the markets.

Exness understands that effective risk management goes hand-in-hand with advanced security measures. They implement a comprehensive framework designed to safeguard client funds and personal data, ensuring a secure trading environment. Let’s delve into how Exness addresses these vital areas.

Exness’s Commitment to Security

Your safety is a top priority at Exness. They deploy state-of-the-art security protocols to protect your account and personal information:

- Client Fund Segregation: Exness holds client funds in segregated accounts, separate from the company’s operational funds. This crucial measure ensures that your money remains untouched, even in unforeseen circumstances concerning the company.

- Advanced Data Encryption: All data transmissions between you and Exness, including personal details and transaction information, are protected using powerful encryption technologies. This prevents unauthorized access and keeps your sensitive information confidential.

- Two-Factor Authentication (2FA): For an added layer of security, Exness strongly encourages and supports two-factor authentication. Enabling 2FA means that even if someone has your password, they cannot access your account without a second verification step from your registered device.

Essential Risk Management Tools at Your Fingertips

Beyond security, Exness provides a suite of powerful tools and policies designed to help you manage your trading risk effectively. These features are integral to protecting your capital from unexpected market movements and emotional trading decisions.

Key Risk Management Features:

| Feature | Benefit to Traders |

|---|---|

| Negative Balance Protection | This crucial policy ensures that your account balance can never fall below zero, even during periods of extreme market volatility. You will never owe the broker money. |

| Stop-Loss Orders | Set a predetermined price at which your position will automatically close to limit potential losses on a trade. This is a fundamental risk control mechanism. |

| Take-Profit Orders | Lock in your gains by setting a specific price where your trade will automatically close once your desired profit level is reached. |

| Margin Call & Stop Out Levels | Exness has clear margin call and stop out levels. These mechanisms automatically close positions when your margin level falls to a critical point, preventing further losses and protecting your remaining capital. |

| Volatility Protection | Specific protections are in place to manage the impact of sudden market gaps or extreme volatility, aiming to execute orders as close as possible to the requested price. |

Implementing these tools into your daily trading strategy can significantly reduce your exposure to risk and enhance your overall trading discipline. Exness encourages traders to familiarize themselves with and utilize all available risk management features to build a resilient trading approach.

As a professional trader, understanding and leveraging these security and risk management features is essential. Exness provides the framework, allowing you to focus on your trading strategies with confidence, knowing that robust protections are in place. Choose a broker that prioritizes your safety and empowers your trading journey.

Exness Educational Resources for Thai Traders

Embarking on your forex trading journey or looking to refine your strategies? Exness understands that knowledge is power in the dynamic world of financial markets. That’s why we dedicate ourselves to providing an extensive array of educational resources specifically tailored for our valued Thai traders. Our goal is simple: empower you with the insights and skills needed to navigate the complexities of forex trading with confidence and success.

Why Education is Your Strongest Ally

The forex market can seem daunting at first glance, but with the right foundation, anyone can learn to understand its movements and make informed decisions. Education isn’t just about learning definitions; it’s about developing critical thinking, risk management skills, and a strategic mindset. For Thai traders, having access to comprehensive learning materials in your native language makes this journey much smoother and more effective.

Here’s why investing time in learning through Exness resources pays off:

- Master the Basics: Understand fundamental concepts like pips, leverage, and margin.

- Develop Strategies: Learn various trading approaches, from technical analysis to fundamental analysis.

- Manage Risk: Grasp essential risk management principles to protect your capital.

- Stay Updated: Keep abreast of market news and economic indicators that influence currency prices.

- Build Confidence: Trade with greater assurance when you understand the ‘why’ behind market moves.

Dive Into Our Comprehensive Learning Hub

Exness offers a rich variety of educational tools designed to cater to different learning styles and experience levels. Whether you are a complete beginner or an experienced trader seeking to enhance your expertise, you will find valuable content.

Explore a World of Knowledge:

| Resource Type | What You Gain |

|---|---|

| Webinars & Live Sessions | Engage with expert analysts in real-time, ask questions, and get live market insights. These sessions often cover current events and practical trading examples. |

| Video Tutorials | Learn at your own pace with easy-to-understand video guides covering platform functionalities, trading strategies, and market analysis techniques. Perfect for visual learners. |

| Educational Articles & Guides | Access a vast library of well-researched articles that break down complex trading topics into digestible pieces. From beginner guides to advanced strategies, you’ll find it here. |

| Forex Glossary | Decipher industry jargon with our comprehensive glossary. Quick definitions for every term you encounter, ensuring clarity. |

| Demo Accounts | Practice your strategies in a risk-free environment using virtual funds. Apply what you learn without risking real capital, an essential step before live trading. |

Tailored for Your Success

We understand the unique needs of Thai traders. Our educational content is often available in Thai, ensuring that language is never a barrier to your learning. We constantly update our materials, reflecting current market conditions and popular trading instruments, providing relevant and timely information.

Your journey to becoming a confident and successful trader begins with a strong educational foundation. Take advantage of these valuable resources provided by Exness. We are committed to supporting your growth every step of the way.

Comparing Exness with Other Brokers in Thailand

Choosing the right forex broker in Thailand can feel like navigating a complex maze. With numerous options available, Thai traders often wonder how Exness stacks up against its competitors. We all look for reliable trading conditions, excellent support, and seamless access to our funds. Let’s explore what sets Exness apart and how it compares to other forex brokers operating in the vibrant Thai market.

Many brokers target the Thai market, each with their own set of offerings. However, experienced traders in Thailand often prioritize specific features that directly impact their trading experience and profitability. These crucial elements include:

- Trading Conditions: What are the typical spreads, available leverage, and execution speeds like? Volatile markets demand razor-sharp execution.

- Deposit and Withdrawal Methods: Can you easily fund your account and withdraw profits using local Thai payment solutions? Convenience is king.

- Customer Support: Do they offer localized support in Thai language, and are they available when you need them? Time zones matter.

- Platform Variety: Do they provide widely used and reliable platforms like MetaTrader 4 and MetaTrader 5? Traders need familiar tools.

- Account Types: Do they cater to different trading styles and capital sizes, from micro to professional accounts? Flexibility is important.

Exness has built a strong reputation among Thai traders, often distinguishing itself through a focus on competitive conditions and robust client services. While other brokers might offer attractive initial incentives, the long-term trading experience often highlights Exness’s strengths in areas that truly matter for active forex trading in Thailand.

Here’s a quick comparison highlighting some typical differences you might encounter:

| Feature | Exness (Common Offering) | Other Brokers (Varied Offering) |

|---|---|---|

| Spreads | Often very low, stable, even zero on some account types. | Can vary widely, often higher, especially on standard accounts. |

| Leverage | High and often unlimited leverage options (with conditions). | Generally lower, capped at common ratios like 1:500 or 1:1000. |

| Local Payment Options | Extensive local Thai bank transfers, QR payments, e-wallets. | Might offer fewer local options, relying more on international methods. |

| Withdrawal Speed | Known for instant or very fast withdrawals, even on weekends. | Can take hours or days, often only processed on business days. |

| Customer Support | Available 24/7 in multiple languages, including Thai. | Limited hours, fewer language options, or slower response times. |

When you evaluate brokers, look beyond the surface. While some competitors might offer enticing bonuses, consistent low spreads, reliable execution, and swift withdrawals truly empower your trading journey. Exness aims to provide transparency and efficiency, which are highly valued by professional and novice Thai traders alike. The ease of funding and withdrawing via local Thai bank options significantly enhances convenience, a common challenge with many international brokers. Furthermore, their dedication to providing competitive trading conditions consistently positions them as a strong contender in the dynamic landscape of forex brokers in Thailand. Ultimately, your choice depends on your specific needs, but understanding these key differences helps you make a well-informed decision.

Exness Thailand Reviews and Testimonials

When you choose a forex broker, hearing from other traders is crucial. Exness Thailand has built a strong reputation, and the feedback from its users truly tells a story. Thai traders often share their experiences, highlighting what makes Exness a preferred choice in the local market. These Exness Thailand reviews offer valuable insights into the day-to-day trading reality with the broker.

Many users consistently praise several key aspects of their trading journey with Exness. Let’s look at some common points that frequently appear in their testimonials:

- Seamless Withdrawals: One of the most common compliments relates to the speed and efficiency of withdrawals. Traders often mention how quickly they can access their funds, which builds a lot of trust and confidence. This reliable withdrawal process is a significant advantage for many.

- Responsive Customer Support: Thai traders value accessible and helpful support. Exness provides dedicated customer support in multiple languages, including Thai, ensuring that queries are resolved promptly and effectively. This focus on local support enhances the user experience.

- User-Friendly Platforms: Both experienced and new traders find the trading platforms offered by Exness intuitive and easy to navigate. The availability of various platforms caters to different trading styles and preferences, making the overall experience smooth.

- Competitive Trading Conditions: Users frequently highlight the tight spreads and diverse range of trading instruments available. These favorable conditions allow traders to optimize their strategies and manage their costs effectively.

- Reliability and Trust: For many, Exness stands out as a reliable forex broker in Thailand. The consistent performance, regulatory compliance, and transparent operations contribute to a strong sense of security among its user base.

Of course, no service is perfect for everyone, and occasionally, you might find diverse perspectives. Some traders might discuss specific technical issues or personal preferences regarding certain features. However, the overarching sentiment in Exness customer feedback tends to lean heavily towards positive experiences, particularly concerning fundamental services like withdrawals and support.

It’s clear that Exness actively listens to its community. The broker often implements updates and improvements based on user suggestions, demonstrating a commitment to enhancing the trading environment for everyone. This dedication to continuous improvement helps solidify its standing among Thai traders.

Ultimately, while these user testimonials offer a great overview, the best way to understand the trading with Exness in Thailand is to experience it yourself. Explore the features, try the platforms, and see how it aligns with your trading goals.

Frequently Asked Questions

Is it legal to trade with Exness in Thailand?

Yes, it is legal for Thai residents to open an account and trade with Exness. While Exness is an international broker without a local Thai license, you trade with its globally regulated entities, which adhere to high international standards for fund safety and transparency.

What types of accounts does Exness offer?

Exness provides a range of accounts to suit different traders. Standard accounts are great for beginners and most traders, offering commission-free trading. Professional accounts (like Raw Spread, Zero, and Pro) are designed for experienced traders, offering ultra-low spreads and specialized conditions.

What are the main payment methods for deposits and withdrawals in Thailand?

Exness offers convenient local payment options for Thai traders, including online banking transfers from Thai banks, QR payment systems, and popular e-wallets. These methods are known for fast processing, often instant, and typically have no commission fees from Exness.

Which trading platforms are available on Exness?

Exness supports the industry-standard MetaTrader 4 (MT4) and the advanced MetaTrader 5 (MT5) platforms. They also offer the proprietary Exness Terminal, a web-based platform that requires no download, and robust mobile trading apps for both Android and iOS.

Does Exness provide customer support in the Thai language?

Yes, Exness offers dedicated customer support with Thai-speaking staff. Support is available 24/7 through various channels like live chat, email, and phone, ensuring Thai traders can get assistance in their native language whenever they need it.