- Competitive Spreads: Enjoy some of the tightest spreads in the industry, significantly reducing your trading costs.

- Fast Execution: Experience lightning-fast order execution, crucial for capitalizing on market movements in real time.

- Diverse Instruments: Access a wide range of trading instruments, including major and minor currency pairs, cryptocurrencies, stocks, indices, and commodities. This variety empowers you to diversify your portfolio.

- Flexible Leverage: Benefit from high, flexible leverage options, allowing you to amplify your trading power while managing risk effectively.

- Local Payment Methods: Exness supports various convenient and secure payment methods popular in South Africa, making deposits and withdrawals seamless.

- 24/7 Customer Support: Get assistance whenever you need it, with dedicated support available round the clock in multiple languages.

- Why Exness is a Top Choice for South African Traders

- Key Advantages for South African Traders

- Why Traders Choose Exness: A Quick Look

- Exness South Africa Regulation and Security: Is Your Investment Safe?

- Regulated for Your Protection: The FSCA Connection

- Beyond Regulation: Exness’s Robust Security Measures

- The Verdict: Is Your Investment Safe with Exness?

- Opening an Exness Account in South Africa: A Step-by-Step Process

- 1. Visit the Official Exness Website

- 2. Initiate Your Registration

- 3. Choose Your Account Type

- 4. Complete Your Profile Information

- 5. Verify Your Identity and Residence

- 6. Fund Your Account

- 7. Download and Access Your Trading Platform

- Exness Account Types Tailored for South African Clients

- Standard Accounts: Your Gateway to Trading

- Key features of Standard Accounts:

- Professional Accounts: For the Discerning Trader

- Explore the Professional Account options:

- Funding Your Exness South Africa Account: Deposit and Withdrawal Methods

- Depositing Funds: Getting You Ready to Trade

- Withdrawing Your Profits: Easy Access to Your Earnings

- Trading Platforms Offered by Exness in South Africa

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Generation

- Exness Terminal (WebTerminal): Trading Anywhere, Anytime

- Available Trading Instruments with Exness SA

- Forex (Foreign Exchange)

- Metals

- Cryptocurrencies

- Energies

- Stocks

- Indices

- Exness Trading Conditions: Spreads, Leverage, and Swaps for SA Traders

- Spreads: Your Trading Cost

- Leverage: Magnifying Your Market Exposure

- Swaps: Overnight Holding Costs or Benefits

- Exness Customer Support for South African Clients

- Understanding Exness Fees and Commissions in South Africa

- What Trading Costs Should You Watch For?

- Non-Trading Fees: Simple and Straightforward

- Exness Partnership Programs in South Africa: IB and Affiliates

- Understanding the Exness IB Program in South Africa

- Benefits for South African IBs:

- Exploring the Exness Affiliate Program in South Africa

- Why Become an Exness Affiliate in South Africa?

- Choosing the Right Path for You

- Mobile Trading Experience with Exness in South Africa

- Unlocking Trading Power on the Go

- Key Features for South African Traders:

- Advantages of Mobile Trading with Exness in South Africa

- Security and Support: Peace of Mind for Mobile Traders

- Educational Resources and Trading Tools for Exness South Africa Users

- Empowering Your Knowledge Base

- Unlocking Trading Potential with Essential Tools

- Exness South Africa vs. Local Brokers: A Comparative Analysis

- Summary Comparison Table

- Frequently Asked Questions

Why Exness is a Top Choice for South African Traders

South African traders are discerning. They seek a reliable partner, competitive conditions, and seamless trading experiences in the dynamic forex market. Exness consistently stands out as a preferred broker, offering a compelling blend of features that cater specifically to the needs of the local trading community. From robust security measures to exceptional trading terms, Exness makes a strong case as the go-to platform.

Many traders globally, including those in South Africa, value transparent operations and a broker that truly understands their needs. Exness delivers on these fronts by prioritizing client satisfaction and providing an environment conducive to successful trading.

Key Advantages for South African Traders

Here’s a breakdown of the core benefits that make Exness an attractive option:

- Competitive Trading Conditions: Access some of the tightest spreads in the industry, often starting from 0.0 pips on major currency pairs. This significantly reduces your trading costs, allowing more room for potential profit. You also benefit from high leverage options, giving you flexibility to manage your capital effectively.

- Robust Security and Reliability: Exness operates under strict international regulatory frameworks, ensuring the safety of client funds through segregated accounts. This commitment to security provides peace of mind, knowing your investments are protected by a globally recognized and trusted entity.

- Diverse Range of Instruments: Explore a vast selection of trading instruments. Beyond forex, you can trade cryptocurrencies, stocks, indices, and commodities. This variety empowers you to diversify your portfolio and seize opportunities across different markets.

- Flexible Funding Options: Enjoy convenient and fast deposit and withdrawal methods, including local South African payment solutions. This ensures you can manage your funds with ease, without unnecessary delays or complications. Withdrawals are processed rapidly, often instantly, which is a major advantage for active traders.

- Excellent Customer Support: Receive round-the-clock, multilingual customer service. The Exness support team is ready to assist you with any queries or issues, ensuring you always have a helping hand when you need it. This dedicated support significantly enhances the trading experience.

- Advanced Trading Platforms: Trade on popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), renowned for their powerful analytical tools, charting capabilities, and automated trading features. Exness also offers its intuitive Exness Terminal, a user-friendly web-based platform perfect for both beginners and experienced traders.

One South African trader recently commented, “Exness has transformed my trading. The low spreads and instant withdrawals mean I can focus purely on my strategy, not on administrative hurdles.” This sentiment echoes widely among the platform’s users.

Why Traders Choose Exness: A Quick Look

| Feature | Benefit for Traders |

|---|---|

| Low Spreads | Reduced trading costs, higher profit potential |

| Instant Withdrawals | Quick access to your funds, improved cash flow |

| Diverse Assets | More trading opportunities, portfolio diversification |

| 24/7 Support | Always-available assistance, peace of mind |

| Regulated Environment | Secure trading, protection of funds |

Ultimately, Exness provides a robust, trader-centric ecosystem that aligns perfectly with the demands of the South African market. Its commitment to competitive pricing, security, and exceptional service truly sets it apart, making it a reliable and attractive choice for anyone looking to excel in forex trading.

Exness South Africa Regulation and Security: Is Your Investment Safe?

When you enter the dynamic world of forex trading, one question towers above all others: Is your investment safe? This concern becomes even more critical when choosing a broker. For traders in South Africa considering Exness, understanding their regulatory framework and security measures is essential. Let’s delve into how Exness protects your capital and ensures a secure trading environment.

Regulated for Your Protection: The FSCA Connection

The cornerstone of a secure trading experience is robust regulation. In South Africa, the Financial Sector Conduct Authority (FSCA) is the vigilant watchdog ensuring financial entities operate with integrity and transparency. While Exness maintains multiple global licenses, its commitment to serving South African traders often aligns with a local or internationally recognized regulatory framework that extends protective measures to its clients. This oversight is vital.

What does FSCA oversight, or compliance with other strong international regulators, mean for you? It ensures:

- Fair Trading Practices: Brokers must adhere to strict guidelines, preventing manipulation and promoting equitable execution of trades.

- Client Fund Segregation: Your funds are held in separate bank accounts from the company’s operational capital. This means your money remains secure, even if unforeseen financial difficulties were to affect the broker.

- Transparency: Regulated brokers must provide clear and understandable information about their services, fees, and risks.

- Dispute Resolution: Should a conflict arise, there are established channels for resolution, offering an impartial body to review your concerns.

This multi-layered approach to regulation demonstrates a broker’s commitment to upholding high standards and prioritising investor protection.

Beyond Regulation: Exness’s Robust Security Measures

Regulation is just one piece of the puzzle. A truly secure broker implements strong internal security protocols to safeguard your assets and personal information. Exness employs a range of advanced security features designed to give you peace of mind:

Exness Security Safeguards:

| Security Feature | Benefit to You |

|---|---|

| Segregated Accounts | Your deposits are separate from Exness’s company funds, protected from operational risks. |

| Negative Balance Protection | Your trading account cannot go into a negative balance. You won’t lose more money than you deposited. |

| Data Encryption (SSL) | All your personal and financial data transmitted through their platforms is encrypted, keeping it private and secure. |

| Two-Factor Authentication (2FA) | An extra layer of security for your account login, preventing unauthorized access. |

| Regular Audits | Independent auditors review their financial practices and security systems, ensuring compliance and integrity. |

These measures are not merely add-ons; they are fundamental components of a trusted trading environment. They show that Exness prioritizes the safety of your funds and information, going the extra mile to protect you from potential threats.

The Verdict: Is Your Investment Safe with Exness?

Combining adherence to regulatory standards with robust internal security measures, Exness demonstrates a strong commitment to client safety. For traders in South Africa, this means you can engage in the forex market with greater confidence. Your investments are handled with care, your personal data is protected, and you trade within a framework designed to ensure fairness and transparency. While no financial market is without risk, choosing a broker like Exness that prioritizes regulation and security significantly mitigates common concerns, allowing you to focus on your trading strategies.

Opening an Exness Account in South Africa: A Step-by-Step Process

Ready to dive into the dynamic world of forex trading? Exness offers a robust and user-friendly platform, and opening an Exness account in South Africa is a straightforward process designed for efficiency and compliance. Whether you’re a seasoned trader or just starting your journey, navigating the financial markets with a reliable broker like Exness can make all the difference. Let’s walk through each essential step to get you set up and ready to trade.

Here’s your detailed guide to establishing your Exness presence:

1. Visit the Official Exness Website

Your first move is to go directly to the official Exness website. Always ensure you are on the legitimate site to protect your personal and financial information. Look for the “Open Account” or “Register” button, usually prominently displayed on the homepage.

2. Initiate Your Registration

The registration process begins by providing some basic contact details. You will typically need to enter your email address or phone number and create a secure password. Make sure your password is strong and unique to safeguard your new Exness account.

3. Choose Your Account Type

Exness offers various account types tailored to different trading styles and experience levels. As you progress, you’ll select an account that best suits your needs:

- Standard Account: Perfect for beginners and experienced traders alike, offering competitive spreads and no commission.

- Pro Account: Designed for professional traders, featuring low spreads, no commission on many instruments, and instant execution.

- Raw Spread Account: Ideal for high-volume traders seeking the lowest possible spreads, with a small commission per lot.

- Zero Account: Offers zero spreads on the top 30 instruments for 95% of the trading day, with a small commission.

Take a moment to understand the features of each to make an informed decision for your forex trading journey.

4. Complete Your Profile Information

Once you choose your account type, you’ll proceed to fill in your personal details. This includes your full name, date of birth, and physical address. Exness, like all regulated brokers, requires this information to comply with international financial regulations and protect traders. Accuracy here is crucial for the next step.

5. Verify Your Identity and Residence

This is a critical step, especially in South Africa, due to Financial Intelligence Centre Act (FICA) requirements. To fully verify your Exness account, you will need to upload documents to confirm your identity and residential address. Common documents include:

| Document Type | Examples |

|---|---|

| Proof of Identity | Valid Passport, National ID Card, Driver’s License |

| Proof of Residence | Utility Bill (electricity, water, rates), Bank Statement, Rental Agreement (dated within the last 3-6 months) |

Ensure your documents are clear, valid, and show all corners. The verification team usually processes these quickly, but slight delays can occur if documents are unclear or incomplete.

6. Fund Your Account

After your account is verified, you are ready to make your initial deposit. Exness provides numerous convenient payment methods for South African traders, including local bank transfers, credit/debit cards, and various e-payment systems. Choose the method that works best for you and follow the instructions to deposit funds securely. Remember to start with an amount you are comfortable risking.

7. Download and Access Your Trading Platform

With funds in your account, you are now ready to engage with the financial markets! Exness supports popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). You can download the desktop versions, use their web trader, or access the mobile apps. Log in with your Exness account credentials, and you’re set to explore charts, analyze market trends, and place your first trades.

Opening an Exness account in South Africa truly opens the door to a world of trading opportunities. By following these clear steps, you’ll navigate the setup process efficiently and securely, putting you on the path to becoming an active participant in the global forex market.

Exness Account Types Tailored for South African Clients

Navigating the world of online forex trading requires a robust platform and an account that perfectly matches your trading style and experience level. For traders in South Africa, Exness offers a diverse range of account types, meticulously designed to cater to everyone from aspiring beginners to seasoned professionals. Understanding these options helps you make an informed choice, setting the stage for a more effective and profitable trading journey.

Exness broadly categorizes its accounts into two main groups: Standard Accounts and Professional Accounts. Each category offers distinct features regarding minimum deposit, spread structure, commission, and available instruments, ensuring there’s a fit for almost every trading strategy and capital size.

Standard Accounts: Your Gateway to Trading

The Standard Account is the most popular choice among new traders and those who prefer straightforward trading conditions without complex commission structures. It offers competitive spreads and no commission per trade, making it an excellent starting point for anyone entering the forex market. This account allows access to a wide range of trading instruments, including forex pairs, cryptocurrencies, metals, energies, and indices.

Within the Standard category, you also find the Standard Cent Account. This unique option is perfect for micro-lot trading, allowing you to test strategies and get comfortable with live trading using smaller capital. It effectively reduces your risk exposure while providing a real market experience.

Key features of Standard Accounts:

- Low minimum deposit requirements, making them accessible.

- Stable and competitive spreads with no commission.

- Suitable for all trading strategies, including scalping and swing trading.

- Access to a broad spectrum of trading instruments.

- Instant withdrawal options, a significant advantage for South African traders.

Professional Accounts: For the Discerning Trader

For traders with more experience, higher trading volumes, or those who demand the tightest spreads and specific execution models, Exness offers a suite of Professional Accounts. These accounts are engineered to meet the demands of advanced strategies and high-frequency trading.

Explore the Professional Account options:

| Account Type | Description | Key Benefits |

|---|---|---|

| Raw Spread Account | Offers ultra-low, sometimes zero, spreads with a fixed commission per lot. | Ideal for scalpers and high-volume traders who prioritize minimal spreads. You know exactly what you pay in commission. |

| Zero Account | Provides zero spreads on the top 30 trading instruments for 95% of the trading day, coupled with a small commission. | Exceptional for those focusing on major currency pairs and popular assets. Offers incredible cost efficiency on key instruments. |

| Pro Account | Features highly competitive spreads, zero commission, and instant execution. | A versatile choice for both discretionary and algorithmic traders seeking prime trading conditions without commissions. Balances tight spreads with simplicity. |

Choosing the right Exness account type is a crucial step in your trading journey. Consider your trading experience, capital, preferred instruments, and strategy. Whether you are taking your first steps into the market or executing complex strategies, Exness provides an account tailored to your specific needs, ensuring a seamless and efficient trading experience from South Africa.

Funding Your Exness South Africa Account: Deposit and Withdrawal Methods

Seamless funding is essential for any serious trader, and Exness understands this crucial need for its South African clients. Accessing your trading capital quickly and withdrawing your hard-earned profits without hassle makes all the difference in your trading journey. Exness provides a robust and flexible system designed to offer convenience, speed, and security for both deposits and withdrawals, ensuring you can focus on the markets, not on banking complexities.

Depositing Funds: Getting You Ready to Trade

Getting capital into your Exness South Africa account is a simple, user-friendly process. Exness offers a variety of deposit methods tailored to suit different preferences, ensuring you can fund your trading account with ease. Whether you prefer traditional banking or modern e-wallet solutions, you’ll find an option that works for you.

- Local Bank Transfers (EFTs): Many South African traders favor direct electronic fund transfers. This method allows you to move funds directly from your local bank account to your Exness trading account. It’s secure, widely used, and you can initiate transfers directly from your online banking platform.

- Credit/Debit Cards: Visa and MasterCard are popular choices for instant deposits. Simply link your card, enter your details, and your funds reflect almost immediately, allowing you to seize market opportunities without delay.

- Electronic Payment Systems (e-wallets): For those who prioritize speed and convenience, Exness supports several popular e-wallets. These services offer rapid transactions, often processing your deposit within minutes, making them ideal for quick top-ups.

Exness aims for instant processing on most deposit methods, meaning your funds hit your trading account swiftly, letting you jump into action when the markets call. Always remember to check for any minimum deposit requirements before you begin.

Withdrawing Your Profits: Easy Access to Your Earnings

Just as important as depositing is the ability to withdraw your profits efficiently. Exness prides itself on offering fast and reliable withdrawal methods, giving you control over your earnings. The process is straightforward, designed to get your money to you without unnecessary delays.

When it comes to cashing out, Exness generally processes withdrawals using the same method you used for your deposit, which is a standard security protocol. This ensures a smooth and secure transaction flow. Popular withdrawal options for South African traders include:

- Bank Transfers: Transferring funds directly back to your local South African bank account is a secure and commonly used method for larger withdrawals. While it might take a business day or two to reflect, it’s a reliable way to receive your earnings.

- Credit/Debit Card Refunds: If you deposited via card, your profits can often be returned directly to the same card, acting as a refund. This method is convenient for smaller amounts.

- Electronic Payment Systems: Withdrawals to e-wallets are often among the fastest, with funds typically arriving within minutes or a few hours after processing by Exness.

Exness focuses on quick processing times for withdrawals, often completing them within minutes or a few hours for many methods, especially e-wallets. For bank transfers, expect typical banking industry timeframes. Before your first withdrawal, ensure your account is fully verified, as this is a crucial step to safeguard your funds and comply with financial regulations.

Trading Platforms Offered by Exness in South Africa

For every South African trader, the trading platform is the heart of their market experience. Exness understands this crucial need, which is why they offer a selection of robust, reliable, and user-friendly platforms designed to empower traders, whether you’re just starting out or you’re a seasoned professional. These platforms provide the tools, speed, and security you need to navigate the dynamic forex and CFD markets.

MetaTrader 4 (MT4): The Industry Standard

MetaTrader 4, or MT4, remains the gold standard for forex trading globally, and it’s a core offering for Exness clients in South Africa. Its enduring popularity stems from its intuitive interface, powerful charting tools, and the flexibility it offers. Traders often choose MT4 for its:

- User-Friendly Interface: Easy to navigate, even for newcomers, making it simple to place trades, manage orders, and monitor your portfolio.

- Advanced Charting Tools: Provides a wide range of analytical objects and timeframes to help you identify trends and make informed decisions.

- Expert Advisors (EAs): Supports automated trading strategies, allowing you to execute trades based on pre-set parameters without constant manual intervention.

- High Customization: You can personalize the platform to suit your trading style and preferences, including indicators and templates.

MT4 offers a stable and secure environment, essential for executing trades quickly and efficiently in the fast-paced South African market.

MetaTrader 5 (MT5): The Next Generation

For traders seeking more advanced features and access to a wider range of financial instruments, MetaTrader 5 (MT5) is an excellent choice. Exness provides MT5 to South African traders looking for enhanced capabilities beyond what MT4 offers. While building on the success of its predecessor, MT5 introduces significant upgrades:

- More Timeframes: Offers 21 timeframes compared to MT4’s 9, providing deeper analytical capabilities.

- Additional Indicators: Comes with more built-in technical indicators and analytical objects.

- Economic Calendar: Integrated directly into the platform, helping traders stay updated on market-moving events.

- Expanded Instrument Access: While primarily known for forex, MT5 often allows trading of more CFDs, including stocks and commodities, giving you more diversification opportunities.

- Order Management: Supports more pending order types, offering greater flexibility in trade execution.

MT5 is designed for traders who demand greater analytical depth and broader market access, making it a powerful tool for sophisticated strategies.

Exness Terminal (WebTerminal): Trading Anywhere, Anytime

Beyond the MetaTrader suite, Exness also offers its own proprietary Exness Terminal, a web-based platform that allows you to trade directly from your browser. This means no downloads are required, and you can access your account from any device with an internet connection. The Exness Terminal prioritizes ease of use and accessibility, making it ideal for traders who value convenience without compromising on essential trading features. It provides real-time quotes, charting tools, and efficient order execution, ensuring you never miss a market opportunity.

No matter your preference, Exness ensures a seamless trading experience with platforms that are robust, secure, and packed with the features South African traders need to succeed.

Available Trading Instruments with Exness SA

Diving into the markets requires a diverse toolkit, and Exness SA provides just that. We understand that every trader has unique preferences and strategies, which is why we offer a broad spectrum of trading instruments. This variety empowers you to explore different market dynamics, diversify your portfolio, and seize opportunities across various asset classes. Your trading journey with us opens doors to global financial markets, ensuring you always find something to match your trading style.

Here’s a closer look at the key instrument categories you can trade with Exness SA:

Forex (Foreign Exchange)

The cornerstone of global finance, forex trading involves exchanging one currency for another. With Exness SA, you gain access to a vast array of major, minor, and exotic currency pairs. Trade popular pairs like EUR/USD, GBP/JPY, or USD/CAD. The forex market operates 24/5, offering continuous opportunities for traders around the world. We provide competitive spreads and reliable execution, making your currency trading experience seamless.

Metals

Precious metals like gold and silver often serve as safe-haven assets and popular trading instruments. You can trade gold (XAU/USD) and silver (XAG/USD) against the US Dollar. These commodities attract traders looking for stability during economic uncertainty or seeking to capitalize on their price fluctuations. Metals trading provides an excellent way to diversify your portfolio beyond traditional currencies.

Cryptocurrencies

Embrace the future of finance with our cryptocurrency offerings. Trade popular digital assets such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) against the US Dollar. The crypto market is known for its volatility and potential for significant price movements, attracting traders eager to explore new frontiers. Our platform makes it easy to engage with this exciting and rapidly evolving asset class.

Energies

The energy market moves global economies, and you can participate in its dynamics. Trade crude oil, including benchmarks like US Oil (WTI) and UK Oil (Brent). These instruments are highly reactive to geopolitical events and supply-demand shifts, providing frequent trading opportunities. Engage with this vital sector and potentially profit from price changes in a market that constantly impacts daily life.

Stocks

Invest in the performance of leading global companies. With Exness SA, you can trade CFDs on a selection of popular stocks from major exchanges. This allows you to speculate on price movements of companies without actually owning the underlying shares. Stocks offer a way to diversify your trading and connect with the growth stories of innovative businesses.

Indices

Gain exposure to entire stock markets or sectors through indices. Trade CFDs on major global indices like the S&P 500, Dow Jones Industrial Average, NASDAQ, FTSE 100, and DAX. Indices offer a broader perspective on market performance and can be a powerful tool for diversification and capturing overall market trends. It’s a way to trade the health of an economy or a specific industry with a single instrument.

Exness Trading Conditions: Spreads, Leverage, and Swaps for SA Traders

Understanding the trading conditions a broker offers is crucial for any successful forex trader, especially for those in South Africa. Exness stands out with competitive offerings designed to suit various trading styles. Let’s dive into the specifics of spreads, leverage, and swaps that South African traders can expect when trading with Exness.

Spreads: Your Trading Cost

Spreads represent the difference between the bid and ask price of a currency pair, essentially your cost to open a trade. Exness is well-known for offering tight and stable spreads, which can significantly impact your profitability, especially during active trading sessions. They provide a range of account types, each with its own spread structure, allowing you to choose what best fits your strategy. For instance, the Raw Spread and Zero accounts boast minimal spreads, sometimes even zero, plus a small commission, making them ideal for scalpers and high-volume traders. Standard accounts offer commission-free trading with slightly wider but still very competitive spreads.

Tight spreads mean less of your capital is immediately consumed by transaction costs, leaving more room for potential profit. Exness ensures transparency in their spread offerings, reflecting real-time market conditions.

Leverage: Magnifying Your Market Exposure

Leverage is a powerful tool that allows you to control a large amount of money in the market with a relatively small deposit. Exness provides exceptionally high leverage options, up to unlimited leverage under certain conditions, which can be a game-changer for South African traders looking to maximize their market exposure. While high leverage can amplify potential gains, it also carries increased risk, so responsible use is paramount. Beginners often start with lower leverage to manage risk effectively.

Here’s how Exness leverage can benefit you:

- Increased Capital Efficiency: You can open larger positions with less initial margin.

- Access to Larger Trades: Even with a modest account balance, you can participate in significant market moves.

- Flexibility: Exness often adjusts leverage based on account equity, providing a dynamic risk management approach.

Always consider your risk tolerance before utilizing high leverage. It’s a double-edged sword that requires careful consideration and a robust risk management plan.

Swaps: Overnight Holding Costs or Benefits

Swaps, also known as rollover interest, are charges or credits applied to positions held open overnight. They reflect the interest rate difference between the two currencies in a pair. For many traders, especially those who hold positions for several days or weeks, swaps can accumulate and become a significant factor in overall trading costs. However, Exness offers a substantial advantage here: swap-free accounts for many instruments.

Exness provides swap-free trading for a wide range of assets, including major forex pairs, indices, and some commodities, catering to the needs of traders who prefer not to incur overnight financing costs. This feature is particularly beneficial for swing traders or those adhering to specific trading principles that avoid interest charges. Being swap-free means you can hold your positions for extended periods without worrying about daily interest deductions, simplifying your profit calculations and reducing unexpected expenses.

In summary, Exness offers a compelling set of trading conditions for South African traders, combining competitive spreads, flexible and high leverage options, and valuable swap-free trading on many instruments. These conditions empower traders with greater control over their trading costs and potential returns.

Exness Customer Support for South African Clients

Navigating the dynamic world of forex trading requires not only skill and strategy but also robust, reliable support. For our valued **South African clients**, Exness goes the extra mile to provide a superior **Exness customer support** experience. We understand that quick, effective help can make all the difference, especially when opportunities arise or challenges appear in the fast-paced markets.

Exness prides itself on its **dedicated support team**, always ready to assist you. Our professionals are well-trained to handle a wide array of inquiries, from technical trading issues to account management questions. They ensure you receive the precise and timely help you need, allowing you to focus on your trading activities with confidence.

You have multiple convenient **customer service channels** at your disposal, designed to ensure you can reach us effortlessly. Each option provides a distinct benefit, catering to your specific needs:

- Live Chat: For immediate queries and real-time solutions, our live chat service offers instant connection to a support agent. This is perfect for quick questions or urgent matters that require rapid attention.

- Email Support: If your query is more complex or requires detailed explanations and attachments, sending an email allows you to provide comprehensive information and receive a thorough, well-documented response.

- Phone Assistance: Sometimes, speaking directly to a person is the most effective way to resolve an issue. Our phone lines connect you with a knowledgeable representative who can provide direct **trading assistance** and personalized guidance.

One of the key pillars of our support is **24/7 availability**. We know the forex market never sleeps, and neither do we when it comes to supporting our traders. No matter the time of day or night, or even on weekends, our support team is on standby to help you. This continuous accessibility ensures that no trading opportunity is missed and no concern goes unaddressed, providing unparalleled peace of mind.

Our commitment extends beyond just being available; we focus on efficient **query resolution**. The team’s expertise and the streamlined support process ensure that most issues are resolved quickly and effectively on the first contact. We also value **local expertise**, ensuring our team understands the unique requirements and nuances relevant to **South African clients**, providing more tailored and effective solutions. With Exness, you get more than just a broker; you gain a reliable partner committed to your trading success.

Understanding Exness Fees and Commissions in South Africa

As a savvy forex trader in Exness South Africa, mastering your trading costs is paramount to long-term success. Every pip counts, and a clear grasp of what you pay and why can significantly impact your bottom line. At Exness, we believe in transparent pricing, ensuring you always know where you stand. Let’s dive into the specifics of the fees and commissions you might encounter while trading with us.

Forex trading isn’t just about spotting opportunities; it’s also about managing expenses. Your profits can quickly erode if you don’t account for the various charges involved. We structure our fees to offer competitive conditions for all types of traders, from beginners to seasoned professionals.

What Trading Costs Should You Watch For?

When you trade on Exness, several key cost components come into play. Understanding each one helps you make informed decisions about your trading strategy and account choice:

- Spreads: This is the difference between the bid and ask price of a currency pair. Exness offers competitive spreads that can be variable or stable, depending on market conditions and your chosen account type. Tighter spreads mean lower trading costs for you.

- Commissions: While many of our account types offer commission-free trading on major pairs, some specialized accounts, like our Raw Spread or Zero accounts, feature a small commission per lot traded. This allows for ultra-tight spreads, making them ideal for high-volume or algorithmic traders.

- Swap Fees: Also known as overnight interest, swap fees apply when you hold a position open past a certain time (usually 00:00 server time). You either pay or receive swap, depending on the interest rate differential between the two currencies in the pair and the direction of your trade.

We work hard to keep these costs competitive, allowing you more capital to focus on your trades. Our goal is to provide a trading environment where your success is truly achievable.

Non-Trading Fees: Simple and Straightforward

Beyond the direct costs of placing trades, it’s natural to wonder about other potential charges. Here’s a quick look at non-trading fees:

| Fee Type | Exness Policy | Impact on Your Trading |

|---|---|---|

| Deposit Fees | Generally 0% on deposits. | You fund your account without incurring additional charges, maximizing your capital from the start. |

| Withdrawal Fees | Mostly 0% on withdrawals. | Withdraw your profits without worrying about deductions, giving you full access to your earnings. |

| Dormant Account Fee | None. | We do not charge dormant account fees, allowing you flexibility even if you take a break from trading. |

Exness commits to providing a fair and clear fee structure. We prioritize your trading experience, aiming to keep it as cost-effective and transparent as possible. By understanding these aspects of our trading costs, you can better plan your financial strategies and focus on what truly matters: making successful trades in the dynamic forex market.

Exness Partnership Programs in South Africa: IB and Affiliates

Are you an influential trader, a community leader, or someone with a knack for connecting people in the financial markets? Exness offers exceptional partnership programs designed to reward your efforts in expanding the trading community, particularly within the vibrant South African market. Joining an Exness partnership program is a fantastic way to earn substantial passive income while helping others discover one of the most reputable forex brokers in the industry. Whether you prefer direct engagement or broad marketing, Exness provides tailored solutions to fit your style.

There are two primary avenues for partnership: the Introducing Broker (IB) program and the Affiliate program. Both are crafted to provide competitive commission structures and robust support, ensuring your success as you refer new traders to Exness.

Understanding the Exness IB Program in South Africa

The Introducing Broker (IB) program is ideal for individuals or entities who maintain close relationships with traders and actively guide them. As an IB, you act as a direct liaison between Exness and new clients, providing support and insights. Your role involves referring traders who then open accounts and trade with Exness. This hands-on approach builds strong relationships and often leads to higher client retention.

Benefits for South African IBs:

- Competitive Commission Structure: Earn a commission based on the trading activity of your referred clients. The more they trade, the more you earn.

- Personalized Support: Get dedicated account management and resources from Exness to help you onboard and support your clients effectively.

- Advanced Reporting Tools: Access detailed analytics and real-time data to track your referrals’ trading volumes and your earnings.

- Building a Trading Community: Establish yourself as a trusted authority within the South African trading community, attracting more traders through your expertise.

- Flexible Withdrawal Options: Enjoy seamless and swift payouts of your earned commissions.

Exploring the Exness Affiliate Program in South Africa

The Exness Affiliate program caters to those who excel in digital marketing, content creation, and online promotion. If you run a trading blog, a finance-focused website, manage social media channels, or engage in email marketing, this program offers a perfect fit. Affiliates primarily focus on driving traffic and client acquisition through various online channels using unique referral links.

Why Become an Exness Affiliate in South Africa?

The affiliate model provides a scalable way to generate income without direct client support, focusing instead on broad reach and effective marketing. This program is particularly strong for those who wish to leverage their online presence to attract new users to Exness in the diverse South African forex landscape.

| Feature | Description |

|---|---|

| Diverse Marketing Materials | Access a wide array of banners, landing pages, widgets, and other promotional tools. |

| Performance-Based Rewards | Earn commissions based on the number of qualified traders you refer who start trading. |

| Global Recognition | Partner with a globally recognized broker, enhancing your credibility and reach. |

| Advanced Tracking System | Utilize sophisticated tools to monitor your campaign performance and conversion rates. |

| No Direct Client Handling | Focus purely on marketing and referral, with Exness handling all client support and account management. |

Choosing the Right Path for You

Both Exness partnership programs offer excellent opportunities to monetize your influence and network within the financial markets in South Africa. Your choice between the IB and Affiliate program depends on your preferred engagement style and existing resources. If you thrive on direct interaction and building personal relationships, the IB program might be your ideal choice. If you’re a digital marketing guru looking to leverage your online platforms for broad reach, the Affiliate program offers immense potential. Regardless of your choice, partnering with Exness means aligning with a broker known for its reliability, competitive conditions, and strong support system for its partners and traders.

Mobile Trading Experience with Exness in South Africa

The fast-paced world of forex demands instant access to markets. For traders in South Africa, a robust mobile trading experience is not just a luxury; it’s a necessity. Exness understands this crucial need, offering an intuitive and powerful mobile platform that puts the global financial markets right in your pocket. Whether you’re commuting, enjoying a braai, or simply away from your desk, your trading never has to stop.

Gone are the days when you needed a high-end desktop setup to manage your trades effectively. The Exness mobile app transforms your smartphone or tablet into a comprehensive trading station, perfectly designed for the dynamic South African trading community. It provides the flexibility to monitor your positions, execute trades, and analyze market movements with unparalleled ease.

Unlocking Trading Power on the Go

What makes the mobile trading experience with Exness truly stand out for traders in South Africa? It’s a combination of speed, functionality, and user-friendliness. Imagine having all the tools you need, from real-time quotes to advanced charting, literally at your fingertips. The Exness app delivers just that, ensuring you never miss a trading opportunity, no matter where you are.

Key Features for South African Traders:

- Instant Trade Execution: Open and close positions rapidly with minimal latency.

- Real-Time Market Data: Stay updated with live price feeds for major currency pairs and other instruments.

- Advanced Charting Tools: Utilize a variety of indicators and chart types for in-depth technical analysis.

- Account Management: Easily manage deposits, withdrawals, and monitor your trading history.

- Customizable Interface: Personalize your trading environment to suit your preferences.

- Notifications and Alerts: Set up price alerts to be notified of significant market moves.

Advantages of Mobile Trading with Exness in South Africa

For South African traders navigating diverse time zones and often busy schedules, the mobile platform offers significant advantages. It democratizes access to financial markets, allowing more people to participate and manage their investments effectively.

| Advantage | Benefit to Traders |

|---|---|

| Flexibility | Trade anytime, anywhere – perfect for traders with busy lives. |

| Speed | React instantly to market news and price changes. |

| Accessibility | Easy access for both new and experienced traders. |

| Control | Full command over your trading account and positions. |

| Convenience | All features neatly packaged in a user-friendly app. |

Security and Support: Peace of Mind for Mobile Traders

When you trade on the go, security is paramount. Exness prioritizes the safety of your funds and personal data. The mobile app employs robust encryption and security protocols, giving you peace of mind while managing your trades from your mobile device. You can trade with confidence, knowing your information is protected.

Furthermore, Exness provides excellent customer support, accessible even through the mobile platform. Should you have any queries or encounter an issue, help is readily available, ensuring a smooth and uninterrupted trading journey. This dedicated support adds another layer of comfort for South African traders who value reliable assistance.

As one seasoned trader from Johannesburg puts it, “The Exness mobile app changed how I approach my trading. I can check my positions during my lunch break, set pending orders while waiting for a meeting, and never feel out of touch with the market. It’s truly liberating!”

Educational Resources and Trading Tools for Exness South Africa Users

Embarking on your trading journey, or even if you are a seasoned pro, demands continuous learning and access to top-notch resources. For traders in South Africa, Exness understands this crucial need, providing a comprehensive suite of educational materials and powerful trading tools. We believe that an informed trader is a confident and successful trader. Our goal is to equip you with everything you need to navigate the dynamic forex markets with expertise and precision.

Empowering Your Knowledge Base

Knowledge is your greatest asset in the financial markets. Exness offers a rich library of educational content designed to cater to all levels, from complete beginners to advanced strategists. We make complex concepts easy to understand, ensuring you grasp the fundamentals before moving to sophisticated strategies.

- Comprehensive Video Tutorials: Our video library covers everything from platform navigation to advanced technical analysis. Learn at your own pace, pausing and replaying sections as needed. Visual learning makes understanding intricate topics much simpler.

- Expert-Led Webinars: Join live sessions with experienced traders and market analysts. These interactive webinars provide deep dives into current market trends, trading psychology, and advanced strategies. It’s a fantastic opportunity to ask questions and get real-time insights.

- In-Depth Articles and Guides: Access a vast collection of articles explaining forex basics, trading terms, risk management, and various trading strategies. Our guides break down complex topics into digestible pieces, making learning accessible and fun.

- Free Demo Account: Practice trading in a risk-free environment with virtual funds. Test your strategies, get familiar with the trading platform, and build confidence without putting your capital on the line. This is an invaluable tool for applying what you learn.

Unlocking Trading Potential with Essential Tools

Beyond education, having the right tools is paramount for making informed decisions and executing trades effectively. Exness offers a suite of powerful trading tools integrated seamlessly into your experience, enhancing your analysis and helping you spot opportunities.

Here are some of the key tools available to enhance your trading:

| Tool Category | Description | Benefit for Traders |

|---|---|---|

| Economic Calendar | Tracks major economic announcements and events globally. | Helps traders anticipate market volatility and price movements based on economic data. |

| Market Analysis & Insights | Provides daily market commentary, technical and fundamental analysis from experts. | Offers valuable perspectives on market direction and potential trading setups, saving research time. |

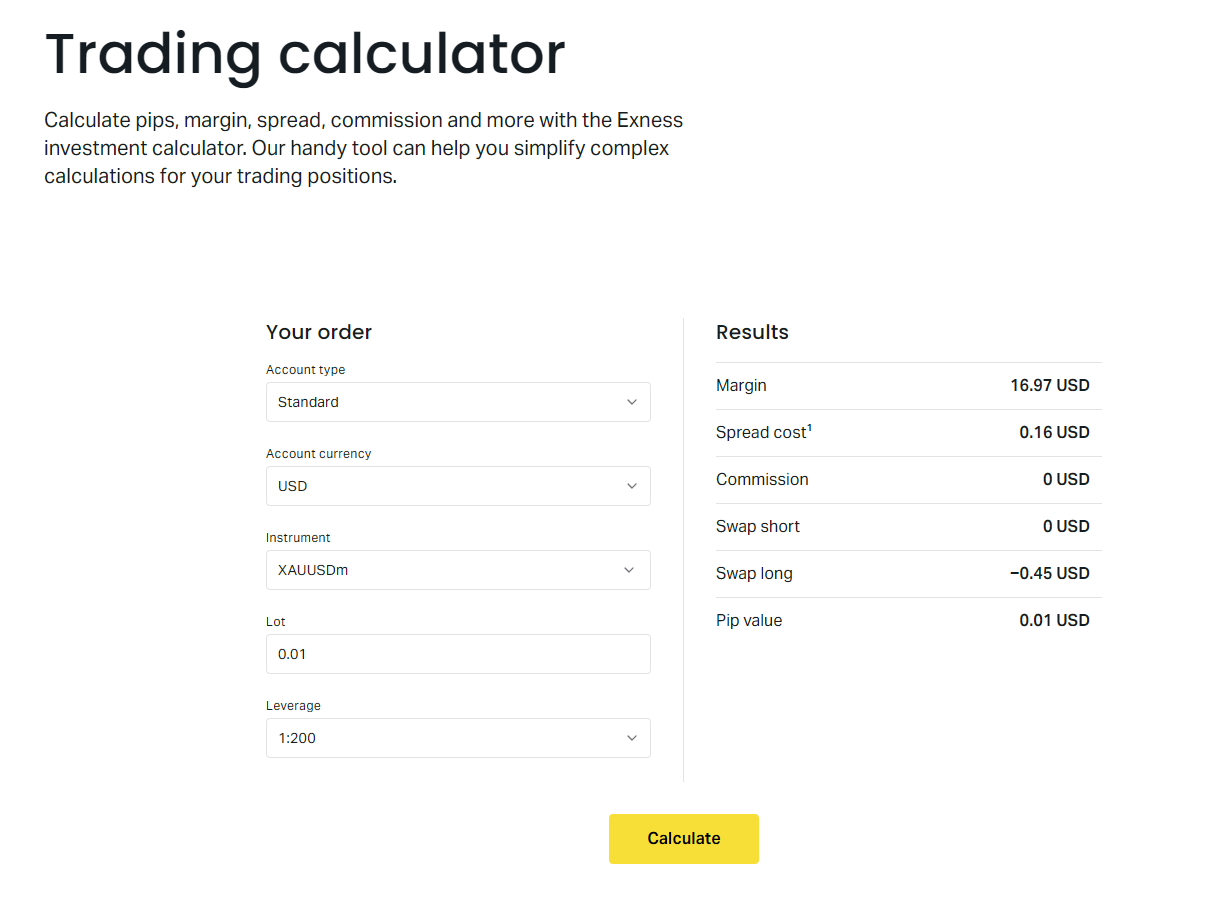

| Advanced Calculators | Includes Margin, Pip, and Currency Converters. | Assists in precise risk management and trade planning, ensuring you understand potential profits and losses. |

| Trading Central Indicators | Offers powerful analytical tools and technical indicators directly on your charts. | Identifies trading signals, support/resistance levels, and provides actionable insights for entry and exit points. |

These resources and tools are not just features; they are integral components of our commitment to your success as a trader in South Africa. We continuously update our offerings to ensure you always have access to the most relevant and powerful information and technology. Dive in, explore, and elevate your trading game!

Exness South Africa vs. Local Brokers: A Comparative Analysis

Forex traders in South Africa often face a pivotal decision: should they opt for an internationally renowned broker like Exness or choose a locally established firm? Both avenues offer unique advantages and cater to different trading preferences. Understanding these distinctions is crucial for aligning your choice with your personal trading style and risk tolerance. Let’s dive into a detailed comparison to help you make an informed decision for your trading journey.

When it comes to regulation and trust, Exness operates under a robust framework of international licenses, providing a broad global reach and adherence to diverse financial standards. This multi-jurisdictional oversight often appeals to traders seeking extensive liquidity and global market access. Conversely, local South African brokers are directly regulated by the Financial Sector Conduct Authority (FSCA). FSCA regulation offers specific, localized investor protection mechanisms tailored precisely to the South African market. Traders often weigh the benefits of a global powerhouse’s reach against the comfort and specificity of domestic regulatory oversight.

The actual trading conditions and costs represent another critical area of comparison. Exness is widely recognized for its highly competitive spreads and offers very high, often even unlimited, leverage options under specific account conditions. They also boast an incredibly diverse range of instruments, including a vast selection of forex currency pairs, popular cryptocurrencies, major global stocks, and indices. This extensive variety caters to a wide spectrum of trading strategies, from high-frequency scalping to long-term position trading.

Local South African brokers, while providing all core forex and CFD products, may present varying spreads. Their leverage limits are generally lower, directly influenced by FSCA regulations designed to protect retail traders. While their instrument selection might sometimes be less expansive than a global broker, they might offer unique benefits or localized asset access that resonates strongly with specific South African market participants.

Considering how you fund your account – deposits and withdrawals – is paramount for seamless trading operations. Exness supports a comprehensive array of international payment methods, including various popular e-wallets, traditional bank transfers, and in some cases, cryptocurrency options. Their withdrawal processing is frequently highlighted for its efficiency and speed, a vital factor for traders actively managing their capital and needing quick access to funds.

Local South African brokers typically excel in providing incredibly seamless and convenient local payment solutions. Direct Electronic Funds Transfers (EFTs) from major South African banks are a common and highly efficient offering, making deposits and withdrawals in ZAR straightforward and remarkably fast for local users. This can significantly minimize currency conversion fees and potential delays, offering a distinct advantage for local traders.

Effective client support is invaluable, particularly when you need assistance during crucial trading moments. Exness offers comprehensive multilingual support, often available 24/7, to cater effectively to its vast global client base. While they certainly serve South African traders, their primary support infrastructure is globally distributed, ensuring continuous assistance regardless of time zones.

Local brokers, on the other hand, usually provide support in local languages, operate during standard South African business hours, and typically offer local contact numbers. This localized approach can foster a more direct and personalized connection, which many South African traders find reassuring and highly convenient for addressing specific regional queries.

Regarding the trading platforms available, both Exness and most local South African brokers widely adopt the industry-standard platforms. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the dominant choices across the board, providing robust charting tools, advanced analytical features, and sophisticated automated trading capabilities. Some brokers, both international and local, may also offer proprietary platforms or alternative options like cTrader to further enhance the trading experience, giving traders more choice in their preferred interface.

Summary Comparison Table

| Feature | Exness (International Broker) | Local South African Brokers |

|---|---|---|

| Regulation | Multiple international licenses | FSCA (Financial Sector Conduct Authority) |

| Leverage | Potentially very high/unlimited (conditions apply) | Generally lower (FSCA regulated limits) |

| Instrument Variety | Very broad (forex, crypto, stocks, indices, etc.) | Good, but may be less extensive |

| Payment Methods | Global e-wallets, bank wires, crypto | Direct ZAR EFTs, local payment gateways |

| Withdrawal Speed | Often very fast | Generally fast for ZAR, dependent on bank |

| Customer Support | 24/7 multilingual, global reach | Local languages, SA business hours, local contacts |

| Platform | MT4, MT5, WebTerminal, Mobile | MT4, MT5, potentially proprietary |

Ultimately, the decision between partnering with Exness or a local South African broker truly hinges on your individual priorities as a trader. If global market access, highly competitive trading conditions, and a vast array of instruments are at the absolute top of your list, Exness could be an excellent fit for your trading ambitions. However, if the reassurance of direct local FSCA regulation, seamless ZAR payment convenience, and highly accessible local support are paramount to your trading comfort, then a South African broker might be your preferred choice. Both options undeniably offer valuable opportunities for traders navigating the dynamic and exciting South African forex landscape.

Frequently Asked Questions

Is Exness regulated in South Africa?

Yes, Exness (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa with FSP license number 51024. This ensures that they adhere to local financial standards and provides a layer of protection for traders.

Can I open a trading account in South African Rand (ZAR) with Exness?

Yes, Exness allows South African traders to open accounts denominated in ZAR. This is a significant advantage as it helps avoid currency conversion fees when depositing and withdrawing funds.

What trading platforms can I use with Exness in South Africa?

Exness offers several powerful platforms, including the industry-standard MetaTrader 4 (MT4), the advanced MetaTrader 5 (MT5), and their proprietary, user-friendly Exness Terminal (WebTerminal) that runs directly in your browser.

What are the common deposit and withdrawal methods for Exness users in South Africa?

Exness provides a variety of convenient payment methods for South African traders, including local bank transfers (EFTs), major credit/debit cards like Visa and MasterCard, and popular e-wallets.

What leverage does Exness offer to South African traders?

Exness is known for offering exceptionally high and flexible leverage options, which can even be unlimited under certain conditions. However, leverage increases risk, and traders should use it responsibly according to their risk tolerance.