Are you a serious trader seeking a platform that truly understands your needs? Many experienced traders often hit a wall with standard accounts, finding limitations that hinder their advanced strategies and profit potential. This is where Exness Professional Accounts come into play. Designed specifically for those who demand more from their trading environment, these accounts offer a suite of advantages tailored to the seasoned market participant.

At Exness, we recognize that serious traders require more than just a place to execute trades. You need competitive conditions, superior execution, and specific features that align with your sophisticated approach to the markets. Whether you’re a high-volume scalper, an expert advisor enthusiast, or a long-term position holder, the right account type can significantly impact your bottom line.

This comprehensive guide dives deep into the world of Exness Professional Accounts. We’ll explore what sets them apart, the unique benefits they offer, and how they empower you to trade with greater precision and efficiency. Prepare to uncover the tools and conditions that can elevate your trading journey.

- Why Professional Accounts Matter for Serious Traders

- What Are Exness Professional Accounts?

- Who Should Consider Exness Professional Accounts?

- Experienced Retail Traders

- High-Volume Traders

- Scalpers and Day Traders

- Algorithmic and EA Traders

- Traders Seeking Institutional-Grade Conditions

- Types of Exness Professional Accounts Explained

- Raw Spread Account: Features and Benefits

- Key Features of a Raw Spread Account:

- Advantages for Traders:

- Zero Account: Ultra-Low Spreads and Commissions

- Why choose a Zero Account?

- Pro Account: Ideal for Execution-Focused Strategies

- Key Benefits of Trading with Exness Professional Accounts

- Unparalleled Trading Conditions

- Advanced Features for Serious Traders

- Why Choose Exness for Your Professional Journey?

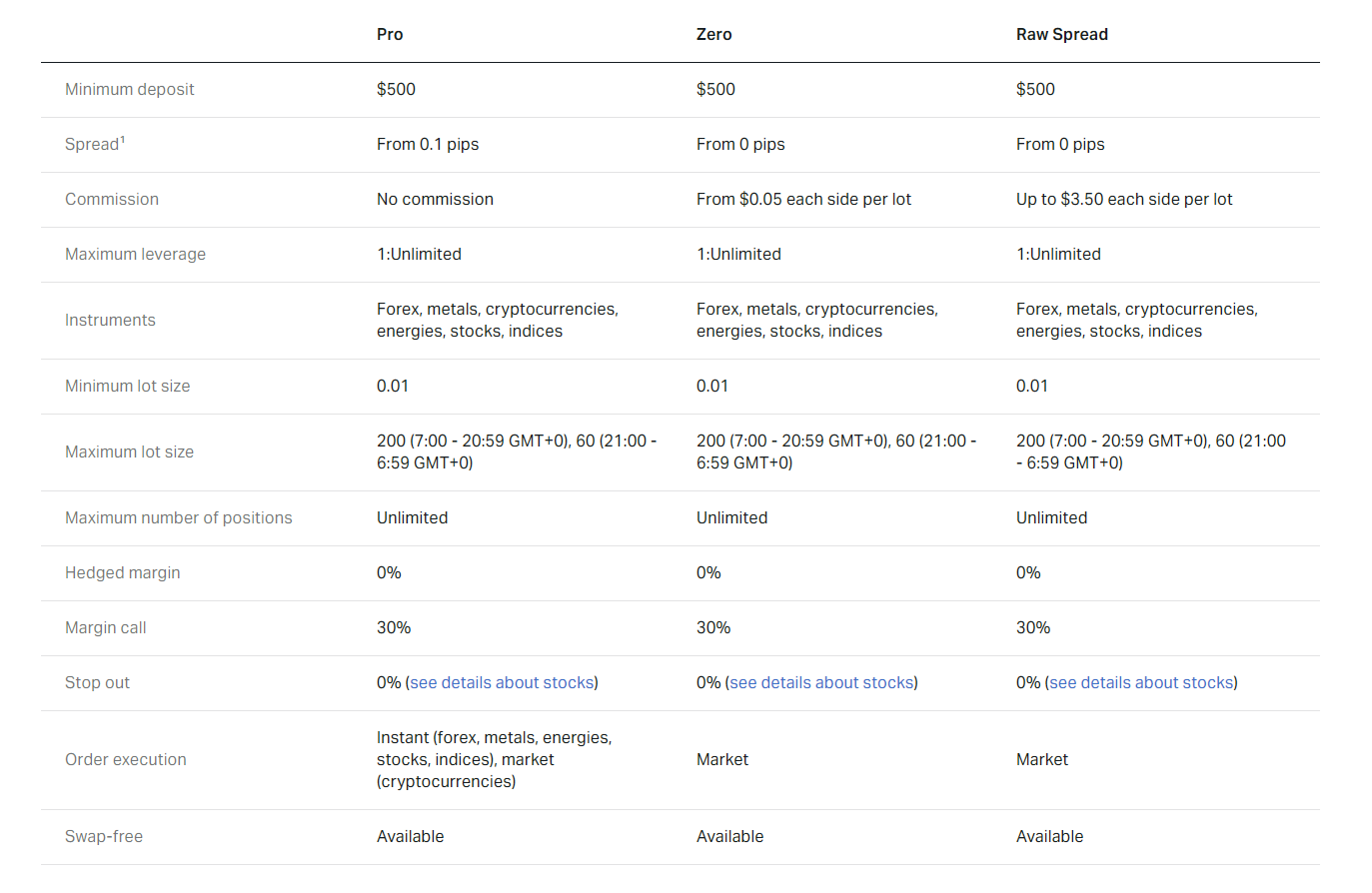

- Comparing Exness Professional Accounts: Raw Spread vs. Zero vs. Pro

- Exness Raw Spread Account

- Exness Zero Account

- Exness Pro Account

- Minimum Deposit Requirements for Exness Professional Accounts

- Typical Exness Professional Account Minimum Deposits:

- Leverage and Margin Conditions on Professional Accounts

- Unlocking Higher Leverage Potential

- The Role of Margin in Professional Trading

- Key Aspects of Margin for Professional Traders:

- Balancing Opportunity and Risk

- Spreads, Commissions, and Swaps on Exness Professional Accounts

- Understanding Spreads on Professional Accounts

- Commissions: When They Apply and Why

- Navigating Swaps: Overnight Holding Costs

- How to Open an Exness Professional Account

- Verification Process for Exness Professional Accounts

- What You Need for Professional Account Verification

- The Step-by-Step Verification Journey

- Benefits of a Verified Professional Account

- Exness Professional Accounts vs. Standard Accounts: A Detailed Comparison

- Is an Exness Professional Account Right for Your Trading Style?

- Maximizing Your Trading Potential with Exness Professional Accounts

- Frequently Asked Questions About Exness Professional Accounts

- What defines an Exness Professional Account?

- Who should consider an Exness Professional Account?

- What are the key benefits of upgrading to a Professional Account?

- Are there specific requirements to open a Professional Account?

- How do I upgrade my existing account to a Professional one?

- Frequently Asked Questions

Why Professional Accounts Matter for Serious Traders

Professional accounts are not just a label; they represent a fundamental shift in how you interact with the market. Here’s why they are indispensable for anyone serious about trading:

- Ultra-Low Spreads: Enjoy significantly tighter spreads, reducing your trading costs on every transaction.

- Optimal Execution: Experience lightning-fast order execution, minimizing slippage and ensuring your trades go through at the prices you want.

- No Trading Restrictions: Trade freely with expert advisors (EAs), scalping strategies, and hedging without any limitations.

- Lower Commission Structures: Benefit from reduced or even zero commissions on certain account types, further enhancing your profitability.

- Dedicated Support: Access specialized support tailored to professional traders’ unique requirements.

Exness offers various professional accounts, each with distinct features designed to cater to different trading styles and preferences. Understanding these differences is key to selecting the account that best complements your strategy. This guide will help you navigate these options and make an informed decision, ensuring you have the optimal setup for consistent success.

What Are Exness Professional Accounts?

Diving into the world of forex trading requires not just skill, but also the right tools and account types. For many seasoned traders and those with specific strategies, standard accounts often fall short. This is where Exness Professional Accounts step in, offering a tailored environment designed to meet the demands of serious market participants. They aren’t just a fancy label; they represent a suite of features crafted for optimized trading conditions.

Think of Exness Professional Accounts as an upgrade, built for traders who understand the nuances of the market and need a robust platform to execute their advanced strategies. These accounts typically boast features that cater to high-volume trading, algorithmic approaches, and specific risk management preferences. They bridge the gap between retail trading and institutional-level conditions, making them a popular choice for those looking to maximize their trading edge.

Who benefits most from these specialized accounts? Generally, they appeal to:

- Experienced Traders: Individuals with a deep understanding of market dynamics and a proven track record.

- Algorithmic Traders: Those who rely on automated systems and require low latency and tight spreads for efficient execution.

- High-Volume Traders: Participants who execute large trades frequently and seek cost-effective solutions.

- Strategy Testers: Traders who need precise conditions to backtest and forward-test complex strategies.

It’s about more than just a higher deposit limit. Professional accounts from Exness often come with specific advantages that directly impact your profitability and trading experience. They focus on delivering a performance-oriented environment where every millisecond and every pip matters. This level of specialization helps traders concentrate on their analysis and execution, rather than worrying about account limitations.

In essence, an Exness Professional Account is your gateway to a more advanced and efficient trading journey. It’s built for those who treat trading as a serious endeavor, demanding precision, speed, and cost-effectiveness from their broker.

Who Should Consider Exness Professional Accounts?

Exness Professional accounts aren’t for everyone, but for a specific group of traders, they offer a significant edge. If you’re serious about taking your trading to the next level, or if your current setup feels limiting, then dive into this section. We’ll explore exactly who benefits most from these tailored trading environments and why they might be the perfect fit for your forex journey.

Consider an Exness Professional account if you fall into any of these categories:

Experienced Retail Traders

You’ve navigated the markets for a while, understand advanced strategies, and now you need a broker that matches your ambition. Professional accounts provide tighter spreads, lower commissions, and faster execution, which are crucial for active traders looking to maximize their profit potential from every trade.

High-Volume Traders

If your trading involves large lot sizes or frequent entries and exits, standard accounts might not offer the cost efficiency you need. Professional accounts are designed to reduce your trading costs per transaction, making high-volume strategies more viable and profitable in the long run.

Scalpers and Day Traders

These trading styles thrive on tiny price movements and require ultra-fast execution and razor-thin spreads. Professional accounts often feature direct market access and minimal latency, giving scalpers and day traders the speed and precision they need to capitalize on fleeting opportunities without significant slippage.

Algorithmic and EA Traders

Automated trading systems (Expert Advisors) perform best with consistent conditions, low latency, and deep liquidity. Professional accounts typically offer stable server environments and superior execution speeds, which are vital for EAs that rely on precise timing and minimal deviation from expected prices.

Traders Seeking Institutional-Grade Conditions

You aspire to trade under conditions similar to those enjoyed by large institutions. Professional accounts aim to bridge this gap, offering raw spreads directly from liquidity providers and flexible leverage options, bringing a more institutional feel to your personal trading experience.

In essence, if you value lower trading costs, superior execution, and a trading environment tailored for serious market participation, an Exness Professional account is definitely worth exploring. It’s about optimizing your setup to give yourself the best possible chance to succeed in the dynamic world of forex.

Types of Exness Professional Accounts Explained

For serious traders who demand superior trading conditions, Exness offers a range of professional accounts designed to meet diverse strategies and trading volumes. These accounts come with distinct features, focusing on tighter spreads, specific commission structures, and robust execution models. Understanding their differences helps you pick the perfect fit for your trading style, whether you are a high-volume scalper or a meticulous swing trader.

First up is the Raw Spread Account, a top choice for traders who prioritize the absolute lowest possible spreads. With this account, you get raw market spreads, often starting from 0.0 pips, combined with a small, fixed commission per lot per side. This transparent cost structure makes it ideal for algorithmic trading, high-frequency strategies, and scalping, where every pip counts. You benefit from deep liquidity and rapid execution, ensuring your orders fill quickly at competitive prices.

Next, consider the Zero Account. As its name suggests, this account offers zero spreads on the top 30 most popular trading instruments for 95% of the trading day. While it charges a commission per lot per side, this account excels for traders who want to minimize spread costs on key pairs, especially during active trading hours or around major news events. It provides incredibly stable pricing, which can be a significant advantage when executing large trades or trading highly volatile markets.

Finally, there’s the Pro Account, often favored by professional traders who seek stable and ultra-low spreads without any commission. This account provides instant execution for most instruments, making it suitable for a wide array of trading strategies, from day trading to swing trading. You’ll find consistently tight spreads across major, minor, and exotic currency pairs, along with other asset classes. Its straightforward cost structure and reliable performance make it a versatile option for experienced traders who prefer simplicity without compromising on quality.

To help you compare these excellent professional options at a glance, here’s a summary of their key characteristics:

| Feature | Raw Spread Account | Zero Account | Pro Account |

|---|---|---|---|

| Minimum Deposit | Typically starts from $200 USD | Typically starts from $200 USD | Typically starts from $200 USD |

| Spreads | Raw spreads from 0.0 pips | 0.0 pips on top 30 instruments for 95% of the day | Low, stable spreads from 0.1 pips |

| Commissions | Small, fixed commission per lot/side | Commission per lot/side | No commission |

| Execution Type | Market Execution | Market Execution | Instant Execution (most instruments), Market Execution (some) |

| Ideal For | Scalpers, High-Frequency Traders, EAs | News Traders, Volume Traders, Zero Spread Priority | Day Traders, Swing Traders, No-Commission Preference |

Choosing the right professional account involves evaluating your trading strategy, frequency, and preferred cost structure. Each Exness professional account offers distinct advantages designed to empower your trading journey with competitive conditions and robust performance.

Raw Spread Account: Features and Benefits

Are you a serious forex trader looking for the most competitive conditions the market offers? Then a Raw Spread Account might be your ultimate solution. This account type strips away the typical markups you find on standard accounts, giving you direct access to institutional pricing. It’s designed for traders who demand precision and minimal trading costs.

A Raw Spread Account is a game-changer for those who understand the true impact of spreads on their profitability. Instead of paying a variable spread that includes a broker’s markup, you get the interbank liquidity price directly, plus a small, fixed commission per lot traded. This transparent pricing model ensures you know exactly what you are paying, making your trading strategy more predictable.

Key Features of a Raw Spread Account:

- Ultra-Tight Spreads: Experience spreads as low as 0.0 pips on major currency pairs, especially during peak market hours. This is the closest you can get to direct market pricing.

- Commission-Based Trading: Instead of spread markups, you pay a small, fixed commission per lot. This structure often results in lower overall trading costs for active traders.

- ECN Execution Model: Your orders go straight to top-tier liquidity providers (banks, financial institutions) without any dealing desk intervention. This means no re-quotes and lightning-fast execution speed.

- Deep Liquidity: Access to the deepest pools of interbank liquidity ensures your large orders can be filled efficiently and at the best available prices.

- Ideal for Specific Strategies: Perfect for scalping, high-frequency trading, and expert advisors (EAs) where every pip counts. The consistent, low spreads provide a stable environment for these demanding strategies.

Advantages for Traders:

Traders who choose a Raw Spread Account often highlight several significant benefits that give them an edge in the volatile forex market. You gain unparalleled cost efficiency and a level of transparency that standard accounts simply cannot offer.

| Benefit | Description |

|---|---|

| Cost Efficiency | Save significantly on trading costs over time, especially with high-volume trading, because you avoid hidden markups on spreads. The low commission structure often outperforms wider-spread accounts. |

| Execution Speed | Benefit from low latency and rapid order execution. The ECN model connects you directly to the market, ensuring your trades are filled almost instantly at the best possible price. |

| Transparency | See true market spreads without any artificial widening. This clarity helps you make better-informed trading decisions and allows for precise backtesting of strategies. |

| Strategy Flexibility | Empower your trading strategies like scalping and hedging. The minimal spread impact allows these precise methods to thrive, maximizing their potential profitability. |

Choosing a Raw Spread Account means you’re serious about your trading and want to optimize every aspect of your execution. It’s a professional choice for professional traders seeking the most competitive and transparent trading environment available.

Zero Account: Ultra-Low Spreads and Commissions

Imagine a trading environment where your costs are virtually nonexistent. That’s the promise of a Zero Account, crafted specifically for traders who prioritize efficiency and maximum profit retention. We built this account type to offer ultra-low spreads, often starting from 0.0 pips on major currency pairs, combined with a clear, competitive commission structure. This means you trade with razor-thin differences between bid and ask prices, drastically reducing your trading overhead.

Trading costs significantly impact your overall profitability, especially if you engage in high-frequency trading or scalp the markets. A Zero Account gives you a distinct edge by minimizing the friction associated with opening and closing trades. Every cent saved on spreads and commissions directly contributes to your bottom line, making your trading strategy more effective and rewarding.

Why choose a Zero Account?

- Unmatched Cost Efficiency: Experience some of the tightest spreads available in the market, often at zero for significant periods, ensuring you pay less for every trade.

- Enhanced Profitability: Lower transaction costs mean a larger portion of your winning trades remain as profit in your account.

- Ideal for Diverse Strategies: Whether you are a precision scalper, an automated trading system user, or a high-volume trader, the minimal costs perfectly complement strategies that require frequent entries and exits.

- Transparent Commission Structure: We believe in clarity. Our competitive commissions are straightforward, so you always know your exact trading expenses without any surprises.

- Direct Market Access Benefits: Enjoy superior execution quality often associated with these types of accounts, reflecting true market prices with minimal slippage.

Consider this perspective:

“In trading, every pip counts. A Zero Account empowers you to capture more of those pips by drastically cutting down on what you pay to enter and exit positions. It’s about optimizing your profit potential from the ground up.”

Ready to experience trading where your costs are practically invisible? A Zero Account shifts the focus from managing high overheads to executing your trading strategy with precision and confidence. It’s a game-changer for serious traders looking to maximize their earning potential.

Pro Account: Ideal for Execution-Focused Strategies

For traders who demand ultimate precision and speed, our Pro Account stands as the ultimate choice. This account type is meticulously engineered to cater to execution-focused strategies like scalping, high-frequency trading (HFT), and those relying on automated systems or expert advisors (EAs). We understand that every millisecond counts when you’re navigating volatile markets, and our infrastructure reflects that commitment.

What makes the Pro Account uniquely suited for these demanding styles?

- Unmatched Execution Speed: Experience lightning-fast order processing. Our low latency connection directly to top-tier liquidity providers ensures your trades execute precisely when you need them to, minimizing slippage and maximizing opportunity.

- Ultra-Tight Spreads: Benefit from some of the market’s most competitive and tight spreads, starting from 0.0 pips. This direct market access provides transparent pricing, crucial for strategies that thrive on minimal transaction costs.

- Deep Liquidity Access: Gain access to deep liquidity pools from leading financial institutions. This ensures robust pricing and the capacity to handle large order volumes without significant price impact, even during peak trading hours.

- Optimal for Algorithmic Trading: If you deploy expert advisors or custom algorithms, the Pro Account offers the stable, high-performance environment essential for their flawless operation. You get the reliability your automated systems require for consistent performance.

This account is specifically designed for professional traders, active day traders, and those who prioritize direct market access and superior trade execution above all else. When your strategy hinges on speed and precise entry/exit points, the Pro Account delivers the competitive edge you need.

Join the ranks of elite traders who trust our Pro Account for their most demanding execution-focused strategies. Experience the difference true performance makes.

Key Benefits of Trading with Exness Professional Accounts

Unlock your full trading potential with an Exness Professional Account. Designed specifically for experienced traders, these accounts offer a suite of powerful advantages that can significantly enhance your strategy and execution. Forget limitations; here, you find the tools and conditions necessary to navigate the dynamic forex markets with precision and confidence.

Unparalleled Trading Conditions

Professional traders demand superior conditions, and Exness delivers. We understand that every pip matters, and every millisecond counts. Our professional accounts provide an environment where your strategies can truly thrive.

- Ultra-Low Spreads: Experience remarkably tight spreads on major currency pairs, indices, and commodities. This directly reduces your trading costs, allowing more of your profits to stay in your pocket.

- Minimal Commissions: Enjoy competitive and transparent commission structures. This clarity helps you better calculate your potential returns and manage your capital effectively.

- Lightning-Fast Execution: Benefit from rapid order execution speeds. In fast-moving markets, quick execution is crucial for securing desired entry and exit points, minimizing slippage, and optimizing your trading performance.

Advanced Features for Serious Traders

Beyond competitive pricing, Exness Professional Accounts come equipped with features tailored for sophisticated trading approaches. These accounts are built to support high-volume strategies and complex market analysis.

Consider these critical advantages:

| Benefit | Impact on Your Trading |

|---|---|

| High Leverage Options | Amplify your market exposure with less capital, perfect for capitalizing on small price movements. |

| Diverse Instrument Selection | Access a broad range of forex pairs, metals, energies, indices, and cryptocurrencies to diversify your portfolio. |

| Dedicated Support | Receive priority assistance from a knowledgeable support team, ensuring quick resolutions to any queries. |

Why Choose Exness for Your Professional Journey?

Choosing a broker is a significant decision. For professionals, it’s about finding a partner who understands the demands of serious trading. Exness provides a robust and reliable trading environment. We combine cutting-edge technology with client-centric services, offering you peace of mind and the operational excellence you deserve. Focus on your strategy, and let Exness handle the rest.

Comparing Exness Professional Accounts: Raw Spread vs. Zero vs. Pro

Choosing the right trading account significantly impacts your strategy and profitability. Exness offers a suite of professional accounts designed for experienced traders seeking optimal conditions: Raw Spread, Zero, and Pro. Each account caters to different trading styles, fee preferences, and market approaches. Understanding their nuances empowers you to select the perfect fit for your forex journey.

Exness Raw Spread Account

The Raw Spread account is a favorite among scalpers and high-frequency traders who demand the absolute tightest spreads available. With this account, you often see spreads starting from an incredibly low 0.0 pips on major currency pairs for a significant portion of the trading day. While the spreads are exceptionally thin, this account operates on a commission-per-lot basis. This means you pay a small, fixed fee for every standard lot traded. This structure makes the trading costs transparent and predictable, especially beneficial for those executing numerous trades throughout the day. If precision entry and exit points are crucial to your strategy, the Raw Spread account delivers the conditions you need to minimize slippage and maximize potential gains.

Exness Zero Account

For traders who prioritize zero spreads on their most frequently traded instruments, the Zero account stands out. This account offers 0-pip spreads on the top 30 most popular trading instruments for 95% of the trading day. Like the Raw Spread account, it comes with a commission per lot. The key distinction lies in the guarantee of zero spreads on a wider selection of frequently traded pairs, making it ideal for traders who focus on specific, high-liquidity instruments. If your strategy revolves around a core set of major and minor currency pairs, or perhaps gold, and you want to minimize spread costs on those particular assets, the Zero account provides that competitive edge. It’s an excellent choice for those who value the certainty of no spread on their preferred instruments.

Exness Pro Account

The Pro account is designed for versatility and those who prefer a commission-free trading environment. This account features raw, competitive spreads that float with market conditions, but you pay absolutely no commission per trade. This makes the Pro account highly appealing to swing traders, position traders, and anyone who holds trades for longer periods, where the accumulated commission costs on Raw Spread or Zero accounts might outweigh the benefit of tighter spreads. While the spreads on the Pro account are generally wider than those on the Raw Spread or Zero accounts, they remain very competitive and suitable for a wide range of trading strategies. If you value simplicity in your cost structure and prefer to avoid per-lot commissions, the Exness Pro account offers a straightforward and highly effective trading solution.

Ultimately, the best Exness professional account for you depends on your unique trading style, preferred instruments, and how you manage trading costs. Do you prioritize razor-thin spreads and don’t mind commissions? Raw Spread or Zero might be your answer. Or do you prefer a commission-free experience with slightly wider but competitive spreads? Then the Pro account is likely your ideal partner in the markets. Evaluate your trading volume, frequency, and target assets carefully to make an informed decision and optimize your trading experience with Exness.

Minimum Deposit Requirements for Exness Professional Accounts

Embarking on your journey with Exness professional accounts opens doors to advanced trading conditions and powerful tools. Understanding the minimum deposit requirements is a crucial first step for serious traders aiming to elevate their experience. Exness offers a range of account types tailored for different strategies and capital levels, and the professional tiers often come with specific entry points designed to match their enhanced features.

Professional accounts are not just standard trading accounts; they often provide tighter spreads, lower commissions, and sometimes higher leverage options, reflecting their suitability for experienced traders with a robust trading plan. The minimum deposit acts as a gateway, ensuring traders have sufficient capital to effectively utilize these premium conditions and manage their positions without undue risk. These requirements ensure a level playing field for those seeking direct market access and superior execution.

Let’s break down the general landscape of minimum deposits for popular Exness professional account types. Keep in mind that specific figures can vary, so always verify the latest information directly on the Exness official website.

Typical Exness Professional Account Minimum Deposits:

- Raw Spread Account: Known for ultra-low, sometimes zero, spreads with a commission per trade. This account type usually requires a higher minimum deposit, often starting from several hundred US dollars or the equivalent in other currencies.

- Zero Account: Offers zero spreads on the top 30 most popular trading instruments for 95% of the trading day, also with a commission. The minimum deposit for a Zero account typically aligns with or is slightly higher than the Raw Spread account.

- Pro Account: Characterized by highly competitive spreads with no commission. This account is often seen as a premium choice for experienced traders who prefer a spread-only model. Its minimum deposit requirement can be quite substantial, reflecting its premium offering.

Meeting the minimum deposit requirement for a professional account is more than just depositing funds; it’s about unlocking a suite of advantages. These advantages can significantly impact your trading efficiency and potential profitability. Professional accounts are designed for traders who demand the best possible execution and pricing, without compromise.

Before making your deposit, carefully assess your trading strategy, capital availability, and risk tolerance. Choosing the right professional account type, and understanding its specific minimum deposit, ensures you start your trading journey with Exness on solid ground. This proactive approach sets the stage for a more effective and potentially more profitable trading experience with the advanced features Exness provides.

Leverage and Margin Conditions on Professional Accounts

For the seasoned forex trader, understanding leverage and margin on a professional account is absolutely critical. It’s not just about bigger numbers; it’s about a completely different set of tools and responsibilities that can amplify your trading potential significantly. While retail accounts often face strict regulatory limits on leverage, professional accounts open up a world of much higher ratios, offering incredible flexibility – and requiring immense discipline.

Unlocking Higher Leverage Potential

On a professional trading account, leverage isn’t merely a feature; it’s a cornerstone that enables you to control much larger positions with a relatively small amount of capital. Unlike the constrained leverage offered to retail traders, professional accounts typically grant access to ratios such as 1:200, 1:400, or even 1:500 or higher. This means that for every dollar you put down, you can control hundreds of dollars in currency. This increased purchasing power is a double-edged sword: it offers the potential for substantial profits from minor market movements, but it also magnifies losses at the same rate. Experienced traders leverage this power strategically, aligning it with their robust risk management frameworks.

The Role of Margin in Professional Trading

Margin is essentially the collateral you need to put up to open and maintain a leveraged position. When you use high leverage on a professional account, the initial margin requirement for each trade is relatively small compared to the total value of the trade. However, understanding margin conditions goes beyond just the initial outlay. It involves being constantly aware of your used margin, free margin, and margin level. These metrics are vital for preventing margin calls and ensuring your account stays afloat during adverse market swings. Professional traders meticulously monitor these figures, often employing sophisticated position sizing and stop-loss strategies to protect their capital.

Key Aspects of Margin for Professional Traders:

- Initial Margin: The percentage of the trade’s value required to open a position. With higher leverage, this percentage is smaller.

- Maintenance Margin: The minimum equity required in your account to keep a position open. If your equity falls below this level, you face a margin call.

- Margin Call: A notification from your broker that you need to deposit more funds to meet your maintenance margin requirements. For professional traders, effective risk management aims to avoid these entirely.

- Stop-Out Level: If you don’t meet a margin call, your broker will automatically close some or all of your positions to prevent further losses, a process known as a stop-out.

Balancing Opportunity and Risk

High leverage and flexible margin conditions on a professional account offer unparalleled opportunities to scale your trading operations and capitalize on volatile markets. You can take on larger position sizes, potentially leading to greater absolute returns. However, this freedom comes with significant responsibility. Without a disciplined approach to risk management, including precise position sizing, strict stop-loss orders, and a deep understanding of market volatility, high leverage can quickly decimate an account. Professional traders integrate advanced analytical tools and comprehensive risk models into their trading plans to effectively manage these powerful tools, always prioritizing capital preservation while aiming for growth.

Spreads, Commissions, and Swaps on Exness Professional Accounts

When you step into the world of professional trading with Exness, understanding the cost structure is crucial. Professional accounts offer distinct advantages, often coming with a different fee model compared to standard accounts. Your trading success hinges not just on strategy, but also on how these trading costs impact your bottom line. Let’s break down spreads, commissions, and swaps, and how they play out on Exness professional account types.

Understanding Spreads on Professional Accounts

Spreads represent the difference between the bid and ask price of a currency pair or other asset. For professional traders, tighter spreads are a major draw. On Exness professional accounts, you typically encounter very low, often raw, spreads. This means the broker adds a minimal markup to the interbank market rates. Why does this matter? Smaller spreads translate directly into lower entry costs for your trades, making it easier to profit from even small price movements. Imagine entering a trade with virtually no initial hurdle – that’s the power of tight spreads. They are particularly beneficial for active traders, scalpers, and those employing high-frequency strategies, where every pip counts.

Commissions: When They Apply and Why

While some Exness professional accounts boast incredibly tight spreads, this often comes hand-in-hand with a commission charge. Think of commissions as a transparent fee for executing your trades. Instead of a wider spread, you pay a fixed amount per lot traded. This model is common on account types like the Raw Spread or Zero accounts. Commissions are typically charged upon opening and closing a trade, calculated based on the volume you trade. For example, you might pay a few dollars per standard lot. This structure appeals to traders who prioritize absolute minimal spreads, as the commission provides an alternative way for the broker to cover their costs while offering highly competitive pricing directly from liquidity providers. It ensures transparency, as you always know the exact fee per trade regardless of market volatility.

Navigating Swaps: Overnight Holding Costs

Swaps, also known as overnight financing charges or credits, are another element of trading costs, especially for positions held open beyond a single trading day. When you hold a trade overnight, you either pay or receive interest based on the interest rate differential between the two currencies in a pair. For instance, if you buy a currency with a higher interest rate and sell one with a lower rate, you might receive a small credit. Conversely, if the rates are reversed, you pay a charge. Exness offers competitive swap rates, and importantly, provides swap-free options for many instruments and regions, particularly for traders adhering to Sharia law principles. This flexibility ensures that holding positions long-term doesn’t always incur overnight costs, allowing you to focus on your strategy without worrying about daily deductions or additions due to interest rate differentials.

How to Open an Exness Professional Account

Ready to elevate your trading experience? Opening a Professional Account with Exness is a straightforward process designed to get you trading with enhanced features quickly. Whether you’re an experienced trader looking for competitive conditions or someone scaling up their strategy, a professional account offers specific advantages. We’ll guide you through each step, ensuring you understand exactly what to do.

Exness makes the journey smooth, from initial registration to full account verification. You’ll find the requirements clear and the process user-friendly. Professional accounts often appeal to those who understand market dynamics and require specific tools or spreads to execute their strategies effectively. It’s about tailoring your trading environment to your expertise.

Here’s a step-by-step guide to get your Exness Professional Account up and running:

- Step 1: Register Your Exness Account: If you don’t already have one, start by visiting the Exness website and completing the initial registration. You’ll need to provide your country of residence, email, and set a password. This creates your personal area where you manage all your trading accounts.

- Step 2: Complete Your Profile: After registration, log into your Personal Area. The system will prompt you to complete your profile. This involves providing personal details such as your full name, date of birth, and phone number. Make sure all information is accurate to avoid any delays later.

- Step 3: Verify Your Identity (POI): For security and regulatory compliance, you must verify your identity. Upload a clear copy of a valid government-issued ID, like your passport or national ID card. The name on your document must match the name you provided in your profile.

- Step 4: Verify Your Residence (POR): Next, you need to verify your address. Submit a recent utility bill (electricity, water, gas) or a bank statement that clearly shows your name and address. Ensure the document is no older than six months.

- Step 5: Select a Professional Account Type: Once your profile is complete and verified, navigate to the ‘Open New Account’ section in your Personal Area. Here, you’ll see various account types. Choose one of the professional options, such as Raw Spread, Zero, or Pro, depending on your preferred trading style and conditions. Review their features carefully before making your selection.

- Step 6: Fund Your Account: With your professional account selected, the final step is to deposit funds. Exness offers a wide range of convenient payment methods, including bank transfers, e-wallets, and local payment solutions. Choose the method that best suits you and transfer the amount you wish to start trading with.

After successfully funding your account, you are ready to explore the markets with your new Exness Professional Account. Remember to explore all the features and tools available to professional traders, which can significantly enhance your trading journey.

Verification Process for Exness Professional Accounts

Ready to elevate your trading experience with an Exness Professional Account? This journey begins with a straightforward verification process designed to secure your funds and ensure compliance with global financial regulations. Think of it as building a strong foundation for your trading future. We make it simple, clear, and efficient so you can focus on what matters most: your trading strategy.

Completing your professional account verification is a crucial step that unlocks higher leverage options, enhanced trading conditions, and a full suite of features tailored for serious traders. It demonstrates your commitment and helps us maintain a safe and transparent trading environment for everyone. Let’s walk through the steps together.

What You Need for Professional Account Verification

To ensure a smooth and quick verification, have the following documents ready. These are standard requirements designed to protect both you and your investments.

- Proof of Identity (POI): A valid, government-issued document showing your photo, full name, date of birth, and an expiration date. Make sure the document is clear and readable.

- Proof of Residence (POR): A document showing your full name and residential address, issued within the last six months. This could be a utility bill, bank statement, or a government-issued residence certificate.

- Proof of Professional Status: Documents demonstrating your financial knowledge and experience. This might include certifications, employment history in financial services, or evidence of significant trading activity with other brokers. We look for indicators that confirm your understanding of complex financial instruments and associated risks.

The Step-by-Step Verification Journey

Follow these simple steps to get your Exness Professional Account up and running. Our dedicated support team is always ready to assist if you encounter any questions along the way.

- Account Registration: If you haven’t already, sign up for an Exness account. This is your first gateway.

- Initial Document Upload: Access your Personal Area and navigate to the verification section. Upload your Proof of Identity and Proof of Residence documents. Ensure they meet the clarity and validity requirements mentioned above.

- Professional Assessment: Complete a detailed questionnaire about your financial background, trading experience, and understanding of market risks. This helps us assess your eligibility for a professional account.

- Professional Status Documentation: Upload any supporting documents that validate your professional status. The more comprehensive your submission, the quicker we can process your application.

- Review and Approval: Our compliance team reviews your submitted documents and assessment. We aim for a swift review process, typically completing it within a few business days. We will notify you once your professional account status is confirmed.

Benefits of a Verified Professional Account

Once verified, you unlock a new level of trading power. This isn’t just about higher leverage; it’s about a trading environment designed for serious market participants.

Key Advantages:

- Access to higher leverage ratios, potentially boosting your trading capital efficiency.

- Eligibility for a wider range of trading instruments and account features.

- Enhanced support and personalized services from our dedicated team.

- Confidence in trading with a regulated and compliant broker.

- Potential for tailored trading conditions that cater to advanced strategies.

Completing the verification process is your gateway to leveraging the full potential of your trading skills with Exness. We prioritize your security and a seamless experience. Get started today and transform your trading journey!

Exness Professional Accounts vs. Standard Accounts: A Detailed Comparison

Exness offers a range of account types designed to meet the diverse needs of traders worldwide. From newcomers taking their first steps in the market to seasoned pros executing complex strategies, there’s an account for everyone. But how do you pick the right one? Let’s dive deep into the core differences between Exness Professional Accounts and Standard Accounts to help you make an informed choice and elevate your trading journey.

Understanding Standard Accounts

Standard accounts are often the go-to choice for most retail traders, and for good reason. They offer a straightforward, accessible entry into the forex and CFD markets. With a Standard account, you typically get stable spreads, no commission fees per trade, and access to a wide range of trading instruments including major currency pairs, commodities, and even cryptocurrencies. It’s perfect if you’re just starting out or prefer a simpler trading environment without too many variables to manage. Minimum deposit requirements are usually low, making it easy to fund your account and begin trading quickly without significant capital outlay.

Exploring Professional Accounts

On the other hand, Professional accounts are crafted for experienced traders who demand specific features and tighter trading conditions. These accounts, which include Raw Spread, Zero, and Pro accounts, often come with ultra-low spreads, sometimes even zero pips on major currency pairs. However, this often involves a commission per trade, which can still be highly cost-effective for active traders. Professional accounts are ideal for high-volume traders, scalpers, and those employing expert advisors (EAs) who benefit immensely from minimal spread costs and rapid execution. While they might require a higher initial deposit or meet certain trading volume criteria, the advantages in cost-efficiency and precision for dedicated traders can be significant.

Key Differences at a Glance

| Feature | Exness Standard Account | Exness Professional Accounts |

|---|---|---|

| Target Trader | Beginner to intermediate, casual traders | Experienced, high-volume, scalpers, EA users |

| Spreads | Stable, floating (average spreads) | Ultra-low, often zero on major pairs (Raw Spread, Zero accounts) |

| Commissions | No commission per trade | Yes, commission per trade (except Pro account sometimes) |

| Minimum Deposit | Generally low and accessible | Can be higher, varies by specific Pro type |

| Execution | Market execution | Market execution, often with faster speeds for specific types |

| Trading Instruments | Wide range (Forex, Metals, Crypto, Stocks, Indices) | Same wide range, optimized for specific strategies |

Which Account Suits You Best?

Choosing between an Exness Standard Account and a Professional Account boils down to your trading experience, strategy, and capital. If you prioritize simplicity, no commissions, and are still learning the ropes of forex trading, the Standard Account is likely your best bet. It provides a solid foundation without overwhelming complexity. However, if you’re a seasoned trader focused on minimizing trading costs through tighter spreads, executing high-frequency trades, or running advanced automated strategies, then one of the Professional Account options, like the Raw Spread or Zero account, will offer the precision and cost structure you need to maximize your trading potential. Always consider your personal trading style and objectives before making your final decision to ensure you pick the account that truly aligns with your ambitions.

Is an Exness Professional Account Right for Your Trading Style?

As a dedicated forex trader, you constantly seek an edge – a trading environment that perfectly aligns with your strategy. The Exness Professional Account isn’t just another option; it’s a meticulously designed platform for traders who demand precision, efficiency, and cost-effectiveness. But the big question remains: does it truly fit your unique trading style and objectives?

The Exness Professional Account stands out with its hallmark features: ultra-low spreads, often zero commissions on many instrument types, and lightning-fast execution speeds. This setup aims to minimize your trading costs and maximize your profit potential, especially for strategies that rely on small price movements and frequent entries and exits. It’s built for performance, catering to those who approach the markets with serious intent and a well-defined methodology.

Consider if your trading approach aligns with the advantages offered by this account type:

- Scalping: If your strategy involves opening and closing trades within minutes or even seconds to capture tiny price discrepancies, the tight spreads and rapid execution are absolutely critical. Every pip matters, and the Exness Professional Account is engineered to reduce your entry and exit costs significantly.

- Day Trading: For those who execute multiple trades within a single trading day, relying on intraday volatility, low transaction costs and minimal slippage can dramatically improve your overall profitability. This account provides the fluidity you need to navigate fast-moving markets.

- Algorithmic Trading (EAs): Automated trading systems thrive on consistent data, minimal latency, and reliable execution. The Professional Account’s infrastructure is optimized to support Expert Advisors (EAs), ensuring your algorithms perform as intended without undue interference from wide spreads or slow order processing.

- High-Volume Trading: If your trading volume is substantial, the accumulated costs from spreads and commissions on standard accounts can be significant. The Professional Account’s competitive pricing structure is designed to mitigate these overheads, allowing more of your capital to work for you.

- Experienced Traders: Seasoned traders who understand market dynamics and implement sophisticated strategies will find the advanced conditions of this account empowering. It offers the refined environment necessary to execute complex trades with precision.

While the benefits are clear, it is essential to consider the full picture. The Exness Professional Account often requires a higher minimum deposit compared to other account types, reflecting its premium features. This means you generally need more starting capital to access its full range of advantages. Additionally, while the account offers superior conditions, it doesn’t eliminate the inherent risks of forex trading. Robust risk management remains paramount, regardless of your account type.

Ultimately, the decision rests on your individual circumstances. Are you an active trader seeking to optimize every aspect of your trading costs and execution? Do you employ strategies that highly benefit from tight spreads and swift order fulfillment? If your answers lean towards a “yes,” then exploring the Exness Professional Account could be a pivotal step in enhancing your trading journey. It’s about empowering your strategy, not just opening an account.

Maximizing Your Trading Potential with Exness Professional Accounts

Are you a serious trader always looking for an undeniable edge? Do you want to take your trading to the next level and truly unlock its potential? Exness Professional Accounts could be exactly what you need to navigate the global markets with unparalleled efficiency. Designed meticulously for experienced traders who demand superior conditions, these accounts offer a powerful suite of features to help you execute your strategies with greater precision and confidence.

Exness understands that advanced traders have unique, sophisticated requirements. Professional accounts are not merely an upgrade; they are a strategic instrument built from the ground up to profoundly optimize your trading environment. Here’s precisely why these accounts are a definitive game-changer for serious market participants:

- Ultra-Tight Spreads: Experience some of the market’s most competitive and often razor-thin spreads, especially on major currency pairs. Lower spreads directly translate to significantly reduced trading costs, which in turn profoundly impacts your profitability, trade after trade, compounding your gains.

- Lightning-Fast Execution: Speed and reliability matter immensely in the volatile forex market. Benefit from swift, near-instantaneous order execution, minimizing costly slippage and ensuring your trades open and close exactly when you intend. This rapid response helps you capitalize on fleeting market opportunities with utmost effectiveness.

- Zero Commissions (on select accounts): Focus intently on your trading strategy without the added burden of extra fees on every single transaction. Certain professional account types offer truly commission-free trading on major instruments, allowing you to retain a significantly larger portion of your hard-earned gains.

- Flexible Leverage Options: Access a wide spectrum of high leverage options, meticulously tailored to align with your robust risk management strategy and precise trading style. This unparalleled flexibility empowers you to amplify your market exposure responsibly, perfectly aligning with your individual comfort levels and strategic goals.

- Dedicated Priority Support: Receive unparalleled, priority support from a highly responsive and knowledgeable team ready to assist with any query you might have. This ensures a seamlessly smooth and uninterrupted trading journey, allowing you to concentrate fully on the markets and your strategic decisions.

Exness proudly offers different professional account types, each meticulously designed to cater to specific trading preferences and highly specialized strategies. Whether you are a meticulous scalper, a strategic swing trader, or an automated algorithmic trader, you will undoubtedly discover an account that aligns perfectly with your individual approach and maximizes your trading potential:

| Account Type Focus | Ideal Trader Profile | Primary Advantage |

|---|---|---|

| Minimal Spread Accounts | High-volume traders, precision scalpers, automated trading systems. | Access to super-low, sometimes even zero, raw market spreads. |

| Commission-Free Accounts | Discretionary traders, those who value simplicity in trading costs. | Trade the most popular instruments without per-lot commissions. |

| All-Round Professional Accounts | Experienced traders seeking balanced and versatile trading conditions. | Stable, consistently low spreads with no commissions on most popular assets. |

If you possess solid trading experience, a clear and insightful understanding of market dynamics and inherent risk, and are actively seeking to optimize your trading conditions for maximum efficiency, then exploring Exness Professional Accounts is a highly logical and strategic next step. These accounts truly empower you to capitalize on dynamic market movements with significantly greater efficiency and potentially enhance your profitability in a meaningful way. They are meticulously built for traders who view forex not just as a casual pursuit, but as a serious, dedicated, and potentially highly rewarding profession.

Ready to fundamentally elevate your trading game? Discover the profound difference professional-grade trading conditions can make for your sophisticated trading strategy. Exness provides the cutting-edge tools and unparalleled environment; you bring the unwavering discipline and astute market insight.

Frequently Asked Questions About Exness Professional Accounts

Diving into the world of professional trading accounts can bring many questions to mind. At Exness, we understand that you seek clarity and comprehensive information to make the best decisions for your trading journey. Below, we address some of the most common inquiries about our Professional Accounts, helping you understand their unique features and how they can elevate your trading experience.

What defines an Exness Professional Account?

An Exness Professional Account is designed for experienced traders seeking enhanced trading conditions. This account type offers access to raw spreads, commission-based trading, and often includes features like unlimited leverage and instant order execution. It’s built to cater to those who demand precision and efficiency in their trading operations, providing a robust environment for active market participation.

Who should consider an Exness Professional Account?

If you have a solid understanding of the forex market, possess significant trading experience, and actively manage larger trading volumes, a Professional Account is likely a perfect fit. It particularly benefits:

- High-volume traders: Those executing numerous trades daily or weekly.

- Scalpers: Traders who capitalize on small price changes, needing tight spreads and rapid execution.

- Algorithmic traders: Users of EAs (Expert Advisors) or automated strategies that require minimal latency and consistent pricing.

- Experienced market participants: Individuals confident in navigating complex market conditions and managing significant capital.

What are the key benefits of upgrading to a Professional Account?

Upgrading to a Professional Account unlocks several advantages tailored for serious traders:

Enhanced Trading Conditions:

- Ultra-low spreads: Access to institutional-grade pricing, often starting from 0.0 pips on major currency pairs.

- No requotes: Enjoy instant execution without price requotes, crucial for volatile markets.

- Lower commissions: Competitive commission structures that benefit high-frequency trading.

Superior Flexibility & Control:

- Unlimited Leverage: For eligible instruments and accounts, allowing greater capital efficiency.

- Advanced Order Types: Access to a wider range of order options to fine-tune your strategies.

- Dedicated Support: Priority access to expert support for any technical or account-related queries.

Are there specific requirements to open a Professional Account?

Yes, to ensure our Professional Accounts serve their intended audience of experienced traders, there are specific criteria. These often include:

- Demonstrating sufficient trading experience, usually through past trading history or declared knowledge.

- Meeting a minimum deposit requirement, which can vary depending on the specific Professional Account type (e.g., Raw Spread, Zero, Pro).

- Successfully completing the standard verification process, including identity and residency checks.

Exness reviews each application to ensure the account aligns with your trading profile and regulatory requirements. We focus on providing the right environment for your expertise.

How do I upgrade my existing account to a Professional one?

The process to upgrade your account at Exness is straightforward. Here’s a general guide:

| Step | Action |

|---|---|

| 1. Log In | Access your Personal Area on the Exness website. |

| 2. Navigate to Accounts | Find the ‘My Accounts’ or ‘Open New Account’ section. |

| 3. Select Professional Type | Choose the specific Professional Account type you wish to open (e.g., Raw Spread, Zero, Pro). |

| 4. Complete Application | Follow the on-screen prompts, providing any requested information about your trading experience or capital. |

| 5. Fund & Trade | Once approved and funded, you can begin trading with your new Professional Account conditions. |

Our support team is always ready to assist you if you encounter any difficulties during this process. We want your transition to be as smooth as possible.

Frequently Asked Questions

What are the different types of Exness Professional Accounts?

Exness offers three main Professional Accounts: Raw Spread, which has ultra-low spreads with a fixed commission; Zero, which provides zero spreads on top instruments with a commission; and Pro, which features low spreads with no commission, making it a versatile choice.

Who should use an Exness Professional Account?

Professional Accounts are designed for experienced traders, including high-volume traders, scalpers, and algorithmic traders who use Expert Advisors (EAs). They are ideal for those who need superior execution speed, lower trading costs, and advanced features.

What is the key difference between Standard and Professional accounts?

The main difference lies in the cost structure and target audience. Standard accounts are simpler, with no commissions and wider spreads, suitable for beginners. Professional accounts offer much tighter spreads (sometimes raw or zero) but may include a commission, catering to serious traders who need cost-efficiency and precision.

What are the benefits of the higher leverage on Professional Accounts?

Higher leverage allows traders to control larger positions with a smaller amount of capital, potentially amplifying profits. However, it also increases risk, so it should be used with a disciplined risk management strategy, a feature professional traders are expected to have.

What is the verification process like for a Professional Account?

The verification process requires standard Proof of Identity (POI) and Proof of Residence (POR) documents, but may also require Proof of Professional Status. This could include evidence of significant trading activity or employment history in the financial sector to confirm your experience.