Step into the heart of your trading journey with the Exness Personal Area, your dedicated command center designed to make forex trading effortless and intuitive. This isn’t just a dashboard; it’s a meticulously crafted environment where every aspect of your trading life converges. From managing your funds and setting up new trading accounts to analyzing your performance and accessing vital support, the Exness Personal Area streamlines your entire experience. We built it with you in mind, ensuring that whether you are a seasoned market veteran or just starting your adventure in currency trading, you have all the tools and resources right at your fingertips. Discover true convenience and efficiency as you navigate the dynamic world of forex through a secure and user-friendly interface.

- Understanding Your Exness Personal Area: An Overview

- Key Features of Your Exness Personal Area

- Why Your Exness Personal Area Matters

- Getting Started: Registration and Exness Personal Area Login

- Your First Step: Registering an Exness Account

- Understanding Your Exness Personal Area

- Seamless Exness Personal Area Login

- Navigating the Exness Personal Area Dashboard and Key Features

- Your Dashboard: A Quick Overview

- Essential Features for Every Trader

- Why Master Your Personal Area?

- Exploring Account Management Tools

- Quick Access to Deposit and Withdrawal Options

- What You Can Expect:

- Managing Your Exness Trading Accounts Efficiently

- Key Strategies for Optimal Account Management

- Benefits of Proactive Account Management

- Opening New Accounts and Internal Transfers

- Streamlining Your Portfolio with Additional Accounts

- Seamlessly Moving Funds: Internal Transfers Explained

- Modifying Account Settings and Leverage

- Seamless Deposits and Withdrawals via Exness Personal Area

- Your Funding, Your Way: Deposits Made Simple

- Effortless Withdrawals: Get Your Profits Fast

- Step-by-Step Deposit Guide and Available Methods

- Your Simple Deposit Journey:

- Popular Deposit Methods at Your Fingertips:

- Important Considerations for Your Deposit:

- Efficient Withdrawal Process and Important Considerations

- Account Verification: Completing KYC in Your Exness Personal Area

- What You Need for Smooth Verification

- Steps to Verify Your Account

- Connecting to Trading Platforms from Your Exness Personal Area

- Monitoring Performance: Accessing Trading History and Analytics

- Exness Support: Getting Help Directly from Your Personal Area

- Why In-Platform Support Matters

- Accessing Support: A Simple Path

- Diverse Channels for Every Need

- Support Options Overview:

- The Benefits of Integrated Support

- Enhancing Security Measures within Your Exness Personal Area

- Why Your Account Security Matters

- Key Security Features at Your Fingertips

- Proactive Steps for Ultimate Account Safety

- Troubleshooting Common Issues in the Exness Personal Area

- Maximizing Your Trading Potential with Your Exness Personal Area

- Key Advantages of a Well-Utilized Exness Personal Area:

- Exness Personal Area: Frequently Asked Questions (FAQs)

- What is the Exness Personal Area?

- How do I access my Exness Personal Area?

- Can I open multiple trading accounts within one Personal Area?

- What are the common deposit and withdrawal methods available?

- Is my personal and financial information secure in the Exness Personal Area?

- How do I verify my account in the Personal Area?

- Can I manage my leverage settings from the Personal Area?

- Frequently Asked Questions

Understanding Your Exness Personal Area: An Overview

Welcome to the heart of your trading journey with Exness! Your Exness Personal Area isn’t just another page; it’s your central command center, meticulously designed to give you complete control over your trading activities. Think of it as your personalized Exness dashboard, where every essential function for managing your investments and accessing powerful trading tools is right at your fingertips. It’s built for efficiency, security, and an unparalleled user experience, ensuring you spend less time navigating and more time strategizing.

Every successful trader understands the importance of a well-organized and intuitive workspace. The Exness Personal Area serves exactly this purpose, simplifying complex financial operations into straightforward actions. Whether you’re a seasoned pro or just starting out, this dedicated client portal provides a seamless interface for all your needs.

Key Features of Your Exness Personal Area

Your personal cabinet is packed with functionalities aimed at making your trading experience smooth and efficient. Let’s explore some of the core capabilities you’ll find:

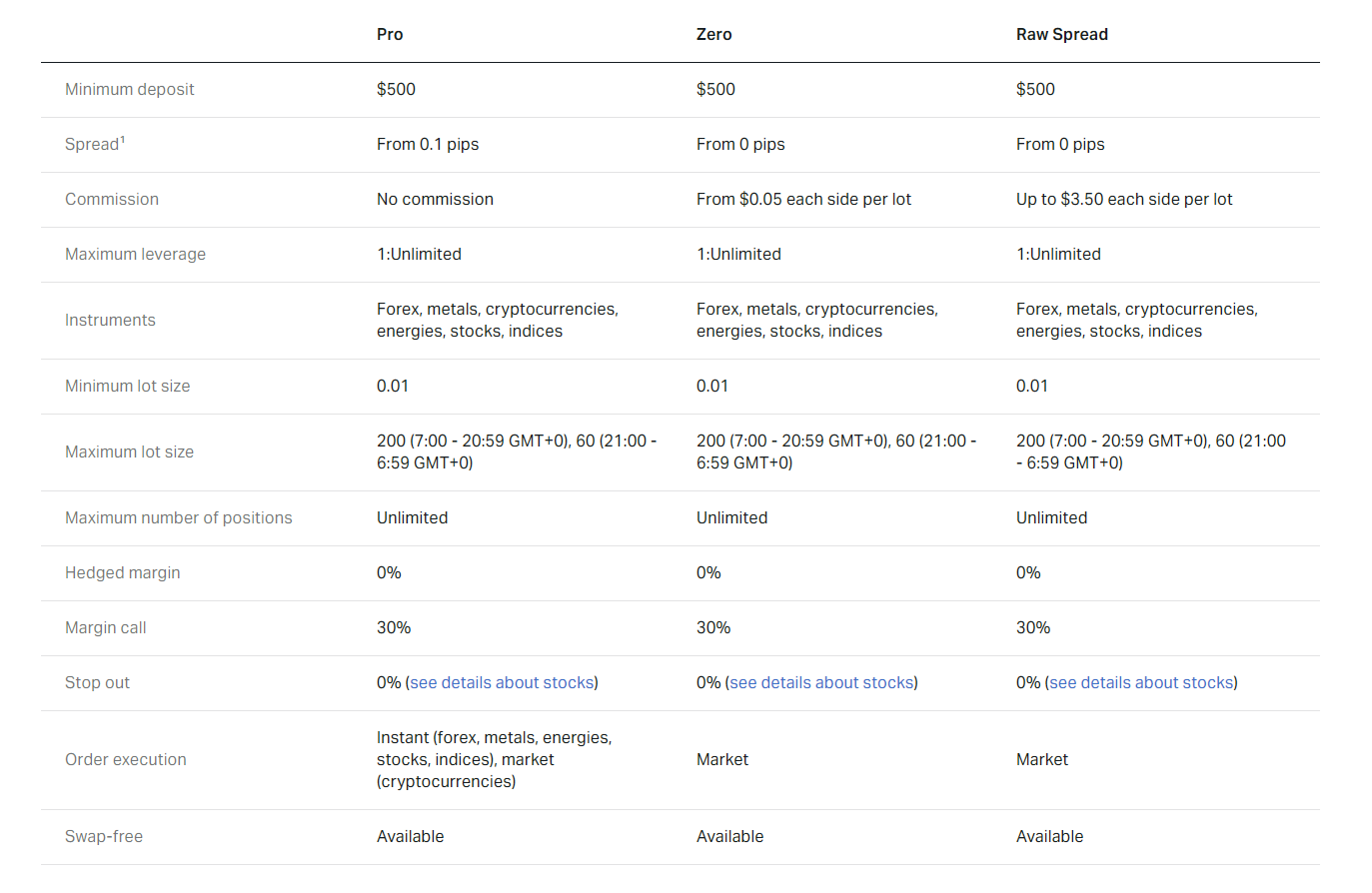

- Account Management: Easily create, view, and manage trading accounts across various types, from Standard to Pro. You can open new accounts, change leverage, or even set up demo accounts for practice.

- Fund Operations: Seamlessly deposit funds using a wide range of payment methods and effortlessly withdraw profits whenever you need. The system is designed for quick and secure transactions.

- Performance Monitoring: Track your trading history, analyze your profit and loss, and monitor your equity in real-time. Gain insights that help refine your trading strategies.

- Personalized Settings: Adjust your account settings, update personal details, and manage security preferences to keep your account safe.

- Access to Trading Platforms: Connect directly to popular platforms like MetaTrader 4 and MetaTrader 5, ensuring you have the right environment for your market analysis and order execution.

Why Your Exness Personal Area Matters

Your Exness Personal Area is more than just a login page; it’s the foundation of your trading success. It offers:

| Benefit | Description |

|---|---|

| Centralized Control | Manage all aspects of your trading from one secure location. No more jumping between different interfaces. |

| Enhanced Security | Benefit from robust security measures protecting your funds and data. Enjoy peace of mind with secure access. |

| Intuitive Navigation | The user-friendly interface makes it simple to find what you need, even for first-time users of the Exness platform. |

| Efficiency & Speed | Perform crucial operations like deposits and withdrawals quickly, allowing you to react to market changes without delay. |

Getting familiar with your Exness Personal Area is the first step towards a confident and controlled trading experience. Take the time to explore its features, understand its layout, and make it your essential hub for all your trading activities. It’s your personalized gateway to the global financial markets, designed to help you achieve your trading goals.

Getting Started: Registration and Exness Personal Area Login

Embarking on your trading journey requires a solid foundation, and choosing the right broker is paramount. Exness stands out as a reliable partner for traders worldwide. The first step to unlocking your trading potential with Exness involves a straightforward registration process and familiarizing yourself with the Exness Personal Area. This secure hub is where all your trading activities, account management, and analytical tools reside. Let’s walk through how to get started and seamlessly access your trading dashboard.

Your First Step: Registering an Exness Account

Opening an account with Exness is designed to be quick and intuitive, getting you ready to trade without unnecessary delays. Follow these simple steps to set up your profile:

- Visit the Official Exness Website: Always start by navigating directly to the official Exness site to ensure security and authenticity. Look for a “Register” or “Open Account” button, usually prominently displayed.

- Provide Basic Information: You will typically need to enter your country of residence, email address, and create a strong password. Choose your password carefully – it’s your key to securing your account.

- Verify Your Email: After submitting your details, Exness sends a verification code or link to your registered email. Check your inbox and spam folder, then follow the instructions to confirm your email address. This step activates your account.

- Complete Profile Details: Once your email is verified, you’ll be prompted to complete your personal profile. This includes your full name, date of birth, and contact number. Ensure all information is accurate to avoid future verification issues.

- Account Type Selection: Decide which account type best suits your trading style and experience level. Exness offers various options, from Standard to Professional accounts, each with different features and minimum deposits.

Congratulations! You’ve completed the initial registration. Now, you’re ready to explore your dedicated trading space.

Understanding Your Exness Personal Area

The Exness Personal Area is more than just a login portal; it’s your comprehensive control center. Think of it as the nerve center for all your trading operations. From here, you manage funds, open new trading accounts, access analytical tools, review your trading history, and communicate with support. It’s designed to give you full control and transparency over your trading activities.

Key functionalities available in your Personal Area include:

- Account Management: Create new trading accounts (demo or live), manage existing ones, and modify account settings.

- Deposit and Withdrawal: Fund your trading accounts using various payment methods and easily withdraw your profits.

- Trading Platform Access: Download or access popular trading platforms like MetaTrader 4 and MetaTrader 5 directly from your Personal Area.

- Analysis Tools: Access market analysis, economic calendars, and trading calculators to inform your decisions.

- Verification Center: Upload necessary documents for identity and residency verification, a crucial step for full account functionality.

- Support: Connect with the Exness customer support team for any queries or assistance.

Seamless Exness Personal Area Login

Accessing your trading dashboard after registration is straightforward. Follow these steps for a quick login:

- Go to the Exness Website: Open your web browser and navigate to the official Exness website.

- Click the “Sign In” or “Login” Button: This button is usually located in the top right corner of the homepage.

- Enter Your Credentials: Input the email address and password you used during the registration process.

- Solve CAPTCHA (if prompted): For security, you might need to complete a CAPTCHA verification.

- Click “Login”: Once your details are correct, click the login button to enter your Personal Area.

Always ensure you are on the legitimate Exness website before entering your login details to protect your account from phishing attempts. Once inside, you’re free to navigate the various sections, fund your account, and prepare to place your first trade. This smooth entry point ensures you can focus on what matters most: your trading strategy.

Navigating the Exness Personal Area Dashboard and Key Features

Your Exness Personal Area isn’t just a login portal; it’s your central command center for all things trading. Think of it as the cockpit of your trading journey, where you manage your accounts, funds, and strategies with precision. Understanding its layout and leveraging its powerful features can significantly streamline your trading operations and enhance your overall experience. Let’s dive in and explore what makes this dashboard an indispensable tool for every trader.

Your Dashboard: A Quick Overview

Upon logging in, your Exness Personal Area dashboard presents a clear, concise snapshot of your trading world. You’ll immediately see your main trading accounts, their balances, equity, and profit/loss figures. It’s designed for quick access, putting the most critical information front and center. You can easily switch between your various trading accounts, whether they are Standard, Pro, or Raw Spread, and monitor their performance at a glance. The intuitive design helps you track your progress without getting bogged down in complex menus.

Essential Features for Every Trader

The Exness Personal Area is packed with functionalities tailored to meet every trader’s needs, from managing capital to accessing analytical tools. Here are some of the key features you’ll utilize frequently:

- Account Management: Create new trading accounts instantly, manage existing ones, and even open demo accounts to practice strategies. You can easily switch between live and demo environments, perfect for testing new approaches without risk.

- Deposits and Withdrawals: Fund your trading accounts securely and withdraw your profits effortlessly. Exness offers a wide array of payment methods, and you can track your transaction history directly from the dashboard. This makes managing your capital flows incredibly convenient.

- Trading Terminal Access: Download various trading platforms like MetaTrader 4 and MetaTrader 5 directly from your Personal Area. You can also access the Exness WebTerminal, allowing you to trade directly from your browser without any downloads.

- Performance Analysis: Gain insights into your trading performance. The dashboard often provides reports and analytics tools that help you review your past trades, understand your strengths, and identify areas for improvement. This analytical support is crucial for refining your trading strategies.

- Support & Settings: Access comprehensive support resources, modify your personal profile, adjust security settings, and manage notifications. It’s also where you’ll find options to verify your account, ensuring full access to all features and higher transaction limits.

Why Master Your Personal Area?

Mastering your Exness Personal Area dashboard means taking full control of your trading environment. It’s not just about executing trades; it’s about efficient capital management, quick access to vital information, and leveraging the tools Exness provides to enhance your trading decisions. A well-navigated Personal Area allows you to focus more on market analysis and less on administrative tasks. Spend some time exploring each section, and you’ll discover how seamlessly it integrates with your daily trading routine, making your journey smoother and more productive.

Exploring Account Management Tools

Diving into the world of forex trading requires more than just making trades; it demands meticulous organization and strategic oversight. Account management tools are your essential allies in this journey, providing the structure you need to navigate the market effectively. These tools help you keep a sharp eye on your performance, manage risk, and refine your trading strategies with precision. They transform scattered data into actionable insights, making your trading decisions more informed and less impulsive.

Consider the benefits these powerful tools bring to your daily trading routine:

- Performance Tracking: Gain a clear, real-time view of your equity, profit and loss, and open positions. Understand what’s working and what needs adjustment.

- Risk Management: Set stop-loss and take-profit levels efficiently, calculate position sizes based on your risk tolerance, and ensure you never overexpose your capital.

- Trade Journaling: Document every trade, including your reasoning, entry/exit points, and emotional state. This becomes an invaluable learning resource.

- Analytical Reporting: Generate detailed reports on your trading history, identifying patterns, strengths, and weaknesses in your approach.

- Automated Alerts: Receive notifications for market events, price movements, or when your predefined conditions are met, allowing for timely action.

Utilizing these tools is not about complication; it’s about simplification. They streamline your workflow, reduce manual errors, and free up your mental energy to focus on market analysis rather than administrative tasks. From basic spreadsheets to sophisticated integrated platforms, the right account management tools empower you to stay disciplined, adapt quickly, and ultimately, grow as a forex trader.

Quick Access to Deposit and Withdrawal Options

In the fast-paced world of forex trading, every second counts, especially when it comes to managing your funds. You need to know that your capital is accessible exactly when you need it, both for funding your trading account and for withdrawing your profits. We understand this critical need for efficiency and reliability.

That’s why we prioritize a seamless experience for all your financial transactions. Our platform is designed with a user-friendly interface that puts deposit and withdrawal options right at your fingertips. No more navigating through multiple menus or enduring lengthy processes. We believe in providing instant access so you can focus on what truly matters: your trading strategy.

What You Can Expect:

- Effortless Deposits: Fund your account quickly and securely with a variety of payment methods. We support instant transfers, so your capital is available for trading almost immediately.

- Rapid Withdrawals: When it’s time to cash out your earnings, our streamlined process ensures your funds reach you without unnecessary delays. We work to process withdrawal requests promptly, allowing you to enjoy the fruits of your successful trades.

- Secure Transactions: Your financial security is paramount. We employ advanced encryption and robust security protocols to protect every transaction, giving you peace of mind with every deposit and withdrawal.

- Transparent Procedures: We provide clear instructions and detailed information about transaction times and any associated fees, ensuring full transparency in all your financial dealings.

Our goal is to remove any friction from your trading journey, starting with your funds. We make sure that managing your capital is as smooth and efficient as your trades themselves.

Managing Your Exness Trading Accounts Efficiently

As a serious trader, mastering the art of managing your Exness trading accounts is paramount to long-term success. It’s not just about opening an account and placing trades; it’s about strategic oversight, risk management, and smart resource allocation. Effective account management allows you to stay organized, minimize potential pitfalls, and maximize your trading opportunities. Let’s dive into some practical approaches to keep your Exness portfolio running smoothly.

Key Strategies for Optimal Account Management

Efficiently managing your Exness accounts involves several core practices. By implementing these, you gain better control over your trading activities and financial well-being.

- Categorize Your Accounts: Don’t just use one account for everything. Consider having separate accounts for different strategies (e.g., scalping, swing trading, long-term investments) or even for different currency pairs. This compartmentalization helps you track performance more accurately for each approach.

- Monitor Your Equity Regularly: Keep a close eye on your equity levels across all your accounts. Understanding your available margin and free margin is crucial for managing risk and avoiding unexpected stop-outs.

- Utilize Performance Reports: Exness provides detailed trading reports. Make it a habit to review these regularly. Analyze your winning and losing trades, identify patterns, and learn from your past performance to refine your strategies.

- Streamline Deposits and Withdrawals: Understand the various payment methods available on Exness and choose those that offer the quickest and most convenient transactions for your region. Efficient fund management ensures you always have capital when you need it and can access your profits without hassle.

Benefits of Proactive Account Management

Neglecting your account management can lead to unnecessary stress and missed opportunities. On the other hand, adopting a proactive stance yields significant advantages:

| Benefit Category | Description |

|---|---|

| Improved Risk Control | By segmenting funds and monitoring balances, you can effectively manage the risk exposure for each trading strategy, preventing one bad trade from impacting your entire portfolio. |

| Enhanced Strategic Clarity | Clear account separation helps you evaluate the effectiveness of individual trading approaches, allowing you to refine or discard strategies that aren’t performing as expected. |

| Quicker Decision Making | With an organized overview of your capital and positions, you can make faster, more informed trading decisions, especially during volatile market conditions. |

| Reduced Administrative Burden | A systematic approach to managing your accounts minimizes time spent on reconciliation and troubleshooting, freeing you to focus on market analysis and trade execution. |

Ultimately, treating your Exness trading accounts as distinct, valuable assets will transform your overall trading experience. It builds discipline, fosters strategic thinking, and empowers you to navigate the forex market with greater confidence and efficiency.

Opening New Accounts and Internal Transfers

As a seasoned trader, you know flexibility is key. Whether you’re looking to diversify your strategies, separate your trading capital, or simply manage funds across different accounts, understanding how to open new accounts and execute internal transfers seamlessly is crucial. It’s all about empowering you with greater control over your trading journey.

Streamlining Your Portfolio with Additional Accounts

Why might you need more than one trading account? Many successful traders use multiple accounts for various reasons:

- Strategy Segregation: Dedicate one account for high-frequency trading and another for long-term investments.

- Risk Management: Isolate funds for different risk profiles, preventing a loss in one area from impacting another.

- Testing New Approaches: Use a separate, smaller account to test new strategies without risking your primary capital.

- Currency Diversification: Hold funds in different base currencies to manage foreign exchange exposure.

The process for opening a new account is straightforward. Most brokers design it to be as user-friendly as possible, typically involving a few key steps:

- Login to Your Dashboard: Access your existing client portal with your credentials.

- Navigate to ‘Open New Account’: Look for a clear button or menu option, often found under ‘Accounts’ or ‘Profile’.

- Choose Account Type: Select the type of account that suits your new objective – a standard, ECN, or perhaps a swap-free account.

- Configure Settings: Decide on leverage, currency, and other specific parameters for the new account.

- Confirm and Activate: Review your choices and submit the request. Your new account is often ready within minutes.

Seamlessly Moving Funds: Internal Transfers Explained

Once you have multiple accounts, the ability to transfer funds between them instantly becomes invaluable. Think of it as moving money from your left pocket to your right, but in the trading world. This feature is a game-changer for dynamic fund management.

Benefits of Internal Transfers:

| Benefit | Description |

|---|---|

| Instant Access | Funds typically transfer immediately, allowing you to react quickly to market opportunities. |

| No Fees | Most brokers offer internal transfers free of charge, saving you money on deposit/withdrawal fees. |

| Enhanced Control | Easily reallocate capital based on performance or changing market conditions. |

| Simplified Reporting | Keep your external bank statements cleaner by managing funds internally. |

Executing an internal transfer is usually just as simple as opening a new account. You’ll typically find the option within your client portal under ‘Funds’ or ‘Transfers’.

As one experienced trader puts it, \”The ability to shift capital between my strategic accounts in real-time gives me a huge tactical advantage. It’s like having multiple specialized tools in my trading arsenal, ready for any market.\”

Always double-check the ‘from’ and ‘to’ account numbers, along with the transfer amount, before confirming. While most transfers are instant, large sums or unusual activity might trigger a brief review by your broker for security purposes. Enjoy the flexibility these features provide, and elevate your trading efficiency!

Modifying Account Settings and Leverage

As an active forex trader, you have the power to fine-tune your trading environment. Adjusting your account settings, especially your leverage, directly impacts your trading strategy and your exposure to market movements. Mastering how to navigate and modify these crucial options on your trading platform is key to optimizing your experience and aligning it perfectly with your individual trading goals.

Your trading platform offers a suite of customizable account settings beyond just your initial capital. You can often manage notification preferences, enhance security by changing your password, update personal contact information, or even select preferred chart display options to suit your analytical style. Regularly reviewing these settings ensures your account remains secure, up-to-date, and precisely tailored to how you like to trade. Always prioritize your account’s safety by utilizing strong, unique passwords and enabling two-factor authentication whenever it’s available.

Now, let’s delve into leverage – a powerful and often misunderstood tool in the world of forex trading. Leverage enables you to control a significantly larger position in the market using a relatively small amount of your own capital, which is known as margin. For example, if you use 1:100 leverage, you can effectively trade $100,000 worth of currency with only $1,000 from your account. While it amplifies your potential for profit, it equally magnifies your potential for loss, making it a critical aspect of risk management.

Most reputable brokers provide straightforward options to modify your leverage directly within your client portal or account management section. The typical process involves logging into your secure account, navigating to the \”Account,\” \”Profile,\” or \”Settings\” tab, and then locating an option such as \”Change Leverage\” or something similar. You’ll usually encounter a dropdown menu or an input field where you can select from the available leverage ratios your broker offers. It’s important to remember that such changes often require confirmation and might not take effect instantaneously, so always review your broker’s specific procedure and timeframes.

Before you decide to adjust your leverage, carefully weigh its potential benefits against its inherent risks:

- Advantages of Higher Leverage:

- Significantly increased purchasing power, allowing for larger trade sizes with a smaller initial capital outlay.

- Potential for substantially higher profits on successful trades, enhancing capital efficiency.

- More flexible use of your trading capital across various opportunities.

- Disadvantages of Higher Leverage:

- Magnified losses can very quickly deplete your account balance, leading to faster margin calls.

- Requires much stricter discipline in risk management due to amplified market exposure.

- Can increase psychological pressure because each price fluctuation has a greater impact on your account equity.

Always align your chosen leverage with your personal risk tolerance and your overarching trading strategy. Many experienced traders advise that beginners start with lower leverage ratios, as this provides a safer environment to learn and gain experience while managing risk effectively. As you develop your skills and increase your trading capital, you might consider higher ratios, but this should always be coupled with robust risk management techniques such as strict stop-loss orders and meticulous position sizing. Your chosen leverage should empower your trading approach, not undermine it.

Seamless Deposits and Withdrawals via Exness Personal Area

Your trading journey should be about market analysis and strategic decisions, not worrying about fund transfers. At Exness, we understand this perfectly. That’s why we’ve engineered the Exness Personal Area to be the ultimate hub for all your financial operations, ensuring every deposit and withdrawal is as smooth and stress-free as possible. This dedicated client portal puts you in complete control, allowing you to manage your funds with unparalleled ease and confidence.

We know that quick access to your capital is crucial. Whether you’re looking to seize a sudden market opportunity or withdraw your profits, the process needs to be efficient and reliable. Our system is designed precisely for this, offering a user-friendly interface that streamlines every transaction. Say goodbye to complex procedures and frustrating delays. With Exness, your focus stays where it belongs: on your trades.

Your Funding, Your Way: Deposits Made Simple

Funding your trading account with Exness is incredibly straightforward, thanks to the intuitive design of your Personal Area. We offer a wide array of payment methods, catering to traders from all corners of the globe. You can choose the option that best suits your needs, knowing that each one is processed securely and swiftly.

- Instant Funding: Many of our deposit methods ensure your funds appear in your trading account almost instantly, allowing you to react quickly to market movements.

- Diverse Options: From popular e-wallets and bank transfers to local payment solutions, you’ll find a method that works for you.

- Zero Deposit Fees: We believe in transparent trading. That’s why we don’t charge any fees on deposits. Your capital goes directly into your trading power.

- Secure Transactions: Every deposit is protected with advanced encryption technologies, safeguarding your financial information at all times.

Effortless Withdrawals: Get Your Profits Fast

Accessing your profits should be just as easy as depositing funds. The Exness Personal Area makes withdrawals simple and efficient. We prioritize speed and security, ensuring your funds reach you without unnecessary delays, so you can enjoy the fruits of your trading success.

Here’s what makes our withdrawal process stand out:

| Feature | Benefit |

|---|---|

| Automated Processing | Many withdrawals are processed automatically, even on weekends, for lightning-fast delivery. |

| Wide Choice of Methods | Withdraw funds using the same convenient options you used for depositing. |

| Transparent Policies | Clear terms and conditions, no hidden fees. What you withdraw is what you get. |

| High Security Standards | Your financial security remains our top priority throughout the entire withdrawal process. |

As one of our satisfied traders recently shared:

“The Exness Personal Area truly changed my trading experience. Funding my account and taking profits has never been this easy or fast. It gives me peace of mind to focus purely on my trading strategy.”

Join the community of traders who experience the difference of a truly seamless financial experience. Your Exness Personal Area is more than just a gateway to your funds; it’s a commitment to efficiency, security, and your ultimate trading success.

Step-by-Step Deposit Guide and Available Methods

Ready to power up your trading account and dive into the forex market? Funding your account is a straightforward process, designed to get you trading quickly and securely. We believe in transparency and ease of use, so let’s walk through how you can deposit funds and explore the convenient methods available to you.

Your Simple Deposit Journey:

- Log In to Your Secure Account: First things first, access your personal trading dashboard using your credentials. Your financial hub awaits!

- Navigate to the Deposit Section: Look for the “Deposit,” “Fund Account,” or “Wallet” tab. It’s usually prominent and easy to find within your account menu.

- Select Your Preferred Method: We offer a variety of options to suit your needs. Choose the one that works best for you, whether it’s a classic bank transfer or a modern e-wallet.

- Enter Deposit Details: Provide the necessary information for your chosen method, such as the amount you wish to deposit. Always double-check your figures here!

- Confirm and Complete: Review your transaction details one last time. Once you’re confident, confirm the deposit. Your funds will then begin their journey to your trading account.

Popular Deposit Methods at Your Fingertips:

We understand that every trader has different preferences. That’s why we support a diverse range of reliable deposit methods, ensuring flexibility and security for your transactions.

- Credit/Debit Cards: Visa and MasterCard are widely accepted. These offer instant deposits, making them incredibly popular for getting funds into your account fast.

- Bank Wire Transfers: For larger amounts or if you prefer a traditional banking approach, bank transfers are a secure choice. While reliable, they might take a bit longer to process, typically 1-3 business days.

- E-Wallets: Digital wallets like Skrill, Neteller, and PayPal provide a swift and secure way to deposit. These methods often process instantly and add an extra layer of privacy.

- Cryptocurrencies: Embracing the future, we also accept deposits via popular cryptocurrencies such as Bitcoin and Ethereum. This method offers decentralization and quick processing, appealing to modern traders.

Important Considerations for Your Deposit:

While depositing is simple, keeping a few things in mind ensures a smooth experience:

\”Always ensure your deposit method matches the name on your trading account for security and compliance purposes. This prevents delays and keeps your funds safe.\”

We work hard to process your deposits as quickly as possible. Instant methods show funds in your account almost immediately, while others may require standard banking times. We also strive for minimal or no deposit fees, but always check the specific terms for your chosen method and any potential charges from your bank or payment provider.

Efficient Withdrawal Process and Important Considerations

Once you’ve achieved success in your trading journey, the next step is accessing your profits. A smooth and efficient withdrawal process is crucial for any trader. We understand that quick access to your funds matters, so we’ve streamlined our systems to make sure your money reaches you without unnecessary delays. Before initiating a withdrawal, always confirm your account is fully verified, as this helps prevent hold-ups. You should also be aware of any minimum withdrawal amounts or potential processing fees that might apply, although we strive to keep these to a minimum. Remember to choose a withdrawal method that aligns with your needs, whether it’s a bank transfer or another electronic option, and always double-check your details to ensure accuracy.

Account Verification: Completing KYC in Your Exness Personal Area

Diving into the world of forex trading requires not only skill and strategy but also a solid foundation of security and trust. A critical step on this journey is completing your account verification, often known as KYC (Know Your Customer), within your Exness Personal Area. This isn’t just a formality; it’s a vital process that protects both you and the trading platform, ensuring a secure and compliant trading environment.

Think of KYC as your digital passport to full trading functionality. It confirms your identity and address, which helps prevent fraud and ensures Exness adheres to international financial regulations. Completing this process unlocks all features, including unlimited deposits and withdrawals, giving you complete control over your trading experience.

What You Need for Smooth Verification

Preparing the right documents beforehand makes the account verification process quick and seamless. Exness typically requires two main types of documents:

- Proof of Identity: This document confirms who you are. Make sure it’s valid and clearly shows your full name, date of birth, and a photograph.

- Proof of Residence: This document verifies your current address. It should be recent, typically issued within the last three to six months, and display your full name and residential address.

Steps to Verify Your Account

Navigating the account verification process in your Exness Personal Area is straightforward. Here’s a quick guide to help you complete your KYC:

- Log In: Access your Exness Personal Area using your registered email and password.

- Initiate Verification: You’ll usually see a prominent notification or a dedicated section for \”Verification\” or \”Complete Profile.\” Click on it to begin.

- Upload Documents: Follow the on-screen prompts to upload clear, high-quality images or scans of your chosen proof of identity and proof of residence documents. Ensure all four corners of the document are visible and the text is legible.

- Submit for Review: Once you’ve uploaded everything, submit your documents. Exness’s verification team will review them.

- Confirmation: You will receive an email notification once your documents are successfully verified. This typically takes a short period, but processing times can vary.

Completing your account verification is a one-time process that opens the door to a seamless and secure trading experience with Exness. Don’t delay – get your KYC done and focus on what truly matters: your trading strategies!

Connecting to Trading Platforms from Your Exness Personal Area

As a seasoned forex trader, you know that seamless access to your trading platforms is crucial for success. Your Exness Personal Area isn’t just a dashboard; it’s your control center for managing accounts, depositing funds, and, most importantly, linking directly to the powerful trading platforms you rely on. This integrated approach simplifies your trading journey, allowing you to focus on market analysis and strategy execution rather cloudy with technical hurdles.

Connecting your trading account from the Exness Personal Area to platforms like MetaTrader 4 or MetaTrader 5 is a straightforward process designed with traders in mind. You won’t waste time searching for server details or manual configurations. Everything you need to get set up and start trading is readily available at your fingertips. This direct link ensures you’re always connected to the markets with your chosen platform settings, whether you’re managing multiple accounts or diving deep into a specific trading strategy.

Here’s why connecting through your Exness Personal Area makes perfect sense:

- Effortless Setup: No more hunting for login credentials or server names. Your personal area provides all the necessary details, often allowing for one-click access or auto-fill options directly into your MetaTrader installation.

- Centralized Management: View all your trading accounts—live, demo, standard, or professional—in one place. You can easily switch between them and initiate connections to different trading platforms as needed.

- Enhanced Security: Managing connections through your secure Exness Personal Area adds an extra layer of protection, keeping your trading activities safe and sound.

- Instant Access: Get to the markets faster. Once connected, you can execute trades, monitor positions, and manage risk with minimal delay, which is vital in the fast-paced forex environment.

Whether you are a scalper, a swing trader, or someone who engages in long-term position trading, efficient platform access is non-negotiable. Leverage your Exness Personal Area to streamline your setup process and optimize your trading experience. It’s about giving you more time to trade and less time troubleshooting.

Monitoring Performance: Accessing Trading History and Analytics

Every successful trader knows that placing a trade is only part of the journey. The real growth comes from consistently monitoring performance, understanding what works, and identifying areas for improvement. Accessing your comprehensive trading history and leveraging robust analytics tools are crucial steps in transforming your trading from a speculative activity into a data-driven enterprise. This disciplined approach sets apart the consistently profitable traders from those who struggle.

Your trading history is more than just a list of past transactions; it is a rich database of your entire trading journey. It meticulously records every open and closed position, showcasing entry and exit points, trade duration, instrument traded, and crucially, the profit or loss for each trade. By regularly reviewing this raw data, you gain invaluable insights into your actual trading behavior, not just your intended strategy. You can spot patterns you might not otherwise notice, understand your decision-making process under pressure, and pinpoint recurring mistakes.

Here are key elements you should regularly review within your trading history:

- Entry and Exit Points: Analyze if your entries align with your strategy and if your exits were optimal for maximizing profit or minimizing loss.

- Trade Duration: Determine if you hold winning trades long enough or if you cut losing trades too quickly or too late.

- Instrument Performance: Identify which currency pairs or assets yield the best results for your strategy and which ones consistently underperform.

- Time of Day/Week: Discover if specific trading sessions or days of the week are more conducive to your trading style.

- Risk-Reward Ratio: Verify that your actual risk-reward ratio aligns with your strategic goals.

While trading history provides the raw data, sophisticated analytics transform that data into actionable intelligence. Trading analytics platforms take your raw trade information and generate meaningful performance metrics, allowing you to quickly assess the effectiveness of your trading strategy. These tools highlight your strengths and weaknesses through visual representations like equity curves, drawdown charts, and detailed statistical reports. This level of trade analysis is indispensable for making informed adjustments to your approach.

Consider these essential performance metrics that analytics typically provide:

| Metric | Insight Gained |

|---|---|

| Total Profit/Loss | Overall financial performance over a period. |

| Win Rate (%) | Percentage of profitable trades out of total trades. |

| Average Profit per Win | Mean profit from your winning trades. |

| Average Loss per Loss | Mean loss from your losing trades. |

| Maximum Drawdown | Largest peak-to-trough decline in your equity curve. Critical for risk management. |

| Profit Factor | Gross profit divided by gross loss. A measure of strategy robustness. |

Leveraging these tools allows you to conduct thorough performance monitoring, ensuring you never trade blindly. You can identify if your current trading strategy is profitable in the long run, or if minor tweaks are necessary to optimize your entry criteria, exit rules, or position sizing. This iterative process of analysis and adjustment is the hallmark of professional forex trading. Make it a habit to regularly dive into your data.

“What gets measured, gets managed.” – Peter Drucker. This timeless principle holds especially true in the dynamic world of forex trading.

Embrace the power of your trading history and the insights from analytics. They are your most reliable coaches, offering objective feedback on your performance. By consistently accessing and interpreting this valuable information, you empower yourself to make smarter, data-driven decisions, refine your methodology, and ultimately, steer your trading journey towards sustained profitability. Make performance monitoring a non-negotiable part of your trading routine, and watch your understanding and results flourish.

Exness Support: Getting Help Directly from Your Personal Area

Navigating the fast-paced world of forex trading requires not only skill and strategy but also reliable support when you need it most. Imagine you’re in the middle of a crucial trade, or perhaps you have a quick question about your account. Waiting for an email response or searching through endless FAQs can cost you valuable time and opportunities. That’s why Exness makes getting help incredibly straightforward and efficient, offering direct access to their support team right from your personal trading area.

Why In-Platform Support Matters

Accessing support directly from your personal area isn’t just a convenience; it’s a strategic advantage. It means less time away from your charts and more time focused on your trades. You’re already logged in, your account details are readily available to the support agent (with your permission, of course), and the context of your query is often clearer. This seamless integration ensures your trading journey remains as smooth as possible, minimizing disruptions and maximizing your peace of mind.

Accessing Support: A Simple Path

Exness designed its personal area with user experience at its forefront, making the support channels intuitive to find. You don’t need to hunt for a separate contact page or leave your trading environment. Here’s how you typically find assistance:

- Log In: First, log into your personal Exness trading account.

- Locate the Support Icon: Look for a dedicated “Support” or “Help” icon, often found in a prominent corner or navigation menu within your personal area dashboard.

- Choose Your Method: Once clicked, you’ll usually be presented with various communication options to get in touch with the Exness team.

Diverse Channels for Every Need

Whether you prefer a quick chat or need to send detailed documentation, Exness offers multiple avenues for assistance, all accessible from your personal area. This ensures you can pick the method that best suits your current situation and the complexity of your query.

Support Options Overview:

| Support Channel | Best For | Typical Response Time |

|---|---|---|

| Live Chat | Immediate questions, technical issues, quick resolutions | Seconds to a few minutes |

| Detailed inquiries, document submission, non-urgent matters | Hours, depending on complexity | |

| Phone Support | Complex issues requiring verbal explanation, urgent account matters | Immediate (during operating hours) |

| Help Center/FAQ | Self-service for common questions, tutorials, troubleshooting | Instant |

The immediate availability of these resources directly within your trading hub means you can resolve issues quickly and efficiently, keeping your focus where it belongs: on your trading strategy.

The Benefits of Integrated Support

Why is this direct access so beneficial for traders?

“Reliable and accessible support is the bedrock of a positive trading experience. We believe help should always be just a click away.”

Indeed, having support embedded within your personal area offers several key advantages:

- Efficiency: No wasted time searching for contact details outside your platform.

- Contextual Help: Support agents can often see the context of your account (with your permission), leading to faster, more accurate solutions.

- Security: All communication happens within a secure, authenticated environment.

- Convenience: Resolve issues without leaving your primary trading interface.

- Peace of Mind: Knowing help is always readily available reduces stress and builds confidence.

By streamlining the support process, Exness empowers its traders to concentrate on what they do best: identifying opportunities and executing trades. So, next time you have a question, remember that your personal area is your first and fastest gateway to expert assistance.

Enhancing Security Measures within Your Exness Personal Area

Your trading account represents your hard-earned capital and your financial aspirations. Protecting it from unauthorized access is not just a recommendation; it is a critical necessity. At Exness, we understand the paramount importance of a secure trading environment. We empower you with robust tools to safeguard your funds and personal information within your Exness Personal Area. Taking advantage of these features ensures peace of mind and allows you to focus solely on your trading strategies.

Why Your Account Security Matters

In the dynamic world of forex trading, cyber threats constantly evolve. A compromised account can lead to significant financial losses and data breaches. Your personal area holds sensitive information, including your trading history, deposit and withdrawal details, and personal identification. Therefore, actively managing and enhancing your Exness security measures is a crucial part of responsible trading.

Key Security Features at Your Fingertips

Exness provides a multi-layered approach to account protection. We put several powerful tools directly into your hands within the Personal Area settings. Utilize these features to build a formidable defense around your account:

- Two-Factor Authentication (2FA): This is arguably your strongest line of defense. When enabled, 2FA requires a second verification step, usually a code sent to your registered phone or email, in addition to your password. This makes it incredibly difficult for anyone to access your account, even if they somehow obtain your password.

- Transaction Passwords: For an added layer of protection on withdrawals and other sensitive operations, you can set up a dedicated transaction password. This separate password ensures that only you can authorize financial movements from your account.

- Email and SMS Notifications: Stay informed about all critical activities. Get instant alerts for logins from new devices, password changes, or withdrawal requests. Timely notifications allow you to react quickly to any suspicious activity.

- Session Management: Your personal area allows you to view active sessions. You can log out of all other devices remotely, ensuring that only your current session remains active. This is especially useful if you log in from public computers.

Proactive Steps for Ultimate Account Safety

While Exness provides the tools, your active participation in securing your account is vital. Here are essential steps every trader should take to maximize their Exness Personal Area security:

- Craft Strong, Unique Passwords: Avoid using easily guessable passwords like birthdays or common phrases. Create complex passwords that combine uppercase and lowercase letters, numbers, and symbols. More importantly, use a unique password for your Exness account that you don’t use anywhere else.

- Enable and Regularly Review 2FA: Make 2FA mandatory for your logins and withdrawals. Regularly check your 2FA settings and ensure your registered contact details are up-to-date.

- Monitor Account Activity: Periodically review your login history and transaction logs within your Personal Area. Familiarize yourself with your normal account activity so you can quickly spot anything out of the ordinary.

- Be Wary of Phishing Attempts: Always verify the sender of any email claiming to be from Exness. Only log in through the official Exness website. Never click suspicious links or provide your credentials in response to unsolicited requests.

- Keep Your Devices Secure: Ensure your computer and mobile devices have up-to-date antivirus software. Avoid logging into your trading account on public Wi-Fi networks or shared computers.

By diligently implementing these enhanced security measures, you build a robust shield around your trading activities. This proactive approach not only protects your capital but also reinforces your confidence in navigating the forex market. A secure trading environment is a successful trading environment.

Troubleshooting Common Issues in the Exness Personal Area

Even the most robust trading platforms can sometimes throw a curveball. When you’re managing your funds, trades, and personal settings, a smooth experience in your Exness Personal Area is non-negotiable. Hiccups can be frustrating, especially when time is money in the dynamic world of forex trading. But don’t fret! Most common issues have straightforward solutions. Let’s dive into the typical snags traders encounter and how to quickly get back on track.

Having trouble logging into your Personal Area? This is often the first hurdle, preventing you from accessing your trading dashboard. Double-checking your credentials is always step one, but sometimes the problem runs a bit deeper. Here’s what to look for:

- Incorrect Login Details: Ensure you are using the correct email or account number and password. Remember, passwords are case-sensitive. If you have multiple Exness accounts, verify you’re attempting to log into the right one.

- Forgotten Password: No need to panic. Use the “Forgot password?” link on the login page. Follow the prompts to reset your password via your registered email or phone number. Keep your recovery information updated.

- Two-Factor Authentication (2FA) Issues: If you’ve enabled 2FA, ensure your authenticator app (like Google Authenticator) is synced correctly or that you are receiving SMS codes. Check your device’s time settings, as time discrepancies can affect OTP generation. If you’ve lost access to your 2FA device, contact Exness support immediately for assistance.

- Browser Cache and Cookies: Sometimes, old data stored in your browser can interfere with new sessions. Clear your browser’s cache and cookies, then try logging in again. A quick reload often does the trick.

Are you experiencing deposit or withdrawal troubles? Funding your account or withdrawing profits should be a seamless process. If you encounter delays or rejections, here’s what to look at with common scenarios and their solutions:

| Issue Symptom | Potential Cause | Quick Fix / Solution |

|---|---|---|

| Deposit Not Reflected | Payment method delay; incorrect details | Verify transaction status with your payment provider. Double-check all entered details. Provide transaction proof to Exness Support. |

| Withdrawal Rejected | Unverified account; insufficient funds; method mismatch | Complete your account verification (Proof of Identity, Proof of Residence). Ensure withdrawal amount doesn’t exceed available balance. Withdraw using the same method used for deposit. |

| Processing Delays | High transaction volume; bank holidays; technical issues | Check Exness’s processing times for your chosen method. Patience might be key, but if it exceeds the stated time, contact support with your transaction ID. |

It’s always a good practice to ensure your account is fully verified before attempting any large transactions. Unverified accounts often face limitations on deposits and withdrawals, which can be a primary cause of rejection.

Facing hurdles with account verification? Account verification (KYC – Know Your Customer) is crucial for security and compliance, but it can sometimes be a sticking point. Follow these tips for a smoother verification process:

- Clarity and Quality: Ensure all submitted documents (Proof of Identity, Proof of Residence) are clear, uncropped, and high-resolution. All details must be legible.

- Matching Details: The name and address on your documents must exactly match the information you provided during registration in your Personal Area. Even minor discrepancies can cause rejections.

- Validity: Make sure your identification documents are current and not expired.

- Accepted Documents: Familiarize yourself with the types of documents Exness accepts (e.g., passport, national ID card, driver’s license for ID; utility bill, bank statement for residence).

- Patience and Follow-Up: Verification can take some time. If your documents are pending for an unusually long period, or if they are rejected with a vague reason, don’t hesitate to reach out to the Exness support team for specific guidance.

“An ounce of prevention is worth a pound of cure, especially in trading. Proactively ensuring your Personal Area details are correct and your account is verified can save you a lot of headache down the line.” – A Veteran Trader’s Wisdom

When All Else Fails: Contact Exness Support. While self-troubleshooting can resolve most issues, there are times when you need expert assistance. Exness offers comprehensive customer support available 24/7. Don’t hesitate to reach out if you’ve tried the common fixes and are still stuck. When contacting support, be prepared to provide your account number, a clear description of the issue, screenshots (if applicable), and any error messages you received. Choose your preferred channel – whether it’s live chat, email, or phone – and stick with it for continuity.

Navigating the Exness Personal Area should be a straightforward experience. By understanding these common issues and their resolutions, you can minimize downtime and focus on what truly matters: your trading journey.

Maximizing Your Trading Potential with Your Exness Personal Area

Your Exness Personal Area is more than just a dashboard; it’s your command center, a powerful hub designed to give you complete control over your trading journey. From managing your funds to analyzing your performance and accessing vital tools, this personalized space is key to unlocking your full potential in the markets. It centralizes everything you need, simplifying complex processes so you can focus on what truly matters: making informed trading decisions.

Think of it as your dedicated trading toolkit, always at your fingertips. Whether you’re a beginner taking your first steps or an experienced trader refining your strategies, the Exness Personal Area provides the robust infrastructure you need to operate efficiently and effectively. Let’s explore how you can leverage its features to elevate your trading game.

Key Advantages of a Well-Utilized Exness Personal Area:

- Effortless Fund Management: Deposit and withdraw funds with ease using a wide array of payment methods. Track your transaction history transparently.

- Account Centralization: Manage multiple trading accounts (Standard, Pro, Raw Spread, Zero) from a single interface, making it simple to switch between strategies or instruments.

- Performance Insights: Access detailed trading reports and analytics that help you understand your profitability, identify patterns, and learn from past trades.

- Security and Control: Enhance your account security with two-factor authentication and customize your personal settings for a tailored experience.

- Access to Tools and Support: Quickly find educational resources, contact customer support, and discover new features designed to improve your trading.

To truly maximize your trading potential, regularly engage with your Personal Area. Don’t just log in to make a deposit or withdrawal; explore its analytical features, review your account statements, and check for new updates or tools Exness provides. A proactive approach to managing your trading environment directly translates into a more organized and potentially more profitable trading experience. Your Personal Area is built to empower you, so make the most of every feature it offers.

Exness Personal Area: Frequently Asked Questions (FAQs)

Navigating your trading journey with Exness becomes incredibly streamlined once you understand the power of your Personal Area. This dedicated hub is your command center for all things related to your accounts, funds, and trading activities. Whether you are a new trader just getting started or an experienced pro looking to optimize your operations, you likely have questions about how to best leverage this powerful tool. We’ve compiled some of the most frequently asked questions to help you unlock the full potential of your Exness Personal Area.

What is the Exness Personal Area?

The Exness Personal Area is your secure, personalized dashboard. It is a web-based portal where you manage all aspects of your trading accounts, including deposits, withdrawals, account verification, monitoring trading history, and accessing various analytical tools and resources. Think of it as your digital office within Exness, designed for seamless management of your trading portfolio.

How do I access my Exness Personal Area?

Accessing your Exness Personal Area is straightforward. You simply visit the official Exness website and click on the “Sign In” or “Personal Area” button, usually located in the top right corner. Then, you enter your registered email address and password. If you are logging in for the first time or from a new device, you might need to complete a two-factor authentication step for enhanced security.

Can I open multiple trading accounts within one Personal Area?

Absolutely! One of the great advantages of the Exness Personal Area is its ability to centralize multiple trading accounts under a single login. You can easily open new real or demo accounts, each with different settings like currency, leverage, or account type (Standard, Raw Spread, Pro, etc.), all from within your Personal Area. This flexibility allows traders to diversify strategies or test new approaches without needing separate logins.

What are the common deposit and withdrawal methods available?

Exness offers a wide array of convenient payment methods to fund your account and withdraw your profits. These generally include:

- Bank Wire Transfers

- Credit/Debit Cards (Visa, Mastercard)

- Various Electronic Payment Systems (e-wallets like Skrill, Neteller, Perfect Money, WebMoney, etc.)

- Cryptocurrencies (Bitcoin, USDT, etc.)

Availability of specific methods can vary based on your region. The Exness Personal Area clearly displays all available options relevant to your location, along with minimum/maximum limits and processing times.

Is my personal and financial information secure in the Exness Personal Area?

Security is a top priority for Exness. Your Personal Area is protected by multiple layers of security protocols. This includes:

- SSL Encryption: All data transmitted between your browser and Exness servers is encrypted.

- Two-Factor Authentication (2FA): You can enable 2FA using SMS or an authenticator app for an extra layer of security during login and critical actions.

- Regular Security Audits: Exness consistently reviews and updates its security measures to guard against potential threats.

Always ensure you keep your login credentials confidential and log out after each session.

How do I verify my account in the Personal Area?

Account verification is a crucial step for full access to all features, especially withdrawals. The process is straightforward within your Exness Personal Area:

- Navigate to the “Verification” section.

- Upload a Proof of Identity (POI) document, such as a passport, national ID card, or driver’s license.

- Upload a Proof of Residence (POR) document, like a utility bill or bank statement, dated within the last three to six months.

Exness aims to review and verify documents quickly, often within a few hours to a day, once submitted correctly.

Can I manage my leverage settings from the Personal Area?

Yes, managing your leverage is simple and intuitive within your Personal Area. For each individual trading account you hold, you can adjust the leverage ratio directly from its settings. This flexibility allows you to adapt your risk management strategy as market conditions or your trading style evolves. Remember, while higher leverage can amplify profits, it also significantly increases potential losses, so choose your settings wisely.

Frequently Asked Questions

What is the Exness Personal Area and what can I do there?

The Exness Personal Area is a secure, web-based dashboard that acts as your central command center. From here, you can manage all your trading activities, including opening new accounts, depositing and withdrawing funds, monitoring your performance, completing account verification (KYC), and accessing customer support.

How do I verify my account in the Exness Personal Area?

To verify your account, log into your Personal Area and navigate to the “Verification” section. You will need to upload two types of documents: a Proof of Identity (like a passport or national ID) and a Proof of Residence (like a recent utility bill or bank statement). This process is essential to unlock full account features, including unlimited withdrawals.

Can I have multiple trading accounts under one Personal Area?

Yes, absolutely. The Exness Personal Area allows you to open and manage multiple real and demo trading accounts under a single login. This is useful for separating different trading strategies, testing new approaches on a demo account, or managing funds across various account types (e.g., Standard, Pro, Zero).

What security features can I use to protect my Exness Personal Area?

Exness provides several security tools to protect your account. The most important is Two-Factor Authentication (2FA), which adds a second layer of security to your login. You can also utilize unique passwords, monitor active sessions, and set up email/SMS notifications for critical activities like logins and withdrawals, all from within your Personal Area.

How do I connect to trading platforms like MT4 or MT5 from my Personal Area?

Your Exness Personal Area makes it easy to connect to trading platforms. It provides all the necessary login credentials and server details for each of your trading accounts. You can use this information to log into the MetaTrader 4 or MetaTrader 5 desktop or mobile applications, or access the Exness WebTerminal directly from your browser.