- Why Exness is a Top Choice for Nigerian Traders

- What Makes Exness Shine for Nigerians?

- Seamless Experience for Every Trader

- Is Exness Regulated and Safe for Nigerians?

- What Makes Exness a Safe Choice for Nigerians?

- How to Open an Exness Account in Nigeria

- What Documents Do You Need for Verification?

- Step-by-Step Registration Process

- Account Verification Requirements

- Common Documentation Needed

- Exness Deposit Methods for Nigerian Users

- Why Deposit with Exness in Nigeria?

- Popular Deposit Options for Nigerian Traders

- Bank Card Deposits

- E-Wallet Solutions

- Local Bank Transfers

- Other Convenient Methods

- Important Considerations for Deposits

- Popular Local Payment Options

- Other Convenient Deposit Channels

- Popular Alternative Deposit Methods

- Choosing Your Ideal Deposit Method: What to Consider

- Seamless Exness Withdrawal Process in Nigeria

- Why Exness Withdrawals Are a Game-Changer for Nigerian Traders

- Popular Exness Withdrawal Methods Available in Nigeria

- Maximizing Your Withdrawal Speed: Essential Tips

- Trading Platforms Available with Exness Nigeria

- MetaTrader 4 (MT4): The Trader’s Classic Choice

- MetaTrader 5 (MT5): The Next-Generation Platform

- Exness Terminal: Trade Directly from Your Browser

- MetaTrader 4 (MT4) & MetaTrader 5 (MT5)

- Understanding MT4

- Exploring MT5

- Choosing Your Platform

- Exness Terminal & Mobile App Trading

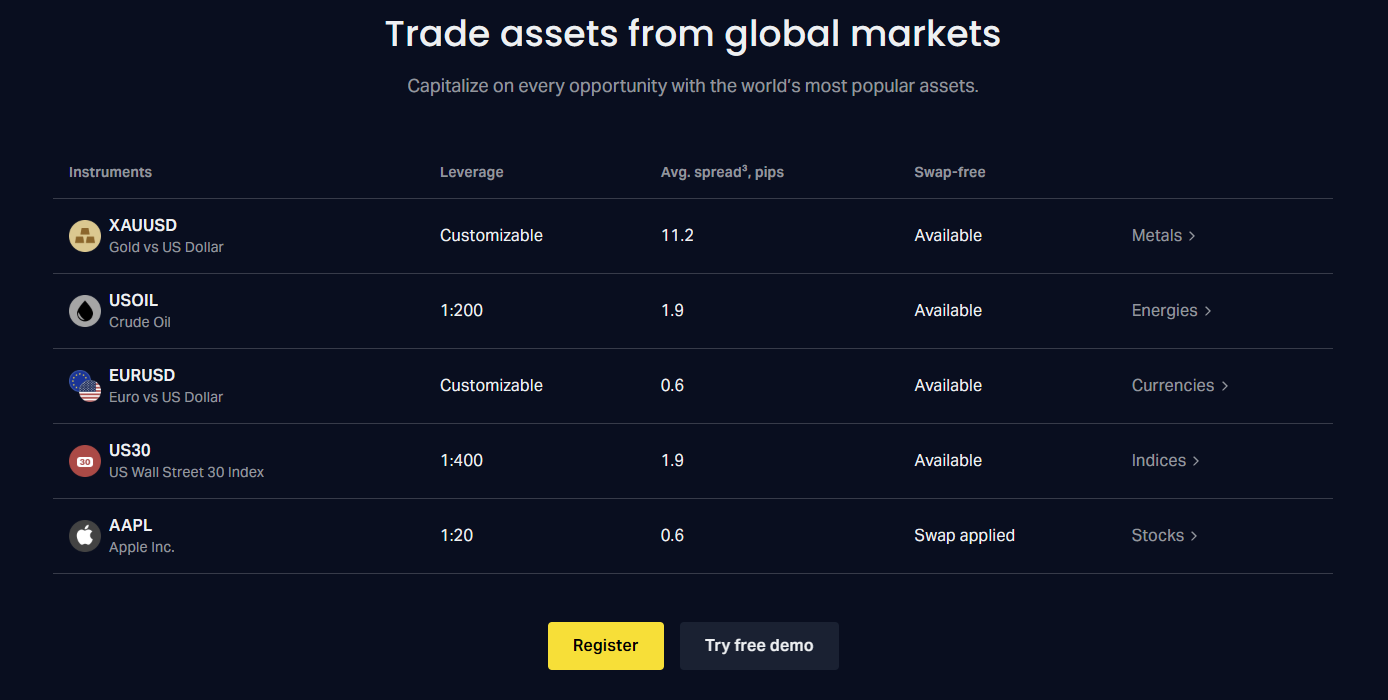

- Tradable Instruments on Exness for Nigerian Clients

- Forex

- Cryptocurrencies

- Metals

- Energies

- Indices

- Stocks

- Understanding Spreads, Commissions, and Swaps on Exness Nigeria

- What is a Spread?

- Unpacking Commissions

- Decoding Swaps (Overnight Fees)

- Why These Costs Matter to Nigerian Traders

- Leverage and Margin Requirements for Nigerian Traders

- Understanding Margin in Forex Trading

- Pros and Cons of High Leverage for Nigerian Traders

- Advantages:

- Disadvantages:

- Managing Leverage and Margin Effectively

- Exness Customer Support: Getting Help in Nigeria

- How Exness Supports Nigerian Traders:

- Exness Promotions and Bonuses for Nigerian Users

- What Kinds of Exness Promotions Can You Expect?

- Why Exness Promotions Matter for Nigerian Traders

- Exness Partnership Programs in Nigeria

- Unlock New Opportunities with Exness

- Why Partner with Exness in Nigeria?

- Risk Management and Responsible Trading with Exness

- Essential Risk Management Tools at Your Fingertips

- Exness vs. Other Forex Brokers in Nigeria: A Comparison

- Key Comparison Points for Nigerian Traders

- Final Thoughts: Is Exness Nigeria Right for You?

- Advantages for Nigerian Traders

- Considerations for Your Decision

- Frequently Asked Questions

Why Exness is a Top Choice for Nigerian Traders

For many Nigerian traders navigating the exciting world of forex, finding a reliable and efficient broker is paramount. The market offers numerous options, but Exness consistently stands out as a preferred partner. Its strong commitment to providing an optimal trading environment, coupled with features tailored for the local market, makes it a compelling choice for both beginners and seasoned professionals across Nigeria.

What Makes Exness Shine for Nigerians?

Exness understands the unique needs of traders in Nigeria, offering a blend of world-class services and local accessibility. Here’s a closer look at the key advantages:

- Competitive Trading Conditions: Traders seek the best possible environment to execute their strategies. Exness delivers with ultra-low spreads, often starting from 0.0 pips on major currency pairs, and lightning-fast order execution. This ensures that your trades go through precisely when you want them to, minimizing slippage and maximizing potential.

- Flexible Leverage Options: The flexibility to choose high leverage can significantly amplify trading potential. Exness provides this option, allowing Nigerian traders to control larger positions with smaller capital, while also emphasizing responsible trading practices.

- Local Deposit and Withdrawal Methods: One of the biggest conveniences for Nigerian traders is the ease of funding and withdrawing. Exness offers a variety of popular local payment methods, including bank transfers and e-wallets, making transactions swift and hassle-free. This eliminates the complexities often associated with international transfers.

- Robust Regulatory Framework: Trust and security are non-negotiable in financial trading. Exness operates under strict regulatory oversight from multiple reputable global authorities. This commitment to transparency and compliance provides peace of mind for Nigerian traders, knowing their funds are handled with the utmost integrity.

- Diverse Range of Trading Instruments: Beyond popular currency pairs, Exness offers access to a wide array of financial instruments, including cryptocurrencies, stocks, indices, and commodities. This allows Nigerian traders to diversify their portfolios and explore various market opportunities.

- 24/7 Multilingual Customer Support: Whenever you encounter a question or need assistance, Exness’s dedicated customer support team is available around the clock. They offer support in multiple languages, ensuring you can communicate effectively and get prompt, helpful responses.

- User-Friendly Trading Platforms: Whether you prefer MetaTrader 4 (MT4) or MetaTrader 5 (MT5), Exness provides access to these industry-standard platforms. They are renowned for their powerful charting tools, technical indicators, and automated trading capabilities, catering to different trading styles and preferences.

Seamless Experience for Every Trader

Exness is not just about features; it’s about providing a seamless and empowering trading experience. From the moment you open an account to executing your first trade and making withdrawals, the process is designed for clarity and efficiency. The commitment to providing educational resources also helps new Nigerian traders gain confidence and develop their skills.

A trader once noted, “In the fast-paced world of forex, having a broker that understands your local context and offers competitive advantages is invaluable.” This sentiment perfectly captures why Exness resonates so strongly with the Nigerian trading community. It’s more than just a platform; it’s a comprehensive trading partner dedicated to your success.

Is Exness Regulated and Safe for Nigerians?

As a Nigerian trader, you’re right to ask about the safety and regulatory standing of any broker before you commit your capital. When it comes to Exness, the short answer is yes, it is a highly regulated and generally safe option for traders in Nigeria and worldwide. Exness holds licenses from various reputable financial services commissions globally, demonstrating a strong commitment to regulatory compliance.

Exness operates under the oversight of several top-tier licensing authorities, which is crucial for establishing it as a trusted broker. These include:

- CySEC (Cyprus Securities and Exchange Commission): A primary European regulator, providing strict oversight for investor protection.

- FCA (Financial Conduct Authority) in the UK: Though not directly serving Nigerian clients for this entity, the FCA license indicates a high standard of operation and financial stability.

- FSC (Financial Services Commission) in the British Virgin Islands and Mauritius: These licenses allow Exness to offer its services internationally, including to clients in Nigeria, while still adhering to established financial conduct rules.

- FSCA (Financial Sector Conduct Authority) in South Africa: This local African regulation adds another layer of credibility and oversight for traders on the continent.

This multi-jurisdictional Exness regulation provides a robust framework that safeguards client interests and ensures fair trading practices. For Nigerian traders, this means you can expect a transparent and secure trading environment.

What Makes Exness a Safe Choice for Nigerians?

Beyond its regulatory licenses, Exness implements several key measures to ensure the safety of your funds and data, making it a reliable option for safe trading in Nigeria:

- Segregated Client Funds: Exness keeps client funds in separate bank accounts from the company’s operational funds. This critical practice ensures that your money remains protected, even if the company faces financial difficulties.

- Negative Balance Protection: This feature is a massive relief for traders. It guarantees you cannot lose more money than you have deposited in your account. Your account balance will never go below zero.

- Advanced Security Protocols: Exness employs strong encryption and other cybersecurity measures to protect your personal information and trading data. This commitment to security helps prevent unauthorized access and keeps your account safe.

- Transparent Trading Conditions: The broker prides itself on clear pricing, fast execution, and no hidden fees. This transparency builds trust and allows you to trade with confidence.

- Audited Financials: Exness undergoes regular audits by independent firms, further verifying its financial stability and operational integrity. This ongoing scrutiny reinforces its status as a trusted broker.

For traders in Nigeria, Exness offers a familiar and accessible platform, supporting local payment methods and providing dedicated customer support. The combination of strong global Exness regulation and client-focused safety measures makes Exness Nigeria a highly viable and secure choice for your forex and CFD trading journey.

How to Open an Exness Account in Nigeria

Are you ready to dive into the exciting world of forex trading? Exness offers a fantastic, user-friendly platform, and getting started in Nigeria is simpler than you might think. Whether you are an experienced trader or just beginning your journey in the financial markets, Exness provides robust tools and a secure environment. Let’s walk through the steps to set up your Exness account and begin trading with confidence.

Opening an Exness account is a straightforward process designed for efficiency. Here’s a clear, step-by-step guide:

- Visit the Exness Website: Navigate to the official Exness website. Be sure to use the correct domain to ensure your security.

- Register Your Account: Look for the \”Open Account\” or \”Register\” button, usually prominently displayed. You will need to provide your country of residence (Nigeria), a valid email address, and create a strong password.

- Choose Your Account Type: Exness offers various account types tailored to different trading styles and experience levels, including Standard, Pro, Zero, and Raw Spread accounts. Consider what suits your trading strategy best. You can also open a demo account to practice without risking real money.

- Verify Your Email and Phone: Exness will send a verification code to your registered email and potentially your phone number. Enter these codes to confirm your contact details.

- Complete Your Personal Profile: Provide your personal information, including your full name, date of birth, and physical address. Make sure this information matches your official identification documents.

- Undergo Account Verification: This is a crucial step for the security of your funds and compliance with financial regulations. You will need to upload documents to verify your identity and proof of residency.

What Documents Do You Need for Verification?

The verification process ensures a secure trading environment for everyone. Prepare these documents to make the process smooth and quick:

- Proof of Identity (POI):

- International Passport (data page)

- National ID Card (both front and back)

- Driver’s License (both front and back)

Ensure the document is clear, valid, and shows your full name, date of birth, and a recognizable photo.

- Proof of Residence (POR):

- Utility Bill (electricity, water, gas – not older than six months)

- Bank Statement (not older than six months)

- Tax Statement (not older than six months)

This document must display your full name and residential address matching the details you provided during registration.

Once you submit your documents, the Exness team typically reviews them within a few hours. You will receive an email notification once your account verification is complete. After successful verification, you are ready to fund your trading account and start trading on the powerful Exness platform!

Exness makes trading accessible and secure for Nigerians, offering competitive conditions and a range of popular trading instruments. Don’t miss out on the opportunities in the global markets!

Step-by-Step Registration Process

Ready to jump into the action and start your trading journey? Joining our community is straightforward, designed to get you trading quickly and securely. We value your time, and our registration process reflects that, ensuring a smooth transition from visitor to active trader.

Here’s a simple guide to help you set up your account:

- Visit Our Platform: Start by navigating to our official website. Look for the prominent “Sign Up” or “Register” button, usually located in the top right corner of the homepage.

- Provide Basic Details: A short form will appear. You’ll need to enter your email address and create a secure password. Make sure your password is strong – a mix of letters, numbers, and symbols works best!

- Complete Your Profile: Next, we’ll ask for some personal information like your full name, date of birth, and country of residence. This is a standard requirement for financial institutions, ensuring a safe and regulated trading environment for everyone.

- Verify Your Identity: This crucial step helps us comply with regulatory standards and protects your account. You’ll typically upload a copy of your government-issued ID (like a passport or driver’s license) and a proof of address (such as a utility bill). Our team reviews these documents quickly.

- Fund Your Account: Once your profile is verified, you’re ready to deposit funds. We offer various secure funding methods to suit your preference. Choose the one that works best for you and deposit your initial capital.

- Start Trading: Congratulations! With funds in your account, you now have full access to our powerful trading platform. Explore the markets, analyze charts, and place your first trade. Welcome to the world of forex trading!

Our dedicated support team is always on standby if you encounter any questions during your registration. We believe in providing a seamless experience, allowing you to focus on what you do best: trading.

Account Verification Requirements

Embarking on your forex trading journey is exciting, but before you dive in, a crucial step awaits: account verification. This process, often seen as a minor hurdle, is actually a cornerstone of a secure and compliant trading environment. Every reputable forex broker requires it, not just to protect themselves, but to safeguard your funds and the integrity of the entire financial system. It’s a standard procedure designed to combat fraud and adhere to international \”Know Your Customer\” (KYC) and Anti-Money Laundering (AML) regulations.

Think of it as setting up a solid foundation for your trading house. You wouldn’t build a mansion on sand, right? Similarly, verifying your account builds trust and ensures that you, and only you, have access to your trading capital. It’s a one-time process that pays dividends in peace of mind.

Common Documentation Needed

Brokers typically ask for two main types of documents:

- Proof of Identity (POI): This confirms who you are.

- Proof of Address (POA): This verifies where you live.

Here are examples of what you might need to submit:

- For Proof of Identity:

- Valid passport (recommended due to global recognition)

- National ID card

- Driver’s license

Ensure these documents are clear, current, and show all four corners. Your name, photo, date of birth, and expiry date must be visible.

- For Proof of Address:

- Utility bill (electricity, water, gas, internet – not older than three to six months)

- Bank statement (from a recognized bank, not older than three to six months)

- Tax statement

- Rental agreement (sometimes accepted)

The document must clearly show your name, address, and the issue date. Screenshots are usually not accepted; an original scanned document or high-quality photo is best.

The verification process is usually straightforward. You upload the required documents through the broker’s secure portal. Many brokers offer fast-track verification, sometimes completing it within a few hours or a day. This step is essential before you can deposit funds, open trades, or withdraw any profits. Embrace it as a vital part of becoming a legitimate and secure participant in the exciting world of forex trading.

Exness Deposit Methods for Nigerian Users

Navigating the world of online forex trading requires not just a keen eye for market trends but also seamless access to your funds. For Nigerian traders, choosing a broker with reliable and convenient deposit methods is paramount. Exness stands out in this regard, offering a variety of secure options tailored to ensure you can fund your trading account with ease and get straight to what matters most: trading.

Why Deposit with Exness in Nigeria?

Exness understands the unique financial landscape in Nigeria and has optimized its deposit services to provide efficiency and security. Our goal is to make your trading journey as smooth as possible, right from the moment you decide to fund your account. Here’s what you can expect:

- Local Payment Solutions: Access popular local payment methods that simplify the process for Nigerian users.

- Instant Processing: Many deposit methods offer instant processing, meaning your funds reflect in your trading account almost immediately.

- No Commission Fees: Exness typically charges no commission on deposits, allowing you to maximize your trading capital.

- High Security Standards: We employ robust security protocols to protect your transactions and personal information.

- Multiple Currency Options: While you’ll deposit in Naira, your trading account can be in USD, giving you flexibility.

Popular Deposit Options for Nigerian Traders

Exness provides a range of deposit methods designed to cater to the diverse preferences of Nigerian traders. Whether you prefer traditional banking or modern e-wallets, you’ll find an option that suits your needs. Here are some of the most commonly used methods:

Bank Card Deposits

Using your Visa or MasterCard is one of the most straightforward ways to deposit funds into your Exness account. It’s a familiar process for most online transactions, offering convenience and security. Funds usually reflect instantly, allowing you to quickly capitalize on market opportunities.

E-Wallet Solutions

Electronic wallets have gained significant popularity due to their speed and ease of use. Exness supports a variety of global e-wallets that are accessible to Nigerian traders, providing a swift and efficient way to manage your deposits. These options often boast rapid processing times, making them ideal for traders who need quick access to their capital.

Local Bank Transfers

For those who prefer traditional banking, Exness also facilitates local bank transfers. This method allows you to deposit directly from your Nigerian bank account. While it might take slightly longer for funds to reflect compared to instant methods, it offers a reliable and secure way to fund your trading activities, especially for larger amounts.

Other Convenient Methods

Beyond the core options, Exness continuously explores and integrates other convenient deposit methods to enhance your experience. These might include various online payment systems tailored to the African market, ensuring you always have a viable option to fund your trading account effortlessly.

Important Considerations for Deposits

While depositing with Exness is designed to be user-friendly, a few points are always good to keep in mind:

- Verification: Ensure your Exness account is fully verified to avoid any delays in deposits or withdrawals. This is a standard security measure.

- Limits: Be aware of the minimum and maximum deposit limits for each method. These are clearly displayed in your Personal Area.

- Processing Times: Although many methods are instant, some might have slight delays due to bank processing or network issues. Always check the estimated processing time for your chosen method.

- Currency Conversion: If your bank account is in Naira and your trading account is in USD, an automatic currency conversion will occur at the prevailing market rate.

We are committed to providing Nigerian traders with a superior trading experience, and that starts with effortless funding. Exness strives to ensure your deposits are safe, fast, and convenient, so you can focus entirely on your trading strategies and market analysis.

Popular Local Payment Options

Navigating the global forex market is thrilling, but how you fund your account and withdraw your profits should never be a headache. While international payment methods like credit cards and wire transfers are common, smart traders know the value of popular local payment options. These methods often provide faster transactions, lower fees, and a more seamless experience, especially when dealing with your local currency.

Think about it: bypassing multiple currency conversions and high international bank charges can save you a significant amount over time. Brokers who understand their clientele offer a diverse range of local solutions, making it easier for you to manage your trading capital efficiently. Let’s explore some of the most frequently used local payment options that are making waves in the trading community:

- Local Bank Transfers: This is a cornerstone for many traders. Instead of relying on slow international wires, local bank transfers allow you to move funds directly from your domestic bank account to your broker’s local bank account. It’s secure, often faster than international options, and usually comes with lower fees. Many traders appreciate the familiarity and trust associated with their own banking system.

- Regional E-Wallets: Beyond global giants like Skrill or Neteller, many regions have their own highly popular e-wallets. These can include services like M-Pesa in Africa, GCash in the Philippines, PayTM in India, or Pix in Brazil. These platforms are designed for convenience, offering instant deposits and withdrawals directly from your mobile device. They often integrate seamlessly with everyday financial activities, making them incredibly user-friendly.

- Online Payment Processors: While similar to e-wallets, some countries have specific online payment gateways that are dominant. Examples might include Boleto Bancário in Brazil, Przelewy24 in Poland, or iDEAL in the Netherlands. These are often direct bank transfer systems or voucher-based methods that cater specifically to the local banking infrastructure and consumer preferences. They offer a secure bridge between your bank and your trading account without sharing sensitive card details.

- Cash Vouchers & Prepaid Cards: For those who prefer not to link their bank accounts directly, cash vouchers or prepaid cards purchased at local outlets offer a fantastic alternative. Paysafecard is a well-known example used globally, but many regions have their own versions. You simply load funds onto the card or voucher with cash, then use the unique code to deposit into your trading account. It’s a great way to manage your spending and maintain privacy.

Choosing the right local payment option can significantly enhance your trading journey. Always check your broker’s available methods and consider factors like transaction speed, fees, and convenience before making your choice. A smooth financial process lets you focus on what truly matters: making informed trading decisions and growing your portfolio.

Other Convenient Deposit Channels

While bank transfers and credit/debit cards are common, the modern forex trader needs more flexibility. We understand that convenience is key when you want to fund your trading account quickly and efficiently. That’s why we offer a wide array of alternative deposit methods designed to make your experience seamless and hassle-free. Your time is valuable, and we make sure your deposits are as swift as your trading decisions.

Popular Alternative Deposit Methods

Explore these diverse options that cater to different preferences and regional availabilities:

- E-wallets: Solutions like Neteller, Skrill, and Fasapay provide instant transfers and are highly popular among global traders due to their speed and security. You can manage your funds digitally with ease.

- Cryptocurrencies: For those who embrace digital assets, depositing with Bitcoin, Ethereum, or other major cryptocurrencies offers a decentralized and often rapid way to fund your account. This method ensures privacy and efficiency.

- Local Bank Transfers: In some regions, we support direct local bank transfers, allowing you to deposit in your local currency without international wire complications. This can often reduce fees and processing times.

- Prepaid Cards: Certain prepaid card services offer a secure and anonymous way to deposit funds, giving you control over your spending and a quick way to top up your account.

- Online Banking Solutions: Services like Sofort and Giropay allow for direct, secure transfers from your online bank account without the need for card details. They offer instant confirmation and peace of mind.

Choosing Your Ideal Deposit Method: What to Consider

When selecting the best way to fund your trading, think about these crucial factors:

| Factor | Description |

|---|---|

| Speed | How quickly do funds reflect in your trading account? Some methods are instant, others take a few hours or days. |

| Fees | Are there any transaction fees involved, either from our side or from the payment provider? Always check for transparency. |

| Security | Does the method offer robust security features like encryption and two-factor authentication? Your financial safety is paramount. |

| Convenience | How easy is it to use the method? Does it integrate well with your existing financial habits? |

| Availability | Is the method supported in your country or region? We strive to offer a wide global reach. |

We are committed to providing you with flexible and secure options so you can focus on what truly matters: your trading strategy. Select the channel that best fits your needs and start trading with confidence today.

Seamless Exness Withdrawal Process in Nigeria

Navigating the financial markets requires not just a robust trading platform, but also a reliable and efficient way to access your profits. For traders in Nigeria, the Exness withdrawal process stands out as remarkably straightforward and secure. You work hard to achieve your trading goals, and getting your funds should never be a complicated affair. Exness understands this, providing a system designed for your peace of mind, ensuring fast access to your earnings.

Why Exness Withdrawals Are a Game-Changer for Nigerian Traders

When you choose Exness, you opt for a broker that prioritizes your convenience, especially when it comes to withdrawing your funds. Here’s what makes the process so impressive:- Speed and Efficiency: Exness aims for instant processing on most electronic methods. This means you often see your funds reflected in your account within minutes, not days.

- Security First: Your financial security is paramount. Exness employs advanced encryption and stringent verification protocols to protect your transactions, giving you confidence with every Exness withdrawal.

- Diverse Local Options: Recognizing the unique needs of Nigerian traders, Exness offers a variety of withdrawal methods, including popular local options that cater directly to your banking preferences.

- Transparent Fees: You receive clear information about any applicable fees, ensuring there are no hidden surprises when you initiate a withdrawal.

Popular Exness Withdrawal Methods Available in Nigeria

Exness provides a comprehensive suite of withdrawal options, catering to various preferences and ensuring you can always find a method that suits you. Here are some of the most widely used methods for a smooth Exness withdrawal experience in Nigeria:- Local Bank Transfers: This is often the most convenient choice for many Nigerian traders. You can directly transfer funds to your local bank account, bypassing international transaction complexities. It’s a reliable and widely accepted method.

- E-wallets (e.g., Skrill, Neteller): For those who prefer digital wallets, services like Skrill and Neteller offer lightning-fast transfers. These methods are excellent for quick access to funds and further online transactions.

- Cryptocurrencies (e.g., USDT TRC20, BTC): Embrace the future of finance with crypto withdrawals. Tether (USDT) on the TRC20 network is a popular choice for its speed and lower transaction costs, offering an efficient way to move your profits.

- Card Withdrawals (Visa/MasterCard): While less common for initial withdrawals from profits in some regions due to specific bank policies, card withdrawals are available and can be a convenient option for some.

Pro Tip: Always withdraw using the same method you used for deposit, if possible. This simplifies the process and helps maintain account security.

Maximizing Your Withdrawal Speed: Essential Tips

To ensure your Exness withdrawal is as seamless and fast as possible, consider these important points:- Complete Account Verification: Before your first withdrawal, make sure your Exness account is fully verified. This involves submitting identity and address documents. A verified account ensures quicker processing and adherence to regulatory standards.

- Match Deposit and Withdrawal Methods: For security reasons, Exness often requires you to withdraw funds using the same method you used to deposit. Adhering to this rule speeds up approval times significantly.

- Check Operating Hours: While many methods offer instant processing, local bank transfers might be subject to bank operating hours in Nigeria. Plan your withdrawals accordingly if you need funds by a specific time.

- Confirm Withdrawal Limits: Be aware of the minimum and maximum withdrawal limits for your chosen method. This helps you plan your transactions effectively and avoid delays.

- Contact Support if Needed: If you encounter any issues or have questions about your Exness withdrawal, the Exness customer support team is available 24/7. Their professional assistance can quickly resolve any concerns.

“The ease of withdrawing my profits from Exness has been a game-changer for my trading strategy. I never have to worry about getting my money when I need it.” – A Satisfied Nigerian Trader.

Your success as a trader extends beyond just making profitable trades; it also includes the ability to easily access your earnings. Exness delivers on this promise for Nigerian traders, offering a reliable, secure, and incredibly efficient withdrawal process. Experience the difference of a truly seamless financial journey with Exness.

Trading Platforms Available with Exness Nigeria

Choosing the right trading platform is like picking the perfect tool for a skilled artisan – it makes all the difference in your trading journey. Here at Exness Nigeria, we understand that flexibility, reliability, and advanced functionality are key. That’s why we offer a suite of industry-leading platforms designed to empower every trader, from the beginner taking their first steps to the seasoned professional executing complex strategies. Each platform provides a unique set of advantages, ensuring you find the ideal environment to analyze markets, place trades, and manage your portfolio with confidence.

MetaTrader 4 (MT4): The Trader’s Classic Choice

MetaTrader 4 remains the undisputed king for many forex traders worldwide, and it’s a staple for Nigerian traders too. Its robust features and user-friendly interface make it an excellent choice for anyone serious about the financial markets. MT4 offers a powerful charting package, a wide array of technical indicators, and the ability to automate your trading with Expert Advisors (EAs). This platform provides a stable and secure environment for executing trades quickly and efficiently.

- Comprehensive Charting Tools: Visualize market movements with various chart types and timeframes.

- Analytical Objects: Use lines, channels, and Fibonacci levels to enhance your market analysis.

- Automated Trading (EAs): Deploy Expert Advisors to trade on your behalf based on predefined rules.

- Customizable Interface: Arrange your workspace to suit your trading style and preferences.

- Security: Enjoy encrypted data transmission between your terminal and the server.

MetaTrader 5 (MT5): The Next-Generation Platform

For traders seeking more advanced capabilities and access to a broader range of markets, MetaTrader 5 takes everything you love about MT4 and elevates it. MT5 offers additional timeframes, more technical indicators, and an economic calendar built right into the platform. It’s designed to support not only forex trading but also other asset classes like stocks, indices, and commodities, providing a truly multi-asset experience. Many Nigerian traders find its enhanced features beneficial for deeper market insights and diversified strategies.

Here’s a quick comparison:

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Number of Timeframes | 9 | 21 |

| Analytical Objects | 44 | 44 |

| Technical Indicators | 30 | 38 |

| Economic Calendar | External | Built-in |

| Pending Order Types | 4 | 6 |

Exness Terminal: Trade Directly from Your Browser

Sometimes, you just need to jump into the markets without downloading any software. That’s where the Exness Terminal shines. Our proprietary web-based platform offers a seamless trading experience directly from your browser. It’s perfect for those who prioritize convenience and accessibility. The Exness Terminal boasts an intuitive design, essential charting tools, and direct access to your trading account, making it incredibly simple to manage your positions from any device with an internet connection.

As one of our Nigerian traders recently put it, “The Exness Terminal is a game-changer for quick trades. I can open it on any computer and manage my positions instantly. It’s incredibly user-friendly and reliable.”

Whether you prefer the robust features of MetaTrader, the advanced capabilities of MT5, or the sheer convenience of the Exness Terminal, you have powerful options at your fingertips. We are committed to providing the best tools so you can focus on what matters most: successful trading.

MetaTrader 4 (MT4) & MetaTrader 5 (MT5)

In the world of online trading, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) stand out as the most widely recognized and utilized trading platforms. Developed by MetaQuotes Software, these platforms offer traders robust tools for market analysis, trade execution, and automated trading. Both are powerful, yet they cater to slightly different needs and preferences among forex and CFD traders.

Understanding MT4

MT4 has long been the industry standard, cherished by millions for its simplicity, stability, and powerful charting capabilities. It’s primarily designed for forex trading, though many brokers also offer CFDs on indices, commodities, and cryptocurrencies through it. Its enduring popularity stems from its user-friendly interface and the extensive availability of custom indicators and Expert Advisors (EAs).

- Intuitive Interface: Easy to navigate for both beginners and experienced traders.

- Advanced Charting Tools: Offers numerous timeframes and drawing tools for in-depth technical analysis.

- Expert Advisors (EAs): Supports algorithmic trading, allowing for automated strategy execution.

- Large Community: An enormous community of users and developers constantly creating new tools and resources.

Exploring MT5

MT5 represents the next generation, offering enhanced features and expanded market access beyond just forex. While it maintains the familiar look and feel of its predecessor, MT5 provides access to a broader range of financial instruments, including stocks, futures, and options, alongside forex and CFDs. It boasts more analytical tools, additional timeframes, and a multi-threaded strategy tester for EAs, making it a more comprehensive platform for diverse trading needs.

Here’s a quick comparison highlighting key differences:

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Primary Focus | Forex, CFDs | Forex, CFDs, Stocks, Futures, Options |

| Order Types | 4 (Buy Limit, Sell Limit, Buy Stop, Sell Stop) | 6 (including Buy Stop Limit, Sell Stop Limit) |

| Timeframes | 9 | 21 |

| Technical Indicators | 30 | 38+ |

| Economic Calendar | No built-in | Built-in |

| Hedging Policy | Allows hedging (default) | Allows both hedging and netting |

Choosing Your Platform

Many traders often ask which platform is \”better.\” The truth is, the choice between MT4 and MT5 largely depends on your trading style, the markets you wish to trade, and your specific needs. If you primarily trade forex and prefer a vast community of custom tools, MT4 remains an excellent choice. However, if you seek access to a wider range of markets, more analytical tools, and a more modern infrastructure, MT5 could be your ideal fit.

Ultimately, both MetaTrader platforms offer robust solutions for serious traders. They provide essential charting, analysis, and execution capabilities that empower you to navigate the dynamic financial markets with confidence.

Exness Terminal & Mobile App Trading

When you step into the world of forex, having robust and reliable trading tools at your fingertips is crucial. Exness understands this, providing traders with both a powerful web terminal and a highly intuitive Exness mobile app. These platforms ensure you can manage your trades and analyze markets seamlessly, whether you are at your desk or literally trading on the go. We designed them to deliver a top-tier trading experience, prioritizing speed, stability, and ease of use for every trader.

The Exness web terminal is your go-to solution for desktop trading. It is a full-featured Exness trading platform accessible directly through your web browser, meaning no downloads or installations are necessary. You get real-time market data, a user-friendly interface, and access to advanced charts for in-depth technical analysis. It allows for quick order placement and instant execution, giving you the edge you need to react to market movements without delay. All your essential tools for market analysis and comprehensive trade management are right there.

For those who prefer flexibility, the Exness mobile app transforms your smartphone or tablet into a portable trading station. It brings the full power of the Exness platform directly to your pocket. This award-winning app offers:

- Full Account Access: Monitor your balance, equity, and margin levels from anywhere.

- Real-time Quotes: Stay updated with live prices for all available instruments.

- One-Click Trading: Execute trades quickly and efficiently with minimal fuss.

- Comprehensive Charting Tools: Perform technical analysis on the go with various indicators and drawing tools.

- Deposit & Withdrawal Management: Easily fund your account or withdraw profits directly from the app.

- Notifications: Get instant alerts on price movements, order execution, and important account activities.

Ultimately, both the Exness web terminal and the Exness mobile app empower you to trade with confidence and control. They combine sophisticated functionalities with exceptional ease of use, making them ideal for both new and experienced traders. Experience the freedom of trading on a platform that truly moves with you.

Tradable Instruments on Exness for Nigerian Clients

As a Nigerian trader, you want access to a wide array of financial instruments to diversify your portfolio and explore various market opportunities. Exness understands this need and offers an impressive selection of assets designed to cater to different trading strategies and risk appetites. Whether you are a beginner or an experienced professional, you will find something that fits your trading goals on this platform.

Exness provides a comprehensive suite of instruments, allowing you to venture into the world’s most dynamic markets. This variety empowers you to react to global economic events and capitalize on price movements across different asset classes. Let’s explore the key categories of instruments available for Nigerian clients:

Forex

The foreign exchange market is the largest and most liquid financial market globally. On Exness, you can trade major, minor, and exotic currency pairs. This means you can participate in the daily fluctuations of currencies like EUR/USD, GBP/JPY, and USD/NGN, among many others. The deep liquidity ensures smooth execution, even during volatile periods.

Cryptocurrencies

Dive into the exciting world of digital assets! Exness offers popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) against major fiat currencies or other cryptocurrencies. Trading crypto CFDs allows you to speculate on price movements without actually owning the underlying asset, making it accessible and flexible.

Metals

Gold and silver have long been considered safe-haven assets and popular choices for traders looking to hedge against inflation or market uncertainty. Exness provides opportunities to trade gold (XAU/USD) and silver (XAG/USD) against the US Dollar. These precious metals can add a unique dimension to your trading strategy.

Energies

The energy market offers significant trading opportunities, driven by global supply and demand dynamics, as well as geopolitical events. On Exness, you can trade popular energy commodities such as Brent Crude Oil (UKOIL) and West Texas Intermediate (USOIL). These instruments allow you to participate in one of the world’s most influential sectors.

Indices

Gain exposure to entire economies or specific sectors through major stock market indices. Exness provides access to popular indices like the S&P 500 (US500), Nasdaq (US100), Dow Jones (US30), FTSE 100 (UK100), and DAX (DE30). Trading indices lets you speculate on the overall performance of a group of companies, offering diversification beyond individual stocks.

Stocks

If you prefer to focus on individual company performance, Exness also offers a selection of CFDs on stocks from leading global companies. While the direct stock offerings might be more limited compared to other brokers, the available options often include high-demand stocks from various sectors, giving you direct exposure to corporate success stories.

Here’s a quick overview of the instrument types you can expect:

| Instrument Type | Examples | Market Characteristic |

|---|---|---|

| Forex (Currencies) | EUR/USD, GBP/JPY, USD/NGN | Highly liquid, 24/5 market |

| Cryptocurrencies | BTC/USD, ETH/USD, LTC/USD | Volatile, 24/7 market |

| Metals | XAU/USD (Gold), XAG/USD (Silver) | Safe-haven, inflation hedge |

| Energies | UKOIL (Brent), USOIL (WTI) | Influenced by geopolitics, supply/demand |

| Indices | US500 (S&P 500), DE30 (DAX) | Reflects overall market performance |

| Stocks | Apple, Google, Microsoft (CFDs) | Company-specific performance |

“Diversification is the cornerstone of a resilient trading portfolio. Exness provides the tools to build it,” notes one experienced trader. By offering such a broad spectrum of tradable instruments, Exness empowers Nigerian traders to explore, adapt, and build strategies that truly align with their individual market views. This extensive selection is a major advantage for anyone looking to make informed decisions in the financial markets.

Understanding Spreads, Commissions, and Swaps on Exness Nigeria

Navigating the vibrant forex market in Nigeria requires a keen understanding of the costs involved. For traders on Exness Nigeria, three primary elements significantly impact your overall profitability: spreads, commissions, and swaps. Grasping these concepts is not just about avoiding surprises; it’s about making informed decisions that align with your trading strategy and maximizing your returns.

What is a Spread?

The spread is the most fundamental cost in forex trading. Simply put, it’s the difference between the bid price (the price at which you can sell a currency pair) and the ask price (the price at which you can buy it). Think of it as the broker’s margin for facilitating your trade. When you open a position, you immediately start at a slight loss equal to the spread. This means your trade needs to move in your favor by at least the size of the spread before it can become profitable.

- Variable Spreads: On Exness, many accounts feature variable spreads, which fluctuate based on market volatility, liquidity, and economic news. During quiet periods, spreads might be tighter, but they can widen significantly during major news releases or at market open/close.

- Tight Spreads: Exness is known for offering competitive, tight spreads, especially on popular currency pairs like EUR/USD, GBP/USD, and USD/JPY, which is a significant advantage for Nigerian traders looking to minimize transaction costs.

Unpacking Commissions

While spreads are a universal cost, commissions are an additional fee charged by some brokers, or on specific account types, for executing a trade. Unlike spreads, which are embedded in the price, commissions are usually a fixed amount per lot traded (or per million USD traded) and are debited separately from your trading account.

On Exness, commissions typically apply to accounts designed for professional traders or those seeking the tightest possible spreads. For instance, Raw Spread and Zero accounts often feature commissions. This structure allows traders to access incredibly narrow spreads, compensating the broker through a transparent commission charge instead. For active traders, this can sometimes lead to lower overall trading costs compared to wide-spread, commission-free accounts, making it a critical factor for your trading strategy.

Decoding Swaps (Overnight Fees)

Swaps, also known as overnight fees or rollover fees, are interest charges or credits applied to positions held open past the market’s daily closing time (typically 5 PM New York time). When you hold a position overnight, you are essentially borrowing one currency to buy another. The swap rate reflects the interest rate differential between the two currencies in the pair, plus or minus a broker’s small markup.

Here’s how swaps can affect your trades:

- Positive Swaps: You receive a credit when the interest rate of the currency you bought is higher than the interest rate of the currency you sold.

- Negative Swaps: You incur a charge when the interest rate of the currency you bought is lower than the interest rate of the currency you sold.

- Triple Swaps: On Wednesdays, a triple swap charge or credit is applied to account for the weekend, as banks don’t settle trades on Saturdays and Sundays.

For Nigerian traders who engage in long-term position trading, understanding swap rates is paramount. Exness also offers swap-free accounts for certain religious beliefs, or swap-free instruments, which can be beneficial for those who hold trades for extended periods and wish to avoid overnight charges.

Why These Costs Matter to Nigerian Traders

Understanding spreads, commissions, and swaps is not merely academic; it directly impacts your trading profitability on Exness. Each of these costs eats into your potential gains, and if not managed, can quickly erode your capital. By carefully considering your trading style—whether you’re a scalper, day trader, or long-term position holder—you can choose the Exness account type that offers the most favorable cost structure for you. Always review the specific terms for the currency pairs you trade, as these costs can vary significantly.

Leverage and Margin Requirements for Nigerian Traders

Leverage is a powerful tool in forex trading, and for Nigerian traders, it offers an exciting opportunity to control larger positions with a relatively small amount of capital. Imagine being able to trade $100,000 in the forex market with just $1,000 of your own money. That’s the magic of leverage! It amplifies your buying power, allowing you to potentially increase your profits significantly. However, with great power comes great responsibility. While leverage can boost gains, it can also magnify losses, making it crucial for Nigerian traders to understand its implications fully.

Understanding Margin in Forex Trading

When you use leverage, you’re essentially borrowing funds from your broker to open a larger trade. The \”collateral\” you put up for this borrowed capital is known as margin. Margin is not a fee or a transaction cost; it’s simply a portion of your account equity held aside by your broker to cover potential losses on your open positions.

Think of it this way:

- Leverage: The ratio of the total value of your trade to the actual capital you put in (e.g., 1:500 means for every NGN 1, you can control NGN 500).

- Margin: The actual amount of your own money required to open and maintain a leveraged position. It’s often expressed as a percentage of the total trade value (e.g., a 0.2% margin requirement for 1:500 leverage).

For example, if you want to open a standard lot (100,000 units) of EUR/USD at a price of 1.1000, the total trade value is $110,000.

- With 1:100 leverage, your margin requirement would be $1,100 ($110,000 / 100).

- With 1:500 leverage, your margin requirement drops to $220 ($110,000 / 500).

Nigerian traders need to be especially mindful of their margin levels, as insufficient margin can lead to a margin call, where your broker asks you to deposit more funds or automatically closes your positions to prevent further losses.

Pros and Cons of High Leverage for Nigerian Traders

While appealing, high leverage comes with a dual nature. Understanding both its advantages and disadvantages is key to successful trading in Nigeria.

Advantages:

- **Increased Profit Potential:** Even small price movements can translate into substantial profits due to the large position size. This is particularly attractive for those looking to grow their capital faster.

- **Capital Efficiency:** You don’t need a massive trading account to participate in the forex market. Leverage allows you to control significant trade volumes with a modest initial deposit, making forex accessible to more Nigerian traders.

- **Greater Market Access:** Higher leverage can enable participation in trades that would otherwise be out of reach given a limited trading account size, opening up more opportunities in the diverse forex market.

Disadvantages:

- **Amplified Losses:** Just as profits are magnified, so are losses. A small adverse price movement can wipe out a significant portion of your trading capital very quickly.

- **Increased Risk of Margin Call:** High leverage means smaller available margin. If your trades go against you, you hit your margin call level much faster, risking forced liquidation of your positions.

- **Emotional Stress:** The potential for rapid gains or losses can lead to intense emotional pressure, sometimes resulting in irrational trading decisions like over-trading or revenge trading.

Managing Leverage and Margin Effectively

Effective risk management is paramount when dealing with leverage. Nigerian traders must not solely focus on the highest available leverage but rather on what is appropriate for their risk tolerance and trading strategy. Here are some critical considerations:

- Choose a Reputable Broker: Select a forex broker that offers flexible leverage options and transparent margin policies. Ensure they are regulated and have a good track record.

- Start Small: Beginners should consider starting with lower leverage ratios until they gain more experience and confidence in their trading abilities.

- Implement Stop-Loss Orders: Always use stop-loss orders to limit potential losses on your positions. This is a crucial risk management tool that automatically closes a trade when it reaches a predetermined price, safeguarding your capital.

- Monitor Margin Levels: Keep a close eye on your account’s margin level. Many trading platforms provide real-time updates on your used margin and free margin. Understand what a margin call means for your account.

- Understand Your Risk Appetite: Don’t trade with money you cannot afford to lose. Align your leverage usage with your personal risk tolerance and financial goals.

By thoroughly understanding leverage and meticulously managing margin requirements, Nigerian traders can navigate the forex market more confidently and work towards achieving their trading objectives while minimizing undue risks.

Exness Customer Support: Getting Help in Nigeria

Navigating the dynamic world of forex trading requires not just skill and strategy, but also reliable support when you need it most. For traders in Nigeria, having access to prompt and effective customer service can make all the difference, transforming potential frustrations into smooth resolutions. Exness understands this critical need, offering a robust support system designed to assist its Nigerian client base with any queries or challenges they might encounter.

When you’re trading forex, questions can arise at any time – whether it’s about account verification, deposit and withdrawal procedures, technical glitches with the trading platform, or understanding specific trading conditions. Exness prioritizes providing accessible and comprehensive assistance to ensure a seamless trading experience for its Nigerian users.

How Exness Supports Nigerian Traders:

- Multiple Communication Channels: Exness offers various ways to get in touch, ensuring you can choose the method that suits you best. This includes live chat, email support, and phone lines. Live chat is often the quickest way to get immediate answers to pressing questions.

- Multilingual Assistance: While English is widely spoken in Nigeria, having support available in other common languages can be a huge plus, ensuring clear communication regardless of the complexity of the issue.

- 24/7 Availability: Forex markets operate around the clock, and so does Exness customer support. This round-the-clock availability means you can seek help no matter when you are trading, be it early morning or late at night.

- Dedicated Local Focus: Exness recognizes the unique needs of its Nigerian traders, offering support tailored to local regulations and common issues faced in the region. This localized approach helps address specific concerns related to payment methods or documentation more efficiently.

Whether you are a seasoned professional or just starting your forex journey, knowing that reliable help is just a click or call away provides significant peace of mind. Exness’s commitment to strong customer service aims to enhance your trading journey, helping you resolve issues swiftly so you can focus on what matters most: your trades.

Exness Promotions and Bonuses for Nigerian Users

For every ambitious trader in Nigeria, leveraging the right tools and opportunities is key to navigating the dynamic forex market. Exness, a renowned brokerage, understands this perfectly. They often roll out a variety of engaging promotions and attractive bonuses designed to enhance your trading experience and provide a significant boost to your trading capital. These promotional offers are more than just incentives; they are a gateway to exploring new strategies, managing risk more effectively, and potentially increasing your profit potential from the very start of your trading journey.

Exness actively tailors its promotions to cater to a diverse range of traders, from newcomers taking their first steps to seasoned professionals seeking an edge. Always remember to review the specific terms and conditions for each offer, as these details help you understand how to fully utilize the benefits. Let’s explore some of the common types of promotional opportunities you might find available for Nigerian traders.

What Kinds of Exness Promotions Can You Expect?

Exness frequently introduces various types of trading bonuses and incentives. While specific offers change, here are some common categories of promotions they typically provide:

- Welcome Bonuses: New Nigerian traders often find attractive welcome bonus offers upon signing up and making their initial deposit. These are a fantastic way to boost your initial trading capital and give you more room to maneuver in the market right away.

- Deposit Bonuses: Existing clients can also benefit from deposit matching bonuses, where Exness adds a percentage of your deposit to your account as bonus funds. This directly increases your trading power, allowing you to open larger positions or diversify your trading strategies.

- Loyalty Programs and Cashback Rewards: Active traders sometimes qualify for loyalty programs that reward consistent trading volume. These can include cashback incentives on your trades, reducing your overall trading costs and putting more money back into your pocket.

- Trading Contests and Competitions: Exness frequently hosts exciting trading contests where traders compete against each other for substantial prize pools. These competitions are not only thrilling but also provide an excellent opportunity to test your trading skills and win significant rewards based on your performance.

- Special Account Conditions: While not a traditional \”bonus,\” Exness often provides highly competitive trading conditions, such as tight spreads on popular currency pairs or commission-free trading on certain account types. These advantageous conditions effectively reduce your trading costs, acting as a continuous benefit similar to a promotion.

Why Exness Promotions Matter for Nigerian Traders

These promotional offers provide distinct advantages that can significantly impact your trading success. Consider these benefits:

| Advantage Category | Benefit to Nigerian Traders |

|---|---|

| Increased Capital | Bonuses provide extra funds, allowing larger positions or more diverse trades without committing additional personal capital. |

| Reduced Initial Risk | With bonus funds, you can experiment with new strategies or assets using less of your own money, thus lowering initial risk. |

| Enhanced Learning Opportunity | More capital gives you the freedom to practice and refine trading strategies on a real money account without fear of quickly depleting your funds. |

| Motivation and Engagement | Promotions like trading contests inject an element of competition and excitement, keeping traders engaged and motivated to improve. |

Claiming Exness promotions is generally straightforward. Typically, you need to meet specific deposit requirements or achieve a certain trading volume. Always ensure you understand the withdrawal conditions associated with any bonus. These conditions specify the volume of trades you need to execute before you can withdraw the bonus funds or profits derived from them.

Exness consistently works to provide valuable resources and opportunities for its trading community. Keep an eye on their official announcements and your client portal for the latest promotional offers designed to give your forex trading a real boost. Take advantage of these opportunities to maximize your potential in the forex market!

Exness Partnership Programs in Nigeria

Are you a forex enthusiast, a financial blogger, or perhaps a seasoned trader with a strong network in Nigeria? Have you ever thought about leveraging your influence or knowledge to earn more than just trading profits? Exness offers a robust suite of partnership programs designed specifically for individuals and businesses looking to expand their income streams within the dynamic Nigerian forex market. These programs allow you to team up with one of the world’s leading brokers, turning your passion for trading into a lucrative venture.

Unlock New Opportunities with Exness

Exness understands the vibrant and growing forex community in Nigeria. Their partnership initiatives are more than just affiliate links; they are comprehensive frameworks built for mutual growth. Whether you are an educator, a community leader, or simply someone who believes in the power of forex trading, there is a program tailored for your ambitions. This is a chance to collaborate with a globally recognized broker, benefiting from their cutting-edge technology, competitive trading conditions, and excellent client support.

Here are the primary types of partnership programs available through Exness:

- Introducing Broker (IB) Program: This program is ideal if you have a network of active traders. As an IB, you refer clients to Exness, and in return, you earn a commission based on their trading activity. It’s a straightforward way to generate a steady income by connecting traders with a reliable broker. You act as a local point of contact and support for your referrals, building a strong relationship with both Exness and your clients.

- Affiliate Program: Perfect for online marketers, content creators, and website owners, the Affiliate Program allows you to promote Exness through various digital channels. You earn commissions for every client who registers and starts trading through your unique referral link. This program often offers various promotional materials and advanced tracking tools to help you optimize your campaigns.

Why Partner with Exness in Nigeria?

Choosing the right partner is crucial, and Exness stands out for several reasons, particularly for the Nigerian market. They offer highly competitive commission structures, ensuring you are well-rewarded for your efforts. Beyond the financial incentives, you gain access to a wealth of resources, including marketing materials, analytical tools, and dedicated partner support. This support helps you navigate the market and grow your client base effectively.

Consider these advantages of joining an Exness partnership program:

- Generous Commissions: Exness provides attractive compensation models, ensuring your hard work translates into significant earnings.

- Reliable Payouts: Enjoy transparent and timely commission payments, giving you peace of mind.

- Comprehensive Support: Benefit from a dedicated team ready to assist you with any questions or challenges.

- Advanced Marketing Tools: Access a suite of professional marketing materials, banners, and landing pages to enhance your promotional efforts.

- Real-time Tracking: Monitor your referrals and earnings with detailed reports and analytics dashboards.

- Brand Reputation: Partner with a globally respected and regulated broker, instilling confidence in your referrals.

Joining an Exness partnership program in Nigeria is a strategic move for anyone looking to capitalize on the booming forex industry. It offers a structured and rewarding path to financial independence by aligning yourself with a leader in the global financial markets. Don’t miss this opportunity to turn your network and influence into a powerful income generator.

Risk Management and Responsible Trading with Exness

Navigating the dynamic forex market demands more than just identifying opportunities; it requires a robust approach to risk management and responsible trading. Many traders, especially newcomers, often overlook this critical aspect, leading to significant setbacks. At Exness, we believe that success in trading isn’t just about profits, but also about protecting your capital and ensuring a sustainable trading journey. Effective risk management is your shield against market volatility, helping you to weather storms and stay in the game for the long haul.

Exness provides a comprehensive suite of tools and features designed to empower our traders with superior control over their financial exposure. We understand that every trade carries inherent risk, and our platform is built to help you mitigate that risk proactively. From flexible leverage options to automatic stop-out levels, we equip you with the means to make informed decisions and safeguard your investments.

Essential Risk Management Tools at Your Fingertips

- Stop Loss Orders: These orders are fundamental. They automatically close your trade when the market moves against your position to a predetermined price, limiting potential losses. Setting a stop loss is a non-negotiable step for any disciplined trader.

- Take Profit Orders: Just as important as limiting losses, locking in gains is crucial. A take profit order automatically closes your trade when it reaches a specific profit target, ensuring you capture your desired returns before the market potentially reverses.

- Margin Call and Stop Out Levels: Exness clearly defines margin call levels and stop-out rules. A margin call alerts you when your margin level is low, giving you a chance to deposit more funds or close positions. The stop-out level automatically closes your most unprofitable trades to prevent your account balance from going negative.

- Negative Balance Protection: For retail clients, Exness offers negative balance protection. This feature ensures that your losses will never exceed the funds in your trading account, providing an additional layer of security and peace of mind.

- Leverage Control: While leverage can amplify profits, it also magnifies losses. Exness allows you to adjust your leverage, enabling you to choose a level that aligns with your risk tolerance and trading strategy. Responsible use of leverage is key to managing your exposure.

Responsible trading extends beyond just using the right tools; it encompasses a mindset and a disciplined approach. Develop a comprehensive trading plan that outlines your goals, entry and exit strategies, and your maximum acceptable risk per trade. Avoid emotional trading decisions fueled by fear or greed. Stick to your plan, even when market conditions are challenging. Understanding your personal risk tolerance and never trading with money you cannot afford to lose are cornerstones of sustainable trading.

By diligently applying risk management principles and adopting responsible trading habits, you not only protect your capital but also foster a more consistent and potentially profitable trading experience. Exness is committed to supporting your journey by providing the resources and environment needed to trade confidently and responsibly. Prioritize capital preservation, and long-term success becomes a much more attainable goal.

Exness vs. Other Forex Brokers in Nigeria: A Comparison

Navigating the vibrant Nigerian forex market means making smart choices, especially when it comes to selecting a broker. Many Nigerian traders look for specific qualities: reliability, cost-effectiveness, and support for local payment methods. Exness has carved out a significant presence here, but how does it truly stack up against the array of other forex brokers vying for your attention?

Let’s dive into a comprehensive comparison, examining the key factors that often influence a trader’s decision. We consider everything from trading costs to the convenience of deposits and withdrawals, and the quality of customer service.

Key Comparison Points for Nigerian Traders

- Trading Costs: Spreads and Commissions

Many brokers in Nigeria offer competitive spreads, but Exness often stands out with its consistently low spreads, particularly on major currency pairs, and transparent commission structures. Some other brokers might advertise low spreads but could have higher commissions or hidden fees. For Nigerian traders, minimizing transaction costs directly impacts profitability, making this a crucial factor. - Deposit and Withdrawal Methods

This is a deal-breaker for many. Exness provides a wide range of local payment options tailored for Nigerian traders, including various e-wallets and bank transfers, often with instant processing and zero fees. While other brokers may offer local bank transfers, the speed and breadth of options can vary significantly. Seamless funding and withdrawal processes are paramount for efficient trading. - Regulation and Security

All reputable brokers serving the Nigerian forex market operate under some form of international regulation, ensuring a degree of security for your funds. Exness holds licenses from top-tier global regulatory bodies, offering peace of mind. When evaluating other brokers, always check their regulatory status to ensure your investments are protected by a robust framework. - Trading Platforms and Tools

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the industry standards, offered by virtually all brokers, including Exness. Exness also complements these with its own user-friendly tools and mobile applications, enhancing the trading experience. While other brokers also provide these platforms, the quality of execution, available indicators, and supplementary tools can differ. - Customer Support

Effective customer support, especially in local languages and accessible during local business hours, is vital. Exness offers 24/7 multilingual support, including English, which is beneficial for Nigerian traders. Some other brokers might have limited support hours or less responsive teams, which can be frustrating when you need urgent assistance. - Range of Instruments

Exness offers a diverse portfolio including forex pairs, cryptocurrencies, commodities, and indices. This broad selection allows Nigerian traders to diversify their portfolios and capitalize on various market opportunities. While many brokers offer a similar range, the liquidity and execution quality for less common instruments can vary.

In conclusion, while the Nigerian forex landscape is rich with options, Exness frequently distinguishes itself through competitive trading conditions, an extensive array of local payment methods, and strong customer support. Every trader has unique needs, so conducting your own due diligence is always advisable. However, understanding these comparison points gives you a solid foundation for choosing the broker that best suits your trading journey.

Final Thoughts: Is Exness Nigeria Right for You?

Deciding on the right online broker is a crucial step for anyone venturing into forex trading in Nigeria. It’s a choice that impacts your daily operations, your access to financial markets, and ultimately, your potential for success. Exness has carved out a significant presence in the global trading landscape, and its offerings hold particular appeal for Nigerian traders.

When evaluating if Exness aligns with your trading aspirations, consider their core strengths. Many traders value Exness for its highly competitive spreads and the flexibility of its leverage options, catering to diverse trading strategies. The broker’s reputation for instant deposits and withdrawals is another major draw, ensuring you can manage your funds efficiently without unnecessary delays. This convenience is a key factor for traders operating in the fast-paced forex environment. They provide access to popular trading platforms like MetaTrader 4 and MetaTrader 5, which offer robust tools for market analysis and trade execution.

However, the suitability of Exness also depends on your individual needs and experience level.

Here’s a snapshot to help you weigh the decision:

Advantages for Nigerian Traders

- Flexible Funding: Often provides convenient local deposit and withdrawal options, simplifying transactions for Nigerian traders.

- Competitive Trading Conditions: Benefits from tight spreads and diverse account types, which can reduce trading costs.

- Fast Transactions: Renowned for swift, often instant, withdrawals, giving traders quick access to their profits.

- Diverse Instruments: Offers a wide range of assets, including major and minor currency pairs, commodities, and indices.

- Strong Customer Support: Provides multilingual customer support, which is vital for resolving any issues promptly.

Considerations for Your Decision

- Regulatory Understanding: While Exness holds strong international licenses, verify their specific regulatory standing relevant to your local jurisdiction if hyper-local compliance is your absolute top priority.

- Educational Resources: Assess if their educational materials meet your specific learning needs, especially if you are a beginner trader.

- Trading Style Match: Ensure their execution model and available account features (e.g., raw spreads, commission structures) align perfectly with your unique trading style, whether you’re a scalper or a long-term swing trader.

Ultimately, Exness presents a compelling case for a significant number of Nigerian forex traders. If you prioritize seamless fund management, competitive trading costs, and a wide array of trading instruments coupled with reliable platforms, then Exness is certainly worth your serious consideration. Before making a final commitment, take the time to explore their offerings, perhaps by utilizing a demo account. This hands-on experience allows you to test their trading environment without financial risk, helping you confirm if their services truly meet your specific requirements as a Nigerian trader. Your success in the financial markets begins with the right partnership.

Frequently Asked Questions

Is Exness safe and regulated for Nigerian traders?

Yes, Exness is a highly regulated broker and is considered safe for Nigerian traders. It holds licenses from multiple top-tier financial authorities, including CySEC, FCA, and FSCA (South Africa), ensuring a secure trading environment. Exness also protects clients with measures like segregated funds and negative balance protection.

What are the common deposit and withdrawal methods in Nigeria?

Exness offers several convenient options for Nigerian traders, including local bank transfers, bank cards (Visa/MasterCard), and popular e-wallets like Skrill and Neteller. They also support cryptocurrency transactions. Most methods are designed for fast processing with no commission fees from Exness.

How do I open an Exness account in Nigeria?

Opening an account is straightforward. You need to register on the Exness website, choose an account type, and complete your personal profile. The final step is account verification, where you’ll upload a Proof of Identity (like a National ID or Passport) and a Proof of Residence (like a recent utility bill).

Which trading platforms can I use with Exness?

Exness provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their powerful charting and automated trading features. Additionally, Exness offers its own proprietary Exness Terminal for web-based trading and a user-friendly mobile app for trading on the go.

What are the main trading costs on Exness?

The primary trading costs on Exness are spreads (the difference between buy and sell prices), commissions (on specific accounts like Raw Spread and Zero), and swaps (overnight fees for holding positions open). Exness is known for its competitive tight spreads, and swap-free options are available for certain accounts.