Are you ready to explore the dynamic world of online forex trading right here in Kenya? Exness Kenya offers a robust and user-friendly platform designed to empower both new and experienced traders. We understand the local market needs and provide the tools, resources, and support you need to navigate currency markets with confidence. Forget the guesswork; this guide is your go-to resource for understanding how Exness makes online trading accessible and rewarding for Kenyans.

Trading currencies is a thrilling journey. It requires a blend of knowledge, strategy, and access to a reliable platform. With Exness Kenya, you get just that: a dependable partner committed to transparency and excellent trading conditions. We focus on providing a seamless trading experience, from simple account creation to fast withdrawals and dedicated local support. Let’s dive in and discover how you can unlock your trading potential with us.

- Why Exness is a Top Choice for Kenyan Traders

- Key Advantages for Kenyan Traders

- Getting Started with Exness Kenya: Account Opening Process

- Your Step-by-Step Guide to Opening an Exness Account:

- Exness Account Types: Finding the Right Fit for Kenya

- Standard Accounts: Ideal for Beginners and Experienced Traders Alike

- Professional Accounts: For the Savvy and High-Volume Trader

- Deposits and Withdrawals on Exness Kenya: Local Payment Solutions

- Your Easy Deposit Options:

- Seamless Withdrawals Back to You:

- Trading Platforms Available to Exness Kenya Users

- Understanding Spreads, Commissions, and Trading Costs with Exness

- What are Spreads? Your Core Trading Cost

- Commissions: Another Piece of the Puzzle

- Beyond Spreads and Commissions: Other Trading Costs

- Why Understanding Trading Costs with Exness is Key to Your Success

- Exness Kenya Regulation and Security Measures

- Leverage and Margin Requirements for Forex Trading in Kenya

- Advantages of Using Leverage

- Disadvantages and Risks of Leverage

- Customer Support and Assistance for Exness Kenya Clients

- Connecting with Exness Support

- Quality and Scope of Assistance

- Educational Resources and Trading Tools by Exness

- Empower Your Knowledge with Exness Education

- In-Depth Trading Guides and Articles

- Engaging Video Tutorials

- Live Webinars with Experts

- Comprehensive Glossary

- Unlock Your Potential with Advanced Trading Tools

- Mobile Trading Experience with the Exness App in Kenya

- Why the Exness App Stands Out for Kenyan Traders

- Key Advantages of Trading with the Exness App:

- Promotions and Bonuses for Exness Kenya Traders

- Why Bonuses Matter to Your Trading

- Common Types of Promotions You Might Encounter

- Navigating Promotional Offers: What to Consider

- Comparing Exness with Other Forex Brokers in Kenya

- Regulation and Security

- Trading Conditions: Spreads and Leverage

- Account Types and Accessibility

- Deposit and Withdrawal Options

- Customer Support and Platforms

- Tips for Successful Trading on Exness Kenya

- Master Your Risk Management

- Develop and Adhere to a Trading Plan

- Frequently Asked Questions

Why Exness is a Top Choice for Kenyan Traders

Are you a Kenyan trader looking for a reliable and powerful broker to supercharge your forex journey? Look no further than Exness. This platform has carved out a significant reputation among the trading community in Kenya, offering a blend of features that cater specifically to the needs of both new and experienced market participants. It’s not just about opening an account; it’s about finding a partner that supports your growth and trading success.

Exness understands the local market dynamics and provides tailored solutions that make a real difference. From seamless deposits and withdrawals to responsive customer support, every aspect is designed with the trader in mind. Let’s explore some of the compelling reasons why Exness stands out as a preferred choice for Kenyans navigating the global financial markets.

Key Advantages for Kenyan Traders

- Competitive Trading Conditions: Exness offers incredibly tight spreads and low commission structures, helping you maximize your potential profits. This means more of your money stays in your pocket with every trade you execute.

- Fast and Reliable Execution: In the fast-paced world of forex, every millisecond counts. Exness provides lightning-fast trade execution, ensuring your orders are filled at the prices you expect, reducing slippage and improving your trading efficiency.

- Localized Payment Solutions: Forget the hassle of complex international transfers. Exness supports a variety of convenient local payment methods popular in Kenya, making deposits and withdrawals smooth, quick, and stress-free.

- Robust Regulatory Framework: Trust and security are paramount. Exness operates under strict regulatory oversight, offering peace of mind that your funds are handled with the utmost care and professionalism.

- Excellent Customer Support: Facing an issue or have a question? Their dedicated customer support team is available in multiple languages, ready to assist you promptly and effectively, ensuring you never feel stranded.

- Variety of Account Types: Whether you are just starting with a cent account or you are a seasoned professional needing a raw spread account, Exness offers a diverse range of account types to suit your trading style and capital.

- Advanced Trading Platforms: Gain access to industry-standard platforms like MetaTrader 4 and MetaTrader 5, packed with advanced analytical tools, charting capabilities, and custom indicators to enhance your trading strategy.

Choosing the right broker is a critical decision that directly impacts your trading experience and potential profitability. Exness has consistently demonstrated its commitment to providing a superior trading environment for Kenyan traders, making it an undeniable top choice for anyone serious about excelling in the forex market.

Getting Started with Exness Kenya: Account Opening Process

Welcome to the exciting world of forex trading! If you are based in Kenya and looking for a reliable, user-friendly platform, Exness Kenya is an excellent choice. Many local traders appreciate its robust features, transparent approach, and commitment to client satisfaction. Ready to dive into the markets?

Opening an account with Exness in Kenya is surprisingly straightforward. The process is designed to get you trading quickly and efficiently, without unnecessary hurdles. We understand you want to spend less time on paperwork and more time on charts, and Exness makes that possible. Let’s walk through it together.

Your Step-by-Step Guide to Opening an Exness Account:

- Visit the Official Exness Website: Ensure you access the legitimate Exness Kenya site to begin your registration. Look for the correct domain to guarantee a secure experience.

- Click \”Open Account\” or \”Register\”: You will find a prominent button, usually on the homepage or in the top right corner. This initiates your sign-up journey.

- Provide Basic Information: Input your country of residence (Kenya), your preferred email address, and create a strong password. This forms the foundational details for your new Exness account.

- Verify Your Email/Phone: Exness sends a verification code to your registered email or phone number. Enter this code to confirm your contact details and proceed to the next stage.

- Complete Your Profile: Fill in personal details accurately, such as your full name, date of birth, and residential address. Accuracy here is crucial for the subsequent verification steps.

- Choose Your Account Type: Exness offers various account types to suit different trading styles and experience levels, including Standard, Pro, Raw Spread, and Zero accounts. Each type offers unique features regarding spreads, commissions, and execution. Select the one that best fits your trading strategy.

- Verify Your Identity (KYC): This is a mandatory step for security and compliance. You will need to upload copies of your identification document (such as a national ID card or passport) and proof of residence (like a utility bill or bank statement). The Exness verification team processes these documents quickly, often within minutes.

- Make Your First Deposit: Once your account is fully verified, you can fund it using various convenient local payment methods available in Kenya. Exness supports popular options for seamless deposits.

- Start Trading! With funds in your account, you are ready to explore the vast opportunities in the forex, crypto, indices, and commodities markets. Navigate to the trading platform and begin your journey.

Exness prioritizes ease of access and security, making the account opening process for Kenyan traders smooth and efficient. It will not be long before you join countless other traders who trust Exness for their forex and CFD trading journey. Take this first step today and unlock your trading potential!

Exness Account Types: Finding the Right Fit for Kenya

Navigating the world of forex trading requires more than just market knowledge; it demands the right tools and the right trading environment. For traders in Kenya, Exness offers a range of account types, each designed to cater to different trading styles and experience levels. Choosing the perfect account is crucial for optimizing your trading experience and achieving your financial goals. Let’s break down the options so you can make an informed decision.

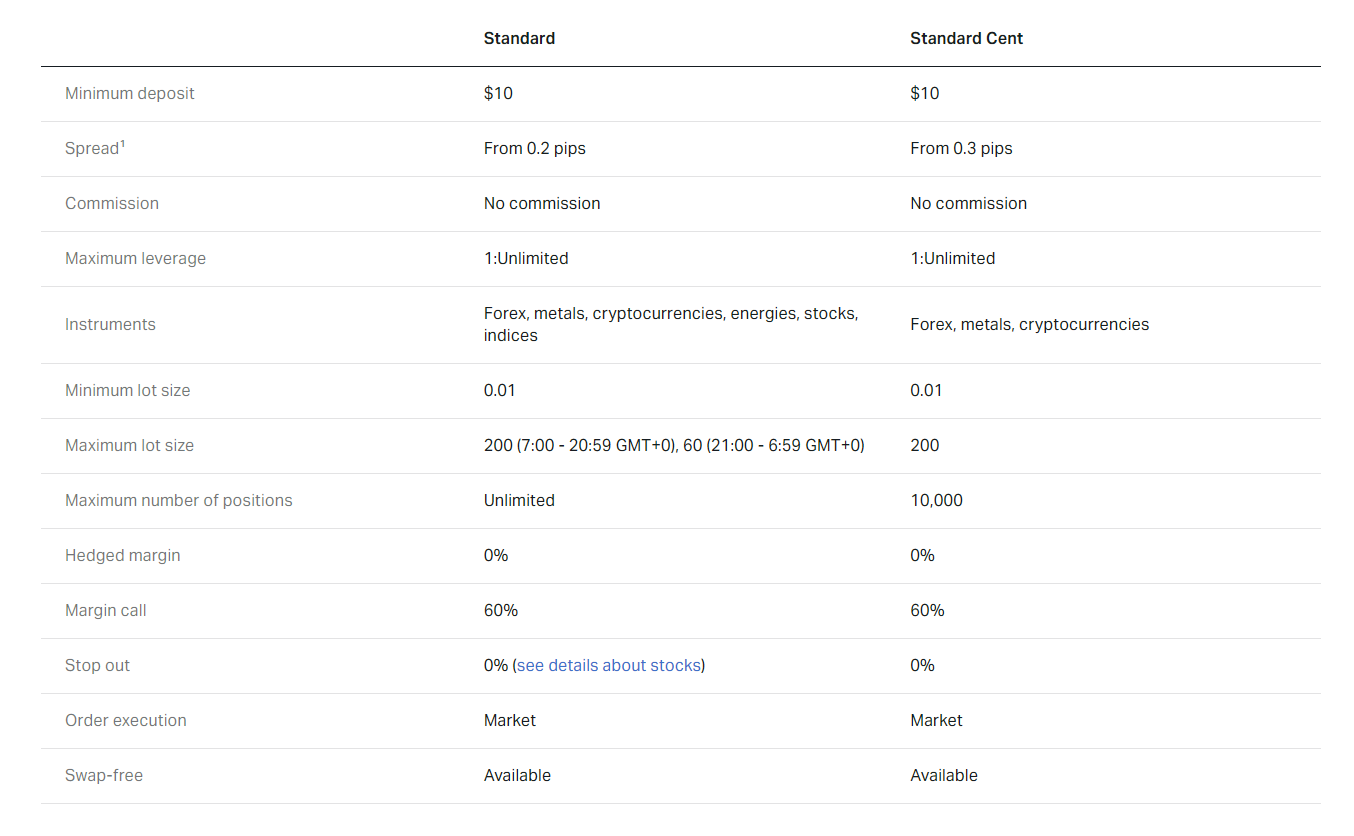

Exness primarily categorizes its accounts into two main groups: Standard and Professional. Understanding the key differences between these will help you pinpoint the best fit for your trading journey.

Standard Accounts: Ideal for Beginners and Experienced Traders Alike

The Standard Account is often the go-to choice for many traders, especially those just starting out in the forex market. It offers simplicity, competitive spreads, and no commission on trades. This makes it an excellent entry point for new traders looking to get comfortable with live trading without the added complexity of commissions.

- Standard Account: This is your most versatile option. It requires a low minimum deposit, making it accessible for a wide range of traders. You get stable spreads and fast execution, suitable for various trading strategies, from scalping to swing trading. It’s truly a great starting point for anyone in Kenya eager to begin their trading journey.

- Standard Cent Account: Looking to practice with real money but minimize risk? The Standard Cent account allows you to trade in cents rather than dollars. This means you can test strategies, manage emotions, and get a feel for market volatility with a much smaller capital outlay. It’s perfect for fine-tuning your skills before committing larger funds.

Professional Accounts: For the Savvy and High-Volume Trader

If you’re an experienced trader in Kenya, or if you engage in high-frequency trading and prioritize razor-thin spreads or specific commission structures, the Professional Accounts might be exactly what you need. These accounts cater to those who understand the nuances of market execution and cost optimization.

“A professional trader understands that every pip counts, and the right account type can significantly impact their bottom line,” notes one veteran forex analyst.

- Raw Spread Account: As the name suggests, this account offers raw, interbank spreads, which can be incredibly tight, often starting from 0.0 pips. While you pay a small, fixed commission per lot, the ultra-low spreads often make it the most cost-effective option for high-volume traders and scalpers. If you demand the lowest possible spreads, this account delivers.

- Zero Account: This account gives you zero spreads on the top 30 most popular instruments for 95% of the trading day. Like the Raw Spread account, it involves a commission. This option is fantastic for traders who focus on major currency pairs and frequently open and close positions, as it eliminates spread costs on those key assets.

- Pro Account: This account also boasts very low spreads, similar to professional-grade trading, but without the commission fees. It offers instant execution and is a great bridge between standard and the more specialized professional accounts. It appeals to swing traders and day traders who value tight spreads without the added complexity of calculating commissions per trade.

Ultimately, your choice of Exness account type in Kenya should align with your trading goals, experience level, capital, and preferred strategy. Take the time to evaluate each option carefully, perhaps even starting with a demo account to test the waters before committing to a live trading environment.

Deposits and Withdrawals on Exness Kenya: Local Payment Solutions

As a forex trader, you know that seamless deposits and withdrawals are absolutely crucial. You need to fund your account quickly and access your profits without hassle. For traders in Kenya, Exness understands this need perfectly. We focus on providing highly convenient local payment solutions, ensuring your trading journey is smooth from start to finish.

Forget the long waits and complex processes. Exness Kenya empowers you with a range of payment methods tailored specifically for the local market. This commitment means you can manage your funds with speed and confidence, allowing you to focus on what truly matters: your trading strategies.

Your Easy Deposit Options:

- M-Pesa: The king of mobile money in Kenya! Fund your Exness account instantly and securely using your M-Pesa wallet. It’s fast, incredibly convenient, and widely used across the country.

- Local Bank Transfers: Prefer traditional banking? You can easily deposit funds directly from your Kenyan bank account. Exness integrates with local banks to facilitate swift and reliable transfers.

- Other Mobile Money Solutions: Depending on the latest offerings, Exness may also support other popular mobile money services, giving you even more flexibility. Always check the client area for the most current options available to you.

Seamless Withdrawals Back to You:

Getting your profits out should be as simple as putting money in. Exness ensures your withdrawals are just as efficient, utilizing the same local channels you trust.

- M-Pesa Withdrawals: Experience the convenience of withdrawing your trading profits directly to your M-Pesa account. It’s a quick way to access your funds for immediate use.

- Local Bank Withdrawals: If you deposited via bank transfer, you can typically withdraw back to your Kenyan bank account. This provides a secure and traceable method for larger amounts.

Exness consistently works to optimize its payment gateway in Kenya, making sure you always have access to the most reliable and efficient deposit and withdrawal methods. Before initiating any transaction, simply log into your Personal Area. You’ll find all the current options, minimums, and maximums clearly laid out, ensuring full transparency. Trade confidently, knowing your funds are always accessible with Exness Kenya.

Trading Platforms Available to Exness Kenya Users

As a forex trader in Kenya, having access to robust and user-friendly trading platforms is crucial for success. Exness understands this, which is why they offer a selection of industry-leading platforms designed to cater to various trading styles and experience levels. Whether you’re a seasoned pro or just starting your journey, you’ll find a platform that fits your needs perfectly. These platforms provide advanced charting tools, real-time market data, and seamless execution, empowering you to make informed decisions and act swiftly on market opportunities.

Here are the primary trading platforms you can leverage with Exness Kenya:

- MetaTrader 4 (MT4): This legendary platform remains a favorite among forex traders worldwide. Its simplicity, powerful charting capabilities, and extensive range of indicators make it an excellent choice for both manual and automated trading. MT4 supports Expert Advisors (EAs), allowing you to automate your trading strategies and backtest them efficiently. It’s known for its stability and user-friendly interface, making it easy to navigate even for beginners.

- MetaTrader 5 (MT5): Building on the success of MT4, MetaTrader 5 offers enhanced features and broader market access. Beyond forex, MT5 supports trading in stocks, futures, and commodities, providing a more diverse portfolio management option. It boasts more timeframes, additional analytical tools, a built-in economic calendar, and a deeper market depth display. For traders looking for more advanced functionalities and a wider range of instruments, MT5 is the clear choice.

- Exness Terminal (WebTerminal): For those who prefer trading directly through their web browser without downloading any software, the Exness WebTerminal is an excellent solution. It offers a clean, intuitive interface with essential trading functions, real-time quotes, and basic analytical tools. You can access your account and trade from any device with an internet connection, providing ultimate flexibility. It’s perfect for quick trades or when you’re away from your primary trading setup.

Choosing the right platform often depends on your specific trading goals and technical preferences. Each platform provides a secure and reliable environment, ensuring your trading experience is smooth and efficient. Dive in and explore the capabilities each one offers to find your perfect trading companion.

Understanding Spreads, Commissions, and Trading Costs with Exness

As a seasoned forex trader, you know success isn’t just about spotting trends; it’s also about managing your expenses. Every transaction in the forex market comes with a price, and these trading costs directly impact your bottom line. Understanding spreads, commissions, and other associated fees is absolutely crucial for any trader, whether you’re just starting or you’ve been in the game for years. When you trade with a broker like Exness, knowing how these costs are structured helps you make smarter decisions and keep more of your hard-earned profits.

What are Spreads? Your Core Trading Cost

The spread is the most common trading cost you’ll encounter. Think of it as the difference between the buying price (ask) and the selling price (bid) of a currency pair. When you open a trade, you immediately pay this difference. It’s essentially how brokers make their money from each transaction. For instance, if EUR/USD has a bid price of 1.0700 and an ask price of 1.0701, the spread is 1 pip. The tighter the spread, the less you pay to enter a trade, which is particularly beneficial for active traders and scalpers.

- Variable Spreads: These spreads constantly change based on market volatility, liquidity, and economic news. During major news events, spreads can widen significantly.

- Fixed Spreads: These remain constant regardless of market conditions. While they offer predictability, they might be slightly wider during calm periods compared to variable spreads.

Exness offers competitive spreads across a wide range of currency pairs, catering to different trading strategies. They strive to provide tight spreads, especially during peak trading hours, helping you minimize your trading costs.

Commissions: Another Piece of the Puzzle

While spreads are almost universally present, commissions are an additional fee that some brokers charge, often on specific account types. A commission is a flat fee or a percentage charged per trade or per lot traded. You usually find commissions on ECN (Electronic Communication Network) or Raw Spread accounts, where the spreads themselves are exceptionally tight – sometimes even zero pips on major pairs. The broker charges a commission because they are giving you direct access to interbank liquidity with minimal markup on the spread.

Exness provides various account types, allowing you to choose whether you prefer a commission-free environment with slightly wider spreads or a commission-based model with raw, ultra-tight spreads. Your trading volume and strategy will determine which option is more cost-effective for you.

Beyond Spreads and Commissions: Other Trading Costs

It’s not just spreads and commissions that add up. Other costs can affect your profitability, and you need to be aware of them:

- Swap Fees (Overnight Fees): If you hold a position overnight, you might pay or receive a swap fee. This is an interest rate differential between the two currencies in a pair. Positive swaps can earn you money, while negative swaps will cost you.

- Inactivity Fees: Some brokers charge a fee if your account remains dormant for an extended period.

- Deposit/Withdrawal Fees: While many brokers, including Exness, offer free deposits and withdrawals for common methods, always check for any specific fees associated with certain payment systems or large transfers.

- Slippage: Although not a direct fee, slippage occurs when your order is executed at a different price than intended, often during volatile market conditions. This can result in a less favorable entry or exit price, effectively increasing your trading cost for that specific trade.

Why Understanding Trading Costs with Exness is Key to Your Success

Ignoring trading costs is like driving a car without checking the fuel gauge – you’re headed for trouble. For forex traders, these expenses directly eat into your potential profits. A seemingly small difference in spread or commission can accumulate into a significant amount over many trades, especially if you trade frequently or with large volumes. Exness prides itself on transparency and competitive pricing, offering various account types designed to meet different trading needs. By thoroughly understanding their cost structure, you can select the account that minimizes your expenses and maximizes your trading efficiency. Always analyze your trading style, average trade duration, and typical trade volume to choose the most advantageous cost model with Exness.

Exness Kenya Regulation and Security Measures

Navigating the forex market in Kenya demands a broker you can trust implicitly. Security is not just a feature; it’s the bedrock of your trading journey. When you choose Exness in Kenya, you align with a platform that places paramount importance on safeguarding your investments and personal data. We understand the local market dynamics and operate under stringent regulatory frameworks, providing you with a secure and transparent trading environment. At the heart of our operations in Kenya is compliance with the Capital Markets Authority (CMA). The CMA is Kenya’s primary financial regulatory body, tasked with supervising, licensing, and monitoring the activities of all capital market institutions, including online forex brokers. Their oversight ensures that financial service providers operate with integrity, transparency, and fairness. Choosing a CMA-regulated broker like Exness means you are trading with an entity that adheres to high standards of financial conduct and client protection.The CMA’s regulatory framework brings several key benefits directly to your trading experience:

- Client Fund Segregation: Your funds remain separate from the company’s operational capital. This means your money is safe, even in unforeseen circumstances involving the broker.

- Fair Trading Practices: The CMA actively monitors brokers to prevent manipulation and ensure transparent pricing, offering you a level playing field.

- Regular Audits: We undergo regular financial audits to confirm our solvency and adherence to regulatory requirements, boosting your confidence.

- Dispute Resolution: Should any issues arise, the CMA provides a clear pathway for dispute resolution, giving you an impartial body to address concerns.

Beyond regulatory compliance, Exness layers on additional security measures to fortify your trading experience. We implement robust encryption protocols to protect your personal and financial data during transmission and storage. Our systems actively monitor for suspicious activities, ensuring the integrity of your account. Furthermore, we offer negative balance protection, a crucial safeguard that ensures your account balance will never fall below zero, even if market movements are extreme. This means you cannot lose more money than you deposit. We believe in providing you with all the tools and protections necessary to focus on your trading strategies, free from unnecessary worries about the safety of your funds.

Leverage and Margin Requirements for Forex Trading in Kenya

Diving into forex trading in Kenya means understanding powerful tools like leverage and margin. These concepts are fundamental for any trader looking to maximize their opportunities in the global currency markets. Simply put, they allow you to control larger positions with a relatively small amount of capital. But remember, with great power comes great responsibility – and significant risk if not managed correctly.

Leverage is essentially a loan from your broker. It lets you open trading positions much larger than your actual trading capital. For example, with 1:500 leverage, you can control a $50,000 position with just $100 of your own money. This amplifies your potential profits, making even small market movements significant. Kenyan traders often find this appealing as it opens up the forex market without needing a massive initial investment. However, it equally amplifies potential losses, which is a crucial point many new traders overlook.

Advantages of Using Leverage

- Increased Market Exposure: Control larger trade sizes than your account balance normally allows, maximizing your potential returns on successful trades.

- Capital Efficiency: You do not need a large sum of money to start trading. Leverage makes forex accessible to a broader range of Kenyan traders.

- Profit Amplification: Even small price changes can lead to substantial profits due to the magnified position size.

Disadvantages and Risks of Leverage

- Loss Amplification: Just as profits are amplified, so are losses. A small adverse market movement can quickly wipe out your account if not managed with care.

- Margin Calls: If your trade goes against you, your broker might issue a margin call, demanding more funds to maintain your position. Failure to meet it means automatic liquidation of your trades.

- Overtrading Temptation: The ease of opening large positions can tempt traders to overleverage, leading to excessive risk-taking.

Now, let us talk about margin. Margin is the amount of money your broker reserves from your trading account to keep a leveraged position open. Think of it as a good-faith deposit. When you open a trade, a portion of your capital becomes “locked up” as initial margin. This is not a fee; it is collateral. The margin requirements vary depending on the currency pair, your broker, and the leverage you use. For instance, with 1:100 leverage on a $10,000 position, your margin requirement might be $100. This reserve helps cover potential losses and ensures you can meet your obligations.

Managing your margin is critical for longevity in forex trading in Kenya. Your broker constantly monitors your account’s equity versus your used margin. If your equity falls below a certain percentage of your margin requirements (known as maintenance margin), you risk a margin call. This happens when your account no longer has sufficient funds to support your open positions. To avoid this stressful scenario, experienced Kenyan traders always prioritize robust risk management strategies like setting stop loss orders and never over-committing their trading capital.

For Kenyan traders, it is essential to be aware of the regulatory landscape that influences leverage levels. Local financial regulators aim to protect investors by sometimes imposing limits on the maximum leverage brokers can offer. Always choose a regulated broker that adheres to these guidelines, ensuring a safer trading environment. Understanding these requirements helps you make informed decisions and avoids unnecessary risks.

To succeed, treat leverage with respect. Do not just focus on the profit potential; understand the associated risks. Develop a solid trading plan, always use stop loss orders to cap your potential losses, and never risk more than you can comfortably afford to lose. Smart use of leverage and a clear understanding of margin requirements are hallmarks of a professional approach to forex trading in Kenya.

Customer Support and Assistance for Exness Kenya Clients

A reliable trading experience hinges on excellent customer support. For Exness Kenya clients, access to prompt and professional assistance is a cornerstone of their seamless trading journey. We understand that questions or issues can arise at any moment, whether you’re managing your account, executing trades, or navigating the platform. That’s why our robust Exness customer service is designed to provide comprehensive support tailored to your needs.

Our dedicated support team is available around the clock, ensuring that help is always just a few clicks or a call away. This 24/7 support means you can get answers to your trading inquiries or technical assistance no matter your schedule. Our goal is to empower Kenya forex traders with the confidence that expert help is readily available whenever they need it.

Connecting with Exness Support

Reaching our customer service team is straightforward, with multiple convenient channels designed for your comfort and urgency:

- Live Chat: For immediate questions and quick resolutions, our live chat Exness service is the fastest way to connect. You can chat directly with a support agent from your trading platform or the Exness website, getting real-time answers.

- Email Support: If your query is less urgent or requires detailed documentation, sending an email to our support team is an excellent option. Expect a comprehensive response that addresses all aspects of your inquiry thoroughly.

- Phone Support: Sometimes, a direct conversation is best. You can reach our support specialists by phone, allowing for a personal touch and clear communication of complex issues. Our phone lines are accessible to Exness Kenya clients for direct assistance.

Quality and Scope of Assistance

The Exness customer service team comprises highly trained professionals who possess deep knowledge of the forex market and our trading platforms. They are not just problem solvers; they are advisors ready to guide you through various aspects of your trading. Whether you need help with account verification, deposit and withdrawal procedures, technical glitches with the trading terminal, or understanding specific trading conditions, our team offers clear, concise, and accurate information.

Beyond direct contact, Exness also provides extensive self-help resources. Our comprehensive Help Centre features a rich library of frequently asked questions, detailed guides, and tutorials. These resources cover a wide array of topics, enabling you to find answers independently and deepen your understanding of our services. This multi-layered approach ensures that Exness Kenya clients always have the support they need to trade with confidence and clarity.

Educational Resources and Trading Tools by Exness

Navigating the dynamic world of forex trading demands more than just a keen eye for market movements. It requires a solid foundation of knowledge and access to powerful tools. Exness understands this crucial need, offering a comprehensive suite of educational resources and practical trading tools designed to empower traders at every stage of their journey, from novice to seasoned professional. We believe that an informed trader is a successful trader.Empower Your Knowledge with Exness Education

Education is your first line of defense and your best offense in the markets. Exness provides a rich library of learning materials to help you grasp complex concepts and refine your trading strategies. Think of it as your personal trading academy, always open and accessible.Here’s a glimpse of what you can expect:

In-Depth Trading Guides and Articles

Our comprehensive articles cover everything from the basics of forex and understanding currency pairs to advanced technical analysis and fundamental drivers. Learn about market psychology, risk management, and how to interpret economic reports. Each guide breaks down complex topics into easy-to-digest segments.Engaging Video Tutorials

Prefer visual learning? Our video tutorials walk you through platform navigation, executing trades, setting up indicators, and applying various trading strategies. These bite-sized videos make learning quick and effective, allowing you to see concepts in action.Live Webinars with Experts

Join our live interactive webinars led by experienced market analysts. These sessions offer real-time market insights, strategy discussions, and Q&A opportunities, giving you direct access to professional perspectives and the chance to deepen your understanding of current market trends.Comprehensive Glossary

Confused by trading jargon? Our extensive glossary provides clear definitions for every term you’ll encounter in the trading world, ensuring you always speak the language of the market.

Unlock Your Potential with Advanced Trading Tools

Beyond education, Exness equips you with an arsenal of trading tools that transform raw data into actionable insights. These tools are designed to streamline your analysis, improve your decision-making, and manage your trades more effectively.Consider these essential tools:

- Economic Calendar

- Stay ahead of market-moving events with our real-time economic calendar. Track key economic indicators, central bank announcements, and geopolitical developments that impact currency values. This tool is indispensable for fundamental analysis.

- Pip Calculator

- Quickly determine the value of a pip for any currency pair, helping you calculate potential profits or losses before opening a trade. It’s crucial for precise risk management.

- Margin Calculator

- Understand the margin required for your trades with different leverage settings. This tool helps you manage your account equity efficiently and avoid unnecessary risks.

- Currency Converter

- Easily convert between different currencies using real-time exchange rates. Perfect for quickly assessing the value of your base currency against others.

- Trading Central Analysis

- Gain access to professional technical analysis and trading signals from Trading Central, a renowned third-party provider. This powerful tool offers actionable trading ideas and helps you identify potential market opportunities based on expert analysis.

These educational resources and trading tools are more than just features; they are foundational elements designed to build your confidence and refine your skills. They help you make informed decisions, manage risk intelligently, and ultimately, strive for consistent success in the forex market. We invite you to explore these invaluable offerings and elevate your trading experience with Exness.

Mobile Trading Experience with the Exness App in Kenya

In today’s fast-paced world, staying connected to the financial markets is more crucial than ever for traders. For Kenyan traders, the ability to engage with the forex market anytime, anywhere has become a game-changer. The Exness app revolutionizes this experience, offering a robust and user-friendly platform right at your fingertips. Imagine having the power to execute trades, monitor your portfolio, and react to market shifts, all from your smartphone. This is the essence of modern mobile trading, and the Exness app brings it seamlessly to the Kenyan trading community.

Why the Exness App Stands Out for Kenyan Traders

The Exness app isn’t just another trading application; it’s a comprehensive tool designed to cater to the needs of both novice and experienced forex traders. It offers a smooth and intuitive experience, ensuring that even complex trading actions feel simple. From checking real-time market data to managing your account, every feature is optimized for mobile convenience. This dedication to a superior user experience truly sets it apart, allowing Kenyan traders to focus on their strategies rather than grappling with complicated interfaces.

Key Advantages of Trading with the Exness App:

- Uninterrupted Access: Trade on the go, whether you’re commuting, at home, or anywhere with an internet connection. Never miss a potential opportunity.

- Intuitive Interface: The app boasts a clean and easy-to-navigate design, making it simple to find what you need and execute trades quickly.

- Real-Time Market Data: Get instant access to live quotes, charts, and market news, empowering you to make informed decisions without delay.

- Comprehensive Account Management: Easily manage your funds with various deposit and withdrawal options, monitor your trading history, and adjust settings directly within the app.

- Enhanced Security: Your funds and personal data are protected with advanced security protocols, giving you peace of mind while trading.

One of the most appreciated aspects is the app’s reliability. Downtime is minimal, and the responsiveness ensures that your trading commands are executed swiftly. This is vital in the volatile world of forex trading, where every second can count. For Kenyan traders, the Exness app has become an indispensable tool, transforming how they interact with the global financial markets. It truly brings the power of global forex trading directly into their hands, backed by reliable 24/7 support should any questions arise.

Promotions and Bonuses for Exness Kenya Traders

As a forex trader in Kenya, you’re always looking for an edge, and who doesn’t love a good promotion or bonus? These offers can significantly enhance your trading journey, providing extra capital, reducing costs, or even giving you a competitive challenge. Exness, known for its commitment to excellent trading conditions, often provides various incentives designed to benefit its diverse client base, including traders right here in Kenya.

Why Bonuses Matter to Your Trading

Bonuses and promotions aren’t just about free money; they are strategic tools that can help you manage risk, increase your trading volume, or simply explore new strategies with less personal capital at stake. Think of them as a boost to your trading power. They allow you to:

- Increase Trading Capital: A deposit bonus, for instance, adds more funds to your account, giving you a larger margin to work with.

- Access More Opportunities: With more capital, you might be able to open more trades or trade larger lots.

- Learn and Practice: Some promotions, like demo contests, offer a risk-free environment to hone your skills and win real prizes.

- Earn Rewards for Loyalty: Many brokers appreciate consistent traders and offer loyalty programs that provide cash back or other exclusive benefits.

Common Types of Promotions You Might Encounter

Brokers like Exness typically offer a range of promotions tailored to different trader needs. While specific offers can change, here are some popular types you might see:

- Deposit Bonuses: The most common type, where the broker matches a percentage of your deposit, adding extra funds to your trading account. For example, deposit $100 and get an extra $20 as a bonus.

- Trading Contests: Compete against other traders on demo or live accounts to win cash prizes or other rewards. These often focus on profitability or trading volume.

- Referral Programs: If you introduce new traders to the platform, you might receive a bonus once they meet certain trading criteria. It’s a win-win for everyone!

- Loyalty Programs or VIP Tiers: For active traders, these programs offer exclusive benefits like lower spreads, dedicated account managers, or cashback on trades.

- Risk-Free Trades: Occasionally, brokers offer a chance to make a trade where any loss is covered by the broker, giving you confidence to try new strategies.

Navigating Promotional Offers: What to Consider

While promotions are exciting, it’s vital to read the fine print. Understanding the terms and conditions is crucial to truly benefit from any offer. Here’s what to look for:

As a professional trader, I always advise looking beyond the initial appeal and understanding the full scope of any offer. A well-understood bonus can be a powerful tool in your trading arsenal, especially when trading with a reliable broker like Exness, which aims to provide competitive advantages to its Kenyan traders.

Comparing Exness with Other Forex Brokers in Kenya

Navigating the forex landscape in Kenya means choosing a broker that perfectly matches your trading style and security needs. While many international brokers offer their services, it’s crucial to compare them carefully. Exness stands out for several reasons, but how does it truly stack up against its competitors in the Kenyan market?

Regulation and Security

When selecting a forex broker, regulation is paramount. Exness operates under multiple reputable international licenses, providing a strong layer of security for traders. This multi-jurisdictional regulation often gives Kenyan traders more confidence compared to some smaller, less regulated local entities or offshore brokers with less stringent oversight. Always check a broker’s regulatory status with relevant bodies before committing your funds.

Trading Conditions: Spreads and Leverage

One of Exness’s most touted features is its competitive spreads, especially on major currency pairs, and flexible leverage options. Many Kenyan traders find these conditions highly appealing, as lower spreads mean reduced trading costs. Other brokers in Kenya might offer similar conditions, but it’s essential to compare average spreads during volatile periods and understand any hidden fees. Exness often provides unlimited leverage under specific account conditions, a feature less common among all brokers but very attractive to experienced traders.

Account Types and Accessibility

Exness offers a range of account types, from standard accounts suitable for beginners to professional accounts designed for high-volume traders. This variety ensures that both new and experienced Kenyan traders can find an account that fits their capital and strategy. Some local brokers might offer fewer account options, potentially limiting flexibility. Minimum deposit requirements also vary significantly across brokers, impacting accessibility for those with smaller starting capital.

Deposit and Withdrawal Options

For Kenyan traders, the ease and speed of deposits and withdrawals are critical. Exness excels here with a wide array of payment methods, including local options popular in Kenya. Fast withdrawals, often processed instantly for many methods, are a significant advantage. Other brokers might have slower processing times or fewer local payment gateway integrations, which can be inconvenient. Always verify the available methods and any associated fees before funding your account.

Customer Support and Platforms

Effective customer support is vital, especially when you face technical issues or have urgent questions. Exness provides multi-language support, including English, 24/7. This constant availability ensures you can get assistance whenever you need it, which isn’t always the case with every broker. Furthermore, Exness offers industry-standard platforms like MetaTrader 4 and MetaTrader 5, familiar to most traders, alongside its own web terminal. While most brokers offer MT4/MT5, checking for mobile compatibility and additional analytical tools is always a good idea.

Tips for Successful Trading on Exness Kenya

Embarking on your trading journey with Exness Kenya offers incredible opportunities, but success isn’t just about opening an account. It demands discipline, strategic thinking, and a solid understanding of the markets. Here are essential tips to help you navigate the complexities of forex trading and boost your chances of consistent profitability. Remember, the market rewards preparation and punishes impulse.The first step to thriving in the trading world is continuous learning. Markets evolve, and so should your knowledge. Understand the fundamentals that drive currency movements, analyze technical indicators, and grasp the impact of global events. Never stop educating yourself; it’s your most valuable asset.

Master Your Risk Management

One of the most critical aspects of successful trading is robust risk management. Without it, even the most profitable strategy can lead to significant losses. Here’s what you need to prioritize:

- Define Your Risk Per Trade: Decide how much capital you are willing to risk on any single trade. A common rule is not to risk more than 1-2% of your total trading capital per trade. This protects your account from being wiped out by a few losing trades.

- Use Stop-Loss Orders: Always place a stop-loss order for every trade you execute. A stop-loss automatically closes your position if the market moves against you by a predefined amount, limiting your potential losses.

- Determine Position Sizing: Calculate your position size based on your stop-loss level and your risk per trade. This ensures that no matter the price movement, your risk remains within your set limits. Avoid over-leveraging, as high leverage can amplify both gains and losses.

- Manage Emotions: Fear and greed are traders’ worst enemies. Stick to your trading plan and avoid making impulsive decisions based on market swings. Emotional trading often leads to poor outcomes.

Develop and Adhere to a Trading Plan

A well-defined trading plan acts as your roadmap. It outlines your strategy, goals, risk tolerance, and rules for entry and exit. This plan keeps you disciplined and focused, especially during volatile market conditions.

Your trading plan should include:

Once you create your plan, the challenge is sticking to it. Review your trades regularly to identify what works and what doesn’t, but resist the urge to constantly change your strategy based on short-term results.

Practice makes perfect, and for traders, this means utilizing a demo account. Exness Kenya provides an excellent demo environment where you can test strategies, get familiar with a trading platform, and gain confidence without risking real money. Treat your demo trading seriously, as if it were a live account. This builds good habits and strengthens your decision-making process.

“The market does not care about your hopes or fears. It only cares about the price.”

– Unknown Trader

Staying informed about global economic news, central bank announcements, and geopolitical events is vital. These factors significantly influence currency prices. While technical analysis focuses on charts, fundamental analysis provides the “why” behind price movements. A successful trader combines both perspectives.

Frequently Asked Questions

What are the main benefits of using Exness in Kenya?

Exness offers Kenyan traders several key advantages, including competitive low spreads, fast trade execution, localized payment solutions like M-Pesa, a variety of account types, and strong regulation under bodies like the CMA, ensuring a secure and efficient trading environment.

What payment methods can I use for deposits and withdrawals in Kenya?

Exness provides convenient local payment methods for Kenyan traders. You can easily deposit and withdraw funds using popular options like M-Pesa and local bank transfers, making fund management fast and hassle-free.

What types of trading accounts does Exness offer to Kenyan traders?

Exness caters to all levels of traders with Standard accounts (including Standard and Standard Cent) ideal for beginners, and Professional accounts (Raw Spread, Zero, Pro) designed for experienced, high-volume traders who need tighter spreads and specific commission structures.

Is Exness regulated in Kenya?

Yes, Exness is regulated by the Capital Markets Authority (CMA) of Kenya. This ensures that the broker adheres to strict standards of client fund protection, fair trading practices, and overall financial integrity, providing a secure trading environment for Kenyan clients.

Which trading platforms can I use with Exness in Kenya?

Kenyan traders can use the world-renowned MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced tools and stability. Additionally, Exness offers its own user-friendly WebTerminal for trading directly in a web browser without any downloads.