Are you ready to explore the dynamic world of online trading right from Egypt? Exness offers a gateway to global financial markets, making it a popular choice for traders across the country. This guide is your comprehensive resource, designed to help you understand why Exness Egypt stands out and how you can maximize your trading potential. We cover everything from account types to trading platforms, ensuring you have all the information you need to start your journey with confidence. Discover how simple and accessible online trading can be when you choose the right partner.

- What is Exness and Its Global Presence?

- Exness’s Global Reach Explained:

- Is Exness Available and Legal for Traders in Egypt?

- What Makes Exness Accessible for Egyptian Traders?

- Understanding Exness Regulation and Licenses Relevant to Egyptian Traders

- Why Regulation Matters for You

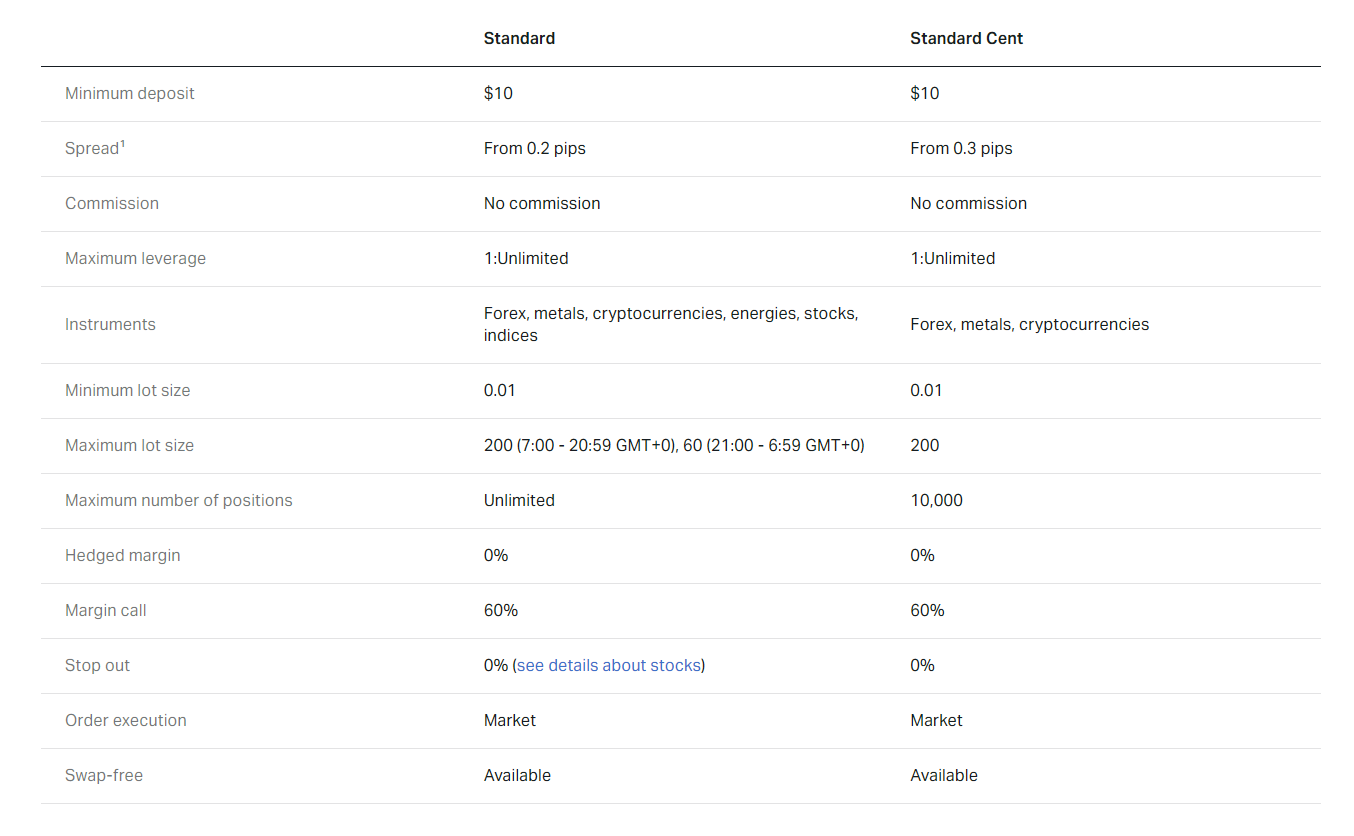

- Key Exness Account Types for Egyptian Clients

- Standard Account Features for Exness Egypt

- Key Advantages of the Standard Account:

- Professional Account Benefits (Raw Spread, Zero, Pro)

- Raw Spread Account: Precision and Purity

- Zero Account: Eliminating the Bid-Ask Gap

- Pro Account: Comprehensive Elite Trading Conditions

- Deposit and Withdrawal Methods for Exness Egypt

- Key Payment Methods Available to Exness Egypt Traders:

- Important Considerations for Your Transactions:

- Popular Payment Options for Egyptian Traders

- Transaction Fees and Processing Times with Exness

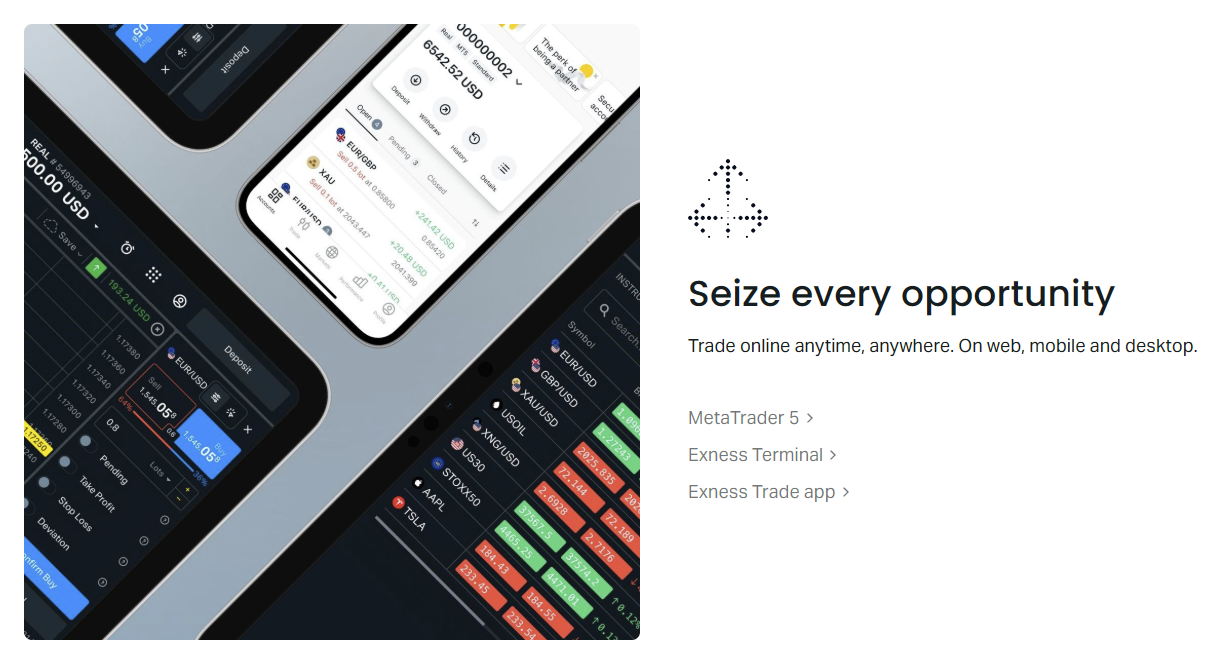

- Trading Platforms Offered by Exness in Egypt (MT4, MT5, Exness Terminal)

- Available Financial Instruments for Egyptian Traders

- Forex (Foreign Exchange)

- Stocks (Equities)

- Commodities

- Indices

- Customer Support and Localized Services for Exness Egypt Users

- What to Expect from Exness Egypt Customer Support:

- Advantages of Trading with Exness in Egypt

- Why Exness Appeals to Egyptian Traders

- Flexible Account Options and Low Spreads

- Advanced Trading Platforms and Tools

- Instant Withdrawals and Deposits

- Robust Customer Support and Localization

- Potential Considerations for Egyptian Traders Using Exness

- How to Open an Exness Account in Egypt: A Step-by-Step Guide

- Your Journey to Trading Begins Here: Step-by-Step Account Opening

- Step 1: Visit the Exness Website

- Step 2: Complete the Registration Form

- Step 3: Verify Your Email Address

- Step 4: Provide Personal Information

- Step 5: Verify Your Identity and Residency (KYC)

- Step 6: Choose Your Account Type and Set Trading Preferences

- Step 7: Fund Your Account

- Step 8: Start Trading!

- Leverage, Spreads, and Trading Conditions for Egyptian Users

- Unlocking Potential with Leverage

- The Power and Peril of Leverage:

- Navigating Spreads: Your Trading Costs Explained

- Types of Spreads You’ll Encounter:

- Optimizing Your Trading Conditions as an Egyptian Trader

- Key Trading Conditions to Consider:

- Exness Security Measures and Fund Protection for Egyptian Traders

- Key Pillars of Exness Security:

- Why Exness Fund Protection Matters for Egyptian Traders:

- Advantages of Exness’s Security Protocols:

- Exness Egypt: Frequently Asked Questions (FAQs)

- Frequently Asked Questions

What is Exness and Its Global Presence?

Exness stands out as a premier global multi-asset broker, established with a clear vision: to provide traders worldwide with a reliable and transparent trading environment. Since its inception, Exness has rapidly grown, cementing its reputation as a trusted partner for both retail and institutional clients. We focus on delivering innovative financial services and products, ensuring a seamless experience for anyone looking to navigate the dynamic forex and CFD markets.

Our commitment to excellence is reflected in our robust trading conditions, which include competitive spreads, fast execution speeds, and a wide array of instruments. This dedication has allowed Exness to cultivate a substantial global footprint, attracting millions of traders from diverse regions across the globe. We understand that traders demand accessibility and efficiency, which is why our platforms are designed to cater to various trading styles and preferences, whether you are a novice or a seasoned professional.

Exness’s Global Reach Explained:

- Extensive Market Access: Exness offers a broad spectrum of trading instruments, including major and exotic currency pairs, cryptocurrencies, stocks, indices, and commodities. This diverse offering appeals to a wide international audience with varied investment interests.

- Regulatory Compliance: Operating under multiple reputable regulatory licenses ensures that Exness maintains high standards of transparency and security. These licenses allow us to serve clients legally and responsibly in numerous jurisdictions, building trust across borders.

- Multilingual Support: We pride ourselves on providing customer support in multiple languages, available 24/7. This commitment to localization helps us effectively serve our diverse client base, ensuring traders feel understood and supported, regardless of their native tongue.

- Localised Payment Solutions: Understanding the unique needs of different regions, Exness offers a wide range of local payment methods. This makes deposits and withdrawals convenient and accessible for traders in various countries, enhancing their overall experience.

In essence, Exness isn’t just a broker; it’s a global trading ecosystem designed to empower traders around the world. Our continuous innovation and unwavering focus on client satisfaction are the cornerstones of our expansive global presence, making us a top choice for traders seeking a reliable and feature-rich platform.

Is Exness Available and Legal for Traders in Egypt?

For Egyptian traders looking to step into the dynamic world of forex, a crucial question often arises: Can you trade with Exness in Egypt, and is it legal? The straightforward answer is yes, Exness is indeed available and widely utilized by traders across Egypt, operating within the established framework for international online brokerage services.

Exness has built a strong global presence, recognized for its commitment to providing transparent and accessible trading conditions. This commitment extends to Egyptian traders, who can readily access the platform to engage in forex trading and other financial markets. While Egypt has its own financial regulations, online trading with internationally regulated brokers like Exness is common practice, offering local traders the opportunity to participate in the global financial arena.

What Makes Exness Accessible for Egyptian Traders?

Exness understands the unique needs of its diverse client base, including those in Egypt. Here’s why many Egyptian traders find Exness a preferred choice:

- Flexible Account Types: Exness offers a variety of trading accounts tailored to different experience levels and capital sizes, from cent accounts perfect for beginners to professional accounts with competitive spreads.

- Local Payment Methods: Ease of deposits and withdrawals is paramount. Exness often supports various convenient payment methods relevant to the Egyptian market, ensuring seamless transactions for your trading accounts.

- Customer Support: Access to responsive customer support, sometimes even in Arabic, makes the trading journey smoother for Egyptian traders, addressing any queries or issues promptly.

- Competitive Trading Conditions: Benefit from tight spreads, low commissions on certain account types, and high leverage options that can be appealing for various trading strategies in the forex market.

Regarding legality, it’s important to understand that Exness operates under robust international regulations from multiple reputable financial authorities worldwide. This multi-jurisdictional licensing allows Exness to serve clients globally, including those in Egypt, while upholding high standards of client protection and financial integrity.

Therefore, if you are an Egyptian trader considering Exness for your forex trading journey, you can proceed with confidence. Exness provides a reliable and accessible platform, ensuring that you can participate in online trading with a globally recognized and regulated broker, making your entry into the forex market both practical and secure.

Understanding Exness Regulation and Licenses Relevant to Egyptian Traders

Embarking on your forex trading journey requires confidence, and that confidence often comes from knowing your broker operates under strict regulatory oversight. For Egyptian traders, this is not just a preference; it’s a necessity. The forex market can be a dynamic place, and strong regulation acts as a vital safeguard for your investments.

Exness understands the importance of trust and security. As a global broker, Exness holds various licenses from different regulatory bodies around the world. These licenses are not mere badges; they represent commitments to adhering to stringent financial standards, protecting client funds, and operating with transparency.

Why Regulation Matters for You

As an Egyptian trader, you might wonder which specific regulations apply to your trading account. While Exness serves clients globally, their multi-jurisdictional licensing means they comply with different rules depending on where their clients are located. This diverse regulatory framework allows them to cater to a broad audience while maintaining a high level of operational integrity.

Consider these advantages of trading with a regulated broker:

- Client Fund Segregation: Regulated brokers keep client funds in separate bank accounts from the company’s operational funds. This ensures your money is protected, even if the company faces financial difficulties.

- Financial Stability Requirements: Regulators often require brokers to maintain certain levels of capital, proving their financial stability and ability to meet obligations.

- Dispute Resolution: Should any issues arise, regulatory bodies typically offer avenues for dispute resolution, providing an impartial third party to review your case.

- Transparency in Operations: Licensed brokers are subject to regular audits and must report their financial activities, promoting greater transparency in their trading conditions and execution.

When you choose a broker like Exness, which operates under reputable regulatory umbrellas, you gain an added layer of peace of mind. This allows you to focus on your trading strategies and market analysis, knowing that your capital is handled responsibly. Always verify a broker’s current licenses and regulatory status directly on their official website to ensure you have the most up-to-date information relevant to your region.

Key Exness Account Types for Egyptian Clients

Navigating the dynamic forex market demands the right tools, and for Egyptian traders, choosing the appropriate Exness account is a crucial first step. Exness offers a diverse range of account types, carefully designed to meet the varying needs of both novice and experienced traders. Understanding these options helps you optimize your trading strategy, manage costs effectively, and access the specific features most beneficial for your unique trading style.

Exness primarily categorizes its offerings into two main groups: Standard Accounts and Professional Accounts. Each group caters to different trading volumes, strategic approaches, and levels of experience, ensuring every trader finds a perfect fit that aligns with their financial journey and trading aspirations.

The Standard Account: Ideal for New and Growing Traders

The Standard Account is often the go-to choice for traders just starting their journey or those who prefer straightforward trading conditions. It’s incredibly accessible, typically requiring a low minimum deposit, making it perfect for budget-conscious traders in Egypt. This account provides a comfortable entry point into the forex world, allowing you to learn and grow without complex fee structures. It truly offers a solid foundation for building your trading confidence. Here’s what makes it stand out:

- Consistent Spreads: Enjoy stable, competitive spreads without worrying about commissions per trade. This simplifies cost calculation and allows for clear budgeting.

- Wide Range of Instruments: Trade major, minor, and exotic currency pairs, cryptocurrencies, metals, energies, and indices. This vast variety allows for broad market participation and diversification.

- Flexibility for Strategies: It suits all trading strategies, including scalping, hedging, and automated trading. You can adapt your approach without account restrictions.

- No Commissions: You pay only through the spread, which is naturally built into the buy and sell prices. This transparent pricing model makes it easy to understand your trading costs.

Professional Accounts: For Experienced and High-Volume Traders

If you’re an experienced trader looking for tighter spreads, specific execution models, or lower trading costs for high volumes, Exness offers a suite of Professional Accounts. These accounts are precision-engineered for efficiency, appealing to those who understand the nuances of market execution and detailed pricing. They cater to traders who demand optimal conditions for their advanced strategies.

Among the professional offerings, you will find distinct options tailored to specific trading preferences. The Raw Spread Account offers ultra-low, often zero spreads, but charges a small, fixed commission per lot traded. This structure makes it excellent for traders who prioritize the absolute tightest spreads possible, making it especially popular among scalpers and high-frequency traders who execute numerous trades.

The Zero Account, as its name suggests, provides zero spreads on the top 30 most popular trading instruments for 95% of the trading day. Like the Raw Spread account, it involves a commission per lot. This option is perfect for traders focusing on specific highly liquid pairs, giving them exceptional control over their entry and exit points and reducing immediate trading costs on key assets.

Finally, the Pro Account combines low, stable spreads with no commissions, similar to the Standard account but with significantly tighter spreads. It offers instant execution for most instruments, making it ideal for discretionary traders seeking rapid order fulfillment without per-trade fees. This account type balances competitive pricing with the simplicity of commission-free trading, appealing to those who value speed and clarity.

Ultimately, your decision should align seamlessly with your individual trading goals, risk tolerance, and current experience level. Exness provides comprehensive information and dedicated support to help Egyptian traders make an informed choice, ensuring you have the right foundation for a successful and empowering trading journey. Evaluate your needs carefully to select the account that truly empowers your trading most effectively.

Standard Account Features for Exness Egypt

Are you looking to dive into the exciting world of forex trading with a reliable and accessible platform in Egypt? The Standard Account with Exness offers a fantastic entry point for both new and experienced traders. It’s designed to provide a straightforward and highly competitive trading environment, making it a popular choice for many traders across the region.

One of the main appeals of the Exness Standard Account is its simplicity and transparency. You get consistent trading conditions without hidden fees, allowing you to focus purely on your trading strategies. This account type is well-suited for those who prefer fixed, predictable costs and a wide range of trading instruments.

Key Advantages of the Standard Account:

- Low Minimum Deposit: Start trading with an accessible initial deposit, perfect for managing your risk and learning the ropes.

- Stable Spreads: Enjoy competitive and stable spreads on major currency pairs, metals, cryptocurrencies, and more. This predictability helps in calculating potential profits and losses.

- No Commission: Trade without worrying about commission fees on your transactions. Your cost is built into the spread, simplifying your trading expenses.

- Flexible Leverage: Access flexible leverage options, giving you the power to amplify your trading capital while maintaining control over your risk management.

- Wide Range of Instruments: Trade hundreds of financial instruments including popular forex pairs, gold, silver, crude oil, and major stock indices.

- Instant Execution: Benefit from instant order execution, ensuring your trades are placed at the price you see, minimizing slippage.

As a professional trader, I often recommend the Standard Account for its balance of features and user-friendliness. It provides a robust foundation for building your trading journey, whether you’re engaging in short-term scalping or longer-term swing trading strategies. Its straightforward nature means less time spent on administrative tasks and more time focused on market analysis.

Consider these aspects when choosing your account:

| Feature | Benefit for Traders |

|---|---|

| Low Spreads | Reduces trading costs and improves profitability. |

| Flexible Leverage | Allows for greater market exposure with less capital. |

| Zero Commission | Simplifies cost structure, clear execution price. |

| Instant Execution | Minimizes price discrepancies and ensures timely trades. |

In essence, the Exness Standard Account in Egypt is built for accessibility and performance. It offers a clear path to trading financial markets with strong support and reliable conditions.

Professional Account Benefits (Raw Spread, Zero, Pro)

As a seasoned forex trader, you understand that your trading environment significantly impacts your success. Standard accounts might suit beginners, but professional account types like Raw Spread, Zero, and Pro offer distinct advantages designed to empower your strategies and maximize your potential. These specialized accounts are not just an upgrade; they are essential tools for serious traders looking for optimal conditions.

Let’s break down the unique benefits each professional account type brings to your trading desk:

Raw Spread Account: Precision and Purity

The Raw Spread account truly lives up to its name, offering you direct access to interbank market prices. Imagine trading with spreads as low as 0.0 pips on major currency pairs – this is the reality. You get the purest form of pricing, with only a small, transparent commission applied per lot traded. This structure is a game-changer for high-frequency traders and scalpers who thrive on minimal price differences. It means your entry and exit points are incredibly precise, reducing your trading costs over time and giving you a significant edge in fast-moving markets.

Zero Account: Eliminating the Bid-Ask Gap

Similar to the Raw Spread, the Zero account is engineered for those who demand the absolute tightest pricing. Many brokers offer actual zero spreads on popular currency pairs, especially during peak liquidity hours. This model completely bypasses the traditional bid-ask spread, replacing it with a fixed, low commission. For traders who execute a high volume of trades or use strategies sensitive to spread costs, a Zero account can dramatically improve profitability. It provides crystal-clear cost structures, allowing you to focus purely on market movements without the constant consideration of spread widening.

Pro Account: Comprehensive Elite Trading Conditions

The Pro account often represents the pinnacle of a broker’s offerings, combining various elite features tailored for advanced traders. While specific benefits can vary, Pro accounts generally provide a holistic package designed to enhance every aspect of your trading. Expect tighter spreads than standard accounts, sometimes rivaling Raw Spread or Zero accounts, alongside lower commissions. You also gain access to higher leverage options, allowing greater capital efficiency. Furthermore, Pro accounts frequently come with dedicated customer support, often including a personal account manager, access to advanced trading platforms, and exclusive market analysis or tools. This comprehensive suite ensures you have every resource at your disposal to execute complex strategies and manage significant trading capital effectively.

Choosing the right professional account is a strategic decision. Consider your trading style, frequency, and capital. Whether you prioritize ultra-tight spreads, fixed commissions, or a full suite of premium services, these accounts are built to meet the rigorous demands of expert forex traders like you, helping you optimize your performance and achieve your financial goals.

Deposit and Withdrawal Methods for Exness Egypt

For traders in Egypt, seamless deposit and withdrawal processes are not just a convenience; they are essential for effective trading. You need to fund your trading account quickly and access your hard-earned profits without unnecessary hassle. Exness understands this critical need, offering a diverse range of convenient and secure payment options specifically tailored for its Egyptian clients. Your trading journey becomes significantly smoother when you have reliable and efficient ways to manage your funds.

Exness makes funding your account and withdrawing your profits a straightforward experience. Their user-friendly Personal Area allows you to initiate deposit limits and withdrawal requests with just a few clicks. The system is designed for both speed and clarity, ensuring you spend less time on administrative tasks and more time focusing on market opportunities. This dedication to efficient transaction speed is a hallmark of the Exness platform for Egyptian traders.

Key Payment Methods Available to Exness Egypt Traders:

Electronic Payment Systems: E-wallets like Skrill, Neteller, and Perfect Money offer incredibly fast, often instant, funding and withdrawal solutions. Many Egyptian traders find these digital wallets exceptionally convenient for their online transactions, providing swift access to funds.

Bank Cards: Visa and Mastercard remain universally popular choices for secure transactions. You can use your debit or credit card for direct deposits into your trading account. Withdrawals are also seamlessly processed back to your card, offering a familiar and reliable method.

Local Bank Transfers: For those who prefer traditional banking, direct bank transfers allow you to move funds from your Egyptian bank account directly to your Exness trading account and vice-versa. This method offers familiarity, robust security, and the comfort of using your established banking relationships.

Cryptocurrencies: Embracing modern financial trends, Exness supports various popular cryptocurrencies for both deposits and withdrawals. This offers a modern, often cost-effective, and decentralized alternative for tech-savvy traders in Egypt who appreciate the benefits of digital assets.

Important Considerations for Your Transactions:

| Consideration | Exness Egypt Approach |

|---|---|

| Processing Speed | Many methods provide instant deposits. Withdrawal requests typically process within minutes to a few hours, depending on the chosen method and bank processing times. |

| Transaction Fees | Exness generally prides itself on charging no commission on deposits or withdrawals, making your financial transactions more cost-effective and maximizing your trading capital. |

| Security | All transactions on the platform are encrypted with advanced protocols, safeguarding your personal and financial information against unauthorized access. |

| Minimum/Maximum Limits | Limits vary by specific payment method, but Exness offers flexibility to accommodate various trading capital sizes, from small initial deposits to large withdrawal requests for experienced Egyptian traders. |

Pro Tip for Egyptian Traders: Always verify the most current local payment options available directly within your Exness Personal Area, as these can sometimes be updated to better serve regional needs. Ensure your registered account details precisely match your payment method details to avoid any potential delays in processing. For the fastest possible processing of your withdrawal requests, consider initiating them during standard business hours. Smart management of your funds is an integral part of successful forex trading!

Popular Payment Options for Egyptian Traders

Navigating the world of forex trading requires not only sharp analytical skills but also reliable and convenient ways to manage your funds. For Egyptian traders, choosing the right payment option is crucial for smooth deposits and withdrawals. A seamless financial process allows you to focus on your trades without unnecessary delays or complications. Let’s explore some of the most popular methods that traders in Egypt often use to fund their accounts and withdraw their profits.

Here are some of the widely accepted payment solutions that cater to the needs of forex traders across Egypt:

- Bank Transfers: Traditional bank wire transfers remain a popular and secure method. You can directly transfer funds from your local Egyptian bank account to your brokerage account. This option is generally reliable for larger transactions, though it might take a few business days for funds to reflect.

- Credit and Debit Cards: Visa and MasterCard are universally accepted and offer one of the fastest ways to deposit funds. Most brokers support these cards, allowing instant deposits which means you can start trading almost immediately after funding your account. Withdrawals to cards can take a few days to process.

- E-wallets (Electronic Wallets): Digital wallets like Skrill, Neteller, and Perfect Money have gained significant traction among forex traders globally, and Egyptians are no exception. They offer speed, convenience, and an added layer of privacy by acting as an intermediary between your bank and your broker. Deposits and withdrawals are usually very fast, often instant.

- Local Payment Solutions: Some brokers integrate with local Egyptian payment gateways or even offer direct bank transfers to Egyptian banks, which can simplify the process further and reduce potential fees associated with international transactions. It’s always worth checking if your chosen broker provides such localized options.

When selecting your preferred payment method, always consider factors like processing times, transaction fees, and any deposit or withdrawal limits set by your broker. A good practice is to use the same method for both deposits and withdrawals, as this often streamlines the verification process and ensures a smoother financial experience.

Transaction Fees and Processing Times with Exness

Understanding the financial mechanics of your trading platform is paramount for effective capital management. When you trade with Exness, knowing the ins and outs of transaction fees and processing times for your deposits and withdrawals empowers you to make smarter, more informed decisions about your trading capital. You want your funds accessible when you need them, and you want to minimize unnecessary costs. Exness strives to provide a transparent and efficient financial environment for traders worldwide.

When it comes to withdrawing your hard-earned profits, Exness maintains a strong focus on speed and reliability. Processing times are a critical factor for any trader, and Exness understands this necessity. For most e-wallet withdrawal options, you can expect near-instant processing, often within minutes or a few hours after your request is approved.

For deposits, Exness generally offers a straightforward and cost-effective approach. Many popular deposit methods, including bank cards, e-wallets, and bank transfers, come with zero transaction fees directly from Exness. This means the amount you deposit is the full amount that reflects in your trading account, allowing you to maximize your initial capital for market engagement. While Exness aims to keep your entry costs low, always be mindful of potential fees charged by your chosen payment system provider or intermediary banks. These are external charges, not levied by Exness itself, and they can sometimes apply, especially for international bank transfers or specific local payment options.

Bank transfers, while highly secure, typically take longer, usually between one to seven business days, depending on your bank and location. Remember, the first withdrawal often requires a verification process, which is a standard security measure to protect your funds and prevent unauthorized access. Once your account is fully verified, subsequent withdrawals tend to be much faster.

Here’s a quick look at general expectations for financial operations with Exness:

- Deposits:

- E-wallets (Skrill, Neteller, Perfect Money etc.): Typically instant.

- Bank Cards (Visa, Mastercard): Instant to a few hours.

- Bank Transfers: Can range from instant (for specific local options) to 3-5 business days.

- Exness Fees: Generally 0% on most methods.

- Withdrawals:

- E-wallets: Often instant to a few hours after approval.

- Bank Cards: 3-10 business days.

- Bank Transfers: 1-7 business days.

- Exness Fees: Varies by method; some options are fee-free, others may have a small flat fee or percentage.

Exness prides itself on offering quick withdrawals and transparent fee structures, ensuring you have clear visibility over your financial operations. This commitment allows you to focus more on your trading strategies and less on the complexities of moving your money around. Always check the specific details for your preferred payment methods within your personal area on the Exness platform, as conditions can vary by region and chosen service.

Trading Platforms Offered by Exness in Egypt (MT4, MT5, Exness Terminal)

Choosing the right trading platform is crucial for success in the dynamic forex market. As an Egyptian trader, you need a reliable, feature-rich, and user-friendly environment to execute your strategies. Exness understands these needs and offers a robust selection of platforms designed to cater to various trading styles and preferences. Whether you are a seasoned professional or just starting your journey, Exness provides the tools to help you navigate the markets effectively. You gain access to industry-leading solutions that ensure seamless trading and deep market insight right at your fingertips.

MetaTrader 4 (MT4): The Time-Tested Forex Workhorse

MetaTrader 4, or MT4, remains the gold standard for forex traders globally, and it is incredibly popular among Egyptian traders. Its reputation comes from its powerful charting capabilities, extensive analytical tools, and a user-friendly interface that simplifies complex trading tasks. Many traders prefer MT4 for its stability and the vast community support available, offering countless custom indicators and Expert Advisors (EAs).

- Comprehensive Charting: Analyze market trends with ease using a wide range of customizable charts and timeframes.

- Automated Trading with EAs: Deploy Expert Advisors to automate your trading strategies 24/5, removing emotional biases.

- Rich Indicator Library: Access a huge selection of technical indicators to enhance your market analysis.

- Secure and Reliable: Benefit from a platform known for its robust security features and dependable performance.

MT4 stands as a testament to reliability and efficiency, making it an excellent choice for dedicated forex trading in Egypt.

MetaTrader 5 (MT5): The Advanced Multi-Asset Gateway

MetaTrader 5, often seen as the successor to MT4, expands your trading horizons far beyond just forex. MT5 offers enhanced functionalities, more analytical tools, and access to a broader range of financial instruments, including stocks, indices, and commodities, alongside forex. It is ideal for traders looking to diversify their portfolios and employ more sophisticated strategies across various asset classes.

Discover the key differences that set MT5 apart:

| Feature | MT4 | MT5 |

|---|---|---|

| Number of Timeframes | 9 | 21 |

| Execution Types | Market, Instant | Market, Instant, Request, Exchange |

| Economic Calendar | No | Yes (Integrated) |

| Netting and Hedging | Hedging Only | Both Netting and Hedging |

| Market Depth (DOM) | No | Yes |

Many Egyptian traders are migrating to MT5 to leverage its advanced capabilities and access new trading opportunities. As one trader wisely put it,

“MT5 gives me the power to explore so many markets without switching platforms. It’s a true game-changer for diversification and deep market analysis.”

Exness Terminal: Seamless, Web-Based Trading on the Go

For traders who value convenience and accessibility, the Exness Terminal offers a powerful, web-based solution. You can access this innovative platform directly from your browser, eliminating the need for any downloads or installations. Designed with user experience in mind, Exness Terminal provides a clean, intuitive interface that makes trading simple and efficient, even for beginners. It integrates seamlessly with your Exness account, offering real-time market data and quick order execution.

Why traders love Exness Terminal:

- Instant Access: Start trading immediately from any device with an internet connection – no software required.

- Intuitive Design: Navigate easily with a user-friendly interface that simplifies complex trading operations.

- Integrated Analysis: Access essential trading tools and analytics directly within the platform.

- Fast Execution: Benefit from Exness’s commitment to speedy and reliable trade execution, even during volatile market conditions.

Exness Terminal is perfect for traders in Egypt who need flexibility and a streamlined trading experience without compromising on powerful features.

Available Financial Instruments for Egyptian Traders

Are you an Egyptian trader looking to dive into the exciting world of financial markets? The good news is, you have a growing range of options at your fingertips! Egypt’s financial landscape continues to evolve, offering incredible opportunities for those ready to learn and execute strategic trades. Understanding the instruments available is your first step toward building a diversified portfolio and achieving your trading goals. Let’s explore the key financial instruments accessible to Egyptian traders today.

Here are some of the primary financial instruments Egyptian traders often engage with:

- Forex (Foreign Exchange)

- Stocks (Equities)

- Commodities

- Indices

- Exchange-Traded Funds (ETFs)

- Cryptocurrencies

Forex (Foreign Exchange)

The forex market is the largest and most liquid financial market globally. For Egyptian traders, it offers the chance to trade currency pairs, speculating on the exchange rate fluctuations between, for example, the Egyptian Pound and the US Dollar, or other major global currencies like EUR/USD, GBP/JPY, and USD/CHF. Its 24/5 accessibility and high liquidity make it a popular choice for traders seeking dynamic opportunities. Many online brokers provide access to this market, making it relatively easy to get started with a trading account.

Stocks (Equities)

Investing in stocks means buying a share of ownership in publicly traded companies. Egyptian traders can access both local equities listed on the Egyptian Exchange (EGX) and, through international brokers, global stocks from exchanges like the NYSE or NASDAQ. Trading stocks allows you to potentially profit from a company’s growth, dividends, and overall market performance. It’s a classic way to participate in the real economy and build long-term wealth.

“Successful trading isn’t just about picking the right instrument; it’s about understanding its nuances and how it fits your personal trading strategy and risk tolerance.”

Commodities

Commodities are raw materials or primary agricultural products that can be bought and sold. Think gold, silver, crude oil, natural gas, and agricultural products like wheat and corn. Trading commodities allows Egyptian traders to speculate on price movements driven by supply and demand, geopolitical events, and economic cycles. Gold and oil are particularly popular, often acting as safe havens or inflation hedges.

Indices

Stock market indices represent the performance of a basket of stocks from a particular exchange or sector. Instead of trading individual company shares, you can trade an index like the EGX 30 (representing the top 30 companies on the Egyptian Exchange), the S&P 500 (US), or the DAX 40 (Germany). Trading indices offers a way to diversify your exposure across an entire market segment, rather than relying on the performance of just one company.

Choosing the right financial instrument depends on several factors, including your trading style, risk tolerance, capital available, and market knowledge. Many Egyptian traders find success by starting with one or two instruments they understand well and gradually expanding their portfolio as they gain experience. Diversification across different instrument types can also help manage risk and potentially enhance returns over time.

Customer Support and Localized Services for Exness Egypt Users

When you navigate the dynamic forex market, having reliable support by your side isn’t just a convenience; it’s a necessity. For traders in Egypt, Exness understands this critical need, offering a robust customer support system tailored to local requirements. We know that timely assistance can make all the difference, whether you’re a seasoned pro or just starting your trading journey.

Our commitment to Egyptian traders shines through our localized services. We speak your language, understand your specific market nuances, and are ready to assist with any query, big or small. This localized approach ensures that you always feel understood and supported, eliminating communication barriers that can often hinder effective problem-solving.

What to Expect from Exness Egypt Customer Support:

- Multilingual Assistance: Our dedicated support team includes agents fluent in Arabic, ensuring clear and comfortable communication for all Egyptian traders.

- 24/7 Availability: Trading never sleeps, and neither do we. Get round-the-clock support for your account, trading platform issues, or any urgent questions you might have.

- Prompt Responses: We pride ourselves on quick response times, minimizing any downtime or frustration you might experience. Your time is valuable, and we respect that.

- Comprehensive Problem Solving: From deposit and withdrawal inquiries to technical glitches with your trading terminal, our experts are equipped to guide you through every challenge.

- Account Management Help: Need assistance with account verification, changing details, or understanding specific trading conditions? Our team is here to help simplify complex processes.

We believe effective support goes beyond just answering questions. It’s about empowering you with the knowledge and confidence to trade effectively. Our support agents don’t just provide answers; they offer solutions, often guiding you step-by-step through processes to ensure you gain a complete understanding.

Choosing a broker with strong localized customer support can significantly enhance your trading experience. It’s about having a trusted partner who understands your needs and is always there to help you succeed in the forex market. We continually refine our services based on trader feedback, ensuring our support remains top-tier and perfectly aligned with the needs of our Exness Egypt community.

Advantages of Trading with Exness in Egypt

Diving into the forex market offers exciting opportunities, and for traders in Egypt, choosing the right broker is a critical step. Exness stands out as a strong contender, providing a tailored experience that resonates with local market needs. Let’s explore some of the key benefits you gain when you choose Exness for your trading journey.

Why Exness Appeals to Egyptian Traders

Exness offers a comprehensive trading environment designed to empower both novice and experienced traders. Their approach prioritizes accessibility, efficiency, and robust support, making it a preferred choice for many seeking to navigate the global currency markets from Egypt.

Flexible Account Options and Low Spreads

- Diverse Account Types: Exness provides a range of account types, including Standard, Raw Spread, and Zero accounts. This variety allows traders to select an option that perfectly matches their trading style, capital, and risk tolerance. Whether you prefer commission-free trading or ultra-low spreads with a small commission, there’s an account for you.

- Competitive Spreads: One of the biggest draws is their incredibly tight spreads, especially on major currency pairs. These low spreads significantly reduce your trading costs, potentially increasing your profitability over time. This is a major advantage for scalpers and day traders who execute numerous trades.

Advanced Trading Platforms and Tools

Access to reliable and feature-rich trading platforms is non-negotiable for serious traders. Exness delivers on this front with industry-standard solutions:

| Platform | Key Features |

|---|---|

| MetaTrader 4 (MT4) | User-friendly interface, extensive charting tools, Expert Advisor (EA) support, ideal for automated trading. |

| MetaTrader 5 (MT5) | More indicators and timeframes, built-in economic calendar, depth of market (DOM), supports more asset classes. |

| Exness Terminal (Web & Mobile) | Proprietary platform, intuitive design, real-time quotes, fast execution, accessible from any device. |

Instant Withdrawals and Deposits

Financial flexibility is a top priority for any trader. Exness truly excels in this area with its commitment to instant transactions. You can deposit and withdraw funds quickly and smoothly, often within minutes, thanks to a wide array of payment methods. This ensures your capital is always accessible when you need it, a significant peace of mind for active traders in Egypt.

Robust Customer Support and Localization

Effective customer support can make or break your trading experience. Exness offers 24/7 multilingual customer service, ensuring you receive assistance whenever you need it. For Egyptian traders, this includes support in Arabic, making communication seamless and issues easily resolvable. Their dedicated local support team understands the unique requirements of the Egyptian market.

“Exness truly understands the needs of international traders. Their commitment to rapid transactions and accessible support creates a reliable trading environment.”

In conclusion, Exness provides a compelling package for forex traders in Egypt. From advantageous trading conditions like low spreads and diverse accounts to cutting-edge platforms, swift financial operations, and robust localized support, they equip you with the tools and confidence to pursue your trading goals effectively.

Potential Considerations for Egyptian Traders Using Exness

Engaging in online forex trading presents exciting opportunities, and many Egyptian traders find platforms like Exness highly appealing due to their competitive trading conditions and wide array of financial instruments. However, as an Egyptian trader, you should always consider specific factors before you dive in. This thoughtful approach ensures a smoother and more effective trading journey, tailored to your local context and individual needs.

A crucial area to examine is the local regulatory environment in Egypt. While Exness operates under robust international licenses, understanding how Egyptian financial authorities view and regulate online forex activities is paramount. Always stay informed about any local restrictions or specific requirements that might impact your trading operations, especially concerning fund transfers and reporting.

Here are some key aspects you should thoroughly review:

- Funding and Withdrawals: Carefully evaluate the available deposit and withdrawal methods. Do they support local Egyptian payment solutions, or are international transfers the primary option? What are the associated fees and typical processing times for converting Egyptian Pounds (EGP) to your account’s base currency, usually USD? Smooth and cost-effective fund management is absolutely vital for sustained and successful trading activity. Ensure the process is convenient for you.

- Account Types and Features: Exness offers a variety of account types, each designed with different minimum deposits, varying spreads, and distinct leverage options. Consider which account structure best suits your trading style, your risk tolerance, and the capital you plan to deploy. Pay close attention to any swap-free options, as these can be particularly advantageous under certain religious considerations, which are often highly relevant in the region.

- Customer Support Accessibility: Check if Exness provides customer support in Arabic and if their support hours align conveniently with Egyptian time zones. Prompt, clear, and culturally sensitive communication can resolve any issues quickly, making your overall trading experience far less stressful and more productive. Efficient support is a major asset.

- Trading Conditions and Instrument Availability: While Exness is widely recognized for its tight spreads and high leverage, take the time to understand exactly how these apply to the specific currency pairs or other financial instruments you intend to trade. Also, consider the potential impact of market volatility during peak trading hours for the Egyptian market, and how this might affect your strategies and execution.

By thoroughly considering these points, Egyptian traders can make more informed decisions, enhancing their trading experience and better aligning it with their personal circumstances and local financial landscape.

How to Open an Exness Account in Egypt: A Step-by-Step Guide

Are you an aspiring trader in Egypt looking to dive into the exciting world of forex and CFD trading? Exness offers a user-friendly platform, competitive conditions, and excellent support, making it a top choice for many traders. Opening an account with Exness from Egypt is a straightforward process when you know the steps. Let’s walk through it together and get you ready to trade!

Your Journey to Trading Begins Here: Step-by-Step Account Opening

Getting your Exness account up and running is simpler than you might think. Follow these clear steps to join the thousands of traders already benefiting from Exness’s offerings:

Step 1: Visit the Exness Website

Start by navigating to the official Exness website. Ensure you are on the legitimate site to protect your personal and financial information. Look for the “Open Account” or “Register” button, usually prominently displayed on the homepage.

Step 2: Complete the Registration Form

You’ll find a simple registration form asking for essential details. This typically includes your country of residence (Egypt, in this case), your email address, and a strong password. Create a unique and secure password that combines letters, numbers, and symbols to keep your account safe.

Step 3: Verify Your Email Address

After submitting the form, Exness sends a verification code or link to the email address you provided. Check your inbox (and spam folder, just in case) for this email. Enter the code on the Exness site or click the verification link to confirm your email. This step is crucial for activating your account.

Step 4: Provide Personal Information

Once your email is verified, the system will prompt you to complete your profile. You’ll need to enter more personal details like your full name, date of birth, and phone number. Exness requires this information to comply with regulatory standards and to ensure a secure trading environment for everyone.

Step 5: Verify Your Identity and Residency (KYC)

This is a standard and vital step for all regulated brokers known as Know Your Customer (KYC). You’ll upload documents to verify your identity and proof of residency. For identity, a clear photo of your national ID card or passport usually works. For proof of residency, a utility bill (electricity, water, gas) or a bank statement showing your name and address, issued within the last three to six months, is typically accepted. Make sure the documents are clear, legible, and match the information you provided earlier.

Step 6: Choose Your Account Type and Set Trading Preferences

Exness offers various account types, like Standard, Standard Cent, Raw Spread, and Zero, each designed to suit different trading styles and experience levels. Consider your trading goals, preferred instruments, and capital before making a choice. You can also select your preferred trading platform (MetaTrader 4 or MetaTrader 5) and leverage settings. Don’t worry, you can always open additional account types later.

Step 7: Fund Your Account

With your account verified and set up, you are ready to deposit funds. Exness provides several convenient payment methods suitable for Egyptian traders, including local bank transfers, e-wallets, and more. Choose the method that works best for you, enter the amount, and follow the instructions to complete your deposit. Always check for any minimum deposit requirements.

Step 8: Start Trading!

Congratulations! Once your deposit is processed and appears in your account balance, you can download your chosen trading platform, log in with your account credentials, and begin your trading journey. Explore the markets, analyze charts, and place your first trade. Remember to start with a demo account if you’re new to test your strategies without risking real money.

Opening an Exness account from Egypt is a straightforward path to accessing global financial markets. By following these steps carefully, you’ll be ready to explore trading opportunities in no time. Welcome to the world of informed trading!

Leverage, Spreads, and Trading Conditions for Egyptian Users

For every dedicated forex trader in Egypt, understanding the intricacies of leverage, spreads, and overall trading conditions is absolutely crucial. These elements directly impact your potential profits, your trading costs, and even your peace of mind. Let’s dive into what makes these factors so important for the Egyptian trading community.

Unlocking Potential with Leverage

Leverage is a powerful tool in forex trading. It allows you to control a larger position in the market with a smaller amount of your own capital. Imagine it as a financial booster that multiplies your buying power. For example, with 1:500 leverage, a $100 deposit can control a $50,000 position.

The Power and Peril of Leverage:

While the potential for profit increases, so does the risk of loss. A small unfavorable move against your position can lead to substantial losses if you don’t manage your risk wisely. Always use stop-loss orders to protect your capital.

- Magnified Opportunities: Leverage can significantly amplify your potential gains from even small market movements. It opens doors to larger trades that might otherwise be out of reach for a typical Egyptian trader’s initial capital.

- Risk Management is Key: While the potential for profit increases, so does the risk of loss. A small unfavorable move against your position can lead to substantial losses if you don’t manage your risk wisely. Always use stop-loss orders to protect your capital.

- Availability: Reputable brokers serving the Egyptian market offer various leverage options, often ranging from 1:50 to 1:1000 or even higher. Always choose a leverage level that aligns with your risk tolerance and trading strategy.

Navigating Spreads: Your Trading Costs Explained

Spreads are essentially the cost of trading. It’s the difference between the bid price (what you can sell an asset for) and the ask price (what you can buy an asset for). This small difference is how brokers make their money. For Egyptian forex traders, understanding spreads is vital for managing trading expenses and optimizing profitability.

Types of Spreads You’ll Encounter:

Fixed Spreads: These remain constant regardless of market volatility. They offer predictability, which can be great for beginners or those who prefer consistent costs. However, they might be slightly wider than variable spreads during calm market conditions.

Variable Spreads: These fluctuate based on market supply and demand, liquidity, and volatility. They can become very tight during active market hours but might widen significantly during major news events or less liquid times. Many experienced traders prefer variable spreads for their potential for lower costs during high-liquidity periods.

“Always compare the typical spreads offered by different brokers on the currency pairs you trade most often. Even a fraction of a pip can add up over hundreds of trades, directly impacting your bottom line.”

Optimizing Your Trading Conditions as an Egyptian Trader

Beyond leverage and spreads, several other trading conditions play a significant role in your overall experience and success. A great trading environment ensures smooth execution and reliable support, crucial for traders operating in the dynamic forex market.

Key Trading Conditions to Consider:

| Condition | Why it Matters for Egyptian Traders |

|---|---|

| Execution Speed | Fast execution minimizes slippage, especially during volatile periods or when trading news. You want your orders filled at your desired price, or as close to it as possible. |

| Available Instruments | Look for a wide range of currency pairs, commodities, indices, and cryptocurrencies. Diversification helps you explore more opportunities beyond just major pairs. |

| Deposit/Withdrawal Methods | Convenient and secure local payment options, fast processing times, and low fees are essential for managing your trading capital efficiently from Egypt. |

| Customer Support | Responsive support, ideally available in Arabic, can quickly resolve issues and provide guidance, ensuring a smoother trading journey. |

| Platform Stability | A reliable and user-friendly trading platform (like MetaTrader 4 or 5) is non-negotiable. It should handle high trading volumes without freezing or crashing. |

Choosing the right broker that offers favorable leverage, competitive spreads, and excellent trading conditions truly sets the stage for a successful forex journey. Always do your research and pick a partner that prioritizes your needs as an Egyptian trader.

Exness Security Measures and Fund Protection for Egyptian Traders

As a seasoned trader, I know the first thing on your mind isn’t just profit, but safety. For Egyptian traders looking at Exness, understanding the broker’s commitment to security and fund protection is absolutely crucial. You invest your hard-earned capital, and you need to trade with complete peace of mind, knowing your assets are secure.

Exness prioritizes your security through a multi-layered approach, creating a robust shield around your investments. This isn’t just about meeting regulations; it’s about building trust and ensuring a safe trading environment for every client, especially our valuable Egyptian traders.

Key Pillars of Exness Security:

- Regulatory Compliance: Exness operates under strict regulatory oversight from various reputable financial bodies globally. This commitment to compliance means they adhere to rigorous standards for financial stability, transparency, and ethical conduct. For Egyptian traders, this regulatory backing provides an essential layer of assurance regarding the broker’s operations and integrity.

- Segregation of Client Funds: Your money is never mixed with the company’s operational capital. Exness holds all client funds in separate bank accounts. This vital practice ensures that your deposits are protected, even in unforeseen circumstances concerning the company. This separation is a cornerstone of effective fund protection.

- Negative Balance Protection: This feature is a game-changer for risk management. It means you can never lose more money than you have deposited in your trading account. If market conditions cause your balance to dip below zero, Exness automatically resets it to zero. This safeguard offers significant peace of mind, preventing unexpected debts.

- Robust Data Encryption: Your personal and financial data are safeguarded with advanced encryption technologies. All communication and transactions between you and the Exness platform are encrypted, protecting against unauthorized access and cyber threats. This strong digital security keeps your information private and secure.

Why Exness Fund Protection Matters for Egyptian Traders:

Navigating the global financial markets requires confidence, and that confidence stems directly from reliable fund protection. Exness understands the unique needs of its diverse client base, including Egyptian traders, offering services designed to instill trust and minimize risk exposure beyond market volatility.

Advantages of Exness’s Security Protocols:

- Peace of Mind: With strong regulatory oversight and segregated client accounts, you can focus on your trading strategies without constant worry about the safety of your funds.

- Risk Mitigation: Negative balance protection is a powerful tool, ensuring your potential losses are capped at your deposit amount. This is particularly valuable during highly volatile market periods.

- Data Confidentiality: Advanced encryption ensures your personal and financial details remain private, protected from any malicious external threats.

- Transparent Operations: The clear display of security measures and regulatory licenses shows Exness’s commitment to transparency, building a stronger relationship with its traders.

When you choose Exness, you’re not just selecting a trading platform; you’re partnering with a broker that takes your financial security seriously. This commitment ensures Egyptian traders can engage with global markets confidently, knowing their assets are under vigilant protection.

Exness Egypt: Frequently Asked Questions (FAQs)

Navigating the world of online trading can bring up many questions, especially when it comes to specific regions like Egypt. At Exness, we understand you want clear, concise answers before you start your trading journey. This section addresses the most common inquiries from Egyptian traders, providing you with the essential information you need to trade with confidence and clarity.

Here are some of the questions we frequently receive from our valued clients in Egypt:

Is Exness regulated in Egypt?

Exness is a global broker with licenses from multiple reputable regulatory bodies worldwide. While we do not hold a specific local license directly within Egypt, our operations are overseen by international authorities, ensuring high standards of transparency and security for all our clients, including those in Egypt. Our commitment to strict financial practices protects your trading experience.

What account types does Exness offer for Egyptian traders?

Exness provides a diverse range of account types designed to suit various trading styles and experience levels. Egyptian traders can choose from popular options like Standard, Standard Cent, Raw Spread, Zero, and Pro accounts. Each account offers unique features regarding spreads, commissions, and execution, allowing you to select the best fit for your forex trading strategy. You’ll find competitive conditions whether you’re a beginner or an experienced trader.

How can I deposit and withdraw funds with Exness in Egypt?

We offer a variety of convenient deposit and withdrawal methods tailored for our Egyptian clients. These often include local payment options, bank transfers, and electronic payment systems. The goal is to make your transactions smooth and efficient, allowing you to manage your funds with ease. You can typically find detailed information on available methods, processing times, and any associated fees directly within your personal area on our website.

What is the minimum deposit for Exness Egypt accounts?

The minimum deposit amount at Exness varies depending on the chosen account type. For many of our popular accounts, such as the Standard account, you can start with a very low initial deposit, making forex trading accessible to a wider range of traders in Egypt. Professional accounts may require a slightly higher initial deposit. Always check the specific requirements for your preferred account type on our website.

Which trading platforms are available on Exness for Egyptian clients?

Exness offers industry-leading trading platforms to ensure a robust and flexible trading experience. Egyptian clients can access the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are available across various devices, including desktop, web, and mobile, providing you with the flexibility to trade anywhere, anytime. Both MT4 and MT5 offer advanced charting tools, analytical features, and support for automated trading strategies.

Does Exness offer local customer support in Egypt?

While our main support centers operate globally, Exness provides multi-language customer support that is available around the clock. Our dedicated support team is ready to assist Egyptian traders with any queries or issues they might encounter. You can reach us via live chat, email, or phone, ensuring you always have access to timely assistance in your preferred language, including Arabic.

What about spreads and commissions at Exness for forex trading in Egypt?

Exness is well-known for offering highly competitive trading conditions, including tight spreads and low commissions. The specific spreads and commissions depend on your chosen account type. For instance, our Raw Spread and Zero accounts offer incredibly tight spreads, often starting from 0.0 pips, with a small commission per lot. Standard accounts typically have zero commission with slightly wider spreads. We strive to provide transparent pricing, helping you maximize your trading potential in the forex market.

“Successful trading isn’t just about strategy; it’s also about having a clear understanding of your broker’s services. Always take the time to read through FAQs and terms to ensure you align with their offerings. This clarity empowers your decisions.”

Frequently Asked Questions

Is trading with Exness legal for Egyptian citizens?

Yes, trading with Exness is available to Egyptian traders. While Exness is an internationally regulated broker, Egyptian citizens are generally permitted to trade with such offshore entities. Exness adheres to high standards of security and transparency under its global licenses.

What is the minimum deposit to start trading with Exness in Egypt?

The minimum deposit at Exness depends on the account type. Standard accounts often have a very low minimum deposit, making it accessible for beginners. Professional accounts may require a higher initial deposit. You can find the specific amount for each account on the Exness website.

What payment methods can I use to fund my Exness account from Egypt?

Exness offers several convenient payment methods for Egyptian traders, including bank cards (Visa/Mastercard), e-wallets like Skrill and Neteller, local bank transfers, and cryptocurrencies, ensuring fast and secure deposits and withdrawals.

Does Exness offer customer support in Arabic?

Yes, Exness provides multilingual customer support available 24/7, which includes assistance in Arabic. This ensures that Egyptian traders can get clear and prompt help with their inquiries.

Which trading platforms can I use with Exness in Egypt?

Egyptian traders can use the globally popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are available on desktop, web, and mobile. Exness also offers its own proprietary Exness Terminal for a seamless web-based trading experience.