- Exness’s Presence and Role in the Chinese Market

- Regulatory Landscape for Exness in China

- Key Trading Conditions Exness Offers to Chinese Clients

- Flexible Account Types for Diverse Strategies

- Competitive Spreads and Low Trading Costs

- High Leverage Options for Capital Efficiency

- Seamless Deposits and Withdrawals for Chinese Clients

- Dedicated Customer Support in Your Language

- Popular Payment Methods for Exness China Users

- Key Payment Methods for Exness China:

- Exploring Exness Account Types for Chinese Traders

- Standard Account Options

- Why Choose a Standard Account?

- Professional Account Options

- Is a Professional Account Right for You?

- Advanced Trading Platforms Available for Exness China

- Key Platforms and Their Advantages:

- Dedicated Customer Support and Localization Efforts by Exness

- Ensuring Fund Security and Trader Protection with Exness

- Analyzing Exness Performance vs. Local Chinese Brokers

- Key Comparison Points: Exness vs. Local Chinese Brokers

- Advantages of Choosing Exness for Forex Trading in China

- Key Benefits for Chinese Traders

- Navigating Potential Challenges for Exness China Users

- Common Challenges and Navigation Strategies

- Internet Connectivity and Access Restrictions

- Deposit and Withdrawal Methods

- Account Verification Process

- Customer Support Accessibility and Language

- Strategies for Optimizing Trading with Exness in China

- Key Optimization Strategies for Exness Traders in China

- The Future of Exness and the Chinese Forex Industry

- Market Dynamics and Exness’s Position

- Anticipating Growth and Innovation

- How to Open an Exness Account from China

- Step-by-Step Account Opening Process

- Essential Documents for Verification

- Funding Your Exness Account

- Exness China: Common Questions Answered

- What You Need to Know About Exness and Trading in China:

- Key Considerations for Traders

- Frequently Asked Questions

Exness’s Presence and Role in the Chinese Market

Exness has cultivated a significant and influential presence within the dynamic Chinese forex market. This isn’t by chance; it’s the result of a deliberate strategy focused on understanding and meeting the unique needs of Chinese traders. As a leading global broker, Exness recognizes the immense potential and sophistication of the trading community in China, making it a key focus for its operational strategies.

The role Exness plays extends beyond simply offering a platform. It’s about building trust and providing an environment where Chinese traders feel comfortable and empowered. This includes tailoring services that resonate deeply with local preferences and regulatory nuances. The commitment to a superior trading experience has allowed Exness to carve out a substantial market share, becoming a preferred choice for many active participants in the region.

The broker’s dedication to transparency and reliable service has fostered a strong reputation among Chinese traders. This steadfast commitment helps maintain its position as a go-to platform, contributing significantly to the accessibility and growth of forex trading within the country. Exness continues to adapt and innovate, ensuring its offerings remain perfectly aligned with the evolving demands of one of the world’s most exciting trading communities.

Exness makes several key contributions to the Chinese trading landscape, ensuring it remains a top choice:

- Localized Support: Exness provides dedicated customer support in Mandarin, ensuring that traders can communicate effectively and resolve issues quickly without language barriers. This direct line of communication is crucial for building strong relationships within the Chinese forex community.

- Region-Specific Payment Solutions: Understanding the unique payment ecosystem in China, Exness offers a variety of popular local deposit and withdrawal methods, making transactions seamless and convenient for Chinese traders.

- Competitive Trading Conditions: Chinese traders often seek optimal trading conditions. Exness delivers this with tight spreads, ultra-fast execution speeds, and a wide array of instruments, directly addressing the demands of a high-volume trading environment.

- Educational Resources: Recognizing the importance of knowledge, Exness provides valuable educational content and market analysis, often localized, to help Chinese traders enhance their skills and make informed decisions about the forex market.

“Exness doesn’t just operate in China; it genuinely integrates with the trading culture, offering the tools and support essential for success in such a competitive market.”

The broker’s dedication to transparency and reliable service has fostered a strong reputation among Chinese traders. This steadfast commitment helps maintain its position as a go-to platform, contributing significantly to the accessibility and growth of forex trading within the country. Exness continues to adapt and innovate, ensuring its offerings remain perfectly aligned with the evolving demands of one of the world’s most exciting trading communities.

Regulatory Landscape for Exness in China

Navigating the financial landscape in China presents unique challenges for international forex brokers like Exness. The regulatory environment for foreign exchange trading within the People’s Republic of China is notably complex and often differs significantly from Western jurisdictions. Unlike many other major markets, there isn’t a singular, clear-cut regulatory body that directly oversees and licenses international online forex brokers serving Chinese citizens.

The People’s Bank of China (PBOC) and the China Banking Regulatory Commission (CBRC), along with other domestic authorities, primarily focus on regulating local financial institutions and the onshore capital markets. This creates a distinctive situation for foreign brokers. International forex trading is often considered a “grey area” for Chinese residents, meaning while it’s not explicitly forbidden, it also lacks explicit governmental endorsement or a dedicated regulatory framework for overseas entities.

For traders in China considering an international broker, this regulatory nuance means they often rely on the broker’s global licenses and reputation. Exness, for example, operates under strict regulations from various reputable international financial authorities such as the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK (though UK operations might differ), and other global regulators. These licenses ensure a high level of client protection, operational transparency, and adherence to international financial standards.

Therefore, while Exness does not hold a specific Chinese regulatory license (as such a license for international online forex brokers is not typically issued), its ability to serve Chinese clients stems from its strong international regulatory framework and its commitment to upholding global best practices in client fund segregation, data security, and fair trading conditions. This approach allows Exness to build trust and provide services to traders who prioritize safety and reliability based on globally recognized standards, even within China’s unique regulatory context.

Key Trading Conditions Exness Offers to Chinese Clients

Exness understands the unique needs of Chinese traders, and they have tailored their trading conditions to provide a powerful and reliable experience. Their commitment focuses on creating an environment where efficiency, flexibility, and strong support come together. This means you gain access to a platform designed for serious market participation, whether you are just starting or have years of experience navigating the financial markets.

When you choose Exness, you are not just selecting a broker; you are partnering with a platform that prioritizes your trading journey. They work hard to ensure the tools and conditions you need are readily available, helping you make the most of every market opportunity.

Flexible Account Types for Diverse Strategies

Exness offers a range of account types, each designed to suit different trading styles and capital levels. This flexibility means you can pick the account that best matches your individual approach to the forex market.

- Standard Account: Perfect for new traders and those who prefer straightforward conditions. You benefit from stable spreads and no commission per lot. It’s an excellent entry point to explore the market.

- Professional Accounts (Raw Spread, Zero, Pro): These accounts cater to experienced traders seeking tighter spreads, lower commissions, or instant execution. If you engage in high-volume trading or use specific strategies like scalping, these options provide the optimal environment.

Each account type gives you access to a wide variety of trading instruments, including major and minor currency pairs, metals, cryptocurrencies, and indices. This broad selection allows you to diversify your portfolio and explore different market opportunities.

Competitive Spreads and Low Trading Costs

One of the most attractive aspects of trading with Exness is their commitment to offering highly competitive spreads. Low spreads mean lower trading costs for you, directly impacting your profitability over time. They understand that every pip counts, especially for active traders.

“Exness consistently strives to provide some of the tightest spreads in the industry, making their platform a cost-effective choice for traders worldwide, including their valued Chinese clients.”

Their advanced technology and strong liquidity providers help maintain these tight spreads, even during volatile market conditions. This stability provides a more predictable trading environment, allowing you to focus on your strategy rather than worrying about excessive costs.

High Leverage Options for Capital Efficiency

Exness offers incredibly flexible leverage options, including unlimited leverage under certain conditions. This can significantly amplify your trading power, allowing you to control larger positions with a smaller amount of capital. However, it’s crucial to understand how leverage works.

Consider the benefits and risks of high leverage:

| Advantages of High Leverage | Disadvantages of High Leverage |

|---|---|

| Magnifies potential profits on successful trades. | Amplifies potential losses on unsuccessful trades. |

| Allows control of larger positions with less capital. | Increases margin call risk if market moves against you. |

| Opens up more trading opportunities for smaller accounts. | Requires strict risk management and discipline. |

Exness promotes responsible trading and provides tools like margin call protection to help manage risk effectively. They also offer educational resources to help traders understand leverage fully before they use it.

Seamless Deposits and Withdrawals for Chinese Clients

For Chinese clients, convenient and fast funding methods are crucial. Exness excels in this area, offering a variety of localized payment options that ensure your funds move quickly and securely. You can deposit and withdraw your capital with confidence, knowing the process is efficient and reliable.

They pride themselves on instant withdrawal processing for many payment methods, meaning you get access to your profits almost immediately. This commitment to swift transactions sets Exness apart, providing peace of mind and operational efficiency.

Dedicated Customer Support in Your Language

Exness prioritizes excellent customer service. They offer dedicated support for their Chinese clients, available in Mandarin, ensuring you can communicate effectively and get the help you need without language barriers. Their support team consists of knowledgeable professionals ready to assist with any queries you might have, from technical issues to account management.

You can reach their support team through multiple channels, including live chat, email, and phone. This accessibility means help is always just a few clicks or a call away, making your trading experience smoother and more enjoyable. They truly care about providing a responsive and helpful service.

Popular Payment Methods for Exness China Users

As a forex trader, you understand that smooth and reliable transactions are crucial for your trading journey. When you trade with Exness in China, knowing your options for depositing funds and withdrawing your profits efficiently makes a significant difference. Exness prioritizes providing convenient and secure payment solutions tailored to the local market, ensuring you can focus on your strategies without worrying about your money.

Chinese traders have access to a variety of popular payment methods designed for speed and ease of use. These options help you manage your funds effectively, whether you are topping up your trading account or cashing out your gains. Let’s explore some of the most favored choices that Exness offers to its users in China.

Key Payment Methods for Exness China:

- China UnionPay: This is arguably the most widely used and accepted payment method across China. UnionPay allows direct bank transfers from your local bank account, offering a familiar and secure way to fund your Exness account. It’s highly convenient for both deposits and withdrawals, often processing transactions quickly.

- Local Bank Transfers: Exness supports direct transfers from various Chinese banks. This method is straightforward and widely accessible, making it a go-to choice for many traders. You can initiate deposits or withdrawals directly from your online banking platform, providing a seamless experience.

- Online Payment Systems: While specific e-wallets like Alipay or WeChat Pay might have varying direct support depending on Exness’s current partnerships, Exness often facilitates deposits through aggregated online payment systems that connect to these popular local e-wallets. These systems offer quick and efficient transactions, leveraging the digital payment habits of Chinese users.

When choosing your preferred payment method, always consider factors like processing times, any potential fees (though Exness often offers zero fees on deposits and withdrawals), and transaction limits. Exness aims to provide transparency on all these aspects, so you can make informed decisions. Their commitment to offering robust local payment solutions underscores their dedication to serving the Chinese trading community effectively.

Ultimately, the goal is to provide you with a hassle-free financial experience. Whether you’re making your initial deposit or celebrating a profitable withdrawal, Exness offers popular payment methods that cater specifically to the needs and preferences of traders in China, making your trading journey smoother and more enjoyable.

Exploring Exness Account Types for Chinese Traders

Are you a Chinese trader looking for the perfect platform to elevate your forex journey? Exness offers a diverse range of trading accounts designed to meet the needs of every trader, from beginners taking their first steps to seasoned professionals navigating complex markets. Choosing the right account type is crucial for optimizing your trading experience, impacting everything from spreads and commissions to available instruments and leverage. Let’s dive into the various Exness account types and discover which one aligns best with your unique trading style and goals.

Exness broadly categorizes its trading accounts into two main groups: Standard Accounts and Professional Accounts. Each category offers distinct advantages, catering to different preferences and strategies in the fast-paced world of forex trading.

Standard Account Options

Standard accounts on Exness are ideal for the majority of retail traders, offering straightforward conditions and accessibility. They are perfect if you are just starting out or prefer a more predictable trading environment without complex commission structures.

- Standard Account: This is the most popular choice, known for its stable spreads and no commission per lot. It’s an excellent entry point for new traders in China, providing a comfortable environment to learn and grow. You can trade a wide range of instruments, including major forex pairs, commodities, and cryptocurrencies.

- Standard Cent Account: For those who want to practice with real money but minimize risk, the Standard Cent account is a fantastic option. Trades are executed in cents, making it possible to test strategies with very small capital. It’s perfect for new Chinese traders looking to build confidence without significant financial commitment.

Why Choose a Standard Account?

Many traders find immense value in the simplicity and transparency of Exness Standard accounts. Here are some key benefits:

| Feature | Benefit for Chinese Traders |

|---|---|

| No Commission | Lower overall trading costs, simpler profit calculation. |

| Stable Spreads | Predictable trading costs, easier strategy planning. |

| Low Minimum Deposit | Accessible to traders with varying capital levels, including beginners. |

| Wide Instrument Range | Opportunity to diversify trading across various markets. |

Professional Account Options

If you’re an experienced trader seeking tighter spreads, raw spreads, or specific commission structures to optimize your high-volume or high-frequency strategies, Exness Professional accounts are designed for you. These accounts offer more specialized conditions for advanced trading approaches.

There are three distinct professional account types available:

- Raw Spread Account: This account type offers incredibly tight spreads, often starting from 0.0 pips on major currency pairs. While there is a small, fixed commission per lot, the combination of raw spreads and a clear commission structure can significantly reduce trading costs for high-volume traders.

- Zero Account: As the name suggests, the Zero account offers zero spreads on the top 30 trading instruments for 95% of the trading day. This means you often pay virtually no spread on your trades, with a commission applied. It’s highly sought after by scalpers and day traders who demand the lowest possible execution costs.

- Pro Account: The Pro account is another excellent option for experienced traders, featuring low spreads with no commission. It offers instant execution and is tailored for those who prioritize minimal trading friction without a separate commission structure.

Is a Professional Account Right for You?

Choosing a professional account can unlock new levels of efficiency for your trading. Consider these points if you’re an experienced Chinese trader:

“For traders who execute large volumes or employ sophisticated strategies like scalping, the cost savings from tighter spreads and optimized commission structures in professional accounts can significantly impact their bottom line. It’s about precision and efficiency.”

Here’s a quick overview of who benefits most from each professional account type:

- Raw Spread: Best for high-frequency traders and those who prioritize the absolute lowest interbank spreads, willing to pay a fixed commission.

- Zero: Ideal for scalpers and algorithmic traders who need zero spread on popular instruments for most of the trading day, coupled with a commission.

- Pro: Suited for experienced traders who prefer low spreads without any commission per lot and value instant execution for their strategies.

Before making your final choice, we highly recommend familiarizing yourself with all the specific conditions, including minimum deposit requirements and available leverage, for each Exness account type. Your ideal trading partner awaits!

Advanced Trading Platforms Available for Exness China

For traders in China, having access to cutting-edge tools is non-negotiable. Exness China understands this deeply, which is why we provide a robust selection of advanced trading platforms. These aren’t just interfaces; they are powerful ecosystems built to empower your trading journey, offering precision, speed, and reliability. We ensure you have the best technology at your fingertips, whether you are a seasoned professional or just starting out in the dynamic forex market.

Our commitment to your success is reflected in the platforms we offer. Each platform boasts unique strengths, designed to cater to various trading styles and preferences. We constantly upgrade our systems to give you a seamless and efficient trading experience.

Key Platforms and Their Advantages:

- MetaTrader 4 (MT4): This industry-standard platform is renowned for its user-friendly interface and comprehensive charting tools. Many traders prefer MT4 for its reliability, extensive customization options, and the vast availability of Expert Advisors (EAs). It offers flexible trading, allowing you to execute various order types with ease.

- MetaTrader 5 (MT5): Building on MT4’s success, MT5 offers enhanced analytical tools, more timeframes, and additional pending order types. It provides access to a broader range of financial instruments beyond forex, including stocks and futures, making it a versatile choice for diversified portfolios. MT5’s multi-threaded strategy tester is a significant advantage for rigorous backtesting.

- Exness Terminal: Our proprietary web-based platform offers a streamlined, intuitive experience directly in your browser. It combines powerful features with simplicity, ensuring quick execution and easy navigation. The Exness Terminal provides real-time market data, advanced charting, and integrated economic news, all designed to keep you informed and agile.

These advanced trading platforms available through Exness China equip you with everything needed to navigate the markets confidently. You gain access to real-time quotes, in-depth analytical capabilities, and sophisticated order management systems. Our goal is to provide a stable and fast environment, ensuring your trades execute precisely when you need them to.

Dedicated Customer Support and Localization Efforts by Exness

When you navigate the dynamic world of forex trading, having a reliable support system is not just a luxury—it’s an absolute necessity. At Exness, we understand this fundamental need, which is why we pour significant resources into providing truly dedicated customer support. Our commitment ensures that assistance is always within reach, whenever you need it, wherever you are. We pride ourselves on offering comprehensive help that goes beyond basic FAQs, connecting you with knowledgeable professionals who can address your specific trading inquiries and technical challenges efficiently.

Our support team operates around the clock, offering 24/7 assistance to global traders. This means whether you are trading during your local market hours or seizing opportunities across different time zones, an expert is ready to assist you. Our focus is on quick, accurate, and empathetic responses, ensuring your trading journey remains as smooth as possible. We believe that exceptional client satisfaction stems from a support system that not only resolves issues but also anticipates your needs and provides proactive guidance.

Beyond the impressive uptime, Exness stands out for its robust localization efforts. We know that effective communication goes far beyond speaking English. To truly serve our diverse client base, we have built a powerful network of regional teams and multilingual support specialists. This strategic approach means you can receive assistance in your native language, making complex trading concepts and platform functionalities much easier to grasp. Our localization efforts include not just language, but also understanding regional market nuances, local payment methods, and specific regulatory environments.

This commitment to localized service ensures that every trader, regardless of their geographical location, feels understood and valued. It’s about building trust and fostering a strong relationship with our community. By investing in dedicated customer support and comprehensive localization efforts, Exness provides more than just a trading platform; we offer a supportive ecosystem designed to empower your success in the forex market.

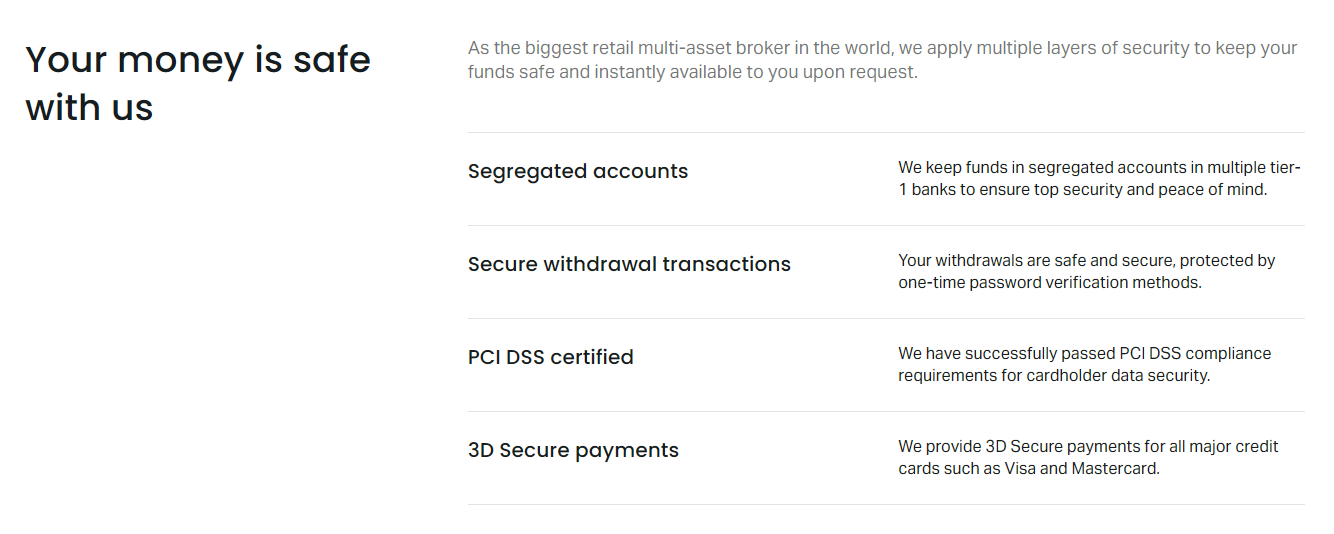

Ensuring Fund Security and Trader Protection with Exness

As dedicated forex traders, we understand that the safety of your capital is paramount. When you choose a broker, the question of fund security and trader protection isn’t just a concern—it’s the foundation of your trading confidence. Exness stands out precisely because it prioritizes these vital aspects, building a secure environment where you can focus on market analysis and strategy without constant worry.

Exness’s commitment to your financial well-being is multifaceted, covering various layers of security and protective measures:

- Strict Regulatory Compliance: Exness holds licenses from reputable regulatory bodies worldwide. These licenses aren’t just formalities; they mandate adherence to rigorous financial conduct, capital adequacy requirements, and, most importantly, strict client fund protection rules. This regulatory oversight acts as a powerful safeguard for your investments.

- Segregation of Client Funds: A fundamental principle of financial security is the segregation of client funds. Exness meticulously keeps your trading capital in separate bank accounts, distinct from the company’s operational funds. This critical measure ensures your money remains yours, protected and accessible even if unforeseen corporate events were to occur.

- Negative Balance Protection (NBP): Market volatility can be unpredictable. Exness provides automatic Negative Balance Protection, which means your potential losses can never exceed the funds available in your trading account. This crucial feature prevents you from falling into debt with the broker, offering a vital safety net against extreme market movements.

- Advanced Data Encryption: Your personal information and transactional data are protected by state-of-the-art encryption technologies. Exness employs robust security protocols to safeguard your privacy and ensure that all your interactions on their platform are secure from unauthorized access.

- Transparent and Efficient Withdrawal Processes: The ability to access your funds quickly and securely is a testament to a broker’s reliability. Exness is highly regarded for its transparent, swift, and reliable withdrawal system, ensuring that you can easily retrieve your profits and capital whenever you need them, reinforcing trust and peace of mind.

Beyond these technical and regulatory safeguards, Exness fosters a culture of transparency and proactive risk management. They equip traders with tools and support to navigate the markets responsibly. Your journey with Exness means trading within a robust framework designed to protect your interests every step of the way.

Analyzing Exness Performance vs. Local Chinese Brokers

Navigating the forex market in China presents a unique set of challenges and opportunities. Traders often weigh their options between established global players like Exness and the more domestically focused Chinese brokers. Understanding the performance disparities between these two categories is crucial for making an informed choice that aligns with your trading style and priorities. Let’s break down how Exness stands up against its local counterparts.

One of the most significant distinctions lies in regulatory oversight. Exness operates under multiple international licenses from reputable bodies, offering a robust framework for client fund security and transparent operations. Local Chinese brokers, on the other hand, often operate within a different regulatory environment, which can sometimes mean less transparency or more localized rules. This difference in regulatory backing directly impacts the level of trust and security a trader might feel.

When it comes to trading conditions, you often see clear differences. Exness is renowned for its competitive spreads, often starting from 0.0 pips on major currency pairs, and flexible leverage options that cater to various risk appetites. Execution speed is typically lightning-fast, ensuring minimal slippage even during volatile market periods. Local brokers might have varying spreads and leverage, often dictated by domestic policies, and their execution speeds can differ depending on their infrastructure and liquidity providers. Instrument availability also varies; Exness offers a vast array of currency pairs, metals, energies, stocks, and cryptocurrencies, while local brokers might focus more on a specific set of instruments relevant to the Chinese market.

Key Comparison Points: Exness vs. Local Chinese Brokers

| Feature | Exness (Global Perspective) | Local Chinese Brokers (Domestic Perspective) |

|---|---|---|

| Regulation & Security | Multiple top-tier international licenses (e.g., CySEC, FCA, FSCA). Strong fund segregation. | Regulated by domestic authorities. Regulatory transparency can vary. |

| Spreads & Fees | Often among the lowest spreads, especially on major pairs. Transparent fee structure. | Spreads can be higher or variable. Fee structures might be less globally competitive. |

| Leverage Options | Highly flexible leverage, including unlimited leverage under certain conditions. | Leverage often capped due to local regulatory restrictions. |

| Trading Platforms | MetaTrader 4 (MT4) & MetaTrader 5 (MT5), desktop, web, and mobile. | May offer MT4/MT5, but also proprietary platforms or other locally popular software. |

| Deposit/Withdrawal | Wide range of global and local payment methods, including instant withdrawals. | Primarily focus on Chinese local payment methods. Withdrawal speed varies. |

| Customer Support | 24/7 multilingual support (including Chinese), accessible via live chat, email, phone. | Focus on Chinese language support during local business hours. |

Think about the practical aspects of your trading journey. When it comes to depositing and withdrawing funds, Exness provides an extensive array of global and regional payment solutions, with a strong emphasis on instant processing, particularly for withdrawals. This speed and convenience can be a game-changer for active traders. Chinese local brokers, naturally, excel in offering popular domestic payment methods, but their international transfer options or processing times might not always match the speed of global giants.

Finally, consider the user experience and customer support. Exness prides itself on its 24/7 multilingual support, ensuring that traders can receive assistance anytime, anywhere, and in their preferred language, including Chinese. This level of constant availability and global reach is a significant advantage. Local Chinese brokers usually offer excellent support in Mandarin and other local dialects, but their hours of operation might align more with local business times, and their ability to handle complex international queries could be limited.

Ultimately, your choice depends on your priorities. If you value robust international regulation, competitive global trading conditions, and round-the-clock support, Exness presents a compelling option. If your trading is strictly localized and you prioritize methods specific to the Chinese financial ecosystem, a local broker might fit your needs. Always conduct your own research to ensure the broker you choose aligns perfectly with your individual trading strategy and security expectations.

Advantages of Choosing Exness for Forex Trading in China

Navigating the global forex market can feel complex, especially for traders in China. Yet, choosing the right broker makes all the difference. Exness stands out as a preferred option for many Chinese forex enthusiasts. Its offerings align well with the needs of both new and experienced traders, providing a robust and reliable trading environment.

Key Benefits for Chinese Traders

When you consider Exness, you unlock several distinct advantages designed to enhance your trading journey. Here are some of the most compelling reasons to choose them:

- Competitive Trading Conditions: Exness is renowned for its ultra-low spreads, often starting from 0.0 pips on major currency pairs. This significantly reduces your trading costs, allowing more of your profits to stay in your pocket.

- Fast and Reliable Execution: In forex, every millisecond counts. Exness boasts incredibly fast order execution speeds, helping you enter and exit trades precisely when you intend to. This minimizes slippage and maximizes your control over trades.

- Flexible Leverage Options: Exness offers high leverage options, allowing you to control larger positions with a smaller capital outlay. They also provide unlimited leverage under certain conditions, a powerful tool for experienced traders managing their risk diligently.

- Diverse Range of Trading Instruments: Beyond standard forex pairs, Exness gives you access to a wide array of instruments. You can trade cryptocurrencies, metals, energies, stocks, and indices, diversifying your portfolio and exploring new market opportunities all from one account.

- Convenient Deposit and Withdrawal Methods: Understanding the local context, Exness provides multiple convenient payment methods that resonate with Chinese users. This includes popular local banking options and e-wallets, making funding your account and withdrawing profits smooth and hassle-free.

- Excellent Multilingual Customer Support: Getting timely help matters. Exness offers professional customer support available in multiple languages, including Mandarin Chinese. Their dedicated team is ready to assist you 24/7, ensuring your questions get answered quickly and effectively.

- Robust Trading Platforms: Traders gain access to industry-leading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms offer advanced charting tools, technical indicators, and automated trading capabilities, empowering you to analyze markets and execute strategies efficiently.

- Transparent Trading Environment: Exness operates with high transparency. They provide detailed transaction histories and clear terms, building trust and ensuring you have all the information you need about your trades and account activity.

Choosing Exness means opting for a broker that understands and caters to the specific needs of forex traders in China, helping you pursue your financial goals with confidence.

Navigating Potential Challenges for Exness China Users

Trading the forex market offers incredible opportunities, but for our fellow traders in China using platforms like Exness, the journey can sometimes present unique hurdles. It’s crucial to understand these potential challenges beforehand so you can prepare, adapt, and keep your trading journey smooth and profitable. Think of it not as a roadblock, but as a series of strategic points where smart navigation makes all the difference.

We’ve compiled some common obstacles Exness users in China might encounter and offer practical advice on how to navigate them effectively. Your success in the markets often hinges on your ability to anticipate and overcome operational issues, not just market movements.

Common Challenges and Navigation Strategies

Internet Connectivity and Access Restrictions

China’s internet infrastructure, while advanced, includes specific regulations that can sometimes affect access to international trading platforms. You might experience occasional slowdowns or difficulties reaching the Exness website or trading terminals directly.

Navigation Strategy: Consider using a reputable Virtual Private Network (VPN) service. A good VPN can help maintain a stable and secure connection to Exness servers. Always choose a paid, reliable VPN designed for consistent performance, as free options often lack the necessary speed and security for trading. Also, keep alternative access methods in mind, like mobile apps, which can sometimes provide more consistent connectivity.

Deposit and Withdrawal Methods

Transferring funds internationally into and out of trading accounts can sometimes face delays or restrictions due to banking regulations in China. While Exness offers a variety of payment solutions, specific local bank policies might impact the speed or availability of certain methods.

Navigation Strategy: Diversify your payment options. Exness typically supports multiple local payment methods that cater to Chinese users. Explore these options, and if possible, set up accounts with different providers to ensure you always have a reliable way to fund your trading. Cryptocurrencies, where permitted, can also offer a fast and efficient alternative for deposits and withdrawals, bypassing traditional banking channels. Always verify the latest available methods directly on the Exness website.

Account Verification Process

International brokers, including Exness, adhere to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This means providing personal identification and proof of address. For users in China, submitting the correct documents and ensuring they meet international standards can sometimes be a point of confusion or delay.

Navigation Strategy: Prepare your documents meticulously. Ensure your identification (passport or national ID) and proof of address (utility bill, bank statement) are clear, valid, and match the information on your Exness account exactly. If possible, provide documents in English or with certified translations to speed up the verification process. Don’t hesitate to contact Exness support if you have any doubts about which documents are acceptable; proactive communication can save a lot of time.

Customer Support Accessibility and Language

While Exness offers robust customer support, differences in time zones and potential language barriers could sometimes make immediate problem resolution challenging for Chinese traders, especially during peak hours or for complex issues.

Navigation Strategy: Utilize all available support channels. Exness provides live chat, email, and phone support. If live chat isn’t immediately responsive, send an email with detailed information about your issue. Check if Exness offers dedicated Chinese-speaking support lines or departments, as this can greatly enhance communication. Many brokers also have extensive FAQ sections and help centers; often, answers to common queries can be found there quickly.

Facing challenges is part of any journey, especially in the dynamic world of forex trading. For Exness users in China, understanding these potential hurdles transforms them from obstacles into opportunities for strategic planning and smart execution. By being proactive, informed, and resourceful, you can navigate these issues with confidence, ensuring your focus remains where it belongs: on the markets.

Strategies for Optimizing Trading with Exness in China

Navigating the dynamic world of forex trading in China presents unique challenges and rewarding opportunities. For traders utilizing the Exness platform, optimizing your approach is key to achieving consistent success. The Chinese market operates with its own specific nuances, from regulatory frameworks to local market sentiment, all of which demand a tailored strategy. Successful trading isn’t just about predicting price movements; it’s about efficient execution, robust risk management, and a deep understanding of the environment you operate within.

Many Chinese traders look for platforms that offer reliability, competitive conditions, and excellent support. Exness fits this profile for numerous participants in the region. However, merely having access isn’t enough. You must actively optimize your trading journey to make the most of your capital and time. Let’s explore some core strategies that can significantly enhance your trading performance when using Exness in the vast Chinese market.

Key Optimization Strategies for Exness Traders in China

- Understand Local Market Dynamics: China’s financial news, economic indicators, and national policies significantly impact currency pairs and commodities. Successful forex trading requires you to stay informed about domestic developments. Focus on how these events might influence global markets and, consequently, your chosen assets. Integrate this local insight into your broader technical and fundamental analysis.

- Leverage Exness’s Platform Features: Exness provides a range of tools and features designed to enhance your trading experience. Explore their various account types to find one that best suits your trading style and capital. Utilize their analytical tools, economic calendars, and educational resources. Understanding how to effectively use pending orders, stop-loss, and take-profit levels is crucial for automated risk management, especially in volatile periods.

- Master Efficient Fund Management: For traders in China, secure and convenient deposit and withdrawal methods are paramount. Exness typically offers localized payment solutions that cater to the Chinese market. Optimize your capital allocation by maintaining sufficient margin levels to withstand market fluctuations and avoid margin calls. Always prioritize the security of your funds.

- Implement Robust Risk Management: This cannot be overstated. No matter how good your trading strategy, without proper risk management, your capital is vulnerable. Determine your acceptable risk per trade (e.g., 1-2% of your account balance). Use appropriate lot sizes and always place stop-loss orders. Diversifying your trading instruments can also mitigate risk, rather than concentrating all your capital on a single currency pair.

- Optimize Connectivity and Execution Speed: Trading in forex requires fast execution, especially for scalping or day trading strategies. Ensure you have a stable and high-speed internet connection. While Exness is known for its low latency, your local connection can impact trade execution. Consider using a VPS (Virtual Private Server) if you experience significant delays, which can provide a more consistent trading environment.

- Stay Informed on Regulatory Changes: The regulatory landscape for online trading in China can evolve. While Exness operates globally, staying aware of any domestic guidelines or advisories is part of responsible trading. This proactive approach helps you anticipate potential impacts on your trading activities.

By consciously applying these strategies, Chinese traders using Exness can create a more resilient, efficient, and ultimately more profitable trading framework. Remember, consistent effort in learning and adapting is the cornerstone of long-term success in the challenging yet exciting world of forex trading.

The Future of Exness and the Chinese Forex Industry

The landscape of global finance constantly evolves, and nowhere is this more evident than in the dynamic interplay between leading brokerage platforms like Exness and the robust, yet complex, Chinese forex market. Understanding this relationship is key to anticipating the next wave of opportunities and challenges for traders and brokers alike.

China represents one of the world’s most significant and intriguing financial frontiers. Its sheer market size and the growing interest in online trading make it an irresistible target for international online brokers. However, navigating the Chinese regulatory landscape requires deep insight and a strategic approach.

Market Dynamics and Exness’s Position

The Chinese forex market is characterized by several unique factors:

- High Demand for Diversified Investments: As local investment options mature, Chinese investors increasingly seek international financial products, including forex trading.

- Digital Savvy Population: China boasts a massive, tech-fluent population, readily adopting digital platforms and mobile trading solutions.

- Evolving Regulatory Framework: While strict, the regulatory environment for online brokers is always in motion, demanding adaptability.

Exness, with its global reach and a strong emphasis on technology and client-centric services, is well-positioned to leverage these dynamics. The platform’s commitment to transparent trading conditions, competitive spreads, and robust execution capabilities resonates with traders seeking reliable access to the forex market.

Anticipating Growth and Innovation

The future of Exness within the Chinese forex industry appears poised for significant growth, driven by several key factors:

| Factor | Impact on Future |

|---|---|

| Technological Advancements | Improved trading technology, AI-driven insights, enhanced mobile trading apps will redefine trader experience. |

| Regulatory Adaptations | Continuous adjustment to local requirements will be crucial for sustained operation and expansion. |

| Localization Strategies | Tailoring services, support, and educational content to Chinese traders’ specific needs will boost engagement. |

| Education and Support | Providing comprehensive educational resources empowers traders and fosters a sustainable trading community. |

The emphasis on high-quality customer support, alongside a dedication to digital innovation, remains a cornerstone of Exness’s strategy. As the Chinese market matures, traders will increasingly prioritize brokers who offer stability, security, and advanced trading tools. Exness’s global footprint and continuous development in these areas give it a distinct advantage.

“The future of online trading hinges on a seamless blend of technology, regulation, and user experience. Brokers who master this balance in complex markets like China will lead the way.”

Ultimately, the synergy between Exness’s global operational excellence and the burgeoning demands of the Chinese forex market promises a fascinating journey. Expect continued innovation in trading platforms, more tailored financial services, and a deeper integration of global best practices into the local trading environment. This evolution will benefit not only the brokers but, most importantly, the traders themselves, by providing enhanced opportunities and a more robust trading experience.

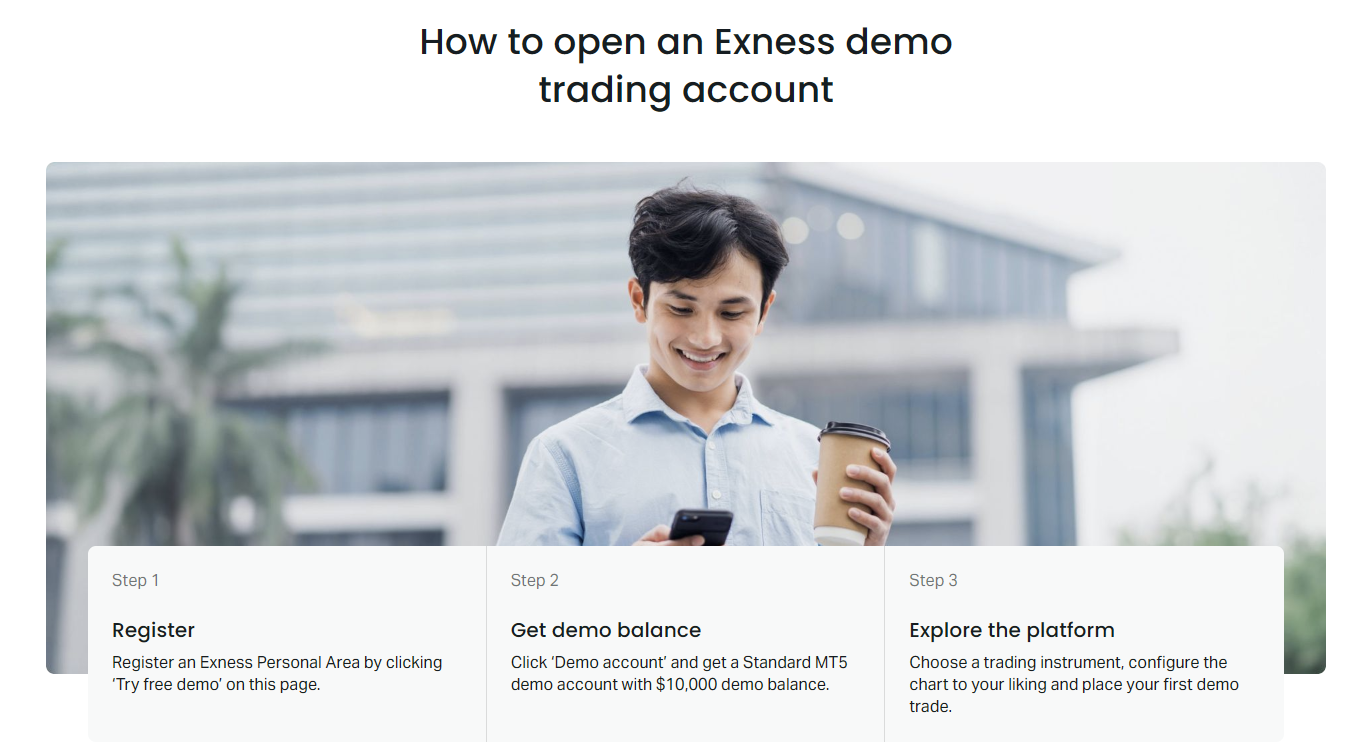

How to Open an Exness Account from China

Navigating the global forex market can seem complex, especially for traders in China. Yet, accessing a reputable broker like Exness is entirely possible with the right approach. Many aspiring and experienced traders in China look for reliable platforms that offer competitive conditions and robust support. Exness stands out as a popular choice due to its advanced trading features and commitment to client satisfaction.

Opening an Exness account from China involves a few straightforward steps. It’s crucial to follow each one carefully to ensure a smooth and successful registration. We’ll guide you through the process, helping you overcome any potential hurdles and get you ready to trade. Remember, diligence in the initial setup pays off by providing a secure and compliant trading environment.

Step-by-Step Account Opening Process

- Visit the Official Exness Website: Always start by accessing the official Exness website. Be cautious of unofficial links to protect your personal and financial information. Look for the “Open Account” or “Registration” button, usually prominently displayed on the homepage.

- Choose Your Account Type: Exness offers various account types tailored to different trading styles and experience levels, such as Standard, Standard Cent, Pro, Zero, and Raw Spread accounts. Consider your trading volume, preferred spreads, and commission structure before making a choice.

- Provide Your Personal Information: You will need to fill out a registration form with basic details. This typically includes your country of residence (China), email address, and a strong password. Ensure all information is accurate to avoid issues later during verification.

- Verify Your Email and Phone Number: After submitting your initial details, Exness will send a verification code to your email or phone number. Enter this code on the platform to confirm your contact details. This is an important security step.

- Complete Your Profile: You’ll then be prompted to provide more detailed personal information, including your full name, date of birth, and residential address. It’s essential to provide truthful information that matches your identification documents.

- Undergo Account Verification (KYC): This is a critical stage. To comply with regulatory requirements and ensure the security of your funds, Exness requires you to verify your identity and address.

Essential Documents for Verification

For Chinese residents, typical documents required for Exness account verification include:

- Proof of Identity: A clear, color copy of your national ID card (front and back), passport, or driver’s license. The document must be valid and show your full name, date of birth, and photo.

- Proof of Residence: A recent utility bill (electricity, water, gas), bank statement, or government-issued document that clearly shows your full name and residential address in China. This document should typically be no older than six months.

Make sure the images are clear, well-lit, and all four corners of the document are visible. Blurry or incomplete documents will lead to delays in the verification process. Once you submit these documents, the Exness compliance team will review them. This process usually takes a short time, and you will receive a notification once your account is fully verified.

Funding Your Exness Account

After successful verification, you are ready to fund your trading account. Exness supports various payment methods suitable for traders in China. These often include:

- Bank transfers

- E-wallets (e.g., Perfect Money, WebMoney, Neteller, Skrill)

- Local payment solutions (where available and compliant with local regulations)

Always check the Exness website’s ‘Deposits & Withdrawals’ section for the most current and localized options. Pay attention to any minimum deposit requirements and transaction fees, though Exness is known for its favorable deposit and withdrawal conditions.

Opening an Exness account from China is a straightforward process when you follow these steps. With a verified account and funded balance, you are all set to explore the vast opportunities in the forex market with a trusted broker.

Exness China: Common Questions Answered

Navigating the world of online forex trading can bring up a lot of questions, especially when you’re looking at a global broker like Exness from a specific region. If you’re a trader in China, you likely have unique considerations and common queries about how Exness operates for you. Let’s dive into some of the most frequently asked questions to give you a clearer picture and help you trade with confidence.

Exness has built a strong reputation worldwide, known for its competitive trading conditions, wide range of instruments, and client-centric approach. For traders in China, understanding the specifics of their service is key to a smooth and successful trading journey. We understand your concerns and aim to provide transparent answers.

What You Need to Know About Exness and Trading in China:

- Accessibility: Many traders wonder if Exness services are accessible in China. Exness generally offers its services to a global audience, and traders from China can register accounts and access their trading platforms. However, it’s always wise to check local regulations and your internet service provider’s policies.

- Account Registration: The registration process for Chinese traders is similar to that for traders in other regions. You typically need to provide personal details and complete a verification process, which includes identity and residency proof. This is a standard procedure to ensure security and compliance.

- Funding Methods: One of the most critical aspects for any trader is how to deposit and withdraw funds. Exness strives to offer a variety of convenient payment solutions. For Chinese clients, common methods might include local bank transfers, e-wallets, and sometimes cryptocurrency options. Always check the Exness client area for the most up-to-date and region-specific payment options available to you.

- Customer Support: Having reliable customer support in your native language can make a huge difference. Exness provides multilingual support, and Chinese language support is often available through various channels like live chat, email, or phone. This ensures you can get assistance with any issues or questions promptly.

- Regulatory Compliance and Security: Traders often ask about the safety of their funds. Exness operates under regulation from various reputable financial authorities globally. While specific local regulations in China might differ, Exness adheres to international standards for client fund segregation and data protection, providing a secure trading environment.

Key Considerations for Traders

When you trade with any broker, it’s beneficial to weigh the pros and cons based on your personal trading style and needs. For traders in China considering Exness, here are some points to think about:

| Advantages of Trading with Exness | Potential Considerations |

|---|---|

| Low spreads and competitive trading costs | Internet access and latency from your location |

| High leverage options (use responsibly) | Varying payment method availability at times |

| Wide range of trading instruments (Forex, Crypto, Indices, etc.) | Local banking restrictions may impact transfers |

| 24/7 customer support, often in Chinese | Staying updated with evolving local regulations |

| User-friendly trading platforms (MT4, MT5, WebTerminal) |

As a professional trader, I always emphasize due diligence. Before you commit, explore the Exness website for the latest information relevant to your region. Their comprehensive FAQs section is also a great resource for detailed answers on account types, trading conditions, and more.

“Trading successfully means being well-informed. For Chinese traders, understanding Exness’s specific offerings and services tailored to their region is the first step towards a confident trading journey.”

Exness strives to provide a transparent and efficient trading experience for its global client base. By addressing these common questions, we hope to empower you with the knowledge you need to make informed decisions and focus on your trading strategies.

Frequently Asked Questions

Is Exness legally available for traders in China?

Forex trading with international brokers like Exness exists in a “grey area” in China. While not explicitly licensed domestically, Exness is accessible and operates under strong international regulations (like CySEC), ensuring high standards of client fund protection and security for Chinese traders.

What are the most common payment methods for Exness users in China?

Exness provides several convenient payment methods for Chinese clients, including China UnionPay, local bank transfers, and various e-wallets. They prioritize seamless and fast transactions to ensure efficient funding and withdrawals.

How do I open and verify an Exness account from China?

You can open an account on the official Exness website. The process involves filling out a registration form and completing a KYC (Know Your Customer) verification. You will need to provide a valid proof of identity (like a passport or national ID) and a proof of residence (like a recent utility bill or bank statement).

What are the main advantages of trading with Exness in China?

Key advantages include highly competitive spreads, fast execution speeds, flexible leverage options, and dedicated customer support in Mandarin. Exness also provides a wide range of trading instruments and secure, localized payment options.

I’m in China and having trouble connecting to Exness. What should I do?

Due to internet regulations in China, some users may experience connectivity issues. Using a reputable and reliable VPN (Virtual Private Network) can often resolve these problems by creating a stable and secure connection to Exness’s servers.