Welcome, fellow traders! Are you ready to dive into the dynamic world of online forex trading from Bangladesh? The forex market is vast, offering incredible opportunities, and choosing the right forex broker is your first crucial step. This comprehensive guide shines a spotlight on Exness Bangladesh, a prominent name in the industry, trusted by traders worldwide. We’re here to equip you with the knowledge and insights to confidently navigate the financial markets, whether you’re a complete beginner or an experienced trader looking to refine your approach. Get ready to explore everything from understanding currency pairs to mastering effective trading strategies, ensuring your journey in the forex market is both informed and successful.

- Why Exness is a Top Choice for Traders in Bangladesh

- Is Exness Legal and Regulated for Bangladeshi Traders?

- What Exness’s Global Regulation Means for You:

- How to Register an Exness Account in Bangladesh

- Step-by-Step Exness Registration Guide

- Essential Documents for Account Verification

- Benefits of Registering with Exness

- Advantages

- Considerations

- After Registration: What’s Next?

- Required Documents and Verification Process

- What Documents Do You Typically Need?

- The Verification Journey: Step-by-Step

- Exness Account Types: Finding the Right Fit for Bangladeshis

- Standard Accounts:

- Professional Accounts:

- Which Account is Right for You?

- Benefits of Standard Accounts

- Features of Professional Accounts

- Convenient Deposit and Withdrawal Methods for Exness Bangladesh

- Local Bank Transfers and Popular E-wallets

- Local Bank Transfers: Reliability and Reach

- Popular E-wallets: Speed and Convenience

- Processing Times and Associated Fees

- Deposit Processing Times and Fees

- Withdrawal Processing Times and Fees

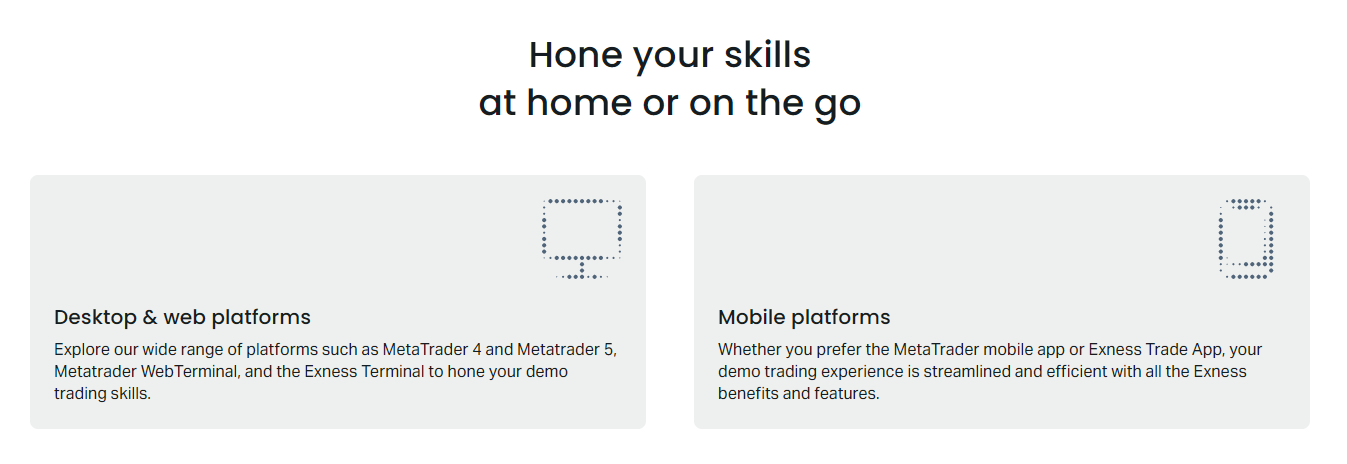

- Trading Platforms Available for Exness Users in Bangladesh

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Generation Platform

- Exness Terminal: Intuitive Web-Based Trading

- Exness Trade App: Mobile Trading at Your Fingertips

- MetaTrader 4 & 5 Functionality

- Exploring the Exness Terminal Web Platform

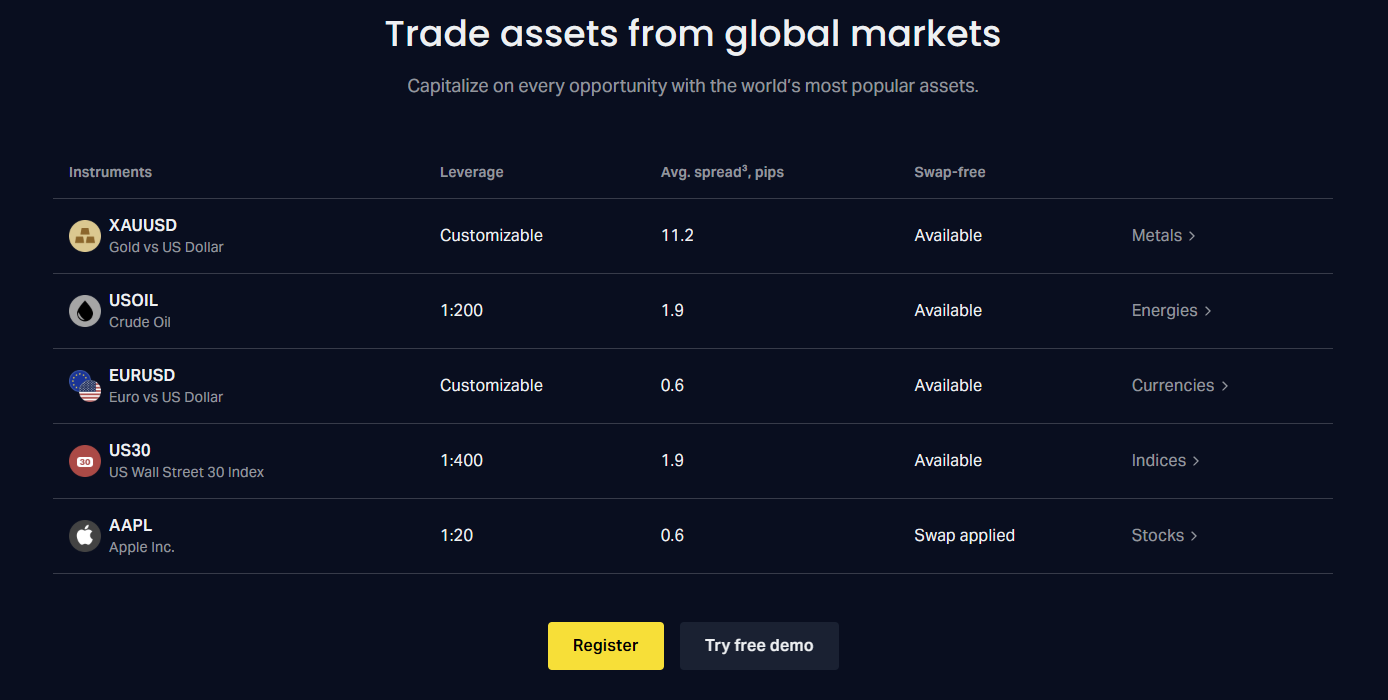

- Exploring Trading Instruments on Exness Bangladesh

- Unveiling the Trading Instrument Categories

- Why Instrument Variety Matters for Your Trading

- Major and Minor Forex Pairs

- What Are Major Pairs?

- Exploring Minor Pairs (Cross-Currency Pairs)

- Which Pairs Should You Trade?

- Cryptocurrencies, Indices, and Commodities

- Understanding Exness Spreads, Leverage, and Trading Conditions

- Exness Spreads: What You Need to Know

- Exness Leverage: A Double-Edged Sword

- Benefits of High Leverage:

- Risks of High Leverage:

- Exness Trading Conditions Beyond Spreads and Leverage

- Execution Speed:

- Commissions and Swap Fees:

- Available Trading Instruments:

- Customer Support and Platform Stability:

- Exness Customer Support and Local Assistance for Bangladesh

- How Exness Support Helps You

- Local Assistance Tailored for Bangladesh

- Common Ways to Contact Support

- Educational Resources and Trading Tools from Exness

- Unlocking Your Potential with Learning Materials

- Key Educational Offerings:

- Empowering Your Trades with Essential Tools

- Powerful Trading Utilities at Your Disposal:

- Mobile Trading with Exness: Apps for iOS and Android

- Why Choose Exness Mobile Apps?

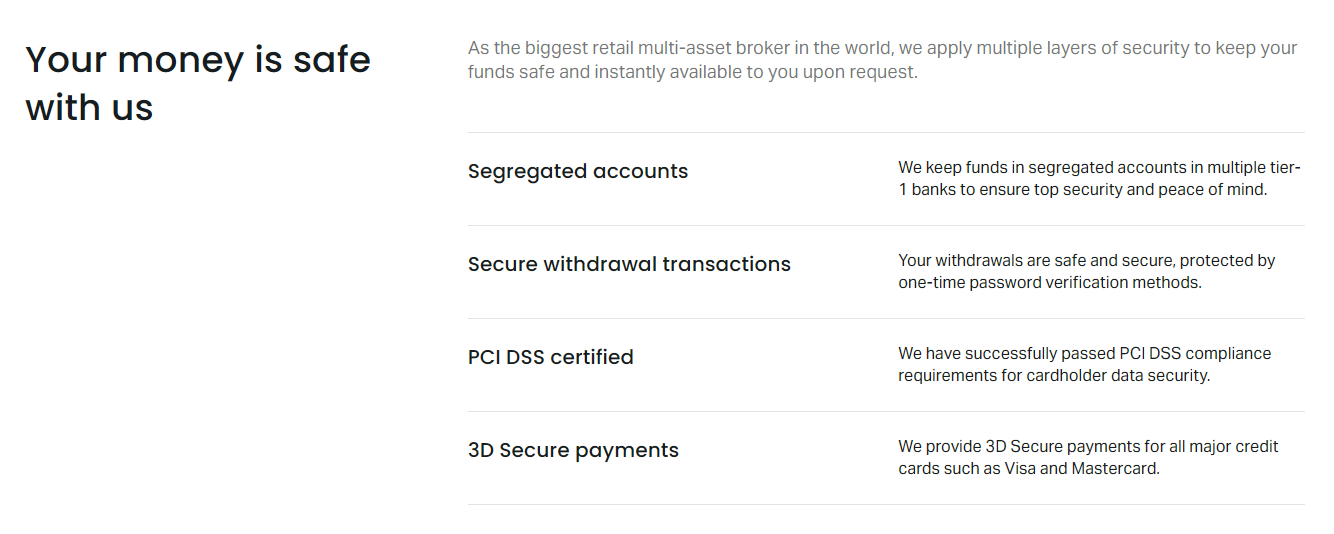

- Security and Fund Protection Measures at Exness Bangladesh

- Exness Promotions and Bonuses for Bangladeshi Traders

- Why Exness Promotions Matter to You

- Types of Bonuses You Might Encounter

- Frequently Asked Questions

Why Exness is a Top Choice for Traders in Bangladesh

Navigating the forex market demands a reliable and feature-rich broker. For traders in Bangladesh, Exness stands out as a leading platform, offering a compelling blend of advanced trading conditions, security, and exceptional client support. Its commitment to transparency and user-centric services makes it a go-to option for both novice and experienced market participants.

Here are several key reasons why Exness has earned its reputation as a preferred broker in the region:

- Competitive Trading Conditions: Exness provides some of the market’s most attractive trading conditions, including ultra-low spreads on major currency pairs and other instruments. This means lower trading costs, which is crucial for profitability, especially for active traders.

- Diverse Range of Instruments: Traders can access a wide array of financial instruments. Beyond popular forex pairs, Exness offers cryptocurrencies, indices, energies, and stocks. This diversity allows traders to explore various markets and diversify their portfolios effectively.

- Flexible Account Types: Whether you’re a beginner or a professional, Exness has an account type tailored to your needs. From Standard accounts with no commissions to Raw Spread and Zero accounts designed for high-volume traders seeking the tightest spreads, there’s a perfect fit for every trading style.

- Robust Regulatory Framework: Exness operates under multiple international regulatory licenses, ensuring a high level of client fund security and operational transparency. This regulatory oversight provides peace of mind for traders, knowing their investments are handled by a reputable and compliant entity.

- Convenient Local Payment Options: For traders in Bangladesh, depositing and withdrawing funds is seamless. Exness supports a variety of convenient local payment methods, ensuring quick and hassle-free transactions. This ease of access to funds is a significant advantage.

- Advanced Trading Platforms: The broker offers industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their powerful charting tools, analytical features, and customizable interfaces. These platforms are available across multiple devices, allowing traders to manage their positions anytime, anywhere.

- Exceptional Customer Support: Exness prides itself on providing responsive and multilingual customer support. Traders can get assistance with their queries efficiently, ensuring a smooth trading experience.

- Instant Withdrawals: One of Exness’s most lauded features is its commitment to instant withdrawals. This means traders can access their profits quickly, a critical factor for managing capital effectively.

The combination of these features solidifies Exness’s position as a top-tier choice for forex traders seeking a reliable, cost-effective, and user-friendly platform in Bangladesh.

Is Exness Legal and Regulated for Bangladeshi Traders?

Many Bangladeshi traders ask if Exness is a legitimate and safe platform for their forex activities. It’s a crucial question, especially when you’re entrusting your capital to an online broker. Let’s dive into Exness’s regulatory status and its implications for traders in Bangladesh.

Bangladesh has a unique regulatory environment when it comes to online forex trading. The central bank, Bangladesh Bank, primarily regulates financial institutions within the country. However, direct regulation of international online forex brokers by Bangladeshi authorities is not as straightforward as it might be in some other jurisdictions with dedicated forex regulatory bodies.

Exness, as an international brokerage firm, operates under a global framework of licenses and regulations. This means they are regulated by reputable financial authorities in various parts of the world. These international licenses are what give brokers like Exness their credibility and operational legitimacy on a global scale. When an international broker accepts clients from Bangladesh, they do so based on their global regulatory standing, as Bangladesh does not have a specific local license for such brokers.

What Exness’s Global Regulation Means for You:

While Exness isn’t regulated directly by a Bangladeshi authority, its multiple international licenses offer a layer of protection and assurance. Here’s what that generally entails:

- Client Fund Segregation: Regulated brokers typically keep client funds in separate accounts from the company’s operational funds. This protects your money in case of the broker’s insolvency.

- Financial Transparency: Regulated entities often undergo regular audits and must meet strict financial reporting standards, promoting transparency.

- Investor Protection Schemes: Some regulators include compensation schemes that can protect client funds up to a certain amount if a broker fails.

- Dispute Resolution: Reputable regulators usually have processes in place for resolving disputes between clients and brokers.

Exness holds licenses from several top-tier regulatory bodies, including those from Cyprus (CySEC), the UK (FCA), and South Africa (FSCA), among others. These licenses signify that Exness adheres to strict operational and financial standards set by these authorities. For Bangladeshi traders, engaging with Exness means you are interacting with a broker that operates under these high international standards, even if there isn’t a specific Bangladeshi regulatory body overseeing their operations within the country.

Ultimately, while direct Bangladeshi regulation of international forex brokers is absent, Exness’s strong global regulatory framework provides a significant level of security and reliability for Bangladeshi traders. It is always wise for traders to understand the regulatory status of their chosen broker and to manage their risk accordingly.

How to Register an Exness Account in Bangladesh

Ready to dive into the world of forex trading with Exness from Bangladesh? Getting started is straightforward, and this guide will walk you through every step of the registration process. Exness offers a user-friendly platform, and opening an account is the first exciting step towards your trading journey. We’ll cover everything from your initial sign-up to verifying your identity, ensuring a smooth start to your online trading experience.

Step-by-Step Exness Registration Guide

Opening an Exness account in Bangladesh involves a few simple steps. Follow this guide carefully to ensure a seamless setup:

- Visit the Official Exness Website: Start by navigating to the official Exness website. Be sure you are on the legitimate site to protect your personal information.

- Click ‘Open Account’: Locate the “Open Account” or “Register” button, usually prominently displayed on the homepage. Click on it to begin the registration form.

- Enter Your Personal Information: You will need to provide basic details. This typically includes your country of residence (Bangladesh), your email address, and a strong password. Create a password that is unique and secure.

- Verify Your Email/Phone: Exness will send a verification code to your registered email or phone number. Enter this code on the registration page to confirm your contact details. This step is crucial for account security.

- Complete Your Profile: After initial verification, you’ll be prompted to complete your profile. This involves providing more detailed personal information such as your full name, date of birth, and residential address. Ensure all information matches your official documents.

- Choose Your Account Type: Exness offers various account types (e.g., Standard, Pro, Raw Spread, Zero) each with different features and trading conditions. Consider your trading style and experience level when making this choice. You can always open multiple account types later.

- Verify Your Identity (KYC): To comply with financial regulations and ensure the security of your funds, you must verify your identity and address. This Know Your Customer (KYC) process is standard practice in the financial industry. You will need to upload clear copies of documents.

Essential Documents for Account Verification

Verification is a critical part of the registration process. Prepare these documents to expedite your account setup:

- Proof of Identity: A clear, valid government-issued photo ID. This could be your National ID card, passport, or driving license. Make sure all four corners of the document are visible, and the text is legible.

- Proof of Residence: A recent utility bill (electricity, gas, water), bank statement, or a government-issued document that clearly shows your full name and residential address in Bangladesh. The document should be no older than three to six months.

“Completing the verification process promptly is key to unlocking all trading features and ensuring smooth withdrawals from your Exness account.”

Benefits of Registering with Exness

Why do traders choose Exness? The platform offers a compelling set of advantages:

Advantages

- Low Spreads: Enjoy competitive spreads on major currency pairs.

- Fast Withdrawals: Experience quick and reliable withdrawal processing.

- Multiple Account Types: Choose an account that fits your trading strategy.

- Regulatory Compliance: Operate within a regulated environment.

- Excellent Customer Support: Access support in multiple languages.

- Variety of Trading Instruments: Trade forex, cryptocurrencies, stocks, indices, and commodities.

Considerations

- Leverage Risks: High leverage can amplify gains but also losses.

- Market Volatility: Forex markets can be unpredictable, requiring risk management.

- Learning Curve: New traders need time to understand the platform and markets.

After Registration: What’s Next?

Once your Exness account is successfully registered and verified, you can:

- Fund Your Account: Deposit funds using various convenient local payment methods available in Bangladesh.

- Download a Trading Platform: Access MT4 or MT5, industry-standard trading platforms, directly from your personal area.

- Start Trading: Begin executing trades on your chosen financial instruments.

- Explore Educational Resources: Utilize Exness’s extensive educational materials to enhance your trading knowledge and skills.

Registering an Exness account in Bangladesh opens the door to a world of trading opportunities. Take your time, complete each step accurately, and get ready to engage with the global markets.

Required Documents and Verification Process

Ready to jump into the exciting world of forex trading? Before you can place your first trade, a crucial step ensures the security and integrity of your trading account: the verification process. Think of it as a gatekeeper, protecting both you and the trading platform from potential fraud and ensuring compliance with global financial regulations. This isn’t just a formality; it’s a vital step to confirm your identity and safeguard your funds.

What Documents Do You Typically Need?

To make the process smooth and hassle-free, have these essential documents ready. They fall into two main categories:

- Proof of Identity (POI): This verifies who you are.

- Proof of Address (POA): This confirms where you live.

Here’s a breakdown of common documents:

- For Proof of Identity:

- Valid Passport (highly recommended due to global recognition)

- National ID Card (both front and back usually required)

- Driver’s License (both front and back usually required)

Important Note: Ensure your ID is valid, unexpired, and clearly shows your name, date of birth, photo, and signature.

- For Proof of Address:

- Utility Bill (electricity, water, gas, internet – typically within the last 3 months)

- Bank Statement (from a recognized bank, also within the last 3 months)

- Credit Card Statement (from a recognized bank, within the last 3 months)

- Government-issued tax document

Important Note: Your POA must clearly display your full name, residential address, and a date of issue. Mobile phone bills are often not accepted.

The Verification Journey: Step-by-Step

The verification process is straightforward and designed for your safety. Here’s what you can expect:

- Account Registration: First, you complete the initial registration form, providing basic personal details.

- Document Upload: You’ll then navigate to a dedicated “upload documents” section within your account dashboard. Here, you will securely upload clear, high-resolution photos or scans of your chosen Proof of Identity and Proof of Address. Make sure all edges of the documents are visible and there’s no glare.

- Review and Approval: The broker’s compliance team reviews your submitted documents. This process usually takes anywhere from a few hours to a couple of business days, depending on the volume of applications and the broker’s specific procedures. They cross-reference the information on your documents with the details you provided during registration.

- Confirmation: Once your documents are verified and approved, you’ll receive a confirmation email. Congratulations, your account is now fully verified and ready for trading!

Sometimes, additional verification steps might be required, such as a brief video call or a specific declaration, especially if there are discrepancies or if you plan on higher deposit limits. Always be truthful and provide accurate information to avoid delays or issues with your account.

Exness Account Types: Finding the Right Fit for Bangladeshis

Choosing the right trading account is a crucial step for any forex trader, and it’s especially important for those in Bangladesh looking to navigate the global markets. Exness offers a diverse range of account types, each designed to cater to different trading styles, experience levels, and capital sizes. Understanding these options helps you select the best fit for your trading journey.

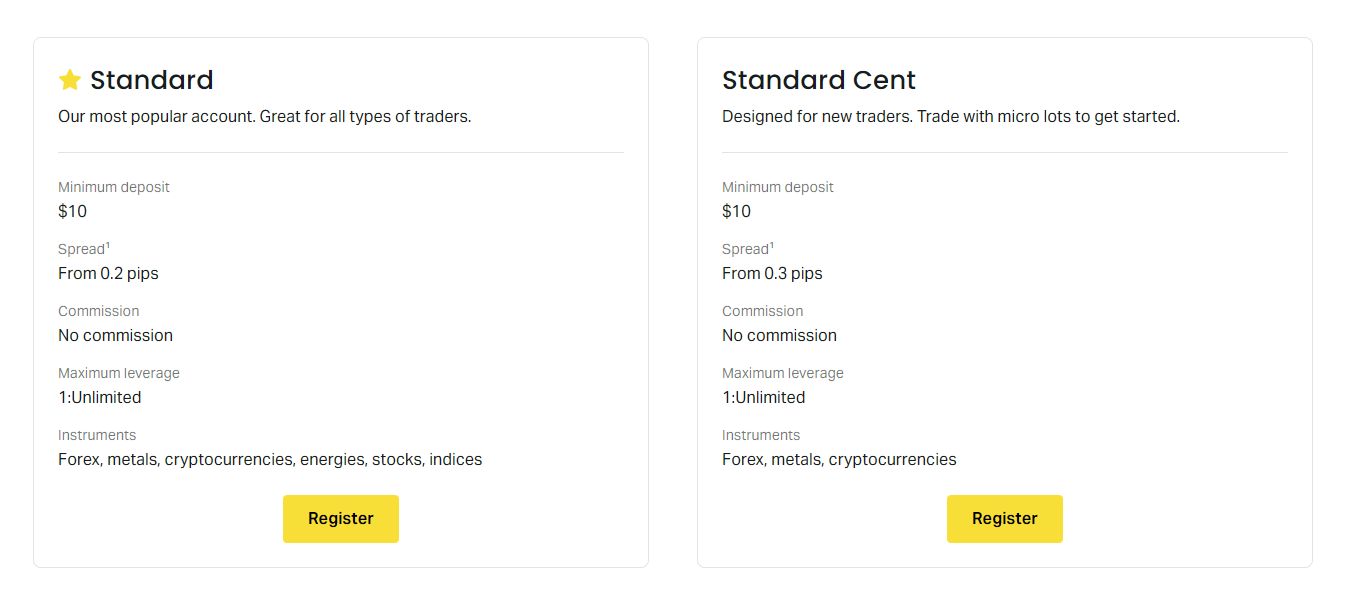

Exness primarily categorizes its accounts into two main groups: Standard Accounts and Professional Accounts. Let’s break down what each offers and who might benefit the most.

Standard Accounts:

These are often the go-to choice for new traders and those who prefer a straightforward trading experience without complex commission structures.

- Standard Account: This is by far the most popular choice. It’s user-friendly, requires a low minimum deposit, and offers competitive spreads with no commissions per trade. It’s excellent for those just starting out or traders who prefer predictable costs embedded in the spread.

- Standard Cent Account: Unique to Exness, this account allows you to trade in cents rather than standard lots. It’s perfect for absolute beginners who want to practice live trading with minimal risk. You can experiment with different strategies and get a feel for the market without committing large amounts of capital.

Professional Accounts:

Designed for experienced traders, these accounts typically offer tighter spreads and different commission structures, catering to specific trading strategies like scalping or high-volume trading.

- Raw Spread Account: As the name suggests, this account provides raw, interbank spreads, which can be incredibly tight, often starting from 0.0 pips on major currency pairs. There’s a small, fixed commission per lot per side. This account is ideal for traders who prioritize the absolute lowest spreads and are active participants in the market.

- Zero Account: Similar to the Raw Spread account in offering very low spreads, the Zero account specifically aims to provide zero spreads on the top 30 most popular trading instruments for 95% of the trading day. Like the Raw Spread account, it involves a commission per lot per side. It’s a fantastic option for those who focus on specific pairs and seek minimal spread costs.

- Pro Account: This account offers ultra-low spreads with no commissions at all. It provides instant execution for most instruments. The Pro account is suitable for experienced traders who need reliable execution and competitive pricing without the added complexity of commissions. It strikes a balance between low spreads and zero commission.

Which Account is Right for You?

Consider these points when making your decision as a Bangladeshi trader:

- Your Experience Level: Are you new to forex, or do you have years of trading under your belt? Beginners often thrive with Standard or Standard Cent accounts.

- Trading Strategy: Do you scalp, swing trade, or engage in long-term position trading? Scalpers and high-frequency traders might prefer Raw Spread or Zero accounts due to their ultra-tight spreads.

- Capital Available: While Exness offers low minimum deposits across the board, some professional accounts might be more beneficial with a larger trading capital to truly capitalize on the spread and commission structures.

- Cost Preference: Do you prefer costs embedded in the spread (Standard, Pro) or separate commission fees (Raw Spread, Zero)?

Exness provides flexibility and options to ensure that every trader, from novice to seasoned professional, finds an account that perfectly aligns with their trading aspirations and financial capacity. Take your time, evaluate your needs, and choose the account that empowers your trading journey.

Benefits of Standard Accounts

Stepping into the world of forex trading requires careful consideration of account types, and standard accounts often stand out as a prime choice for many traders. These accounts offer a fantastic balance, catering to both emerging and experienced participants in the market. You’ll find them an excellent starting point because they typically come with reasonable minimum deposit requirements, making them accessible without demanding a huge initial capital commitment. This accessibility allows you to begin your trading journey with confidence, without feeling overwhelmed by large financial outlays.

Furthermore, standard accounts generally provide competitive spreads, which directly impact your trading costs. Lower spreads mean more of your potential profits stay in your pocket. You also get access to a wide range of trading instruments, including major, minor, and exotic currency pairs, along with other popular assets like commodities and indices. This variety gives you ample opportunities to diversify your portfolio and explore different market dynamics. Many brokers also offer comprehensive educational resources and dedicated customer support for standard account holders, ensuring you have the tools and assistance you need to navigate the market effectively.

Here are some key advantages:

- Accessible Entry: Start trading with moderate capital, making it less intimidating for new traders.

- Competitive Spreads: Enjoy generally tighter spreads compared to micro or cent accounts, leading to better cost efficiency.

- Diverse Instruments: Access a broad selection of currency pairs and other assets, offering ample trading opportunities.

- Standard Lot Sizes: Trade with standard lot sizes, which helps you manage risk and understand your exposure more clearly.

- Educational Support: Often accompanied by excellent educational materials and responsive customer service to guide your trading journey.

Features of Professional Accounts

Stepping up your trading game often means considering a professional account. These aren’t your standard retail setups. They cater to serious traders who demand more from their broker. Think advanced tools, tighter conditions, and a level of support that truly makes a difference. It’s about empowering your trading strategy with the resources it needs to thrive in dynamic markets.

Here’s a breakdown of what you can typically expect when you open a professional trading account:

- Enhanced Leverage Options: Professional traders often qualify for significantly higher leverage ratios compared to retail clients. This means you can control larger positions with a smaller capital outlay, amplifying your potential returns (and risks, of course!).

- Razor-Thin Spreads: One of the biggest advantages is access to some of the tightest spreads in the industry. Lower spreads mean reduced trading costs on every transaction, which can add up to substantial savings over time, especially for high-volume traders.

- Priority Customer Support: Forget waiting in line. Professional accounts usually come with dedicated account managers or a priority support line. You get immediate assistance and personalized service whenever you need it, ensuring your trading experience remains smooth.

- Advanced Trading Tools and Platforms: Gain access to sophisticated analytical tools, premium market insights, exclusive indicators, and advanced order types not available to retail clients. These resources empower you to make more informed decisions and execute complex strategies with precision.

- Exclusive Market Research and Analytics: Brokers often provide professional clients with in-depth market reports, detailed technical analysis, and unique fundamental insights from their expert teams. This intelligence can give you a significant edge in identifying opportunities and understanding market trends.

- Higher Capital Requirements: While offering superior benefits, professional accounts typically require a higher initial deposit or a demonstrated history of significant trading activity. This ensures the account aligns with your serious commitment to trading.

Switching to a professional account isn’t just about different features; it’s about a different trading environment. It’s for those ready to navigate the markets with a professional edge, benefiting from conditions designed to support active and experienced traders.

Convenient Deposit and Withdrawal Methods for Exness Bangladesh

Starting your trading journey and accessing your profits should be straightforward and free from complications. At Exness Bangladesh, we prioritize your financial ease, ensuring seamless funding and effortless withdrawals are at the core of your trading experience. We understand that reliable and fast transactions are crucial for every trader, allowing you to focus on the markets, not on your money transfers.

Funding Your Trading Account with Ease

Getting funds into your trading account in Bangladesh is designed to be as simple as possible. We offer a wide range of deposit methods, carefully selected for their speed, security, and convenience. You can choose the option that best fits your needs, ensuring your capital is ready when market opportunities arise.

- Local Bank Transfers: A highly popular and secure option, allowing you to fund your Exness account directly from your local bank. Many traders in Bangladesh find this method reliable and familiar.

- Electronic Payment Systems (e-wallets): For those who prefer lightning-fast deposits, services like Skrill and Neteller provide instant funding, helping you react quickly to market movements. These e-wallets offer a truly hassle-free experience.

- Credit/Debit Cards: Use your Visa or MasterCard for immediate deposits. This is a quick and straightforward way to add funds using your everyday bank card.

Effortless Withdrawal Options for Your Profits

The excitement of successful trading culminates in accessing your profits. Exness Bangladesh ensures your withdrawal options are just as convenient and efficient as your deposits. We commit to secure payments, making sure your hard-earned money reaches you promptly and safely. You worked for it, and you should get it fast!

Our withdrawal methods mirror many of our deposit options, providing consistency and ease of use for all traders. This streamlined approach means less time managing funds and more time enjoying your gains.

- Local Bank Transfers: Easily withdraw your trading profits directly to your local bank account. This method offers a secure way to receive larger sums.

- Electronic Payment Systems (e-wallets): Enjoy rapid access to your funds through Skrill or Neteller withdrawals, perfect for quickly transferring profits for immediate use.

- Credit/Debit Cards: Where applicable, you can withdraw funds back to the same credit or debit card used for the initial deposit, providing a convenient full-circle solution.

Why Exness Bangladesh Excels in Financial Transactions

Our commitment goes beyond just offering methods; we aim to provide a superior financial transaction experience. Here’s what makes our system stand out for traders:

| Aspect | Your Benefit |

|---|---|

| Speedy Processing | Experience fast transactions for both deposits and withdrawals, minimizing waiting times. |

| Robust Security | Benefit from advanced encryption and security protocols protecting every secure payment. |

| Transparency | Clear information on processing times and any applicable fees (many methods are fee-free). |

| Dedicated Support | Our support team is always available to assist with any queries regarding funding your account or withdrawing profits. |

At Exness Bangladesh, we believe your focus should remain on navigating the forex markets. Our convenient deposit and withdrawal methods are meticulously designed to support your trading journey, making fund management a truly hassle-free part of your experience.

Local Bank Transfers and Popular E-wallets

As a forex trader, managing your funds efficiently is just as crucial as executing winning trades. When it comes to depositing and withdrawing money from your trading account, you have a variety of options. Two of the most commonly used and reliable methods are local bank transfers and popular e-wallets. Understanding the ins and outs of each can significantly streamline your financial operations, letting you focus more on the market.

Local Bank Transfers: Reliability and Reach

Local bank transfers, often referred to as wire transfers or direct deposits, remain a cornerstone for many traders. This method involves moving funds directly from your personal bank account to your forex broker’s bank account within the same country or region. It’s a method valued for its security and the ability to handle larger transaction volumes, making it suitable for serious traders who manage substantial capital.

- Advantages:

- High Security: Banks employ stringent security protocols, offering peace of mind for your funds.

- Higher Transaction Limits: You can typically transfer larger sums compared to other methods.

- Broad Accessibility: Almost everyone has a bank account, making it universally available.

- Lower Fees for Large Sums: While there might be a flat fee, for larger amounts, the percentage cost is often lower.

- Disadvantages:

- Slower Processing Times: Transfers can take a few business days to clear, especially international ones.

- Less Convenient for Small, Frequent Transactions: The process can be cumbersome for small, regular deposits.

- Bank Operating Hours: Transfers usually process only during banking hours, potentially delaying weekend or holiday deposits.

Popular E-wallets: Speed and Convenience

In contrast, e-wallets have surged in popularity due to their speed and unparalleled convenience. These digital wallets, such as Neteller, Skrill, or PayPal, act as intermediaries, allowing you to quickly deposit or withdraw funds from your trading account with just a few clicks. They are particularly favored by traders who value instant access to their capital and prefer seamless online transactions.

Many forex brokers integrate directly with these e-wallets, simplifying the funding process. You typically fund your e-wallet using your bank account or credit card, and then use the e-wallet to move money to and from your trading platform.

| E-wallet Feature | Description |

|---|---|

| Speed | Deposits and withdrawals are often instant or completed within minutes. |

| Convenience | Easy to use, requires minimal steps for transactions, accessible via mobile apps. |

| Privacy | Your bank details are not directly shared with the broker for each transaction. |

| Acceptance | Widely accepted by a vast number of forex brokers globally. |

| Fees | Transaction fees can vary; some charge a small percentage, others flat rates. |

While e-wallets offer incredible speed, it is always wise to check any associated fees for deposits, withdrawals, or currency conversions directly with the e-wallet provider and your broker. Understanding these costs helps you make an informed decision for your trading capital management.

Processing Times and Associated Fees

Understanding the ins and outs of processing times and any associated fees is crucial for every forex trader. You want your capital to be available when you need it, and you certainly don’t want unexpected charges eating into your profits. Let’s break down what you can expect when moving funds in and out of your trading account.

Deposit Processing Times and Fees

Getting funds into your trading account is usually a swift process. Most brokers aim for instant or near-instant deposits, especially with popular methods. However, a few factors can influence the speed.

- Credit/Debit Cards: Typically instant. Your funds appear in your trading account almost immediately, allowing you to seize market opportunities without delay.

- E-wallets (Skrill, Neteller, PayPal): Also generally instant. These methods are fast and convenient, making them a favorite for quick funding.

- Bank Transfers (Wire Transfers): These can take longer, usually between 1 to 5 business days. The exact duration depends on your bank and the international banking network.

When it comes to fees, deposits are often free from the broker’s side. Many brokers absorb these costs to encourage funding. However, be aware that your bank or payment provider might charge their own fees for transactions, especially for international wire transfers. Always check with your bank first.

Withdrawal Processing Times and Fees

Withdrawing your profits or capital is where timing and fees become even more critical. While brokers strive for efficiency, withdrawals inherently take a bit longer due to security checks and banking protocols.

Here’s a general overview of typical withdrawal times:

| Withdrawal Method | Estimated Processing Time | Common Fees (Broker Side) |

|---|---|---|

| Credit/Debit Cards | 2-5 Business Days | Often free, or a small fixed fee |

| E-wallets | 1-2 Business Days | Often free, or a small percentage/fixed fee |

| Bank Transfers | 3-7 Business Days | Typically a fixed fee (e.g., $25-$50) |

Keep in mind that the processing time you see above is typically from the moment the broker processes your request until the funds hit your account. Your broker will first review and approve the withdrawal request, which can add another 1-2 business days. Furthermore, bank holidays in your region or the broker’s region can extend these times. Some brokers might also have a minimum withdrawal amount. Always read their terms and conditions carefully to avoid surprises.

Understanding these timeframes and potential costs helps you manage your trading capital effectively and ensures a smooth financial experience.

Trading Platforms Available for Exness Users in Bangladesh

Choosing the right trading platform is crucial for your success in the dynamic forex market. It’s your primary tool for executing trades, analyzing market movements, and managing your portfolio. For traders in Bangladesh, Exness understands this critical need and offers a diverse range of robust platforms designed to cater to every trading style and experience level. Whether you’re a seasoned professional or just starting your journey, you will find a platform that perfectly fits your requirements for effective trading.

MetaTrader 4 (MT4): The Industry Standard

MetaTrader 4, or MT4, remains the most popular and widely recognized trading platform in the world. Its reliability, powerful charting tools, and user-friendly interface have made it a favorite among forex traders globally, and it’s readily available for Exness users in Bangladesh. MT4 is perfect for those who value stability and a vast community of expert advisors (EAs) and custom indicators.

- Advanced Charting: Access to multiple timeframes, analytical objects, and a wide range of technical indicators for in-depth market analysis.

- Automated Trading: Support for Expert Advisors (EAs) allows you to automate your trading strategies around the clock.

- Customization: Personalize your charts and workspace to suit your preferences and trading style.

- Security: Robust encryption protocols protect your data and trading activities.

- Accessibility: Available on desktop (Windows, Mac), web browser, and mobile devices (iOS, Android).

MetaTrader 5 (MT5): The Next Generation Platform

Building upon the success of MT4, MetaTrader 5 (MT5) offers an enhanced trading experience with more features and analytical capabilities. Exness provides MT5 to Bangladeshi traders looking for an edge in the financial markets. MT5 supports not only forex but also a broader range of financial instruments, including stocks, futures, and CFDs, making it a versatile choice for diversified traders.

Here’s a look at what MT5 brings to the table:

| Feature Category | MT5 Advantage |

|---|---|

| Analytical Tools | More timeframes (21 vs. 9), additional indicators, and graphical objects. |

| Market Depth | Provides a view of market depth (Level II pricing) for better order placement. |

| Order Types | Includes all MT4 order types plus two more: Buy Stop Limit and Sell Stop Limit. |

| Economic Calendar | Integrated economic calendar helps track important financial events directly. |

| Programming Language | MQL5 for more advanced Expert Advisors and indicators development. |

Many experienced traders in Bangladesh appreciate MT5 for its comprehensive features and the ability to trade a wider array of CFDs, including stock CFDs, all from one powerful platform.

Exness Terminal: Intuitive Web-Based Trading

For traders who prefer simplicity and direct access without downloading any software, the Exness Terminal is an excellent choice. This intuitive web-based platform is designed for ease of use, making it perfect for beginners and those who trade on the go from any browser. It seamlessly integrates with your Exness account, offering a streamlined trading experience directly from your web browser in Bangladesh.

What makes the Exness Terminal a great option?

- No Download Required: Trade directly from your web browser, anytime, anywhere.

- User-Friendly Interface: Clean and intuitive design ensures a smooth trading experience for all users.

- Essential Tools: Access to basic charting, popular indicators, and quick order execution.

- Account Management: Easily manage your Exness account, deposits, and withdrawals directly within the terminal.

- Real-time Quotes: Stay updated with live market prices and news feeds.

Exness Trade App: Mobile Trading at Your Fingertips

In today’s fast-paced world, mobile trading is essential. The Exness Trade App brings the entire trading experience to your smartphone or tablet, giving Bangladeshi traders the freedom to manage their positions and respond to market changes no matter where they are. This robust mobile application ensures you never miss a trading opportunity, whether you are commuting or simply away from your desktop.

A professional trader once commented, “The ability to monitor my trades and execute orders from my phone is not a luxury; it’s a necessity in the forex market. The Exness Trade App delivers exactly that, with reliability and speed.”

Key advantages of using the Exness Trade App:

- Full Account Control: Deposit, withdraw, transfer funds, and manage your account details with ease.

- Comprehensive Trading: Open and close trades, set stop-loss and take-profit levels, and view your trading history.

- Market Analysis: Access interactive charts, a variety of technical indicators, and real-time quotes.

- Instant Notifications: Receive price alerts and important updates directly on your device.

- Security: Advanced encryption and biometric login options keep your account safe.

Exness commitment to providing a versatile suite of trading platforms ensures that every trader in Bangladesh can find the ideal environment to pursue their financial goals with confidence and efficiency.

MetaTrader 4 & 5 Functionality

Diving into the world of online trading means getting familiar with the powerful platforms that bring the markets to your fingertips. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) stand as industry titans, widely recognized for their robust capabilities and user-friendly interfaces. They empower millions of traders globally, offering a comprehensive suite of tools for analysis, trading, and automation.

MT4, often called the industry standard, provides a complete trading environment. You get advanced charting tools with multiple timeframes, making it easy to spot trends and patterns. It includes a vast array of technical indicators to help you make informed decisions. Many traders appreciate MT4 for its seamless execution of trades and its strong support for Expert Advisors (EAs), allowing for automated trading strategies to run 24/7. This reliability and widespread adoption make it a go-to choice for forex traders.

MetaTrader 5, while building on MT4’s success, offers an expanded set of functionalities. Think of it as a significant upgrade, designed to cater to a broader range of financial markets beyond just forex. With MT5, you gain access to even more timeframes and a larger selection of built-in technical indicators. It introduces new order types and a Depth of Market (DOM) feature, giving you more insights into liquidity. Traders looking to diversify into stocks, futures, or other CFDs often find MT5’s multi-asset capabilities particularly appealing. It also boasts a more powerful programming language for developing complex trading robots and indicators.

Here’s a quick look at why traders choose these platforms:

- Comprehensive Charting: Both platforms offer highly customizable charts, allowing you to visualize market movements clearly.

- Analytical Tools: Access a wealth of technical indicators and graphical objects for detailed market analysis.

- Automated Trading: Utilize Expert Advisors (EAs) to automate your trading strategies, removing emotional bias.

- Flexible Trading Operations: Place various types of orders, manage positions, and monitor your account in real-time.

- Security: Benefit from secure data transmission between the client terminal and the server, protecting your trading activity.

- Community Support: Join a massive global community of traders and developers, sharing insights and resources.

Ultimately, whether you choose MT4 or MT5 depends on your specific trading needs and the types of instruments you wish to trade. Both platforms provide the essential tools to navigate the dynamic financial markets with confidence.

Exploring the Exness Terminal Web Platform

Diving into the world of online trading requires a reliable and intuitive platform. The Exness Terminal Web Platform stands out as a powerful tool designed for traders of all levels, right in your browser. You don’t need any downloads or installations, which means you can access your trading account from virtually anywhere with an internet connection. This web-based solution provides a seamless experience, ensuring you stay connected to the markets without hassle.

The beauty of the Exness web platform lies in its simplicity and robust functionality. It combines ease of use with advanced trading tools, making it a favorite among our community. Here’s what you can expect when you log in:

- Real-Time Market Data: Get instant updates on currency pairs, commodities, and other instruments. Stay ahead of market movements with precise price feeds.

- One-Click Trading: Execute trades swiftly directly from the charts. This feature saves precious seconds, which can be crucial in fast-moving markets.

- Comprehensive Charting Tools: Utilize a wide array of technical indicators, drawing tools, and multiple chart types. Analyze market trends with precision to inform your trading decisions.

- Order Management: Easily place, modify, and close orders. Set stop-loss and take-profit levels to manage your risk effectively, directly from the platform interface.

- Account Overview: Keep track of your balance, equity, margin, and profit/loss in real time. All your account information is clearly displayed for easy monitoring.

Choosing a web platform offers distinct advantages for active traders:

| Advantage | Description |

|---|---|

| Accessibility | Trade from any computer or device with a web browser, no matter where you are. |

| No Installation Needed | Start trading immediately without waiting for software downloads or updates. |

| Device Flexibility | Enjoy a consistent trading experience whether you use a desktop, laptop, or tablet. |

Experience a powerful trading environment built for efficiency and convenience. The Exness Terminal Web Platform offers you the control and flexibility you need to navigate the forex markets confidently.

Exploring Trading Instruments on Exness Bangladesh

Ready to dive into the exciting world of online trading? Exness Bangladesh offers a robust platform for traders looking to explore a vast array of financial instruments. Whether you are a seasoned pro or just starting your journey, understanding what you can trade is key to building a diversified and effective trading strategy. Exness prides itself on providing access to global markets right from your fingertips, ensuring you have the tools to seize opportunities as they arise.

The beauty of trading with Exness lies in the sheer variety. You aren’t limited to just one or two asset classes. Instead, you can navigate different markets, each with its unique characteristics and potential. This diversity allows you to manage risk, capitalize on various market conditions, and truly tailor your trading approach to your personal goals and risk tolerance. Let’s take a closer look at the primary categories of instruments you can trade.

Unveiling the Trading Instrument Categories

On Exness Bangladesh, you’ll find a comprehensive selection designed to meet diverse trading needs. Here’s a breakdown of the main instrument types available:

- Forex (Foreign Exchange): The largest and most liquid financial market in the world. Trade major, minor, and exotic currency pairs like EUR/USD, GBP/JPY, and USD/BDT. Leverage the constant fluctuations in exchange rates to your advantage.

- Commodities: Essential raw materials that fuel the global economy. Trade popular commodities such as Gold, Silver, Crude Oil, and Natural Gas. These instruments often react to global economic events and supply-demand dynamics.

- Indices: Track the performance of a basket of stocks from a specific stock exchange or sector. Trade popular indices like the S&P 500, Dow Jones, FTSE 100, and Nikkei 225. This allows you to speculate on the overall health of an economy or industry without buying individual stocks.

- Cryptocurrencies: Digital assets that have revolutionized the financial landscape. Trade popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC) against major currencies. Experience the high volatility and unique market drivers of this innovative asset class.

- Stocks (Shares): Own a piece of the world’s leading companies. Trade CFDs (Contracts for Difference) on a wide range of popular stocks from global markets. This gives you the flexibility to go long or short on individual company performance.

Why Instrument Variety Matters for Your Trading

Having a wide range of trading instruments isn’t just about choice; it’s about empowerment. Here’s why it makes a significant difference for traders on Exness Bangladesh:

“A diverse portfolio of trading instruments is like having multiple tools in your kit – you’re prepared for any market condition, whether it’s trending, ranging, or highly volatile.”

Consider these advantages:

| Benefit | Description |

|---|---|

| Diversification | Spread your risk across different markets. If one market is down, another might be up, helping to balance your overall portfolio. |

| More Opportunities | Different instruments move at different times and react to different news. More instruments mean more potential entry and exit points throughout the day or week. |

| Tailored Strategies | You can apply specific strategies to specific instrument types. For instance, high-volatility strategies for crypto, or long-term trend following for indices. |

| Capitalizing on News | Economic reports, geopolitical events, and company announcements impact different instruments. Access to a variety allows you to react quickly to relevant news. |

Exploring the diverse trading instruments on Exness Bangladesh opens up a world of possibilities for traders. Take the time to understand each instrument, its unique characteristics, and how it fits into your trading strategy. This informed approach will put you on the path to becoming a more confident and successful trader.

Major and Minor Forex Pairs

Diving into the forex market means understanding the different types of currency pairs you can trade. Not all pairs are created equal! They fall into categories based on their liquidity and trading volume. This distinction is crucial for every trader, from beginner to seasoned pro, as it impacts everything from volatility to the spread you pay.

What Are Major Pairs?

Major currency pairs are the most frequently traded in the world. They always include the US Dollar (USD) paired with another leading global currency. Their popularity stems from immense liquidity, which means you can always buy or sell them quickly without significantly impacting their price. This high volume also leads to very tight spreads, making them cost-effective to trade.

- EUR/USD: Euro and US Dollar (the most traded pair globally)

- USD/JPY: US Dollar and Japanese Yen

- GBP/USD: British Pound and US Dollar

- USD/CHF: US Dollar and Swiss Franc

- AUD/USD: Australian Dollar and US Dollar

- USD/CAD: US Dollar and Canadian Dollar

- NZD/USD: New Zealand Dollar and US Dollar

Trading major pairs often feels more predictable due to their deep liquidity and generally stable movements, influenced by major economic news from their respective countries. They are a common starting point for many new traders.

Exploring Minor Pairs (Cross-Currency Pairs)

Minor currency pairs, also known as cross-currency pairs, are those that do not include the US Dollar. Instead, they pair two major currencies against each other. While still liquid, they typically have less trading volume than their major counterparts. This can result in wider spreads and potentially more volatile price movements, especially during significant economic announcements related to either currency.

Here are some examples of popular minor pairs:

| Currency Pair | Description |

|---|---|

| EUR/GBP | Euro and British Pound |

| EUR/JPY | Euro and Japanese Yen |

| GBP/JPY | British Pound and Japanese Yen |

| AUD/JPY | Australian Dollar and Japanese Yen |

| EUR/CHF | Euro and Swiss Franc |

Minor pairs offer unique opportunities because their movements are often influenced by dynamics between the two economies without the overshadowing influence of the US dollar. They can present exciting trading setups for those who understand the specific factors driving their price action.

Which Pairs Should You Trade?

Your choice between major and minor pairs depends on your trading style and risk tolerance. Major pairs offer stability and lower transaction costs. They are fantastic for consistent strategies. Minor pairs, on the other hand, can provide higher volatility and unique patterns, which some traders leverage for bigger potential gains. However, they demand more careful risk management due to their wider spreads and sometimes less predictable behavior.

As a renowned trader once said, “The market speaks different languages through its currency pairs. Learn to understand them all, but master the ones that resonate with your strategy.”

Cryptocurrencies, Indices, and Commodities

Beyond traditional currency pairs, the world of trading offers exciting opportunities across diverse asset classes. Expanding your focus to include cryptocurrencies, stock indices, and commodities can significantly diversify your portfolio and open doors to new profit potential. Each of these markets behaves uniquely, presenting distinct challenges and rewards for the astute trader.

Cryptocurrencies: The Digital Revolution

The rise of digital currencies like Bitcoin and Ethereum has undeniably transformed the financial landscape. Their decentralized nature and high volatility attract traders seeking rapid price movements. While these digital assets offer impressive gains, their unpredictable swings demand careful risk management and a deep understanding of market sentiment. Staying informed about technological advancements and regulatory changes is crucial for navigating this dynamic market.

- High Volatility: Potential for significant price swings, offering both large profits and losses.

- 24/7 Trading: Markets operate around the clock, allowing constant engagement.

- Innovation: Constantly evolving technology creates new trading opportunities.

- Decentralization: Not tied to central banks or government policies, offering unique market dynamics.

Indices: A Broad Market View

Trading indices means speculating on the performance of an entire segment of the stock market, rather than individual companies. Major indices like the S&P 500, Dow Jones, or DAX offer a barometer of economic health and corporate performance. They often provide a more stable trading environment compared to individual stocks or cryptocurrencies, as they represent a basket of companies. This diversification within the index itself can mitigate the impact of poor performance from a single component. Analyzing macroeconomic data and company earnings reports is key to successful index trading.

Commodities: The Raw Power of Global Trade

Commodities are the raw materials essential to our daily lives, from oil and natural gas to gold, silver, and agricultural products. Their prices are influenced by global supply and demand, geopolitical events, and economic cycles. Gold, for instance, often acts as a safe-haven asset during times of economic uncertainty, while oil prices react strongly to production levels and industrial demand. Trading commodities allows you to tap into fundamental economic drivers and diversify away from traditional financial assets. Understanding global economic trends and geopolitical developments is paramount when trading these essential resources.

Expanding your trading horizons to include these exciting asset classes can enrich your trading strategy and potentially enhance your overall returns. Each offers unique characteristics and requires a distinct analytical approach. Are you ready to explore the vast possibilities beyond forex?

Understanding Exness Spreads, Leverage, and Trading Conditions

Navigating the forex market demands a clear grasp of your broker’s offerings. For many traders, Exness stands out, but truly understanding their spreads, leverage, and overall trading conditions is key to optimizing your strategy and maximizing your potential. Let’s dive deep into what these terms mean for your daily trades and how Exness structures them to serve its diverse clientele.

Exness Spreads: What You Need to Know

Spreads are the lifeblood of forex trading – the difference between the bid and ask price of a currency pair. They represent your direct cost of opening a trade. Exness is known for its competitive and often tight spreads, but these can vary significantly based on several factors:

- Account Type: Different Exness account types, such as Standard, Raw Spread, or Zero, offer varying spread structures. Raw Spread and Zero accounts, for instance, typically feature ultra-low spreads, sometimes even zero on popular pairs, but compensate with commissions.

- Market Volatility: During periods of high market volatility or major news events, spreads can widen across all brokers, including Exness, due to reduced liquidity.

- Trading Instrument: Spreads differ between currency pairs, commodities, indices, and cryptocurrencies. Major pairs like EUR/USD often have the tightest spreads.

- Time of Day: Spreads might be wider during off-peak hours when liquidity is lower, such as during the Asian session for pairs not involving Asian currencies.

Always keep an eye on the real-time spreads displayed on your trading platform. Understanding how they fluctuate helps you make informed decisions about when to enter and exit trades, directly impacting your profitability.

Exness Leverage: A Double-Edged Sword

Leverage is a powerful tool that allows traders to control a large position with a relatively small amount of capital. Exness offers some of the highest leverage options in the industry, including unlimited leverage under certain conditions, which can be incredibly appealing for traders looking to amplify their market exposure. However, it’s crucial to understand both its advantages and its inherent risks.

Benefits of High Leverage:

- Increased Buying Power: You can open larger positions than your account balance would normally allow.

- Higher Potential Returns: Even small price movements can translate into significant profits if you’re using high leverage on a large position.

- Capital Efficiency: You don’t need to tie up a large amount of capital for each trade, freeing up funds for diversification or other opportunities.

Risks of High Leverage:

“Leverage can be a rocket ship, but it needs a skilled pilot. While it amplifies gains, it equally amplifies losses, making robust risk management non-negotiable.”

The downside of leverage is that it magnifies losses just as easily as it magnifies gains. A small adverse price movement can quickly deplete your account, leading to margin calls or even a stop-out. Exness provides features like stop-out levels and negative balance protection to help manage these risks, but personal discipline and a solid risk management strategy are your best defenses. Always use leverage responsibly and in line with your risk tolerance.

Exness Trading Conditions Beyond Spreads and Leverage

While spreads and leverage are crucial, a broker’s overall trading conditions encompass much more. Exness strives to create an optimal trading environment through several key elements:

Execution Speed:

Exness prides itself on ultra-fast order execution. Rapid execution is vital, especially for scalpers and day traders, as it minimizes slippage – the difference between your requested price and the actual execution price. Their advanced technology infrastructure aims to process your trades in milliseconds, helping you capture market opportunities precisely.

Commissions and Swap Fees:

Depending on your account type, you might encounter commissions. For instance, Raw Spread and Zero accounts charge a small commission per lot traded in exchange for tighter spreads. Swap fees, also known as overnight financing charges, are applied to positions held open past a certain time (usually 5 PM EST). These can be positive or negative depending on the interest rate differential between the two currencies in a pair and whether you’re long or short. Exness also offers swap-free accounts, particularly beneficial for traders following Sharia principles.

Available Trading Instruments:

Exness offers a broad range of trading instruments, including forex major, minor, and exotic pairs, cryptocurrencies, energies, metals, indices, and stocks. This diversity allows traders to explore various markets and diversify their portfolios, adapting to different market conditions and opportunities.

Customer Support and Platform Stability:

Reliable customer support and a stable trading platform are often overlooked but are integral to good trading conditions. Exness provides multilingual customer support, ensuring assistance is readily available when you need it. Their platforms, primarily MetaTrader 4 and MetaTrader 5, are known for their robustness, comprehensive charting tools, and user-friendly interfaces, offering a seamless trading experience.

Exness Customer Support and Local Assistance for Bangladesh

Navigating the forex market can feel like an intricate dance, and having reliable support makes all the difference. For traders in Bangladesh, Exness offers robust customer service designed to provide peace of mind. You need quick answers when issues arise, and Exness understands this necessity. They prioritize keeping your trading journey smooth and uninterrupted, whether you are a beginner taking your first steps or a seasoned professional executing complex strategies.

How Exness Support Helps You

- 24/7 Availability: Get assistance any time, day or night. The forex market never sleeps, and neither does their support.

- Multiple Communication Channels: Reach out through various convenient methods. Choose what works best for you.

- Multilingual Team: Connect with representatives who speak your language, ensuring clear communication.

- Expert Knowledge: Receive accurate and helpful solutions from experienced support staff. They know the platform inside out.

Exness focuses on practical, timely solutions. Imagine you face a technical glitch during a crucial trade or have a question about a deposit; quick support can save your day. Their commitment extends beyond just answering questions. They aim to empower you with the knowledge to make informed decisions and resolve issues efficiently. This level of dedication builds confidence in your trading activities.

Local Assistance Tailored for Bangladesh

Traders in Bangladesh benefit from localized support efforts. This means Exness understands the specific needs and common queries from the region. While they don’t have a physical office in Bangladesh, their digital presence and support structure are highly adapted. They strive to make the experience as seamless as possible, bridging any potential gaps. When you need help, you connect with professionals who understand your context and can offer relevant guidance.

Common Ways to Contact Support

Live Chat: Instantly connect with a support agent directly from the Exness website or trading platform. This is often the quickest way to get real-time help.

Email Support: For more detailed inquiries or if you need to attach documents, email is a great option. Expect a timely and thorough response.

Phone Support: Sometimes, speaking directly to someone makes all the difference. Exness provides phone lines for direct communication, allowing for immediate discussion of your concerns.

Exness understands that effective support is a cornerstone of a successful trading experience. They continually refine their customer service to ensure every trader in Bangladesh feels valued and supported. Your focus should be on trading, and their job is to handle the rest, making sure help is always just a few clicks or a phone call away. Join a community where support truly matters.

Educational Resources and Trading Tools from Exness

Navigating the dynamic world of forex trading requires more than just capital; it demands knowledge and the right instruments. Exness understands this fundamental truth, which is why they offer a comprehensive suite of educational resources and powerful trading tools. Whether you’re taking your first steps into the currency markets or you’re a seasoned trader looking to refine your strategies, you find valuable support here.

Unlocking Your Potential with Learning Materials

Exness makes learning accessible and engaging. Their educational hub is a treasure trove of information, designed to elevate your trading skills from the ground up. You can dive into various topics, from understanding the basics of currency pairs and pips to mastering complex technical analysis indicators. This commitment to trader development helps you build a strong foundation and continually expand your expertise.

Key Educational Offerings:

- Comprehensive Trading Academy: A structured learning path covering everything from forex fundamentals to advanced trading concepts.

- Expert Webinars: Live sessions with market professionals discussing current trends, trading strategies, and risk management.

- Informative Articles and Tutorials: Bite-sized content explaining specific concepts, platform features, and market insights, perfect for quick learning.

- Glossary of Terms: A handy reference for all the forex jargon you encounter.

Empowering Your Trades with Essential Tools

Beyond education, practical tools are indispensable for effective trading. Exness provides a robust collection of utilities engineered to enhance your market analysis, optimize your execution, and manage your trades more efficiently. These tools are integrated seamlessly, ensuring you have everything you need at your fingertips.

Powerful Trading Utilities at Your Disposal:

| Tool | Benefit to Traders |

|---|---|

| Economic Calendar | Stay informed about key economic events and data releases that impact currency volatility. Plan your trades around major announcements. |

| Trader’s Calculator | Instantly calculate margins, swap fees, and pip values for various instruments, helping with position sizing and risk assessment. |

| VPS Hosting | Ensure uninterrupted trading robot (EA) operation with a virtual private server, providing stable, low-latency execution around the clock. |

| Market Analysis Tools | Access various analytical features and indicators directly within the trading platform to identify trends and potential entry/exit points. |

Exness truly believes in empowering its trading community. By providing these top-tier educational resources and cutting-edge trading tools, they equip you to approach the markets with confidence, make informed decisions, and pursue your trading goals more effectively. Explore their offerings and see how they can transform your trading journey.

Mobile Trading with Exness: Apps for iOS and Android

In today’s fast-paced world, staying connected to the financial markets is more crucial than ever. For forex traders, this means having the flexibility to manage trades, monitor charts, and react to market shifts anytime, anywhere. Exness understands this need perfectly, offering robust and intuitive mobile trading applications for both iOS and Android devices. These apps transform your smartphone or tablet into a powerful trading station, ensuring you never miss an opportunity, whether you are commuting, traveling, or simply away from your desktop.

The Exness mobile trading experience is designed with the user in mind. It brings the full power of the Exness platform directly to your fingertips, ensuring seamless execution and access to a wide range of trading instruments. Forget being tethered to your desk; the market is now truly in your pocket.

Why Choose Exness Mobile Apps?

- Unmatched Convenience: Trade on the go, from any location with an internet connection. Execute trades, close positions, and manage your account during your lunch break or while waiting for a flight.

- Full Feature Set: Access real-time quotes, interactive charts with various indicators, and a comprehensive suite of order types. You get the same powerful tools available on the desktop platform.

- Secure and Reliable: Exness prioritizes your security. The mobile apps feature strong encryption and secure login protocols to protect your trading activity and personal data.

- User-Friendly Interface: Both the iOS and Android applications boast a clean, intuitive design, making it easy for both new and experienced traders to navigate and find what they need quickly.

- Instant Notifications: Stay informed with push notifications for price alerts, margin calls, and execution confirmations, keeping you ahead of market movements.

Getting started is incredibly simple. You can download the official Exness Trade app directly from the Apple App Store for your iPhone or iPad, or from Google Play for your Android smartphone or tablet. Once installed, log in with your existing Exness account credentials, and you are ready to dive into the global markets. It’s truly a game-changer for traders who value freedom and flexibility.

Security and Fund Protection Measures at Exness Bangladesh

When you trade forex, safeguarding your capital is paramount. As a dedicated trader, you want to know your funds are secure, and your personal information is protected. At Exness Bangladesh, we prioritize your peace of mind by implementing a robust framework of security and fund protection measures. We understand the unique concerns of traders and work tirelessly to ensure a safe and reliable trading environment. For every trader, from beginners to seasoned pros, understanding how a broker protects their assets is crucial. It’s not just about competitive spreads or fast execution; it’s fundamentally about trust. Here’s a closer look at the layers of security Exness offers:Exness’s Multi-Layered Security Approach:

- Regulatory Compliance: Exness operates under strict regulatory bodies globally. While specific local regulations for Bangladesh may evolve, our international licenses enforce high standards of financial conduct, capital adequacy, and transparency. This means we adhere to rigorous rules designed to protect clients.

- Segregation of Client Funds: Your money is always kept separate from the company’s operational funds. We hold client funds in segregated accounts with top-tier banks. This ensures that even in unforeseen circumstances, your trading capital remains untouchable and accessible to you. It’s a fundamental principle of financial security in the brokerage world.

- Negative Balance Protection: Imagine a sudden market swing wiping out more than your deposited amount.

With negative balance protection, that’s not a risk at Exness. This feature ensures you cannot lose more than the total funds in your trading account. If your balance dips below zero due to market volatility, Exness automatically resets it to zero. This acts as a crucial safety net for every trader.

- Data Encryption and Privacy: We employ advanced encryption technologies, including SSL (Secure Socket Layer) for all data transfers, to protect your personal and financial information. Your deposits, withdrawals, and account details are transmitted securely, preventing unauthorized access. Protecting your privacy is a core commitment.

- Two-Factor Authentication (2FA): For an added layer of security on your account, we encourage and support the use of Two-Factor Authentication. This means that even if someone manages to get your password, they would still need a second verification code from your device to access your account. It’s a simple yet powerful way to secure your login.

- Secure Deposit and Withdrawal Processes: All payment transactions are processed through secure, encrypted channels. We partner with reputable payment providers to ensure your deposits and withdrawals are handled efficiently and safely. Our rigorous verification procedures for withdrawals are in place to ensure funds reach only the rightful account holder.

“As a trader, knowing that my funds are segregated and I have negative balance protection gives me the confidence to focus purely on my trading strategies, not on the safety of my capital.” – A quote from a satisfied trader.

We continuously review and enhance our security protocols to stay ahead of evolving threats in the digital landscape. Our commitment is to provide a trading environment where you can execute your strategies with confidence, knowing that your investments are safeguarded by industry-leading security measures.

Exness Promotions and Bonuses for Bangladeshi Traders

As a seasoned forex trader, I know the thrill of a good trade, and what makes it even better are the fantastic promotions and bonuses that brokers offer. For our fellow Bangladeshi traders, Exness provides an impressive array of incentives designed to enhance your trading experience and give you more opportunities to grow your capital. These programs are more than just free money; they are strategic tools that can boost your initial deposit, reward your loyalty, and even give you a second chance when markets are volatile.

Why Exness Promotions Matter to You

Exness understands the dynamic nature of the forex market and the aspirations of traders in Bangladesh. Their promotions are crafted to offer tangible benefits, whether you are just starting out or you’re a professional navigating complex strategies. Think of these bonuses as an extra boost to your trading power. Here’s a quick look at why these offers are so valuable:

- Increased Trading Capital: Bonuses can significantly increase your effective trading capital, allowing you to open larger positions or diversify your portfolio without needing to deposit more of your own funds initially.

- Risk Mitigation: With bonus funds, you have a larger buffer. This can be particularly helpful for new traders still learning the ropes, as it provides a bit more breathing room during minor market fluctuations.

- Reward for Loyalty: Many Exness promotions reward consistent trading activity and loyalty, turning your regular trades into opportunities for additional benefits.

- Exclusive Opportunities: Some promotions include access to special trading contests or unique features, adding an exciting competitive edge to your trading journey.

Types of Bonuses You Might Encounter

Exness frequently updates its promotional offers, so it’s always wise to check their official platform for the latest details. However, based on common industry practices and Exness’s history, you can often expect to find promotions like these:

- Welcome Bonuses: Specifically for new clients, a welcome bonus often provides a percentage match on your initial deposit, giving you more capital right from the start. This is a fantastic way for Bangladeshi traders to begin their journey with a significant advantage.

- Deposit Bonuses: Not just for new traders, deposit bonuses can be offered periodically to existing clients. When you make a new deposit, Exness might add an extra percentage to your account, effectively increasing your trading power.

- Cashback Programs: These programs reward you based on your trading volume. For every trade you make, you could earn a small rebate, which adds up over time and essentially reduces your trading costs.

- Loyalty Programs & Rewards: Exness values long-term relationships. Loyalty programs often provide exclusive benefits, better trading conditions, or even dedicated support based on your trading activity and account tier.

- Trading Contests: Get ready to showcase your skills! Exness occasionally hosts trading contests where traders compete for prizes based on profitability, trading volume, or other metrics. These add an exciting, competitive dimension to trading.

Always remember, every promotion comes with specific terms and conditions. It’s crucial to read these details carefully to understand withdrawal requirements, trading volume criteria, and any other stipulations. This ensures you can fully leverage the Exness promotions to your advantage as a Bangladeshi trader, turning every trade into a potentially more profitable venture.

Frequently Asked Questions

Is Exness legal for traders in Bangladesh?

Yes, while Exness is not directly regulated by a Bangladeshi authority, it operates under multiple top-tier international licenses (like CySEC, FCA), which ensures high standards of security and reliability for Bangladeshi traders.

What is the best Exness account for a beginner in Bangladesh?

The Standard and Standard Cent accounts are highly recommended for beginners. They have low minimum deposits, no commissions, and the Standard Cent account allows trading with very small amounts (cents), which is ideal for practice.

What deposit methods can I use from Bangladesh?

Exness offers several convenient methods for Bangladeshi traders, including local bank transfers, popular e-wallets like Skrill and Neteller, and credit/debit cards (Visa/MasterCard).

Does Exness offer instant withdrawals in Bangladesh?

Yes, one of Exness’s key features is its commitment to instant withdrawals for many payment systems, allowing traders in Bangladesh to access their profits quickly and efficiently.

What trading platforms does Exness provide?

Exness offers a range of platforms, including the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5), its own user-friendly Exness Terminal (web-based), and the Exness Trade App for mobile trading on iOS and Android.