- What is Exness and its Presence in Argentina?

- Exness in Argentina: A Gateway for Local Traders

- Exness Regulation and Legality for Argentinian Traders

- Why Regulation Matters to You

- Exness Global Regulatory Footprint

- Legality of Trading with Exness from Argentina

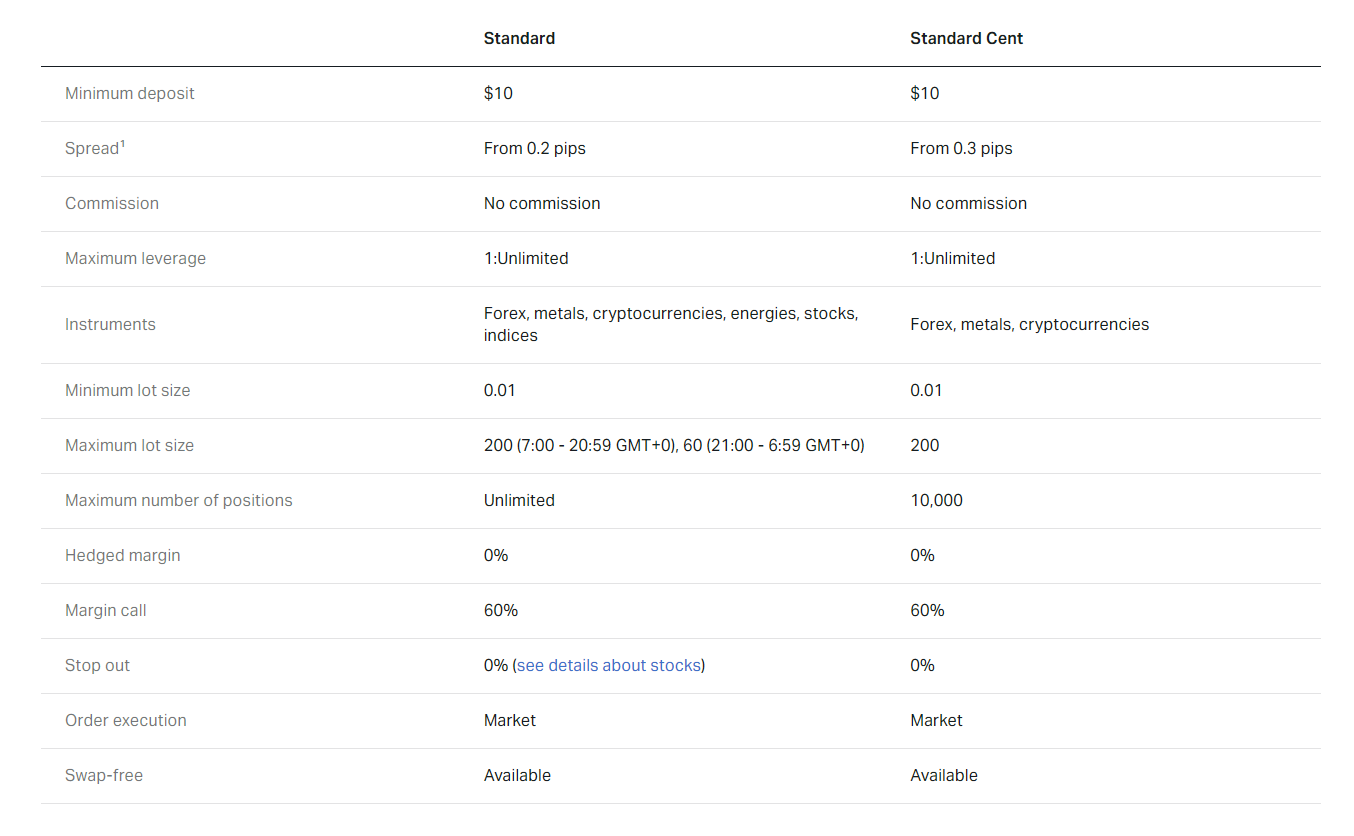

- Choosing Your Exness Account Type in Argentina

- Standard Accounts: Your Gateway to Forex Trading

- Professional Accounts: For the Savvy Trader

- Making Your Final Decision

- Standard Accounts: Ideal for New Argentinian Traders

- Why Argentinian Beginners Thrive with Standard Accounts:

- Professional Accounts: Raw Spread, Zero, and Pro Options

- Raw Spread Accounts: Precision and Power

- Zero Accounts: The Ultimate Low-Spread Experience

- Pro Accounts: Unlocked Potential for Serious Traders

- Which Professional Account Suits You?

- Funding Your Exness Account: Deposits & Withdrawals for Argentina

- Depositing Funds: Getting You Ready to Trade

- Withdrawing Your Profits: Accessing Your Earnings

- Local Payment Methods and E-wallets Supported

- Popular Local Payment Options Available:

- Advantages of Using Our Supported E-wallets:

- Understanding Transaction Fees and Processing Times

- The Lowdown on Transaction Fees

- Deciphering Processing Times

- Strategies for Managing Fees and Times

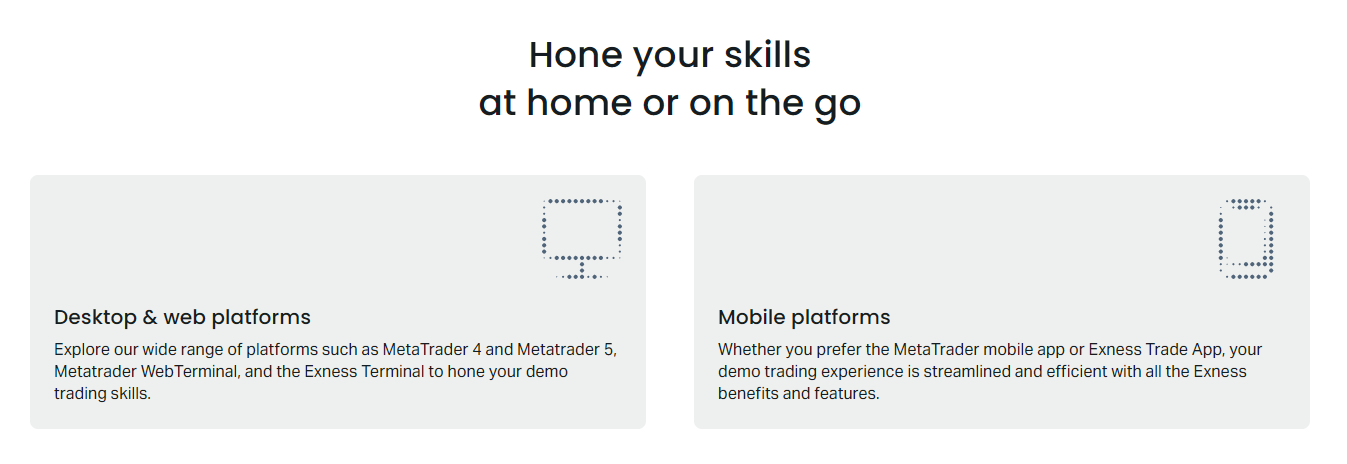

- Exness Trading Platforms Available in Argentina

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Exness Terminal (Web Terminal)

- Mobile Trading Apps

- MetaTrader 4 & 5: Features for Argentinian Traders

- Key Features for Argentinian Traders:

- MetaTrader 4 vs. MetaTrader 5: A Brief Comparison

- Exness Terminal and Mobile App

- The Versatility of Exness Terminal

- Trading On-The-Go with the Exness Mobile App

- Forex (Currency Pairs)

- Cryptocurrencies (Digital Assets)

- Metals (Precious Commodities)

- Energies (Global Commodities)

- Stocks and Indices

- Competitive Spreads, Commissions, and Leverage for Argentinian Clients

- Unpacking Our Advantageous Trading Conditions:

- Exness Customer Support for Argentinian Users

- Advantages and Disadvantages of Trading with Exness in Argentina

- Advantages of Trading with Exness in Argentina

- Disadvantages of Trading with Exness in Argentina

- How to Open an Exness Account from Argentina (Step-by-Step)

- Your Path to Trading: A Simple Guide

- Why Argentine Traders Choose Exness

- Security Measures and Fund Protection with Exness Argentina

- Comprehensive Fund Safety Measures

- Protecting Your Trading Account

- Exness Argentina: Navigating Local Economic Conditions

- The Argentine Economic Landscape for Traders

- How Exness Helps Argentine Traders Adapt

- Diverse Account Options

- Flexible Payment Methods

- Leverage and Risk Management Tools

- Customer Support

- Tips for Argentine Traders Using Exness

- Exness vs. Local Brokers: A Comparison for Argentina

- Understanding the Regulatory Landscape

- Trading Conditions: Spreads, Leverage, and Execution

- Funding Methods and Currency Considerations

- Customer Support and Local Relevance

- Concluding Thoughts

- Exness Argentina: Frequently Asked Questions (FAQs)

- Conclusion: Is Exness the Best Choice for Traders in Argentina?

- Frequently Asked Questions

What is Exness and its Presence in Argentina?

Exness is a powerhouse in the global forex and CFD trading landscape, known for its robust platforms and transparent trading conditions. For over a decade, it has served millions of traders worldwide, consistently ranking among the top brokers by trading volume. When you trade with Exness, you access a wide array of financial instruments, from major and minor currency pairs to cryptocurrencies, energies, and precious metals. Its reputation for reliability and cutting-edge technology makes it a preferred choice for both novice and experienced traders.

The broker prides itself on offering highly competitive spreads, fast execution speeds, and a variety of account types to suit different trading styles and capital sizes. They focus on creating a seamless trading experience, providing popular platforms like MetaTrader 4 and MetaTrader 5, accessible across various devices. Plus, their dedicated customer support is available in multiple languages, ready to assist traders around the clock.

Exness in Argentina: A Gateway for Local Traders

While Exness does not have a physical office or local regulation specific to Argentina, its global presence allows traders in the country to easily access its services. Argentine traders can register an account, deposit funds, and start trading on the Exness platforms just like traders in many other parts of the world. The broker operates under various international licenses, which provide a framework of trust and security for its clients globally.

How does Exness support its Argentine clientele? They understand the importance of convenient transactions. Traders from Argentina can utilize various deposit and withdrawal methods, including bank transfers, e-wallets, and other common payment systems, making it straightforward to manage funds. This flexibility is crucial for traders looking to enter the international markets without unnecessary hurdles.

For Argentine traders, Exness offers:

- Access to Global Markets: Trade currencies, commodities, indices, and digital assets.

- Flexible Account Options: Choose from Standard, Raw Spread, Zero, and Pro accounts, catering to different trading needs and strategies.

- Competitive Conditions: Benefit from low spreads and quick order execution, enhancing your potential profitability.

- Multilingual Support: Get assistance when you need it, ensuring a smooth trading journey.

Essentially, Exness extends its reliable and efficient trading environment to the Argentine trading community, offering a professional gateway to the exciting world of online forex and CFD trading.

Exness Regulation and Legality for Argentinian Traders

When you trade forex, the broker’s regulation isn’t just a detail; it’s the cornerstone of your security and peace of mind. For Argentinian traders looking at Exness, understanding their regulatory status and what it means for your funds is absolutely essential. Let’s dive into how Exness operates and the legality of using their services from Argentina.

Why Regulation Matters to You

Regulation ensures that a broker operates under strict financial guidelines, providing a layer of protection for your investments. This means your funds are typically segregated from the broker’s operational capital, and the company must adhere to transparency and fair trading practices. For traders in Argentina, choosing a regulated broker means:

- Client Fund Security: Your deposits are often held in separate accounts, protecting them if the broker faces financial difficulties.

- Fair Trading Practices: Regulators monitor brokers to prevent market manipulation and ensure honest execution of trades.

- Dispute Resolution: Should an issue arise, there’s usually a clear process to address complaints with regulatory oversight.

- Transparency: Regulated brokers must provide clear information about their services, fees, and risks.

Exness Global Regulatory Footprint

Exness is a globally recognized forex broker, holding licenses from several prominent regulatory bodies around the world. These licenses demonstrate their commitment to maintaining high standards of financial conduct and client protection. While Exness may not hold a specific local license within Argentina, their global regulation provides a robust framework that extends to all their clients, including those in Argentina.

Here’s a look at some of the key regulatory bodies that oversee Exness’s operations:

| Regulatory Body | Jurisdiction | Client Protection Focus |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus (EU) | Investor compensation fund, strict operational rules. |

| Financial Conduct Authority (FCA) | United Kingdom | Financial Services Compensation Scheme (FSCS), high standards of conduct. |

| Financial Sector Conduct Authority (FSCA) | South Africa | Ensuring market integrity and consumer protection. |

Legality of Trading with Exness from Argentina

The absence of a specific local regulation within Argentina for an international broker like Exness does not make their services illegal for Argentinian citizens. Many countries, including Argentina, allow their residents to open accounts with offshore or internationally regulated brokers. What truly matters is the broker’s commitment to global regulatory standards and their operational integrity.

When you trade with Exness, you are engaging with an entity that adheres to the strict rules imposed by its primary regulators. These rules often include robust KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures, which add another layer of security and ensure that transactions are transparent and legitimate. For Argentinian traders, this means you can confidently access the global forex market through a broker that prioritizes security and compliance.

“A globally regulated broker like Exness brings a strong framework of client protection, even when they operate in jurisdictions without specific local licensing requirements. This provides a clear path for Argentinian traders to participate in the forex market securely.”

In conclusion, while Exness operates under a global regulatory umbrella rather than a specific Argentinian one, their multiple licenses from reputable authorities offer significant assurances regarding the safety of your funds and the fairness of their trading environment. Argentinian traders can therefore engage with Exness knowing they are choosing a broker committed to global best practices in security and transparency.

Choosing Your Exness Account Type in Argentina

Navigating the world of online forex trading demands a smart start, and for traders in Argentina, selecting the right Exness account type is a crucial decision. Your choice directly impacts your trading experience, from the spreads you pay to the execution speed of your trades. Exness, a popular trading platform, offers a range of options designed to cater to different levels of experience and trading styles. Understanding these distinctions helps you align your account with your financial goals and risk tolerance.

Before diving in, consider your trading frequency, the capital you plan to invest, and your familiarity with the markets. Are you just starting your journey in forex trading, or do you have years of experience under your belt? Exness provides tailored solutions, ensuring both beginner traders and experienced professionals find a home for their trading activity. Let’s explore the primary account categories available and what each one offers to help you make an informed decision for your trading in Argentina.

Standard Accounts: Your Gateway to Forex Trading

For many newcomers to the forex market, the Standard Account is often the ideal starting point. It offers a straightforward and accessible way to begin trading without overwhelming complexity. This account type boasts competitive trading conditions, making it an excellent choice for those still learning the ropes or testing their trading strategies with smaller volumes.

- Accessibility: Low minimum deposit requirements mean you can start trading with a modest investment.

- Predictable Costs: Spreads are stable and generally wider than professional accounts, but this predictability can be comforting for new traders.

- No Commissions: You typically won’t pay commissions on trades, as the cost is built into the spread.

- Wide Instrument Range: Access to a broad selection of currency pairs, cryptocurrencies, stocks, and other instruments.

- Instant Execution: Trades are executed instantly, which is beneficial for most trading styles.

This account type simplifies the trading process, allowing you to focus on market analysis and decision-making without worrying about intricate fee structures. It’s a reliable option for those looking for a balanced trading environment in Argentina.

Professional Accounts: For the Savvy Trader

If you’re an experienced trader in Argentina looking for tighter spreads, specific execution models, or a different cost structure, Exness Professional Accounts are designed with you in mind. These accounts cater to those who trade higher volumes or employ strategies that benefit from ultra-low spreads and raw pricing. Professional accounts typically come in several variations, such as Raw Spread, Zero, and Pro, each offering distinct advantages.

Factors to Consider When Choosing a Professional Account:

| Account Type Feature | Raw Spread Account | Zero Account | Pro Account |

|---|---|---|---|

| Spreads | From 0.0 pips, plus a fixed commission per lot. | From 0.0 pips on 30 top instruments, with commission. | Very tight spreads, no commission. |

| Commissions | Yes, fixed commission per side per lot. | Yes, commission per side per lot. | No commissions. |

| Execution | Market Execution. | Market Execution. | Instant Execution, with requotes sometimes. |

| Minimum Deposit | Higher than Standard accounts. | Higher than Standard accounts. | Higher than Standard accounts. |

Professional accounts are often preferred by scalpers, high-frequency traders, and those who use Expert Advisors (EAs), where every pip of spread can significantly impact profitability. Your choice among these will depend on your specific strategy and how you prefer to manage your trading costs.

Making Your Final Decision

Ultimately, the best Exness account type for you in Argentina aligns with your trading style, capital, and experience level. Consider your comfort with commissions versus wider spreads, and evaluate the importance of execution speed for your particular strategy. Exness provides transparent information on all its account types, making it easier to compare and choose. Regardless of your choice, Exness offers robust deposit and withdrawal methods, reliable customer support, and a secure trading environment, ensuring you have the tools you need to succeed in the dynamic forex market.

Standard Accounts: Ideal for New Argentinian Traders

Are you just starting your forex journey in Argentina? The world of currency trading can seem complex at first, but choosing the right account type is your first strategic move. For many new Argentinian traders, a Standard Account stands out as the perfect entry point. It offers a balanced environment, providing access to real market conditions without overwhelming you with the complexities often found in more advanced account types.

A Standard Account typically features conventional lot sizes (often 100,000 units of the base currency), competitive spreads, and a good range of available instruments, including major and minor currency pairs. This setup closely mirrors how professional traders operate, giving you valuable experience in a live trading environment. It’s a stepping stone, allowing you to learn the ropes, manage real risk, and develop your trading strategy without the high capital requirements or ultra-tight spreads that might be less forgiving for a beginner.

Why Argentinian Beginners Thrive with Standard Accounts:

- Accessible Entry: Many brokers offer Standard Accounts with reasonable minimum deposit requirements, making forex trading more accessible for individuals looking to start with a modest capital.

- Realistic Market Exposure: You trade actual standard lots, which helps you understand profit and loss calculations more intuitively, preparing you for larger trades in the future.

- Familiar Features: These accounts often come with standard leverage options and common trading platforms (like MetaTrader 4 or 5), making the learning curve smoother.

- Diverse Instrument Selection: You’ll typically have access to a wide variety of currency pairs, allowing you to explore different markets and find your trading niche.

- Educational Support: Brokers often provide extensive educational resources tailored for Standard Account holders, helping you build your trading knowledge and skills.

When you open a Standard Account, you’re not just getting a trading platform; you’re getting an experience designed to nurture your growth as a trader. It’s about building confidence, understanding market dynamics, and applying your strategies in a controlled yet authentic trading setting. So, if you’re an ambitious new trader from Argentina, eager to step into the world of forex, a Standard Account is likely your best starting point for a stable and educational trading experience.

Professional Accounts: Raw Spread, Zero, and Pro Options

Choosing the right account type is crucial for your trading success. It impacts your costs, execution speed, and overall experience. As experienced traders, we understand your unique needs. That’s why we offer specialized professional accounts designed to elevate your trading journey. Let’s explore the Raw Spread, Zero, and Pro options in detail.

Raw Spread Accounts: Precision and Power

The Raw Spread account is a favorite among scalpers and high-frequency traders. It offers the tightest possible spreads, often starting from 0.0 pips on major currency pairs. You get direct access to deep interbank liquidity, ensuring minimal slippage even during volatile market conditions. While the spread is incredibly low, a small, transparent commission per lot applies. This structure provides true market pricing. You see the real cost of your trade upfront, making it ideal for strategies that rely on precise entry and exit points. If you value razor-thin spreads and robust execution, this account is built for you.

Zero Accounts: The Ultimate Low-Spread Experience

Imagine trading with virtually no spread. Our Zero account makes this a reality on selected major pairs. This account often boasts average spreads of 0.0 pips, thanks to our robust liquidity providers. Just like the Raw Spread account, a fixed commission applies per traded lot. This clear pricing model allows you to manage your costs effectively. It removes the uncertainty of fluctuating spreads, providing a consistent trading environment. Many traders who focus on technical analysis and specific price levels find the Zero account perfectly aligns with their strategies. It offers a straightforward cost structure and premium execution speed.

Pro Accounts: Unlocked Potential for Serious Traders

The Pro account caters to seasoned traders who demand more. This is where high volume meets superior conditions. You gain access to competitive spreads, often starting from 0.1 pips, with low commissions tailored for larger trade sizes. But it’s not just about the numbers. Pro accounts come with enhanced features like dedicated account management. You receive personalized support from experts who understand your trading style. You might also unlock higher leverage options and access to a broader range of trading instruments. This account is perfect for those managing substantial capital or running complex trading systems. It provides the flexibility and support required to scale your trading operations.

Which Professional Account Suits You?

Each professional account offers distinct advantages. Your choice depends on your trading strategy, volume, and preferences. Here’s a quick comparison to help you decide:

| Feature | Raw Spread Account | Zero Account | Pro Account |

|---|---|---|---|

| Minimum Spreads | From 0.0 pips | Average 0.0 pips on majors | From 0.1 pips |

| Commission | Per traded lot | Per traded lot | Low, volume-based |

| Ideal For | Scalpers, HFT traders | Consistent low-spread trading | High-volume, experienced traders |

| Execution | ECN/STP, fast | ECN/STP, very fast | ECN/STP, premium |

| Additional Benefits | True market pricing | Ultra-low cost on majors | Dedicated support, higher leverage |

“The difference between a good trader and a great trader often lies in their choice of tools and conditions,” a well-known market analyst once stated. Make sure your account conditions empower your strategy, not hinder it. Explore these professional options and take your trading to the next level.

Funding Your Exness Account: Deposits & Withdrawals for Argentina

For any serious trader in Argentina, a smooth and reliable process for moving funds in and out of their trading account is paramount. Exness understands this critical need, offering a robust and flexible system for both deposits and withdrawals tailored for our community. We know you want to focus on the markets, not on payment hassles. That’s why we’ve streamlined every step to ensure your funds are accessible when you need them, securely and efficiently.

Depositing Funds: Getting You Ready to Trade

Getting started with Exness from Argentina is straightforward. We offer a variety of popular deposit methods designed for speed and convenience, allowing you to fund your trading account quickly so you don’t miss out on market opportunities. Whether you prefer traditional banking or modern digital solutions, we have options to suit your preferences.

Here’s why depositing with Exness is a great experience:

- Instant Processing: Many of our deposit methods are processed instantly, meaning your capital appears in your trading account almost immediately.

- Zero Fees: Exness typically covers all deposit fees, so the amount you send is the amount that lands in your account.

- Diverse Options: From local bank transfers to international credit/debit cards and popular e-wallets, you’ll find a method that works for you. Think about familiar choices that simplify your financial transactions.

- Security First: We employ advanced encryption and security protocols to protect your financial information throughout the deposit process. Your peace of mind is our priority.

Our goal is to make sure your capital is ready when you are, allowing you to engage with the forex market without unnecessary delays.

Withdrawing Your Profits: Accessing Your Earnings

Successfully trading is about making profits, and getting those earnings into your hands should be just as easy as putting money in. Exness is committed to swift and reliable withdrawals for traders in Argentina. We understand that accessing your capital quickly is crucial, whether you’re reinvesting or managing your personal finances.

Consider these advantages when withdrawing from your Exness account:

- Fast Payouts: Our automated withdrawal system often processes requests within minutes, even on weekends. This means you get your money without lengthy waiting periods.

- Flexible Methods: Just like deposits, we offer a range of withdrawal options, allowing you to choose the most convenient way to receive your funds directly in Argentina.

- Transparent Process: We provide clear information on estimated processing times for each method. You always know what to expect.

- No Hidden Costs: Exness maintains a transparent fee policy. We believe you should keep what you earn, and we strive to ensure our withdrawal process supports that principle.

Remember, for your security and to comply with regulatory standards, a one-time account verification is necessary before your first withdrawal. This simple step ensures your funds go to the correct, authorized recipient. Once verified, your withdrawal experience will be consistently smooth and efficient. We empower you to manage your funds with confidence and ease.

Local Payment Methods and E-wallets Supported

Navigating the global forex market requires seamless access to your funds. That’s why we prioritize offering a diverse range of local payment methods and popular e-wallets. We understand that quick, convenient, and secure transactions are crucial for traders worldwide. Our goal is to make your deposit and withdrawal process as effortless as your trading.

We’ve integrated a variety of options to ensure you can fund your account and withdraw your profits with ease. Whether you prefer traditional banking or modern digital solutions, we have you covered.

Popular Local Payment Options Available:

- Direct Bank Transfers: Fund your account directly from your local bank, a reliable and widely used method.

- Regional Bank Solutions: Access specific payment gateways tailored to your country’s banking system, offering faster processing times.

- Mobile Payment Solutions: Utilize popular mobile payment apps that are prevalent in your region for instant deposits.

Advantages of Using Our Supported E-wallets:

E-wallets have transformed online transactions, offering speed and enhanced security. We support a comprehensive list of leading e-wallet providers, ensuring your financial flexibility.

| E-wallet Provider | Key Benefit | Processing Time |

|---|---|---|

| Skrill | Instant Deposits, Low Fees | Instant |

| Neteller | Global Reach, High Security | Instant |

| Perfect Money | Anonymous Transactions, Versatile | Instant |

| FasaPay | Fast Deposits, User-Friendly | Instant |

Choosing the right payment method depends on your personal preferences and regional accessibility. We constantly work to expand our payment network, adding new local options and e-wallets to serve our growing community better. Our commitment is to provide you with the smoothest financial experience, allowing you to focus purely on your trading strategies.

Understanding Transaction Fees and Processing Times

In the fast-paced world of forex trading, every detail counts, and understanding how transaction fees and processing times impact your trades is absolutely crucial. These aren’t just minor details; they significantly affect your overall profitability and liquidity. Let’s break down what you need to know to navigate these aspects like a seasoned pro.

The Lowdown on Transaction Fees

When you open or close a position, you’re interacting with a market that charges for its services. These are your transaction fees. They can vary wildly depending on your broker, the currency pair you’re trading, and even the time of day. Knowing what you’re paying helps you make smarter trading decisions.

Common Types of Fees:

- Spread: This is the most common fee. It’s the difference between the buy (ask) and sell (bid) price of a currency pair. Brokers make their money from this difference. A tighter spread means less cost for you.

- Commission: Some brokers charge a fixed commission per trade, especially for ECN or STP accounts, in addition to or instead of the spread. This often applies to larger volume traders.

- Swap/Rollover Fees: If you hold a position overnight, you might incur a swap fee or earn a swap interest. This is based on the interest rate difference between the two currencies in the pair. It can be positive or negative.

- Deposit/Withdrawal Fees: While less common for trading, some brokers charge fees for funding your account or withdrawing your profits, depending on the payment method used.

Deciphering Processing Times

Beyond the cost, how quickly your transactions are processed can make or break a trade. This refers to the time it takes for your deposits to appear in your trading account, for your trade orders to execute, and for your withdrawals to hit your bank account. In a market where milliseconds can matter, understanding these timeframes is vital.

Why Processing Times Matter:

Imagine spotting a perfect entry point, but your deposit hasn’t cleared. Or you need to withdraw profits quickly, but the process takes days. Efficient processing ensures you can react to market movements and manage your capital effectively.

Factors influencing processing times include:

- Payment Method: E-wallets often offer instant deposits and faster withdrawals compared to bank transfers, which can take several business days.

- Broker’s Internal Procedures: Each broker has their own protocols for verifying transactions, which impacts the overall speed.

- Bank Holidays and Weekends: Non-business days can significantly delay bank transfers and withdrawal processing.

- Verification Requirements: First-time withdrawals or large sums often require additional verification steps, adding to the processing time.

Strategies for Managing Fees and Times

Don’t just accept these elements; manage them strategically!

| Aspect | Effective Strategy |

|---|---|

| High Spreads | Trade during peak liquidity hours when spreads are naturally tighter. Consider ECN accounts if commissions are offset by very low spreads. |

| Commissions | Calculate your effective cost per lot. For high-volume traders, a commission-based model might be more cost-effective than a spread-only model with wider spreads. |

| Swap Fees | Be aware of the swap rates for currency pairs you hold overnight. If you’re a long-term trader, factor these into your profitability calculations. Short-term traders often avoid them. |

| Deposit/Withdrawal Delays | Choose payment methods known for speed and reliability. Plan your withdrawals in advance, especially for large amounts, to avoid last-minute urgency. |

By diligently understanding and actively managing transaction fees and processing times, you gain a significant edge. This proactive approach not only saves you money but also ensures your capital is where you need it, when you need it, allowing you to seize opportunities with confidence.

Exness Trading Platforms Available in Argentina

Ready to dive into the dynamic world of forex and CFD trading from Argentina? Exness offers a robust suite of trading platforms designed to meet the diverse needs of every trader, from beginners to seasoned pros. Whether you prefer the familiar interface of industry-standard software or a cutting-edge web-based solution, Exness ensures a seamless and powerful trading experience right here in Argentina. Let’s explore the top-tier trading platforms at your disposal.

MetaTrader 4 (MT4)

MetaTrader 4 remains the gold standard for many forex traders worldwide, and it’s fully available for Exness Argentina clients. MT4 offers a powerful, user-friendly environment perfect for analyzing financial markets and executing trades. Its popularity stems from its reliable performance and extensive customization options. You can easily access MT4 for desktop, web, or mobile trading, ensuring you never miss an opportunity.

- Intuitive Interface: Easy to navigate, even for new traders.

- Advanced Charting Tools: A wide range of analytical objects and indicators.

- Expert Advisors (EAs): Supports automated trading strategies.

- High Security: Encrypted data transmission for peace of mind.

- Customizable: Tailor your workspace with various layouts and profiles.

MetaTrader 5 (MT5)

For traders seeking enhanced functionalities and access to a broader range of financial instruments, MetaTrader 5 is the natural evolution. MT5 offers more timeframes, additional analytical tools, and a built-in economic calendar, making it ideal for comprehensive market analysis. Exness provides full support for MT5, allowing Argentinian traders to explore more advanced trading strategies with CFDs on stocks, commodities, and indices, in addition to forex trading.

| Feature | MT4 | MT5 |

|---|---|---|

| Number of Timeframes | 9 | 21 |

| Pending Order Types | 4 | 6 |

| Economic Calendar | No | Yes (Built-in) |

| Depth of Market (DOM) | No | Yes |

| Hedging Support | Yes | Yes |

Exness Terminal (Web Terminal)

If you prefer trading directly from your web browser without downloading any software, the Exness Terminal is your go-to solution. This proprietary web-based platform offers a streamlined and highly intuitive trading experience, perfect for quick market entry and exit. It boasts a clean interface and essential trading tools, making web trading simple and efficient. The Exness Terminal is accessible from any device with an internet connection, providing ultimate flexibility for Argentinian traders on the go.

“The Exness Terminal empowers traders with a convenient, powerful web-based platform that combines simplicity with essential trading features. It’s truly designed for a smooth web trading experience.”

Mobile Trading Apps

In today’s fast-paced world, mobile trading is essential. Exness understands this, providing dedicated mobile applications for both MetaTrader 4 and MetaTrader 5, as well as the Exness Trader app. These apps are available for iOS and Android devices, putting the financial markets literally in your pocket. You can monitor your trades, analyze charts, and execute orders anytime, anywhere. This means Argentinian traders can manage their portfolios with maximum convenience, whether they are at home or on the move.

Choosing the right trading platform is crucial for your success in the financial markets. Exness offers a comprehensive selection to ensure every trader in Argentina finds the perfect fit for their trading style and preferences. Explore these powerful platforms today and enhance your forex trading journey.

MetaTrader 4 & 5: Features for Argentinian Traders

For Argentinian traders navigating the dynamic world of foreign exchange, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) stand out as indispensable platforms. These powerful tools offer a comprehensive suite of features designed to enhance your trading experience, from precise market analysis to efficient trade execution. Whether you are a seasoned professional or just starting your journey in the forex market, MT4 and MT5 provide the robust environment you need to pursue your financial goals.

Both platforms are renowned for their reliability and an extensive array of functionalities that cater to diverse trading styles. They offer a stable gateway to global markets, allowing Argentinian traders to connect with various brokers and access a wide range of trading instruments, including currencies, commodities, and indices.

Key Features for Argentinian Traders:

- Advanced Charting Tools: Visualize market movements with a vast selection of timeframes and analytical objects. You can customize charts to your preference, employing various indicators to spot trends and potential entry or exit points.

- Expert Advisors (EAs): Automate your trading strategies with EAs. This feature allows for algorithmic trading, executing trades based on predefined rules without constant manual intervention. Many Argentinian traders appreciate the efficiency and discipline EAs bring to their operations.

- Customizable Indicators: Beyond the standard built-in indicators, both MT4 and MT5 support custom indicators. This flexibility empowers traders to apply unique analytical tools that align with their specific trading methodologies.

- Mobile Trading: Stay connected to the markets even when you are on the go. Both MetaTrader 4 and MetaTrader 5 offer robust mobile applications for iOS and Android devices, ensuring you never miss a trading opportunity from anywhere in Argentina.

- Security and Stability: These platforms prioritize the security of your trading activities. They use strong encryption protocols to protect your data and transactions, providing a secure environment for your forex operations.

MetaTrader 4 vs. MetaTrader 5: A Brief Comparison

While both platforms are excellent, they do have distinct strengths. Understanding these differences can help Argentinian traders choose the best fit for their needs.

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Primary Focus | Forex and CFDs | Forex, CFDs, Futures, Options, Stocks |

| Programming Language | MQL4 | MQL5 |

| Timeframes | 9 | 21 |

| Pending Order Types | 4 | 6 (including Buy Stop Limit, Sell Stop Limit) |

| Economic Calendar | No built-in | Built-in |

| Hedging | Supported (standard) | Supported (standard) |

| Netting | Not natively | Supported (for exchanges) |

Many Argentinian traders find MT4 sufficient for their forex trading needs due to its established community and vast library of EAs and indicators. However, MT5 offers more asset classes and advanced analytical tools, making it appealing for those looking to diversify their trading portfolio beyond just currencies.

Ultimately, both MetaTrader 4 and MetaTrader 5 provide Argentinian traders with a professional-grade environment to execute strategies, analyze markets, and manage risk effectively. Their intuitive interfaces and powerful features empower traders to make informed decisions and confidently pursue their trading goals.

Exness Terminal and Mobile App

Embark on your trading journey with the powerful and intuitive platforms offered by Exness. Whether you prefer the comprehensive web-based terminal or the flexibility of mobile trading on the go, Exness provides solutions designed to meet your needs. These platforms are crafted to ensure a seamless trading experience, giving you access to global markets right at your fingertips.

The Versatility of Exness Terminal

The Exness Terminal is a sophisticated web-based trading platform that combines a user-friendly interface with advanced analytical tools. You don’t need to download any software; simply open your browser and start trading. It’s built for traders who appreciate a clean layout and powerful functionality without the hassle of installation. You get real-time quotes, customizable charts, and a wide array of technical indicators to help you make informed decisions.

- Intuitive Interface: Navigate markets with ease, even if you are new to online trading.

- Advanced Charting Tools: Utilize multiple chart types, drawing tools, and over 100 indicators for in-depth market analysis.

- Fast Order Execution: Experience quick entry and exit from trades, crucial for volatile markets.

- Customizable Layouts: Arrange your workspace to suit your personal trading style and preferences.

Trading On-The-Go with the Exness Mobile App

In today’s fast-paced world, being tethered to a desktop is no longer an option for many traders. The Exness Mobile App offers the ultimate flexibility, allowing you to manage your accounts, analyze markets, and execute trades from anywhere, at any time. Available for both iOS and Android devices, this app brings the full power of Exness to your smartphone or tablet, ensuring you never miss a trading opportunity.

Here’s what makes the Exness Mobile App an essential tool for every trader:

| Feature | Benefit |

|---|---|

| Full Account Management | Deposit, withdraw, and transfer funds effortlessly. |

| Live Price Quotes | Stay updated with real-time market data across all instruments. |

| Interactive Charts | Perform technical analysis directly on your mobile device. |

| Push Notifications | Receive instant alerts on market events and order statuses. |

| User-Friendly Design | Simple and intuitive navigation designed for touchscreens. |

The synergy between the Exness Terminal and the mobile app ensures that your trading experience is cohesive and robust, no matter where you are. You can start analyzing on your desktop and seamlessly switch to your mobile device to execute trades or monitor positions, maintaining full control over your trading activities. It’s about providing you with the freedom and tools to trade effectively, on your own terms.

Unlock incredible potential in the markets with Exness Argentina! We know that true trading success comes from having choices, and that’s why our platform offers an expansive selection of trading instruments. Whether you are a seasoned pro or just starting your journey, our diverse range ensures you find ample trading opportunities to build a truly diversified portfolio.

Here’s a closer look at the key instrument categories you can trade on Exness:

Forex (Currency Pairs)

Dive into the world’s most liquid market. You can trade a vast array of currency pairs, including popular major pairs like EUR/USD, GBP/USD, and USD/JPY. We also provide access to minor and exotic pairs, allowing you to explore unique market dynamics and capitalize on different economic trends. Forex trading offers continuous opportunities around the clock, making it a favorite for many Argentine traders.

Cryptocurrencies (Digital Assets)

Step into the exciting and volatile realm of digital assets. Trade popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many more against major fiat currencies. Cryptocurrency trading on Exness means you can take advantage of significant price movements without needing to own the underlying digital currency. This is a fantastic way to engage with the next generation of financial markets.

Metals (Precious Commodities)

Hedge against inflation or speculate on global economic shifts with precious metals. Our platform allows you to trade Gold, Silver, Platinum, and Palladium. These commodities are often seen as safe-haven assets, providing unique trading dynamics compared to currencies or stocks. Trading precious metals can add a layer of stability and diversification to your overall trading strategy.

Energies (Global Commodities)

Take positions on the vital energy markets. You can trade crude oil (including Brent and WTI) and natural gas, instruments heavily influenced by global supply, demand, and geopolitical events. Participating in energies trading lets you benefit from significant price swings tied to global economic activity and political developments.

Stocks and Indices

Access the equity markets with a wide selection of stocks and global indices. Trade CFDs on shares of leading companies from various sectors worldwide. Alternatively, trade on major stock market indices like the S&P 500, Dow Jones, FTSE 100, and others, giving you exposure to the broader economic performance of entire regions. Stock trading and index trading provide excellent ways to diversify beyond traditional forex and commodity markets.

Why does such a wide range of instruments matter for your trading journey?

- Unleash More Opportunities: Different markets react to news and economic data in unique ways. A broader selection means more potential setups and entries throughout the day.

- Achieve True Diversification: Don’t put all your eggs in one basket. By trading various asset classes, you can spread your risk and potentially reduce overall portfolio volatility.

- Adapt to Market Conditions: Some instruments thrive in volatile markets, while others perform better in stable conditions. Your ability to switch between them gives you flexibility.

- Match Your Strategy: Every trader has a unique style. Whether you are a short-term scalper or a long-term position holder, you will find instruments that align perfectly with your preferred approach.

Exness provides the tools and the deep liquidity for you to explore these markets confidently. Start building your diverse trading portfolio today and seize the world’s opportunities!

Competitive Spreads, Commissions, and Leverage for Argentinian Clients

As a forex trader in Argentina, you know that every pip counts, and the cost of your trades directly impacts your profitability. We understand this crucial aspect of trading, which is why we meticulously structure our offerings to provide truly competitive spreads, transparent commissions, and flexible leverage options tailored specifically for Argentinian clients. Our commitment is to give you an edge in the dynamic global markets.

Unpacking Our Advantageous Trading Conditions:

- Ultra-Tight Spreads: We strive to offer some of the tightest spreads in the industry, starting from just a few pips on major currency pairs. Narrow spreads mean lower transaction costs for you, allowing more of your potential profits to stay in your pocket. Whether you trade EUR/USD, GBP/JPY, or other popular pairs, you will find our pricing highly attractive.

- Clear and Transparent Commissions: Forget hidden fees. Our commission structure is straightforward and easy to understand. We believe in complete transparency, so you always know exactly what you pay for each trade. This clarity helps you manage your trading budget effectively and forecast your costs with confidence, ensuring no unwelcome surprises.

- Flexible Leverage for Strategic Trading: Leverage is a powerful tool that can amplify your market exposure with a smaller initial capital outlay. We offer flexible leverage options designed to suit various trading styles and risk appetites. You can choose the level of leverage that aligns with your strategy, enabling you to capitalize on even small market movements. It’s about empowering your trading journey while encouraging responsible risk management.

When you trade with us, you gain access to a platform engineered for efficiency and cost-effectiveness. Our goal is to minimize your trading expenses while maximizing your potential returns, making your trading experience smoother and more rewarding. We continuously monitor market conditions to ensure our offerings remain at the forefront of the industry, delivering real value to our Argentinian trading community.

Consider these points when evaluating your trading partner:

| Feature | Your Benefit | Impact on Trading |

|---|---|---|

| Tight Spreads | Lower entry/exit costs on trades | Increased profit potential per trade |

| Transparent Commissions | Predictable trading expenses | Better financial planning and budgeting |

| Flexible Leverage | Amplified market exposure | Opportunity to capitalize on smaller moves with less capital |

Join a community where your success is our priority. Experience the difference that competitive trading conditions can make to your forex journey.

Exness Customer Support for Argentinian Users

As a professional trader, I know that reliable customer support isn’t just a bonus—it’s essential. For our fellow Argentinian traders navigating the dynamic forex market with Exness, knowing you have strong, accessible support makes all the difference. Exness understands this critical need, offering a robust customer service system designed to assist you every step of the way.

Whether you’re new to the platform or an experienced veteran, questions and challenges can arise. That’s why Exness provides multiple channels to ensure you get the help you need, precisely when you need it. They prioritize your trading experience, making sure support is always within reach.

So, how does Exness support Argentinian traders effectively? They offer several key avenues for customer service:

- 24/7 Live Chat: This is often your fastest route to assistance. The live chat feature is available around the clock, meaning you can get instant responses to your urgent queries, day or night. It’s perfect for quick problem-solving and immediate guidance.

- Email Support: For more detailed inquiries or when you need to provide specific documentation, email support offers a comprehensive solution. The Exness team aims to respond swiftly, providing thorough answers to your questions.

- Phone Assistance: Sometimes, talking directly to someone is the most effective way to resolve an issue. Exness offers phone lines, allowing you to speak with a support representative who can guide you through complex situations.

- Multilingual Service: Crucially for Argentinian traders, Exness provides customer service in Spanish. This localized support ensures clear communication and a comfortable experience, breaking down language barriers and allowing you to explain your concerns fully.

Think of their customer service as your personal trading safety net. From technical glitches to account management questions, or even understanding specific trading conditions, the Exness support team is equipped to handle a wide range of topics. This dedicated approach ensures that your focus remains on your trades, not on navigating confusing support systems.

The peace of mind that comes from knowing dependable help is always available cannot be overstated. Exness’s commitment to strong customer service truly enhances the overall trading experience for Argentinian users, making it smoother and more secure. They don’t just offer platforms; they offer partnerships, and reliable support is a cornerstone of that partnership.

Advantages and Disadvantages of Trading with Exness in Argentina

Navigating the world of online trading requires careful consideration of your broker. For traders in Argentina eyeing the global markets, Exness often comes up as a prominent option. This international broker offers a range of services designed to appeal to both new and experienced traders. However, like any platform, it presents a unique set of pros and cons, particularly when viewed through the lens of the Argentine trading landscape.

Advantages of Trading with Exness in Argentina

Exness brings several compelling features to the table that can significantly benefit traders operating from Argentina. Its strong reputation and client-centric approach are often highlighted as key selling points.

- Competitive Spreads: Exness is well-known for offering tight spreads, which can reduce trading costs significantly over time. Lower spreads mean more of your potential profits stay in your pocket.

- Variety of Account Types: Whether you’re a beginner or a seasoned pro, Exness provides various account types, including Standard, Raw Spread, and Zero accounts. This flexibility allows traders to choose an account that best fits their trading style, capital, and risk tolerance.

- Instant Withdrawals: One of Exness’s most touted features is its fast withdrawal processing. This means quicker access to your funds, which is a major convenience and builds trust among traders.

- Strong Regulatory Framework: Exness operates under multiple international regulatory bodies. While direct local regulation in Argentina might differ, their global licenses provide a layer of security and transparency for clients.

- Diverse Trading Instruments: Traders can access a wide array of instruments, including forex pairs, cryptocurrencies, stocks, indices, and commodities. This variety allows for portfolio diversification and more trading opportunities.

- Excellent Customer Support: Exness offers multilingual customer support available 24/7. This responsiveness is crucial for traders who need quick assistance with technical issues or account inquiries, especially across different time zones.

Disadvantages of Trading with Exness in Argentina

While Exness offers many positives, traders in Argentina should also be aware of potential drawbacks. Understanding these can help you make a more informed decision and manage your expectations.

- Regulatory Nuances: While Exness holds strong international licenses, the specific regulatory environment within Argentina for international brokers can be complex. Traders should always be aware of local financial regulations and tax implications.

- Limited Local Payment Methods: While Exness supports many global payment options, some popular local Argentine payment methods might not be directly available, potentially leading to extra steps or fees for deposits and withdrawals.

- High Leverage Risks: Exness offers very high leverage options, which, while beneficial for amplifying profits, can also significantly amplify losses. New traders, in particular, must exercise extreme caution and employ robust risk management strategies.

- Potential for High Minimum Deposits on Certain Accounts: While some accounts have low minimum deposits, certain premium account types designed for professional traders might require a higher initial investment, which could be a barrier for some individuals.

- Educational Content Focus: While Exness provides educational resources, some traders might find the depth or localization of educational materials for the Argentine market less extensive compared to platforms with a stronger local presence.

In conclusion, Exness offers a robust and attractive trading environment with many benefits for Argentine traders looking to access global markets. However, a thorough understanding of its features, coupled with an awareness of the local financial landscape, is essential for a successful trading journey.

How to Open an Exness Account from Argentina (Step-by-Step)

Ready to dive into the exciting world of forex trading with Exness from Argentina? Good choice! Exness offers competitive conditions, a wide range of instruments, and robust platforms, making it a popular option for traders globally, including here in Argentina. Opening an account is straightforward and quick. Let’s walk through the process together, step by step, so you can start trading without delay.

Your Path to Trading: A Simple Guide

Follow these easy steps to set up your Exness trading account and begin your journey in the financial markets.

Visit the Official Exness Website: Start by navigating to the official Exness website. Make sure you are on the legitimate site to ensure your security and data privacy. Look for a clear \”Open Account\” or \”Register\” button, usually prominently displayed on the homepage.

Initiate Registration: Click on the \”Open Account\” button. A registration form will appear, prompting you to enter some basic information. This is your first step towards becoming an Exness trader.

Enter Your Details: You need to provide your country of residence (Argentina), a valid email address, and create a strong password. Choose your password carefully – combine uppercase and lowercase letters, numbers, and symbols for maximum security. Then, simply click \”Register\”.

Verify Your Email and Phone Number: Exness will send a verification code to your registered email address or phone number. Enter this code into the designated field on the website. This step confirms your contact information and secures your account.

Complete Your Profile: After verification, you will access your personal area. Here, you must complete your economic profile by providing personal details like your full name, date of birth, and address. This information helps Exness comply with regulatory requirements.

Choose Your Account Type: Exness offers various account types tailored to different trading styles and experience levels. Consider your trading strategy and capital when making your choice. Popular options include Standard, Pro, Raw Spread, and Zero accounts. Each has unique features regarding spreads, commissions, and minimum deposits. You can always open multiple account types later if your needs change.

Fund Your Account: Now it’s time to deposit funds into your trading account. Exness supports a variety of payment methods convenient for Argentine traders, including local bank transfers, e-wallets, and sometimes even cryptocurrencies. Select your preferred method, enter the amount you wish to deposit, and follow the on-screen instructions. Deposits are often instant or processed very quickly.

Complete Account Verification (KYC): To unlock full trading capabilities and unlimited withdrawals, you must complete the Know Your Customer (KYC) process. This involves uploading documents to verify your identity and residence. Typically, you will need:

- Proof of Identity: A clear photo of your National Identity Document (DNI) or passport.

- Proof of Residence: A utility bill (electricity, water, gas), bank statement, or phone bill issued within the last three to six months, showing your name and address.

The Exness team usually reviews these documents quickly, and you will receive a notification once your account is fully verified.

Start Trading: Congratulations! Once your account is funded and verified, you are ready to trade. Download the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platform, log in with your account credentials, and begin exploring the markets. You can trade major, minor, and exotic currency pairs, commodities, indices, and even cryptocurrencies.

Why Argentine Traders Choose Exness

Exness provides several advantages that appeal to traders in Argentina:

- User-Friendly Interface: Their platform and personal area are intuitive and easy to navigate, even for beginners.

- Flexible Account Options: A wide range of account types means you can find one that perfectly matches your trading style and capital.

- Competitive Spreads: Exness is known for its tight spreads, which can significantly reduce your trading costs.

- Reliable Customer Support: Access to multilingual customer service ensures you get help whenever you need it.

- Local Payment Solutions: Convenient deposit and withdrawal options make managing your funds simple and efficient.

Opening an Exness account from Argentina is a seamless process designed to get you trading quickly and securely. Take the first step today and join the global community of Exness traders!

Security Measures and Fund Protection with Exness Argentina

When you navigate the dynamic world of forex trading, your peace of mind is paramount. Knowing your funds are secure allows you to focus on strategy and market analysis, rather than worrying about the safety of your capital. For traders in Argentina, Exness dedicates significant resources to implementing robust security measures and comprehensive fund protection protocols. We understand that trust is the foundation of any successful trading journey.

Our commitment to your security isn’t just a promise; it’s embedded in every aspect of our operations. Exness prioritizes the safety of client funds above all else, ensuring that your investment is handled with the utmost care and professionalism. This focus on security allows our traders, whether experienced or just starting out in Argentina’s vibrant trading community, to trade with confidence.

Comprehensive Fund Safety Measures

Exness employs multiple layers of protection designed to safeguard your deposits and ensure smooth, secure withdrawals. We believe in transparency and want you to clearly understand how your funds are protected.

- Segregated Client Accounts: Your funds are kept in separate bank accounts, distinct from Exness’s operational capital. This means that in the unlikely event of company insolvency, your money remains untouched and is not used for company expenses. This segregation of client funds is a cornerstone of our financial security policy.

- Regulatory Compliance: Operating under strict international regulations, Exness adheres to the highest standards of financial conduct and transparency. While direct regulation in Argentina is evolving, our global licenses provide a strong framework for investor protection wherever you trade.

- Negative Balance Protection: We offer negative balance protection, which means you cannot lose more money than you have deposited. If market movements cause your account balance to fall below zero, Exness will reset it to zero, protecting you from unexpected debt.

- Advanced Data Encryption: All your personal and financial data, including sensitive payment information, is protected using state-of-the-art encryption technologies. This ensures that your information remains confidential and secure during every transaction and interaction with our platforms.

Protecting Your Trading Account

Beyond securing your funds, we implement measures to protect your trading account from unauthorized access. Your account security is a shared responsibility, and we provide the tools to empower you.

- Two-Factor Authentication (2FA): Enhance your login security by enabling 2FA. This adds an extra layer of protection, requiring a code from your mobile device in addition to your password, making it significantly harder for unauthorized individuals to access your account.

- Strong Password Policies: We encourage and enforce the use of complex, unique passwords to further safeguard your account. Regularly updating your password is a simple yet effective step in maintaining account integrity.

- Withdrawal Security Protocols: Our withdrawal process includes verification steps to ensure funds are released only to the authorized account holder. We scrutinize every withdrawal request to prevent any fraudulent activity, ensuring your money reaches you safely and efficiently.

At Exness, we continuously review and update our security frameworks to combat evolving threats and maintain the highest levels of fund protection. Our dedicated team of experts works tirelessly to ensure a secure and reliable trading environment for all our clients in Argentina and worldwide. Trade with peace of mind, knowing that your financial security is our top priority.

Exness Argentina: Navigating Local Economic Conditions

Trading forex in Argentina presents a unique set of challenges and opportunities, primarily due to the country’s dynamic economic landscape. Local traders face considerations like high inflation, currency volatility, and evolving regulatory frameworks. For those using international brokers like Exness, understanding how to navigate these local economic conditions is key to a successful trading journey. Exness aims to provide a reliable platform, but the local economic environment invariably shapes the trading experience.

The Argentine Economic Landscape for Traders

Argentina’s economy is known for its complexities. Traders must be aware of several factors that directly impact their operations:

- Inflationary Pressures: Persistent high inflation means that the purchasing power of local currency can erode quickly. Traders often look to hard assets or stable foreign currencies, like the US dollar, to preserve value.

- Currency Fluctuations: The Argentine Peso (ARS) can experience significant swings against major currencies. While volatility can create trading opportunities, it also adds an extra layer of risk for those managing local funds.

- Capital Controls: The government occasionally implements restrictions on currency exchange and capital movement. These measures can affect how easily traders deposit or withdraw funds from international platforms.

Successfully trading through these conditions requires not just market analysis but also a keen awareness of local economic policy and its potential impact on your trading capital.

How Exness Helps Argentine Traders Adapt

Exness offers features that can assist Argentine traders in mitigating some of the local economic pressures:

Diverse Account Options

Exness provides various account types, including Standard, Raw Spread, and Zero accounts. Traders can choose an account that aligns with their trading style and capital availability, potentially helping them manage their exposure to local currency fluctuations by focusing on assets quoted in more stable currencies.

Flexible Payment Methods

The platform supports a range of deposit and withdrawal methods, including options that may be more resilient to local currency restrictions. While direct bank transfers in ARS might face certain limitations, alternative methods or e-wallets can offer more flexibility for funding and withdrawing in other currencies.

Leverage and Risk Management Tools

Exness’s flexible leverage options allow traders to manage their exposure while potentially amplifying returns. Paired with robust risk management tools like stop-loss and take-profit orders, traders can better protect their capital against sudden market shifts, which are more common during periods of economic instability.

Customer Support

Having access to responsive customer support can be invaluable. For Argentine traders, getting timely assistance on deposit/withdrawal issues or account verification, particularly when dealing with local economic nuances, helps smooth the trading process.

Tips for Argentine Traders Using Exness

Consider these strategies to optimize your trading experience with Exness in Argentina:

Always stay informed about local economic news and government policies. Understand how these might impact the peso and your ability to transact internationally. This vigilance empowers you to make timely decisions about your trading capital.

Additionally, focus on pairs involving major, stable currencies if your primary goal is capital preservation against local inflation. Diversify your trading strategies and assets to spread risk. Most importantly, ensure your risk management practices are robust, especially when operating in a high-volatility environment.

Exness vs. Local Brokers: A Comparison for Argentina

Choosing the right forex broker is a pivotal decision for any trader, and for those in Argentina, the choice often narrows down to an international giant like Exness or a local brokerage firm. Each option presents a unique set of advantages and challenges, deeply influenced by Argentina’s specific economic landscape and regulatory environment. Let’s dissect these differences to help you make an informed decision.

Understanding the Regulatory Landscape

One of the primary considerations for any trader is the regulatory framework governing their chosen broker. Exness operates under strict regulations from multiple international bodies, including CySEC in Cyprus, FCA in the UK, FSC in the BVI, and FSCA in South Africa, among others. This multi-jurisdictional oversight often provides a robust layer of security and transparency, as these regulators impose stringent requirements on client fund segregation, operational transparency, and dispute resolution mechanisms.

On the other hand, local Argentinian brokers primarily fall under the purview of local regulatory bodies. While these regulations are designed to protect local investors, they might not always align with the global standards seen with international behemoths. Traders need to carefully research the specific licenses and track record of any local broker to ensure adequate protection and compliance.

Trading Conditions: Spreads, Leverage, and Execution

Trading conditions are the heartbeat of your forex experience. Here, international brokers like Exness often shine with highly competitive offerings. They typically provide:

- Ultra-low spreads: Often starting from 0.0 pips on major currency pairs, thanks to their high trading volumes and deep liquidity pools.

- Flexible leverage: Exness is renowned for offering unlimited leverage under certain conditions, which can significantly amplify trading power (though it also increases risk). Local brokers might have more conservative leverage limits imposed by local regulations.

- Fast execution speeds: Their advanced technological infrastructure and partnerships with top-tier liquidity providers ensure lightning-fast trade execution, minimizing slippage.

- Diverse account types: Catering to various trading styles and experience levels, from Standard accounts to Professional accounts with raw spreads.

Local brokers, while potentially offering good conditions, might face limitations in terms of liquidity access or technological investment, which could result in slightly wider spreads or less consistent execution, especially during volatile market periods. Their offerings are often tailored more to the domestic market’s specific needs and regulations.

Funding Methods and Currency Considerations

Navigating deposits and withdrawals in Argentina can be complex due to capital controls and exchange rate fluctuations. Here’s a comparative look:

| Feature | Exness (International Broker) | Local Argentinian Brokers |

|---|---|---|

| Available Currencies | Primarily USD, EUR for accounts; accepts various fiat and crypto for deposits. | Often prioritize ARS (Argentine Peso) for accounts and transactions. |

| Deposit/Withdrawal Methods | Wide range: Bank wires, credit/debit cards, e-wallets (Skrill, Neteller, Perfect Money), cryptocurrencies. | Local bank transfers, possibly local e-wallets specific to Argentina, sometimes credit/debit cards. |

| Conversion Fees | Might incur fees when converting ARS to USD/EUR for deposits, depending on your local bank/service. | Generally less direct conversion hassle if dealing primarily in ARS. |

| Speed of Transactions | E-wallet/crypto often instant; bank wires can take 1-5 business days. | Local bank transfers typically fast within Argentina; other methods vary. |

For Argentinian traders, Exness provides the flexibility of using various international methods, including cryptocurrencies, which can sometimes bypass certain local banking restrictions. However, converting ARS to a base currency like USD for your trading account might involve additional steps and potential fees from your local bank or payment provider. Local brokers, on the other hand, are designed to seamlessly handle ARS transactions, potentially offering more direct and simpler funding pathways within the country’s financial system.

Customer Support and Local Relevance

Customer support is crucial, especially when technical issues arise or you need clarity on your account. Exness offers multilingual support, including Spanish, available 24/7 via live chat, email, and phone. Their global presence means they have dedicated teams to assist clients worldwide, often with a robust knowledge base and FAQs.

Local brokers will naturally offer support in Spanish, with staff who deeply understand the local market nuances, banking systems, and regulatory specificities of Argentina. This localized understanding can be a significant advantage when dealing with issues that are unique to the Argentinian context.

Concluding Thoughts

In essence, the choice between Exness and a local Argentinian broker boils down to your priorities. If you value a wide array of instruments, cutting-edge technology, highly competitive trading conditions, and robust international regulation, Exness presents a compelling case. As a direct quote from many experienced traders often highlights, \”Diversifying your broker choice and ensuring strong regulation is key to long-term success.\” However, if seamless ARS transactions, highly localized support, and adherence to purely local regulations are your primary concerns, a domestic broker might be more suitable.

Many Argentinian traders find a balance by using international brokers for their primary trading activities while leveraging local solutions for specific funding needs. Evaluate your own trading style, risk tolerance, and financial comfort with international transactions before making your final decision.

Exness Argentina: Frequently Asked Questions (FAQs)

Embarking on your online trading journey in Argentina brings many questions. You want clarity, reliability, and ease of use. As a leading broker, Exness aims to provide just that. Here, we address some of the most common inquiries from traders like you in Argentina. We cover everything from account creation to managing your funds and understanding trading conditions. Get ready to gain insights into how Exness supports your forex trading aspirations.

Is Exness available and regulated for traders in Argentina?

Yes, Exness is readily available to traders in Argentina. While Exness operates globally under various licenses from top-tier regulatory bodies, it serves clients in Argentina through its international entities. This approach ensures you can access a robust and secure trading platform. Always review the terms of service to understand the specific entity serving your region for online trading Argentina.

What types of Exness accounts can I open in Argentina?

Exness offers a diverse range of account types designed to suit different trading styles and experience levels for forex trading Argentina. You can choose from Standard, Standard Cent, Raw Spread, Zero, and Pro accounts. Each Exness account type comes with unique features regarding spreads, commissions, and minimum deposits. For instance, the Standard account is popular for beginners due to its simplicity, while more experienced traders might prefer the Raw Spread or Zero accounts for tighter trading costs Argentina. An Exness demo account is also available to practice without risk.

How do I deposit and withdraw funds with Exness in Argentina?

Exness provides a variety of convenient deposit methods Argentina and withdrawal options Argentina to fund your trading activities. You can typically use local payment methods, bank transfers, and popular e-wallets. The specific options available might vary, so always check the Client Area for the most up-to-date information relevant to your location. Exness strives for fast processing times for both deposits and withdrawals, ensuring you have quick access to your funds for your online trading Argentina.

What kind of customer support can I expect from Exness?

Exness prides itself on offering exceptional customer support Exness to its clients around the clock. You can reach out to their support team via live chat, email, or phone. They offer assistance in multiple languages, ensuring you get clear and timely answers to your queries. Whether you have questions about your Exness account, technical issues with the trading platform Argentina, or need help with transactions, their dedicated team is ready to assist you.

What are the typical trading conditions, like leverage and spreads, on the Exness platform?

Exness is known for offering competitive trading conditions. The leverage Exness provides can be quite high, even unlimited under certain conditions, allowing traders to maximize their potential. However, higher leverage also involves greater risk, so always trade responsibly. Spreads Exness offers are generally tight, especially on major currency pairs, and can be as low as 0.0 pips on certain account types, contributing to lower trading costs Argentina. The exact spreads and leverage depend on your chosen Exness account type and market conditions.

Is Exness a safe and legitimate platform for online trading in Argentina?

Yes, Exness prioritizes the security of its clients’ funds and personal information. They employ robust security measures, including segregation of client funds from company funds and advanced encryption technologies. As a globally recognized broker, Exness adheres to strict financial standards and regulatory requirements in the jurisdictions where it operates, building trust as a legitimate option for online trading Argentina. Exness maintains a strong reputation within the forex industry for its transparency and reliability, making it a trusted trading platform Argentina.

Conclusion: Is Exness the Best Choice for Traders in Argentina?

After exploring what Exness offers, the question remains: is it truly the best choice for traders operating from Argentina? Based on its comprehensive features and strong reputation, many traders find Exness to be an exceptional platform, particularly given the unique needs and challenges of the Latin American market.

Exness stands out for several compelling reasons that resonate with Argentine traders. Its commitment to transparent trading conditions, competitive spreads, and a wide array of instruments makes it an attractive option whether you trade forex, cryptocurrencies, or commodities. We all know how crucial competitive pricing is in the dynamic world of trading. Beyond the numbers, the reliability of execution and the robust technological infrastructure provided by Exness ensure that your trades go through smoothly, minimizing slippage – a vital factor for active traders.

Here are some key aspects that solidify Exness’s position as a top contender for traders in Argentina:

- Regulatory Compliance: Operating under various reputable licenses offers a layer of security and trust, which is paramount in a volatile market.

- Diverse Account Types: From standard accounts perfect for beginners to professional accounts designed for high-volume traders, Exness caters to various trading styles and capital levels.

- Flexible Payment Solutions: The availability of local payment methods and quick processing times for deposits and withdrawals simplifies financial operations, a significant advantage for traders in Argentina.

- 24/7 Customer Support: Access to round-the-clock support in multiple languages ensures that help is always at hand, addressing any queries or issues promptly.

- Advanced Trading Tools: Access to popular platforms like MetaTrader 4 and 5, along with analytical tools and educational resources, empowers traders to make informed decisions.

While \”best\” is subjective and ultimately depends on individual trading preferences, Exness consistently delivers a high-quality trading environment that meets the demands of both novice and experienced traders. Its focus on user experience, combined with strong operational integrity, positions it as a leading broker in the region.

Consider your own trading goals, experience level, and preferred instruments. Then, explore Exness’s offerings. Many traders in Argentina have already discovered the benefits. If you prioritize competitive conditions, reliable execution, and comprehensive support, Exness definitely deserves your consideration as a prime partner in your trading journey.

Frequently Asked Questions

Is Exness a legal and safe broker for traders in Argentina?

Yes, Exness is a safe and legitimate choice. While it operates under international licenses (like CySEC and FCA) rather than a specific Argentinian one, these regulations ensure high standards of fund security, including segregated client accounts and negative balance protection. Argentine traders can legally use its services.

What account types does Exness offer to Argentinian traders?

Exness provides a range of accounts for Argentinian traders, including Standard accounts ideal for beginners and Professional accounts (Raw Spread, Zero, and Pro) for experienced traders seeking lower spreads and faster execution. A risk-free demo account is also available for practice.

How can I deposit and withdraw money from Exness in Argentina?