Navigating the world of online forex trading demands a broker that understands diverse trader needs. Exness stands out by offering a range of account types, each designed to cater to different trading styles, experience levels, and financial goals. Whether you’re a seasoned professional executing high-volume trades or just starting your journey into the exciting currency markets, Exness provides tailored options to ensure your trading experience is smooth and effective.

Understanding the distinctions between these accounts is crucial. It’s not just about minimum deposits; it’s about the trading conditions, spreads, commissions, and execution models that best align with your strategy. Making the right choice from the start can significantly impact your potential for success and overall satisfaction as an Exness trader. Let’s explore how you can select the perfect fit for your unique trading adventure.

- Understanding Exness Account Categories

- The Main Pillars: Standard vs. Professional Accounts

- Key Considerations When Choosing Your Account

- Standard vs. Professional Account Structures

- Understanding the Standard Account

- Exploring the Professional Account

- Making Your Choice

- Exness Standard Accounts: Ideal for Beginners?

- What Defines an Exness Standard Account?

- Advantages for New Traders

- Potential Considerations for Beginners

- Is It Your Ideal Starting Point?

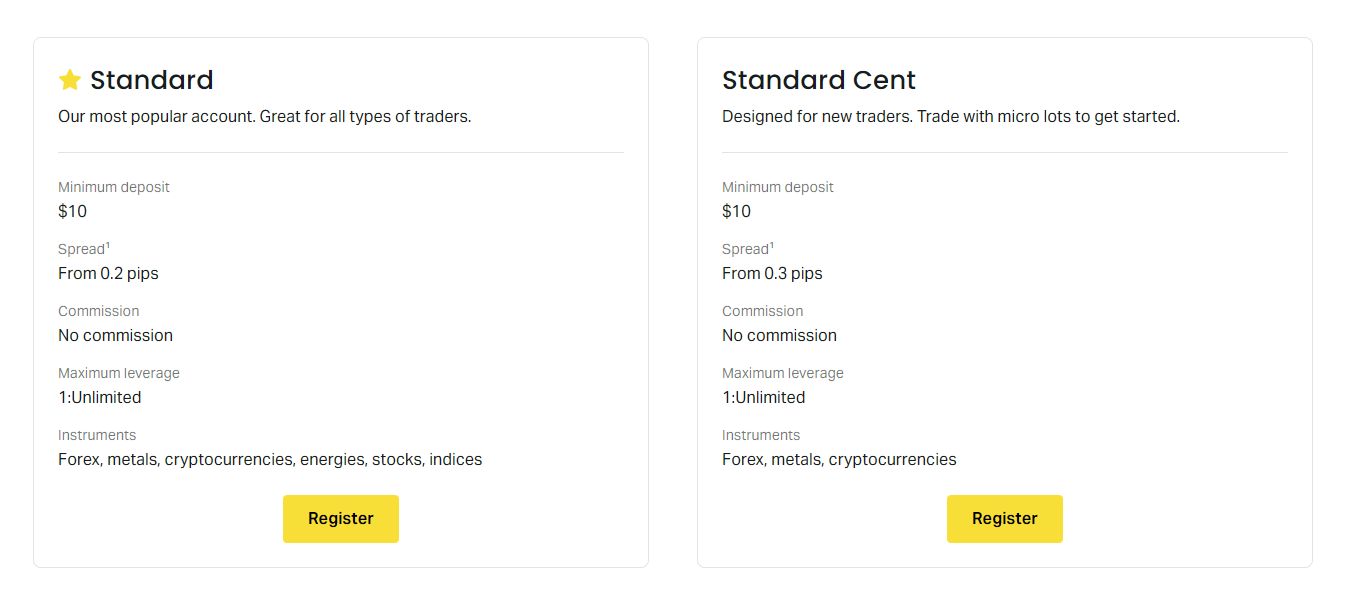

- Key Features of Standard and Standard Cent Accounts

- Standard Account:

- Standard Cent Account:

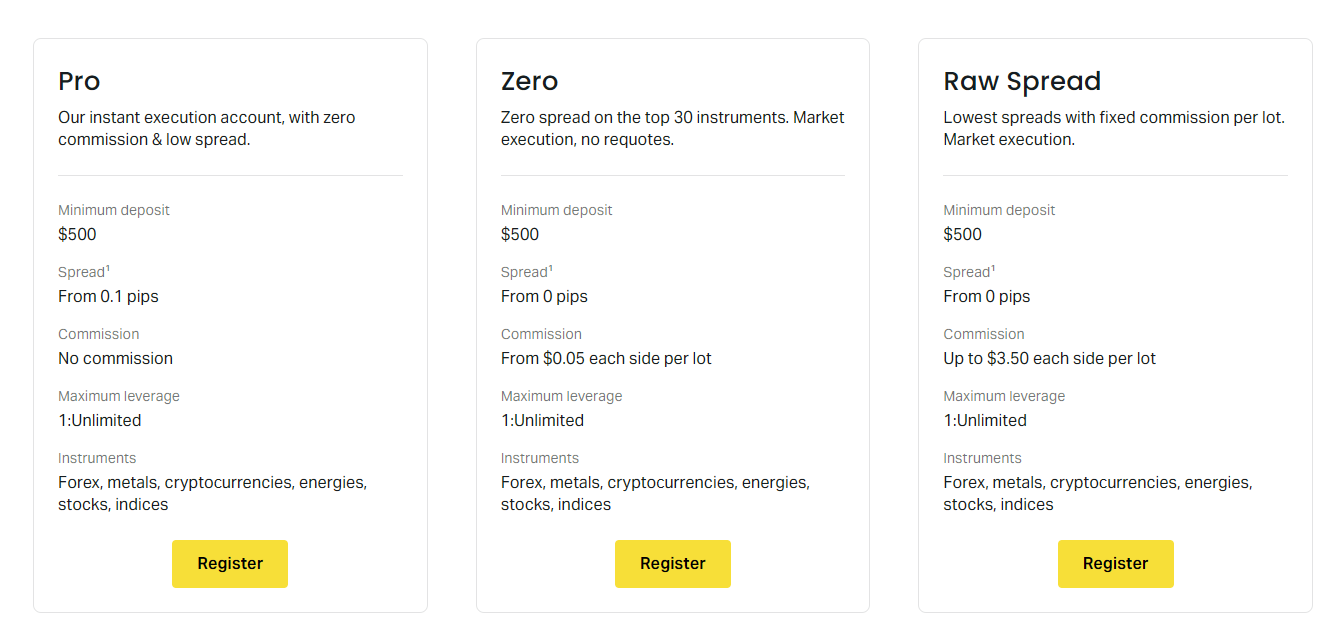

- Exploring Exness Raw Spread Account Benefits

- Key Benefits of the Exness Raw Spread Account:

- Exness Zero Account: What You Need to Know

- Who Benefits from the Exness Zero Account?

- Understanding the Commission Structure

- Pro Account Exness: For Experienced Traders

- What Makes the Exness Pro Account Ideal for You?

- Designed for Strategic Trading

- Comparing Exness Account Types: A Quick Overview

- Standard Accounts

- Professional Accounts

- Raw Spread Account:

- Zero Account:

- Pro Account:

- Choosing Your Account

- Minimum Deposit Requirements for Each Exness Account

- Standard Accounts

- Professional Accounts

- Leverage and Margin Across Exness Account Types

- Unpacking Leverage: Your Trading Amplifier

- Demystifying Margin: The Security Blanket

- Exness Account Types and Their Leverage Dynamics

- Navigating Risk with Smart Leverage Choices

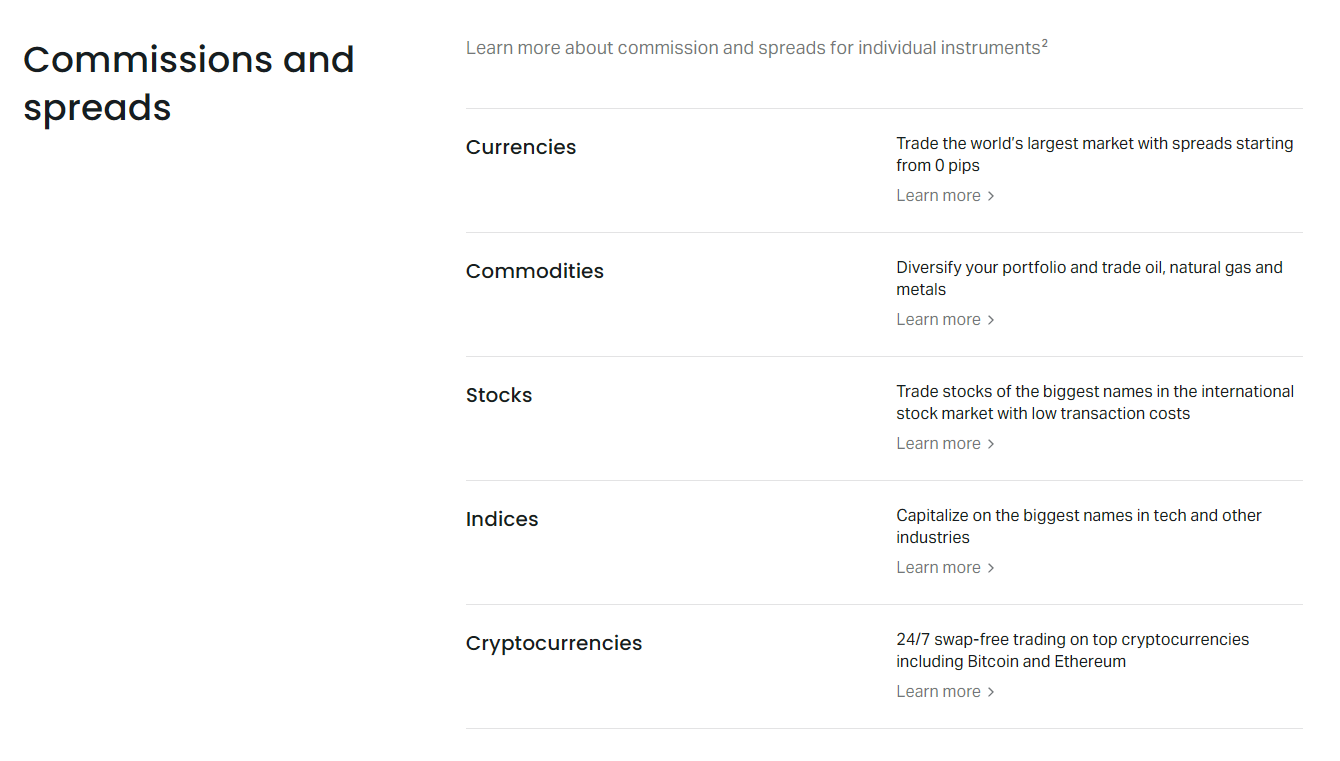

- Spreads, Commissions, and Swaps on Exness Accounts

- How to Choose the Best Exness Account for Your Trading Style

- Exploring Exness Account Types for Your Trading Style

- Standard Account

- Professional Accounts: Raw Spread, Zero, and Pro

- Opening an Exness Account: A Simple Guide

- Step-by-Step Account Opening Process

- Visit the Exness Website

- Provide Basic Information

- Choose Your Account Type

- Verify Your Email and Phone

- Complete Your Profile and Verification

- Fund Your Account and Start Trading

- Verification Process for New Exness Accounts

- Key Steps in Your Exness Account Verification Journey

- Why This Verification Matters for Traders

- Tips for a Smooth Verification Process

- Managing Multiple Exness Account Types Efficiently

- Why Diversify Your Exness Accounts?

- Keys to Efficient Management:

- Exness Account Types: Trading Platforms Compatibility

- Frequently Asked Questions About Exness Account Types

- What types of Exness accounts can I open?

- What’s the main difference between Standard and Professional accounts?

- How do I choose the best Exness account for my trading style?

- Can I open more than one Exness account?

- Are Exness accounts swap-free? What does that mean?

- Frequently Asked Questions

Understanding Exness Account Categories

Diving into the world of forex trading with Exness means exploring a range of account types, each designed to fit different trading styles and experience levels. Choosing the right account is more than just a formality; it directly impacts your trading costs, the tools you access, and ultimately, your profitability. We’re not talking about a one-size-fits-all solution here. Instead, Exness offers tailored environments, ensuring every trader, from the absolute beginner to the seasoned pro, finds a comfortable and efficient trading home.

Before you deposit your first dollar, take a moment to understand the distinctions. Each category comes with its own set of advantages, catering to specific needs like spread preferences, commission structures, and execution methods. This knowledge empowers you to make an informed decision, setting the stage for a smoother and more successful trading journey.

The Main Pillars: Standard vs. Professional Accounts

Exness primarily structures its offerings around two core account families: Standard and Professional. While both provide access to the vast forex market, their underlying mechanics and features cater to distinct trading philosophies. Let’s break down what sets them apart.

- Standard Account: This is often the go-to choice for new traders and those who prefer simplicity. It boasts no commission on trades, with costs primarily embedded in wider spreads. You get instant execution and a wide array of trading instruments. It’s user-friendly and requires a relatively low initial deposit, making it accessible to a broad audience.

- Professional Account: Designed for experienced traders who demand tighter spreads and highly specific execution, this category branches further into Raw Spread, Zero, and Pro accounts. These accounts typically feature very low or even zero spreads on major pairs, often coupled with a commission per lot traded. They offer market execution, which experienced traders often prefer for its speed and directness.

Key Considerations When Choosing Your Account

Your trading goals, risk tolerance, and capital determine the best fit. Here’s a quick guide to help you weigh your options:

| Feature | Standard Account | Professional Account Types |

|---|---|---|

| Spreads | Floating, generally wider | Very tight, often near zero on majors |

| Commissions | None | Yes (on Raw Spread, Zero); None (on Pro) |

| Execution | Instant execution | Market execution |

| Minimum Deposit | Lower | Higher (depending on type) |

| Ideal For | Beginners, casual traders | Experienced traders, scalpers, algo traders |

Consider your trading frequency. If you execute many trades throughout the day, professional accounts with their lower spreads might save you significant money over time, even with commissions. If you hold positions for longer periods and trade less frequently, a standard account could be more cost-effective due to its commission-free structure. Your choice is a strategic one, so evaluate your personal trading style before making your final decision.

Standard vs. Professional Account Structures

Navigating the forex market involves many decisions, and one of the most crucial is choosing the right account type. Your trading style, capital, and experience level all play a significant role in determining whether a Standard or Professional account best suits your needs. Understanding the distinctions is key to optimizing your trading journey and maximizing your potential.

Understanding the Standard Account

Standard accounts are often the gateway for many new and intermediate traders entering the forex world. They are typically designed for accessibility and simplicity, making them an excellent starting point for those building their confidence and refining their strategies.

- Accessibility: Lower minimum deposit requirements make it easier for individuals with smaller capital to get started.

- Simplicity: Often feature a commission-free structure, with costs built into a wider spread. This straightforward pricing can be less intimidating for newcomers.

- Lot Sizes: Typically offer standard lot sizes, allowing for manageable position sizing and risk exposure.

While appealing for their ease of entry, Standard accounts might come with slightly wider spreads compared to their professional counterparts. This is the broker’s primary way of earning revenue on these account types.

Exploring the Professional Account

For the seasoned trader, the Professional account offers a different set of advantages, catering to those with substantial capital, high trading volumes, and a deep understanding of market mechanics. These accounts are built for efficiency and cost-effectiveness for active participants.

Here’s what you often find with a Professional account:

| Feature | Description |

|---|---|

| Raw Spreads | Access to interbank market spreads, which are significantly tighter, often close to zero pips on major currency pairs. |

| Commission-Based | Instead of wider spreads, these accounts typically charge a small commission per trade (per lot traded). This transparent cost structure can be more economical for high-volume traders. |

| Higher Leverage | While regulatory limits apply, professional accounts often provide access to higher leverage options, allowing traders to control larger positions with less capital. |

| Advanced Tools | Potential access to more sophisticated trading tools, dedicated support, and institutional-grade features. |

Professional accounts require you to meet specific criteria, often related to your trading experience, financial knowledge, and capital. They are not for the faint of heart, demanding a robust risk management strategy and a clear understanding of the implications of tighter spreads and commissions.

Making Your Choice

The decision boils down to a few key considerations. Are you new to forex trading, or do you prefer simplicity and wider spreads? A Standard account might be your best bet. Do you trade frequently, manage larger capital, and seek to minimize transaction costs through commissions and razor-thin spreads? Then exploring a Professional account could unlock greater profitability for your trading strategy.

Always assess your own trading volume, risk tolerance, and capital before committing. The best account structure is one that aligns perfectly with your individual trading objectives and financial capacity.

Exness Standard Accounts: Ideal for Beginners?

Embarking on your forex trading journey can feel overwhelming, with countless account types and brokers vying for your attention. If you’re new to the world of currency exchange, you’re likely looking for a straightforward, accessible entry point. Exness Standard Accounts often pop up as a top recommendation for new traders. But are they truly the ideal starting block for your trading adventure?

What Defines an Exness Standard Account?

The Exness Standard Account is a popular choice designed to cater to a wide range of traders, particularly those just getting started. It balances user-friendliness with robust features, making it a comfortable environment for learning and growing. Here’s a quick look at its core components:

- Accessible Minimum Deposit: You can often start with a very low initial deposit, making it affordable for almost anyone to begin trading.

- Stable Spreads: Standard accounts typically feature stable, competitive spreads on major currency pairs, which helps in calculating potential profits and losses more predictably.

- Wide Range of Instruments: You gain access to a broad selection of trading instruments, including forex majors, minors, exotics, metals, cryptocurrencies, and sometimes indices and energies. This variety allows you to explore different markets without needing multiple accounts.

- Flexible Leverage: Exness is known for offering competitive and sometimes even unlimited leverage options under certain conditions, allowing you to control larger positions with a smaller capital outlay. However, high leverage comes with high risk, something beginners must understand thoroughly.

- No Commission on Trades: A significant advantage is the absence of commission fees on your trades. Your costs are primarily built into the spread, simplifying cost calculation.

Advantages for New Traders

The structure of the Exness Standard Account offers several compelling benefits that resonate particularly well with those taking their first steps in trading.

Simplified Cost Structure: With no commissions, you only focus on the spread, which is easy to understand. This transparency helps new traders avoid hidden fees and unexpected charges, making budgeting and risk management clearer.

Low Barrier to Entry: The low minimum deposit means you don’t need significant capital to open an account and start practicing. This reduces the financial pressure and allows you to learn with real money without taking excessive risks.

Extensive Instrument Selection: While you might start with just a few major currency pairs, having access to a wider array of assets from the get-go gives you the flexibility to explore different markets as your confidence grows. You can diversify your portfolio later without switching accounts.

User-Friendly Platforms: Standard accounts seamlessly integrate with popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are renowned for their intuitive interfaces and extensive educational resources. Many beginners find these platforms easy to navigate.

Dedicated Support: Exness generally provides robust customer support, often available in multiple languages 24/7. Access to quick help is invaluable when you encounter issues or have questions as a beginner.

Potential Considerations for Beginners

While an excellent starting point, new traders should be aware of a few aspects of the Standard Account:

- Spread-Based Costs:

- Although there are no commissions, the cost is embedded in the spread. During volatile market conditions, spreads can widen, increasing your transaction costs. Beginners must account for this in their trading plan.

- Leverage Management:

- While flexible leverage is an advantage, it’s also a double-edged sword. High leverage can amplify profits but also magnify losses. New traders must exercise extreme caution and employ strict risk management to protect their capital.

Is It Your Ideal Starting Point?

For a beginner, the Exness Standard Account truly presents a highly viable and attractive option. It offers a low entry barrier, transparent costs, and a versatile trading environment. You get to experience real market conditions with a manageable investment, which is crucial for building practical trading skills. Remember, while the account type is beginner-friendly, trading itself requires continuous learning, discipline, and a strong understanding of risk management. Use the account to learn, grow, and then perhaps explore more advanced options as you gain experience.

Key Features of Standard and Standard Cent Accounts

Understanding the core differences between Standard and Standard Cent accounts is crucial for any trader, whether you’re just starting or looking to refine your strategy. Both offer distinct advantages, designed to cater to varying levels of experience, capital, and trading objectives. Let’s break down what makes each account type unique and how they might fit into your trading journey.

Here’s a look at the standout features for each:

Standard Account:

- Direct Market Access: Trade directly in standard lots, providing exposure to larger market movements and potential profits.

- Wide Instrument Range: Typically offers a broad selection of currency pairs, metals, energies, and indices, giving you plenty of options to diversify your portfolio.

- Competitive Spreads: Often comes with tighter spreads, which can reduce your trading costs over time, especially for frequent traders.

- Suitability: Ideal for experienced traders or those with larger capital who are comfortable with standard lot sizes and want to maximize their market exposure.

Standard Cent Account:

- Micro-Lot Trading: Trades in cents, meaning one standard lot equals 100,000 units in a standard account, but only 1,000 units in a cent account. This significantly reduces the risk per trade.

- Small Minimum Deposits: Usually requires a very low initial deposit, making it accessible for absolute beginners or those who want to test their strategies with minimal financial commitment.

- Risk Management: Provides an excellent environment for learning and practicing without risking substantial capital. It’s like trading with real money, but on a much smaller scale.

- Psychological Comfort: The smaller capital exposure can reduce stress and allow new traders to focus on developing their skills and understanding market dynamics.

Choosing between these two account types boils down to your personal trading goals and risk tolerance. If you’re a seasoned trader seeking significant market exposure and have adequate capital, the Standard account likely suits you best. However, if you’re new to forex, want to practice with live funds but limited risk, or aim to test new strategies, the Standard Cent account offers an invaluable training ground.

Exploring Exness Raw Spread Account Benefits

For many traders, the search for an optimal trading environment often leads to a focus on costs. That’s where the Exness Raw Spread account shines, offering a distinct advantage designed for those who demand precision and minimal trading expenses. This account type is specifically engineered to provide some of the tightest spreads available in the market, making it an attractive option for a wide range of trading strategies, from high-frequency trading to scalping.

What exactly makes the Raw Spread account a game-changer for serious traders? It’s fundamentally about transparency and cost-efficiency. Unlike some other account types where the broker’s fee is built into the spread, the Raw Spread account strips that away, presenting you with raw interbank spreads. Your cost then comes as a small, fixed commission per lot, which makes your trading expenses incredibly predictable and often significantly lower overall.

Key Benefits of the Exness Raw Spread Account:

- Ultra-Low Spreads: Experience spreads as low as 0.0 pips on major currency pairs for a significant portion of the trading day. This dramatically reduces your entry and exit costs.

- Predictable Commission Structure: A fixed commission per lot ensures you know your exact trading cost upfront, aiding in precise risk management and strategy backtesting.

- Ideal for Scalpers and High-Frequency Traders: The razor-thin spreads are perfect for strategies that rely on capturing small price movements multiple times a day. Every pip counts, and the Raw Spread account maximizes your potential gains.

- Enhanced Transparency: You see the true market spread, separate from any broker markup. This provides a clearer picture of market conditions and pricing.

- Execution Speed: Combined with Exness’s robust infrastructure, the Raw Spread account facilitates rapid order execution, crucial for capitalizing on fleeting market opportunities.

Consider this simple comparison:

| Feature | Raw Spread Account | Standard Account (Illustrative) |

|---|---|---|

| Spread Type | Raw Interbank Spreads | Wider, Marked-Up Spreads |

| Trading Cost | Fixed Commission + Raw Spread | Spread Only (includes hidden broker fee) |

| Best For | Scalping, EAs, High Volume | Casual Trading, Simplicity |

| Cost Predictability | High | Moderate |

Choosing the Exness Raw Spread account is a strategic decision for traders who prioritize minimizing their trading costs to maximize profitability. It empowers you with the tools to implement advanced trading strategies without the burden of inflated spreads, giving you a competitive edge in the dynamic forex market.

Exness Zero Account: What You Need to Know

Are you a forex trader constantly chasing the tightest spreads? The Exness Zero Account might be exactly what you need to elevate your trading experience. This account type stands out in the crowded brokerage landscape by offering what it promises: true zero spreads on a significant number of trading instruments for most of the trading day. It’s a compelling option, especially if you prioritize cost-effective execution and demand the most competitive trading conditions.

So, what exactly does “zero spread” entail in the context of Exness trading? It means you literally pay no spread on the top 30 trading instruments for 95% of the trading day. Imagine opening a trade without immediately being in the negative due to a wide bid-ask spread. This feature is particularly attractive for scalpers and day traders who execute numerous trades and need every pip to count.

Who Benefits from the Exness Zero Account?

This account is not a one-size-fits-all solution, but it particularly shines for specific types of forex traders:

- High-Frequency Traders: If you place many trades throughout the day, the cumulative savings from zero spreads can be substantial.

- Scalpers: For strategies that aim for small profits from tiny price movements, the absence of spread costs makes a significant difference.

- Automated Trading (EAs): Expert Advisors often rely on precise entry and exit points. Raw spreads can provide the optimal environment for these systems to perform as intended.

- Traders Seeking Predictable Costs: Instead of variable spreads, you deal with a fixed, known commission, making cost calculations clearer.

Understanding the Commission Structure

While the Exness Zero Account boasts zero spreads, it’s crucial to understand how Exness monetizes this offering. Instead of a spread, you pay a commission per lot. This is a common model for ECN-like accounts that provide raw spreads directly from liquidity providers. The commission typically starts from $3.5 per lot per side, meaning $7 per round turn. While this is a fee, many professional traders prefer it because it offers transparency and predictability, especially compared to spreads that can widen unpredictably during volatile market conditions.

Let’s look at a quick comparison:

| Feature | Exness Zero Account | Typical Standard Account |

|---|---|---|

| Spread on Major Pairs | 0 pips (95% of the time) | Variable (often 1 pip or more) |

| Commission | From $3.5 per lot/side | None |

| Target User | Scalpers, high-volume traders | Beginners, casual traders |

| Cost Predictability | High (fixed commission) | Medium (variable spread) |

The zero-spread feature combined with market execution offers a robust environment for active forex traders. It allows for more precise entry and exit points and ensures that your trading costs are clear and upfront, without the hidden burden of widening spreads. If you’re serious about minimizing your trading expenses and maximizing your profit potential, delving into the specifics of the Exness Zero Account is a highly recommended step.

Pro Account Exness: For Experienced Traders

As a seasoned trader, you understand that success in the forex market hinges on precision, speed, and exceptional trading conditions. You move beyond basic strategies, demanding an environment that not only supports but actively enhances your advanced techniques, including scalping, hedging, and high-frequency trading with Expert Advisors. This is precisely where the Exness Pro Account steps in, crafted exclusively for the discerning, experienced trader.

The Pro Account isn’t just another trading option; it’s a gateway to institutional-grade conditions usually reserved for major players. It’s designed to give you the competitive edge you need to capitalize on every market movement, ensuring your strategies translate into tangible results without hidden costs or execution delays.

What Makes the Exness Pro Account Ideal for You?

The Exness Pro Account differentiates itself with features that truly matter to professional traders:

- Ultra-Low Spreads: Experience incredibly tight spreads, often starting from 0.0 pips for major currency pairs like EURUSD, GBPUSD, and USDJPY. This drastically reduces your trading costs, making frequent trades and high-volume strategies more profitable.

- Zero Commission: Enjoy commission-free trading on a wide range of instruments, including many forex pairs, metals, and cryptocurrencies. This transparency in pricing allows for clearer profit calculations and better risk management.

- Lightning-Fast Execution: Benefit from instant market execution, crucial for volatile markets and news trading. Your orders fill precisely when you need them to, minimizing slippage and maximizing opportunity.

- Unlimited Leverage: Unlock the potential of virtually unlimited leverage under specific conditions, giving you unparalleled flexibility in managing your positions and capital.

- Wide Range of Instruments: Trade over 100 currency pairs, along with metals, cryptocurrencies, energies, and indices, all under superior trading conditions.

Designed for Strategic Trading

The Exness Pro Account recognizes that experienced traders prioritize consistency and a robust trading environment. Here’s why it resonates with top-tier market participants:

“With the Pro Account, I consistently get the tightest spreads and immediate fills. This stability is invaluable when I’m executing complex strategies or managing multiple positions. It simply removes the friction I’ve experienced with other brokers, letting me focus on the market, not my platform.”

This account empowers you to:

- Execute high-volume trades without concern for liquidity.

- Run your Expert Advisors (EAs) with optimal efficiency due to minimal latency.

- Apply advanced scalping techniques with precision, thanks to narrow spreads.

- Implement sophisticated hedging strategies effectively across various asset classes.

If you’re an experienced trader looking to elevate your trading journey, the Exness Pro Account offers the refined conditions and powerful execution you demand. It’s built for those who understand the market’s nuances and require a broker partner that matches their professional aspirations.

Comparing Exness Account Types: A Quick Overview

Exness understands that every trader is unique, with different needs, strategies, and experience levels. That’s precisely why they offer a versatile range of account types. This ensures you find the perfect fit for your trading journey, whether you’re just stepping into the exciting world of forex or you’re a seasoned professional seeking optimal trading conditions.

Let’s break down the main categories:

Standard Accounts

The Standard Account is often the first stop for new traders and those who prefer simplicity and straightforward trading. It offers stable spreads, which means predictable trading costs, and importantly, no commissions per trade. With a very low minimum deposit, it’s incredibly accessible. This account is perfect for exploring the markets, practicing strategies, and getting comfortable with the Exness platform without a massive initial commitment. You get access to a wide array of trading instruments, making it a versatile choice for many.

Professional Accounts

For traders who demand advanced features, tighter trading conditions, and specific execution advantages, Exness provides a suite of Professional Accounts. These are designed to cater to more experienced traders, high-volume strategies, and those who rely on very precise execution. The Professional category includes three distinct options:

Raw Spread Account:

This account focuses on delivering ultra-low raw spreads, often starting from 0.0 pips. While you benefit from extremely tight spreads, a small, fixed commission applies per lot. This setup is ideal for scalpers, high-frequency traders, and those who prioritize the absolute lowest possible spread and trade significant volumes.

Zero Account:

True to its name, the Zero Account aims for zero spreads on the top 30 most popular trading instruments for 95% of the trading day. Like the Raw Spread Account, it involves a small commission. This account is an excellent choice for traders seeking near-zero cost execution on major currency pairs and other popular assets, perfect for those who want to minimize spread costs on frequently traded instruments.

Pro Account:

The Pro Account offers a compelling balance, providing very competitive and stable spreads with absolutely no commission per trade. This option combines the benefit of tight spreads, similar to the Raw Spread and Zero accounts, but without the added per-lot commission. It appeals strongly to discretionary traders, those using expert advisors, and anyone looking for premium trading conditions without the complexity of commissions.

Choosing Your Account

The key distinctions between these Exness account types boil down to spreads, commissions, minimum initial deposit requirements, and available trading instruments. Standard accounts offer unmatched simplicity and accessibility, making them great for beginners. Professional accounts, on the other hand, provide advanced traders with superior trading conditions tailored for specific strategies, whether it’s ultra-low spreads, zero spreads on popular instruments, or competitive spreads without commissions. Always consider your personal trading style, experience level, and capital before making your choice to ensure it aligns perfectly with your objectives.

Minimum Deposit Requirements for Each Exness Account

Understanding the minimum deposit requirements for different Exness account types is crucial for any trader. Whether you are just starting your trading journey or you are an experienced professional, knowing these figures helps you plan your initial capital wisely. Exness offers a range of accounts designed to suit various trading styles and budgets, making it accessible for almost everyone.

Here is a breakdown of the typical minimum deposit requirements you can expect across the most popular Exness account types. Keep in mind that these amounts can sometimes vary slightly based on your region or the payment method you choose, so it is always a good idea to check the latest information directly on the Exness website.

Standard Accounts

The Standard Account is often the go-to choice for many traders, especially those new to the forex market. It offers competitive spreads and no commission, making it a very user-friendly option. For this account type, the minimum deposit is generally quite low, designed to be highly accessible.

- Standard Account: Typically starts from as little as $1. This allows traders to get a feel for the market with minimal risk.

- Standard Cent Account: An excellent option for beginners, allowing you to trade in cents rather than dollars. The minimum deposit for a Standard Cent account is also very low, often just $1. This setup lets you test strategies with tiny amounts, minimizing potential losses while you learn the ropes.

Professional Accounts

For traders seeking tighter spreads, lower commissions, or specific execution models, Exness offers a suite of Professional Accounts. These accounts are tailored for more experienced traders who might require different trading conditions. The minimum deposit for these accounts is generally higher than for Standard accounts, reflecting the more advanced features and conditions they offer.

| Account Type | Minimum Deposit (Approximate) | Key Benefit |

|---|---|---|

| Raw Spread Account | $200 | Ultra-low spreads with a fixed commission per lot. Ideal for scalpers. |

| Zero Account | $200 | Zero spreads on the top 30 most popular instruments for 95% of the trading day, plus a small commission. |

| Pro Account | $200 | Zero commission, low spreads, and instant execution. A great all-rounder for active traders. |

Choosing the right account type based on your trading experience, strategy, and available capital is a critical step. A lower minimum deposit allows you to dip your toes into the market without significant financial commitment, while higher deposits for professional accounts open up more advanced trading environments. Always consider your risk tolerance and financial goals before making a deposit.

Leverage and Margin Across Exness Account Types

Welcome, fellow traders! Let’s dive deep into two pivotal concepts that empower your trading journey on Exness: leverage and margin. Understanding these tools isn’t just about knowing their definitions; it’s about mastering how they interact with different Exness account types to amplify your market exposure. Whether you’re a seasoned professional or just starting out, grasping these mechanics is fundamental to navigating the dynamic world of forex trading and optimizing your trading strategies.

Unpacking Leverage: Your Trading Amplifier

Think of leverage as a powerful financial magnifying glass. It allows you to control a much larger position in the market with a relatively small amount of your own capital. Exness offers incredibly flexible leverage options, ranging from 1:1 up to virtually unlimited leverage under certain conditions for some account types. This means that with every dollar you commit, you can potentially control hundreds or even thousands of dollars in the market. Imagine putting down just $100 and being able to trade a $100,000 position! That’s the power of leverage.

However, while leverage can significantly boost your potential profits, it also magnifies potential losses. A small market movement against your position can quickly erode your capital if you don’t manage your risk carefully. Exness provides tools and clear guidelines to help you harness this power responsibly.

Demystifying Margin: The Security Blanket

If leverage is your amplifier, then margin is the security deposit that makes it all possible. Margin is the amount of money held in your trading account to keep a leveraged position open. It’s not a fee or a cost; it’s simply a portion of your account balance that is “set aside” to cover potential losses on your open trades. When you open a position with leverage, Exness requires a certain percentage of the total trade value as margin.

Here’s how it works:

- The higher the leverage you use, the lower the margin required to open a position.

- If your margin level falls too low due to losing trades, you might receive a margin call, signaling that you need to deposit more funds or close positions.

- Exness implements a stop-out level to automatically close positions if your margin level drops below a critical threshold, protecting your account from going into negative balance.

Understanding your required margin is crucial for effective capital management and ensures you have enough free margin to withstand market fluctuations.

Exness Account Types and Their Leverage Dynamics

One of the strengths of trading with Exness is the diversity of its account offerings, each designed to cater to different trading styles and capital sizes. Critically, the maximum leverage available can vary across these account types and also depends on your account equity. Exness adjusts the maximum available leverage dynamically based on the total equity in your trading account. This progressive approach helps manage risk as your capital grows.

Let’s look at how leverage and margin play out across popular Exness account types:

| Account Type | Key Feature | Leverage Dynamics |

|---|---|---|

| Standard Account | Most popular, accessible, no commissions. | Offers high leverage, often up to unlimited leverage (under specific conditions like account equity below $999 and during non-news periods). Margin requirements are relatively low. |

| Pro Account | Designed for experienced traders, tight spreads, no commissions on most instruments. | Also offers high leverage options, including unlimited. Margin requirements are similar to Standard, but with even tighter spreads, which can affect profit/loss on smaller movements. |

| Raw Spread Account | Zero spreads on major pairs, fixed commission per lot. | Leverage is high, again with the potential for unlimited. The combination of zero spreads and high leverage makes it attractive for scalping strategies, but consider the commission when calculating profitability and effective margin usage. |

| Zero Account | Zero spreads on top 30 instruments for 95% of the trading day, commission per lot. | Similar high leverage offerings as Raw Spread. The extremely low spreads demand precise execution and sound risk management, especially when employing high leverage. |

It’s vital to remember that as your account equity increases, Exness gradually reduces the maximum available leverage to promote responsible trading and protect clients from over-leveraging large positions. Always check the specific leverage conditions for your chosen account type and current equity level within your Exness Personal Area.

Navigating Risk with Smart Leverage Choices

While high leverage is appealing, smart traders know that effective risk management is paramount. Here are a few pieces of advice:

- Start Small: If you’re new to using high leverage, begin with smaller position sizes to get a feel for its impact on your account.

- Define Your Risk: Never risk more than a small percentage of your total trading capital on any single trade.

- Use Stop-Loss Orders: Always implement stop-loss orders to limit potential losses and protect your margin from unexpected market reversals.

- Monitor Margin Levels: Keep a close eye on your free margin and margin level to avoid margin calls and stop-outs.

- Educate Yourself: Stay informed about market news and economic events that can cause sudden volatility, impacting your leveraged positions.

Leverage and margin are powerful tools when used wisely. Exness provides the flexibility and resources to help you employ them effectively across a range of account types, ensuring you have the best possible environment to execute your trading strategies. Trade smart, manage your risk, and unlock your full potential!

Spreads, Commissions, and Swaps on Exness Accounts

Welcome, fellow traders! Understanding the true cost of trading is paramount for your success, and this includes grasping how spreads, commissions, and swaps work on your Exness accounts. These charges directly impact your profitability, so let’s break them down clearly to help you trade smarter.

The spread is simply the difference between the bid (buy) and ask (sell) price of a currency pair. It’s the primary way brokers like Exness earn revenue on ‘spread-only’ accounts. Exness is renowned for providing some of the tightest and most stable spreads in the market, especially on major currency pairs, which effectively lowers your transaction costs when opening or closing trades.

- Tight Spreads: Enjoy very narrow spreads on popular assets like EUR/USD, GBP/USD, and Gold, making your entry points more efficient.

- Stable Pricing: Exness strives for consistent spread pricing, even during periods of increased market volatility, giving you predictable trading conditions.

- Variable Nature: Spreads are variable and reflect real-time market liquidity, ensuring you always get a fair price based on current conditions.

Commissions, on the other hand, are fixed charges applied per trade. You typically find commissions associated with specific Exness account types like the Raw Spread or Zero accounts. While you pay a small fee per lot traded, these accounts usually offer exceptionally low, sometimes even zero, spreads. This structure can be highly advantageous for active traders, scalpers, or those executing high volumes, as it provides extremely precise entry and exit points with minimal spread distortion.

Opting for a commission-based Exness account offers incredible transparency. You know exactly what you pay per trade, which can simplify your profit and loss calculations. Consider your trading style and frequency when deciding if a commission model aligns best with your overall strategy.

Swaps, often called overnight fees, are charges or credits applied when you hold a trading position open past the daily market rollover time. They reflect the interest rate differential between the two currencies in a pair. Depending on the instrument and the direction of your trade, you might receive a positive swap (a credit to your account) or incur a negative swap (a debit). Exness clearly displays swap rates for all instruments, helping you manage your long-term trade costs.

| Scenario | Trader Impact | Exness Feature |

|---|---|---|

| Holding Position Overnight | Interest rate differential applied | Transparent swap rates displayed |

| Positive Swap Rates | Potential earnings for holding | Opportunity for carry trade strategies |

| Negative Swap Rates | Cost incurred for holding | Factor into long-term trade planning |

| Swap-Free Accounts | No overnight charges or credits | Available for religious compliance (Islamic accounts) |

By thoroughly understanding spreads, commissions, and swaps on your Exness account, you empower yourself to make informed decisions. This knowledge allows you to choose the most suitable account type for your trading strategy, optimize your overall trading costs, and ultimately enhance your trading journey. Transparent fees are a cornerstone of effective and successful trading.

How to Choose the Best Exness Account for Your Trading Style

Picking the right Exness account is like choosing the perfect tool for a specific job – it makes all the difference in your trading journey. Your trading style isn’t just a label; it’s a detailed blueprint of how you approach the markets, including your preferred instruments, frequency of trades, and risk appetite. Aligning your trading strategy with the features of an Exness account can significantly enhance your efficiency and profitability, making your experience smoother and more effective. Don’t underestimate this crucial first step; it sets the foundation for your success.

When considering which Exness account suits you, think about these key elements:

* **Your experience level:** Are you just starting out, or do you have years of market experience?

* **Your preferred trading instruments:** Do you focus on major forex pairs, commodities, or cryptocurrencies?

* **Your trading frequency:** Do you place many trades daily (scalping), a few trades weekly (swing trading), or hold positions long-term?

* **Your capital and risk tolerance:** How much capital do you plan to deposit, and how comfortable are you with different fee structures?

Exness offers a range of accounts designed to cater to diverse needs, each with unique characteristics regarding spreads, commissions, and execution methods. Let’s break down the main options to help you make an informed decision.

Exploring Exness Account Types for Your Trading Style

Exness primarily categorizes its accounts into two main groups: Standard accounts and Professional accounts. Within the Professional category, you find Raw Spread, Zero, and Pro accounts. Each type is tailored for different trading styles and expectations.

Standard Account

The Standard account is often the go-to choice for new traders or those who prefer a straightforward trading experience without complex fee structures. It’s also an excellent option for discretionary traders who place fewer, longer-term trades.

* **Key Features:**

* No commission per lot.

* Variable spreads, starting from a competitive level.

* Low minimum deposit requirements, making it accessible.

* Instant execution.

* **Ideal For:**

* Beginner traders learning the ropes.

* Traders who prefer simplicity and clear pricing.

* Swing traders or position traders who are less sensitive to ultra-tight spreads.

Professional Accounts: Raw Spread, Zero, and Pro

These accounts are designed for experienced traders, scalpers, high-frequency traders, and those who use automated trading systems (EAs) where every pip and millisecond counts. They offer tighter spreads, but often come with a commission per lot.

Raw Spread Account

This account lives up to its name by offering raw, interbank spreads, which are incredibly tight, sometimes starting from 0.0 pips.

* **Advantages:**

* Extremely tight spreads, reducing trading costs significantly on a per-pip basis.

* Predictable, fixed commission per lot, making cost calculation straightforward.

* Suitable for all trading strategies, especially those sensitive to spread costs.

* **Considerations:**

* Involves a commission per lot, which adds to the overall trading cost.

* Requires a higher minimum deposit compared to the Standard account.

* **Best Suited For:**

* Scalpers who execute many trades to profit from small price movements.

* High-volume traders aiming to minimize spread impact.

* Traders using expert advisors (EAs) that thrive on minimal spreads.

Zero Account

The Zero account takes tight spreads to the next level, offering 0.0 pip spreads on the top 30 most popular trading instruments for 95% of the trading day.

* **Advantages:**

* Zero spreads on a wide range of popular instruments for most of the trading day.

* Competitive fixed commission per lot.

* Ideal for traders focusing on specific popular currency pairs and commodities.

* **Considerations:**

* While spreads are zero for most of the time on many instruments, a commission still applies.

* The “zero” aspect is on specific instruments for a specific duration.

* **Optimal For:**

* Traders specializing in major forex pairs and popular assets.

* Automated trading systems that require absolute minimum spread.

* Volume traders seeking the lowest possible spread entry costs.

Pro Account

The Pro account focuses on stable spreads and instant execution without commissions, similar to Standard but with typically tighter average spreads and market execution for a wider range of instruments.

* **Advantages:**

* Stable and low spreads with no commission.

* Instant execution, often preferred by experienced traders.

* Good for a wide variety of trading strategies.

* **Considerations:**

* While spreads are tight, they might not be as “raw” as the Raw Spread or Zero accounts during peak volatility.

* **Great For:**

* Experienced discretionary traders who value stable and low spreads without separate commissions.

* Traders who employ various strategies, including day trading and swing trading.

* Those who prioritize swift and reliable execution over absolute lowest spread.

To summarize the account differences, consider this simple comparison:

| Exness Account Type | Spreads | Commissions | Minimum Deposit (General) | Ideal Trading Style |

|---|---|---|---|---|

| Standard | Variable, from 0.3 pips | None | Low (e.g., $10) | Beginner, Discretionary, Swing |

| Raw Spread | Raw, from 0.0 pips | Fixed per lot | Higher (e.g., $200) | Scalping, High-Volume, EA Trading |

| Zero | 0.0 pips on top 30 instruments (95% of day) | Fixed per lot | Higher (e.g., $200) | Specialized Major Pair Trading, Extreme Scalping |

| Pro | Stable, from 0.1 pips | None | Higher (e.g., $200) | Experienced Discretionary, Day Trading, Swing Trading |

Your trading style is unique, and so should be your choice of an Exness account. Don’t rush the decision. Take the time to evaluate your needs, understand your trading habits, and then select the account that best supports your goals. A well-matched Exness account can be a significant asset in your trading arsenal.

Opening an Exness Account: A Simple Guide

Ready to start your journey into the dynamic world of online trading? Opening an Exness account is straightforward and designed to get you trading quickly. Exness offers a seamless experience for both new and experienced traders, providing access to various financial markets, including forex, cryptocurrencies, and more. This simple guide will walk you through each step, ensuring you set up your trading account without a hitch.

Getting started with Exness is simpler than you might think. You only need a few minutes to complete the initial account registration. Here’s a quick overview of what you can expect:

- Quick and easy signup process.

- No complex paperwork upfront.

- Immediate access to a demo account for practice.

- A clear path to verify your live account.

Here’s how to open your Exness account and begin your trading journey:

Step-by-Step Account Opening Process

Visit the Exness Website

Your first step is to navigate to the official Exness website. Look for the “Open Account” or “Register” button, usually prominently displayed on the homepage. Click it to initiate the account creation process.

Provide Basic Information

The registration form will ask for some essential personal information. This typically includes your country of residence, email address, and a secure password. Make sure to use an active email you check regularly, as this will be your primary communication channel with Exness. Create a strong, unique password to protect your trading account.

Choose Your Account Type

Exness offers various account types tailored to different trading styles and experience levels. You might see options like Standard, Pro, or Raw Spread accounts. Briefly review the features of each to decide which one best suits your forex trading needs. Don’t worry, you can always open additional accounts later.

Verify Your Email and Phone

After submitting your initial details, Exness will send a verification code to your email address and possibly your phone number. Enter these codes on the registration page to confirm your contact details. This crucial step helps secure your account.

Complete Your Profile and Verification

To fully activate your live account and access all trading features, you’ll need to complete your personal profile. This involves providing more detailed information and undergoing a verification process. You’ll typically need to upload copies of a valid identification document (like a passport or national ID) and proof of residence (such as a utility bill). This ensures compliance with financial regulations and keeps your funds safe.

The verification process is standard practice in the financial industry. It usually takes a short time, and the Exness support team is always ready to assist if you encounter any issues.

Fund Your Account and Start Trading

Once your account is verified, you are ready to fund it. Exness provides a wide array of convenient deposit methods. Choose the one that works best for you, make your first deposit, and then select your preferred trading platform (like MetaTrader 4 or MetaTrader 5). You are now ready to execute your first trades and explore the vast financial markets!

Opening an Exness account is the first step towards your trading ambitions. Follow these simple steps, and you’ll be ready to explore the exciting possibilities that online trading offers. Welcome to the Exness community!

Verification Process for New Exness Accounts

Diving into the world of forex trading with Exness means building a secure foundation right from the start. A crucial part of this journey is completing your Exness account verification. This isn’t just a formality; it’s a vital step that protects your funds, ensures compliance with international financial regulations, and unlocks the full potential of your trading account, including seamless withdrawals.

Think of the verification process as your personal security clearance. It helps Exness confirm you are who you say you are, preventing fraud and ensuring a safe trading environment for everyone. It’s a standard practice across reputable brokers, designed for your peace of mind.

Key Steps in Your Exness Account Verification Journey

The process is straightforward, designed to get you trading quickly. Here’s a breakdown of what you can expect:

- Email and Phone Verification: This is usually the very first step when you register. You’ll receive a code via email or SMS to confirm your contact details. This simple check establishes a direct line of communication with Exness.

- Identity Verification (Proof of Identity – POI): To confirm your identity, Exness requires a clear copy of a government-issued identification document. This could be your passport, national ID card, or driving license. Ensure the document is valid, not expired, and all details are clearly visible.

- Address Verification (Proof of Residency – POR): The final step confirms your residential address. You’ll typically need to provide a recent utility bill (electricity, water, gas), a bank statement, or a tax statement. The document should be no older than six months, clearly show your name and address, and be issued by a reputable organization.

Why This Verification Matters for Traders

Completing your Exness account verification isn’t just about meeting requirements; it directly benefits your trading experience. Here’s why:

- Full Account Functionality: Verified accounts gain access to all features, including higher deposit limits and, most importantly, the ability to withdraw your profits. Without full verification, withdrawal options are often restricted.

- Enhanced Security: Your funds and personal data are better protected against unauthorized access and fraud. This robust security framework gives you confidence as you navigate the markets.

- Regulatory Compliance: Exness operates under strict regulatory guidelines to maintain its licenses. Your verification contributes to these compliance efforts, ensuring a transparent and fair trading environment for all users.

Tips for a Smooth Verification Process

To ensure your verification sails through without a hitch, keep these pointers in mind:

- Clarity is Key: Make sure all photos of your documents are well-lit, clear, and show all four corners of the document. Blurry images often lead to delays.

- Up-to-Date Documents: Always use current, unexpired documents. Old or invalid documents will be rejected.

- Matching Information: The name and address on your verification documents must exactly match the details you provided during your Exness account registration. Any discrepancies can cause issues.

- Be Patient: While Exness strives for quick verification, processing times can vary based on volume. If you follow all guidelines, approval typically comes swiftly.

By taking a few moments to complete your Exness account verification thoroughly, you set yourself up for a secure, compliant, and ultimately more successful trading journey. It’s an investment in your financial future with Exness.

Managing Multiple Exness Account Types Efficiently

Diving deep into the forex market often means you need more than just one approach. Smart traders know that diversifying their strategies and managing risk effectively can be the key to long-term success. This is precisely where having multiple Exness account types can become a powerful asset in your trading arsenal. It’s not just about opening more accounts; it’s about strategically utilizing each one to optimize your trading performance.

Consider the myriad of trading styles out there. You might be a scalper one day, a swing trader the next, or perhaps you’re building a long-term portfolio. Each style often thrives under different conditions, and critically, different account specifications. Exness offers a range of account types, from the beginner-friendly Standard to the professional-grade Raw Spread, Zero, and Pro accounts, each with unique features like spreads, commissions, and execution methods. Leveraging these differences allows you to tailor your environment to specific trading goals.

Why Diversify Your Exness Accounts?

- Strategy Specialization: Dedicate a Raw Spread account for high-frequency scalping where low spreads are paramount, and use a Standard account for slower, swing trades where the slightly wider spread is less impactful but the zero commission structure is beneficial.

- Risk Segregation: Separate your high-risk experimental strategies from your core, low-risk portfolio. If one strategy faces a setback, it doesn’t immediately impact your entire capital.

- Testing & Development: Utilize a separate account for backtesting new Expert Advisors (EAs) or manual strategies without risking your primary trading capital.

- Currency Pair Optimization: Some account types or even specific EAs might perform better on certain currency pairs due to their unique liquidity and volatility characteristics, making a dedicated account a smart choice.

Keys to Efficient Management:

Juggling multiple accounts doesn’t have to be complicated. With clear planning and disciplined execution, you can streamline your operations:

- Define Clear Objectives: Before opening another account, understand its purpose. What strategy will you use? What risk level will it adhere to?

- Utilize the Exness Personal Area: Your Exness Personal Area is a powerful hub. You can easily switch between accounts, monitor performance, and manage funds centrally. This integrated platform simplifies the oversight of your entire trading ecosystem.

- Implement a Tracking System: Keep a detailed log of each account’s performance, trades, and capital allocation. This helps you identify what’s working and where adjustments are needed across your diversified portfolio.

- Automate Where Possible: For strategies that lend themselves to automation, deploy EAs on specific accounts. This reduces the manual workload and ensures consistent execution according to your predefined rules.

- Regularly Review and Rebalance: Periodically assess the performance of each account and the overall portfolio. Are your capital allocations still optimal? Do any strategies need tweaking or discontinuing?

Managing multiple Exness account types effectively empowers you to explore more trading opportunities, manage risk with greater precision, and ultimately, enhance your overall profitability. It’s a strategic move for serious traders aiming for sustained success in the dynamic forex market.

Exness Account Types: Trading Platforms Compatibility

Navigating the world of online trading requires the right tools and the perfect fit for your trading style. Exness understands this, offering a diverse range of account types designed to cater to everyone from beginners to seasoned professionals. But what good are great accounts without the right platforms to execute your strategies? Let’s dive into how Exness ensures seamless platform compatibility across its various account offerings.

Choosing your Exness account is like picking the right gear for your trading journey. Whether you prefer the straightforward experience of a Standard Account, the razor-thin spreads of a Raw Spread Account, or the zero-commission environment of a Zero Account, Exness has you covered. Each account type boasts unique features, from minimum deposits and spread values to commission structures and leverage options. Your choice heavily influences your daily trading conditions and overall cost.

Now, let’s talk about the engines that power your trades: the trading platforms. Exness prides itself on offering robust and widely-used platforms that integrate flawlessly with all its account types. This flexibility ensures you can choose the environment where you feel most comfortable and productive. Here are the primary platforms you’ll encounter:

- MetaTrader 4 (MT4): This classic platform remains a favorite for many forex traders worldwide. Known for its user-friendly interface, powerful charting tools, and extensive library of custom indicators and Expert Advisors (EAs), MT4 is a go-to for many. Every Exness account type, from Standard to Professional, is fully compatible with MT4, giving you the freedom to trade currencies, metals, and CFDs with ease.

- MetaTrader 5 (MT5): The newer generation platform, MT5, offers all the features of MT4 and more. It includes additional timeframes, more analytical objects, an economic calendar, and the ability to trade stocks and futures alongside forex and CFDs. Exness ensures complete integration with MT5 across all its accounts, providing advanced traders with the enhanced functionality they seek for more complex strategies.

- Exness Terminal: For those who prefer a web-based solution without downloading any software, the Exness Terminal is an excellent choice. This proprietary web platform is incredibly intuitive, offering a clean interface and essential trading tools directly in your browser. It supports all major Exness account types, making it super convenient for quick trades or monitoring your positions on the go, anytime, anywhere.

The beauty of this widespread platform compatibility is simple: you get ultimate control. You can switch between platforms depending on your needs or even use them simultaneously. For instance, you might use MT4 for your automated strategies and the Exness Terminal for manual trades when you’re away from your desktop. This seamless integration ensures your trading experience is efficient, powerful, and perfectly tailored to how you like to operate.

No matter if you are just starting your forex trading journey or if you are a seasoned trader looking for advanced features, Exness provides the account types and platform compatibility to support your ambitions.

Frequently Asked Questions About Exness Account Types

Navigating the world of online trading often starts with understanding the different account types offered by your broker. Exness, a leading broker, provides a variety of options designed to cater to traders of all experience levels and trading styles. We’ve gathered the most common questions our traders ask about Exness account types to help you make an informed decision and get started with confidence.

What types of Exness accounts can I open?

Exness primarily offers two main categories of accounts: Standard and Professional. Each category includes specific account types tailored for different trading needs. Let’s break them down:

- Standard Accounts: These are ideal for new traders and those who prefer straightforward trading conditions with no commissions. They feature tight spreads and reliable execution.

- Professional Accounts: Designed for experienced traders seeking highly competitive conditions, these accounts offer raw spreads or zero commissions, along with ultra-fast execution.

What’s the main difference between Standard and Professional accounts?

The core distinction lies in their pricing structure, spreads, and commissions. Here’s a quick comparison:

| Feature | Standard Account | Professional Account (Raw Spread/Zero) |

|---|---|---|

| Spreads | Stable, low spreads | Ultra-low to zero spreads |

| Commissions | No commission per trade | Varying commission per lot (e.g., Raw Spread) or zero commission (e.g., Zero) |

| Minimum Deposit | Low (e.g., $1 or $10 depending on currency) | Higher (e.g., $200) for specific professional types |

| Execution | Market execution | Fastest market execution |

Choosing between them often comes down to your trading volume, strategy, and whether you prioritize zero commissions or ultra-tight spreads.

How do I choose the best Exness account for my trading style?

Selecting the right account depends on several factors, including your experience, trading strategy, and capital. Consider these points:

- For beginners: A Standard Account is often the best starting point. It’s user-friendly, has a low minimum deposit, and allows you to learn without complex commission structures.

- For scalpers and high-volume traders: Professional accounts like Raw Spread or Zero are excellent. Their ultra-low spreads and fast execution can significantly benefit these strategies, even with commissions.

- For long-term traders: While Standard accounts work well, a low-spread Professional account might still offer better long-term cost efficiency if you hold positions for extended periods.

Think about your typical trade size, frequency, and whether you prefer to pay commissions for tighter spreads or have spreads integrated into the price with no extra fees.

Can I open more than one Exness account?

Yes, absolutely! Exness allows you to open multiple trading accounts under the same Personal Area. This is a great feature for traders who want to:

- Test different trading strategies.

- Separate funds for various trading goals.

- Trade different instrument types with specific account settings.

- Use different base currencies for various accounts.

For example, you could have a Standard Account for discretionary trading and a Raw Spread Account for automated strategies.

Are Exness accounts swap-free? What does that mean?

Exness offers swap-free trading options on all its account types, primarily catering to clients of the Islamic faith. A swap-free account means you do not pay or receive overnight interest (swap) fees on positions held open overnight. For all other traders, Exness provides extended swap-free levels on certain instruments, meaning you can hold positions for a longer period without incurring swap charges, depending on your trading volume and account equity.

This feature helps traders manage costs more effectively, especially for those who hold positions for several days.

Frequently Asked Questions

What are the main categories of Exness accounts?

Exness offers two primary categories: Standard accounts, which are ideal for beginners with no commissions, and Professional accounts (including Raw Spread, Zero, and Pro), designed for experienced traders seeking tighter spreads and advanced features.

Which Exness account is best for someone new to trading?

The Standard or Standard Cent accounts are highly recommended for beginners. They have low minimum deposits, no commission fees, and a straightforward structure, which provides an excellent environment for learning to trade with real money but at a lower risk.

What is the difference between a Raw Spread and a Pro account?

The main difference is the cost structure. The Raw Spread account offers ultra-low, raw interbank spreads but charges a fixed commission per trade. The Pro account, on the other hand, has no commissions and offers very competitive, low spreads, making it a great all-around choice for experienced traders.

Can I use high leverage on all Exness account types?

Yes, Exness offers high and even unlimited leverage (under specific conditions) across most account types, including Standard and Professional. However, the maximum available leverage is dynamically adjusted based on your account equity to promote responsible trading.

Do I need to download software to trade with Exness?

While Exness supports the popular downloadable platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5), it is not required. You can also trade directly from your browser using the Exness Terminal, which is compatible with all account types.