Are you ready to elevate your trading journey? Choosing the right broker is the first, and arguably most critical, step toward success in the dynamic world of online trading. For many seasoned and aspiring traders alike, Exness stands out as a top-tier choice. This comprehensive guide will walk you through everything you need to know about trading with Exness, helping you unlock its full potential.

Exness has built a formidable reputation as a trusted and innovative broker, known for its exceptional trading conditions, advanced technology, and unwavering commitment to client satisfaction. Whether your focus is on forex, commodities, indices, or cryptocurrencies, Exness offers a robust platform designed to meet diverse trading needs.

Our goal is to provide you with an ultimate resource, covering everything from account types and trading platforms to unique features and customer support. By the end of this guide, you will have a clear understanding of why so many traders choose Exness and how you can maximize your trading experience with them.

Let’s dive in and discover how Exness can be your partner in navigating the financial markets with confidence and efficiency.

- Understanding Exness Broker: A Comprehensive Overview

- Key Advantages of Trading with Exness:

- Exness Regulation and Security Measures

- What Regulation Means for You

- Advanced Security Protocols

- Exness Account Types: Finding Your Perfect Match

- Standard Accounts: Your Gateway to Trading

- Professional Accounts: Tailored for Advanced Strategies

- How to Choose Your Perfect Match

- Standard Accounts

- Key Characteristics of a Standard Account:

- Why Choose a Standard Account?

- Professional Accounts

- Trading Platforms Offered by Exness

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Exness Terminal (WebTrader)

- Mobile Trading Apps

- MetaTrader 4 (MT4)

- Why Traders Choose MT4

- MetaTrader 5 (MT5)

- Exness Terminal: Your Trading Hub

- Why Traders Choose the Exness Terminal:

- Tradable Instruments on Exness Broker

- Forex and Cryptocurrencies

- Key Differences and Similarities for Traders

- Stocks, Indices, and Commodities: Diversify Your Trading Horizons

- Unlock the Potential of Individual Companies with Stocks

- Ride Market Waves with Indices

- Tap into Global Supply and Demand with Commodities

- Exness Spreads, Commissions, and Fees Structure

- Deposit and Withdrawal Methods: Fast and Flexible

- Exness Customer Support and Service Quality

- Unwavering Availability: Your Trading Companion

- Multiple Channels for Seamless Communication

- The Caliber of Service: Professionalism and Expertise

- Exness Mobile Trading Experience

- Key Features of the Exness Mobile Platform

- Why Trade on the Go with Exness?

- Advantages:

- A Quick Look at What You Can Do

- Exness Partnership Programs

- Types of Partnership Opportunities

- Why Partner with Exness?

- Educational Resources and Trading Tools for Exness Users

- Is Exness Broker a Reliable and Trustworthy Choice?

- Regulation and Licensing

- Fund Security

- Execution Speed and Slippage

- Withdrawal Process

- Customer Support

- Platform Stability and User Experience

- How to Open and Verify Your Exness Account

- Setting Up Your Trading Profile

- Why Verification is Non-Negotiable

- The Seamless Verification Process

- Tips for a Speedy Verification

- Exness Broker: Key Advantages and Disadvantages

- Exness Broker: Final Thoughts and Recommendations

- Key Strengths We Observed

- Considerations for Traders

- Who Is Exness Best Suited For?

- Our Final Recommendation

- Frequently Asked Questions

Understanding Exness Broker: A Comprehensive Overview

Diving into the world of online trading requires choosing the right partner. Exness stands out as a prominent global broker, recognized for its commitment to providing a transparent and efficient trading environment. With a substantial presence across various continents, this broker has built a strong reputation among both new and experienced traders.

Exness offers a diverse range of financial instruments. You can trade major and minor currency pairs, precious metals like gold and silver, popular cryptocurrencies, energy commodities, and even stock indices. This wide selection allows traders to diversify their portfolios and capitalize on different market opportunities. The broker understands that every trader is unique, offering various account types designed to cater to different trading styles and capital sizes. Whether you are a beginner looking for micro lots or a professional requiring raw spreads, Exness likely has an account that fits your needs.

One of Exness’s core strengths lies in its technological infrastructure. They provide access to industry-standard trading platforms, including the popular MetaTrader 4 and MetaTrader 5, known for their robust charting tools and automated trading capabilities. These platforms ensure fast execution speeds, crucial for navigating volatile markets. Beyond technology, Exness prioritizes customer support, offering multilingual assistance around the clock. This dedication ensures traders receive timely help, enhancing their overall trading experience.

Key Advantages of Trading with Exness:

- Competitive Spreads: Enjoy tight spreads across many instruments, helping to reduce trading costs.

- Fast Withdrawals: Experience quick and hassle-free processing of your withdrawal requests.

- Regulatory Compliance: Operate with a broker that holds licenses from reputable regulatory bodies, offering an added layer of security.

- Innovative Trading Tools: Access features like a trading calculator and economic calendar to enhance your strategy.

- Education and Research: Benefit from various educational resources and market analysis to refine your skills.

Choosing a broker is a significant decision. Exness positions itself as a reliable option, focusing on user satisfaction through advanced technology, a wide range of offerings, and robust support. It strives to create an optimal trading atmosphere for its global client base.

Exness Regulation and Security Measures

When you navigate the dynamic world of forex trading, one factor stands paramount above all others: trust. You need to know your funds are safe and that the platform you choose operates with the highest integrity. This is where regulation and robust security measures come into play. Exness understands this critical need, dedicating significant resources to ensuring a secure and transparent trading environment for everyone.

Exness operates under the watchful eyes of several leading regulatory bodies across the globe. These licenses are not just pieces of paper; they represent a commitment to strict financial standards, client protection, and operational transparency. Being regulated means Exness undergoes regular audits, adheres to capital requirements, and follows precise rules designed to safeguard your investments. This multi-jurisdictional approach provides a strong foundation of reliability, allowing you to focus on your trading strategies with greater confidence.

What Regulation Means for You

- Fund Segregation: Your funds remain separate from the company’s operational capital. In the unlikely event of company insolvency, your money stays protected.

- Regular Audits: Independent third-party auditors frequently review Exness’s financial health and operational compliance, ensuring they meet all regulatory obligations.

- Fair Trading Practices: Regulations enforce fair execution, transparent pricing, and robust dispute resolution mechanisms, ensuring a level playing field for all traders.

Advanced Security Protocols

Beyond regulatory compliance, Exness implements a comprehensive suite of cutting-edge security measures to protect your personal data and financial transactions. They understand that a strong regulatory framework must be complemented by sophisticated technological safeguards. Exness employs advanced encryption technologies, similar to those used by major banks, to secure all data transmissions between your device and their servers. This means your sensitive information, from account details to transaction histories, remains confidential and protected from unauthorized access.

Furthermore, Exness provides critical risk management tools directly to you. Negative balance protection is a prime example. This feature ensures you cannot lose more money than you have in your trading account, offering an invaluable safety net during volatile market conditions. Such measures reflect a deep commitment to client welfare, demonstrating that Exness not only meets regulatory requirements but also proactively enhances trader security.

Choosing a broker with strong regulatory oversight and advanced security measures is not merely a preference; it is a necessity for your long-term success and peace of mind in forex trading. Exness prioritizes these aspects, building a trustworthy environment where you can pursue your trading goals confidently and securely.

Exness Account Types: Finding Your Perfect Match

Navigating the world of online trading requires choosing the right broker, and just as important, the right account type that aligns with your trading style and goals. Exness stands out in the forex trading landscape by offering a diverse range of accounts, each meticulously designed to cater to different types of traders, from newcomers taking their first steps to seasoned professionals executing complex strategies. Finding your perfect match among Exness account types can significantly impact your trading experience, affecting everything from trading costs to execution speed. Let’s explore these options to help you make an informed decision. Exness categorizes its accounts primarily into two main groups: Standard and Professional. This structure allows traders to easily identify the options best suited for their experience level and specific needs.Standard Accounts: Your Gateway to Trading

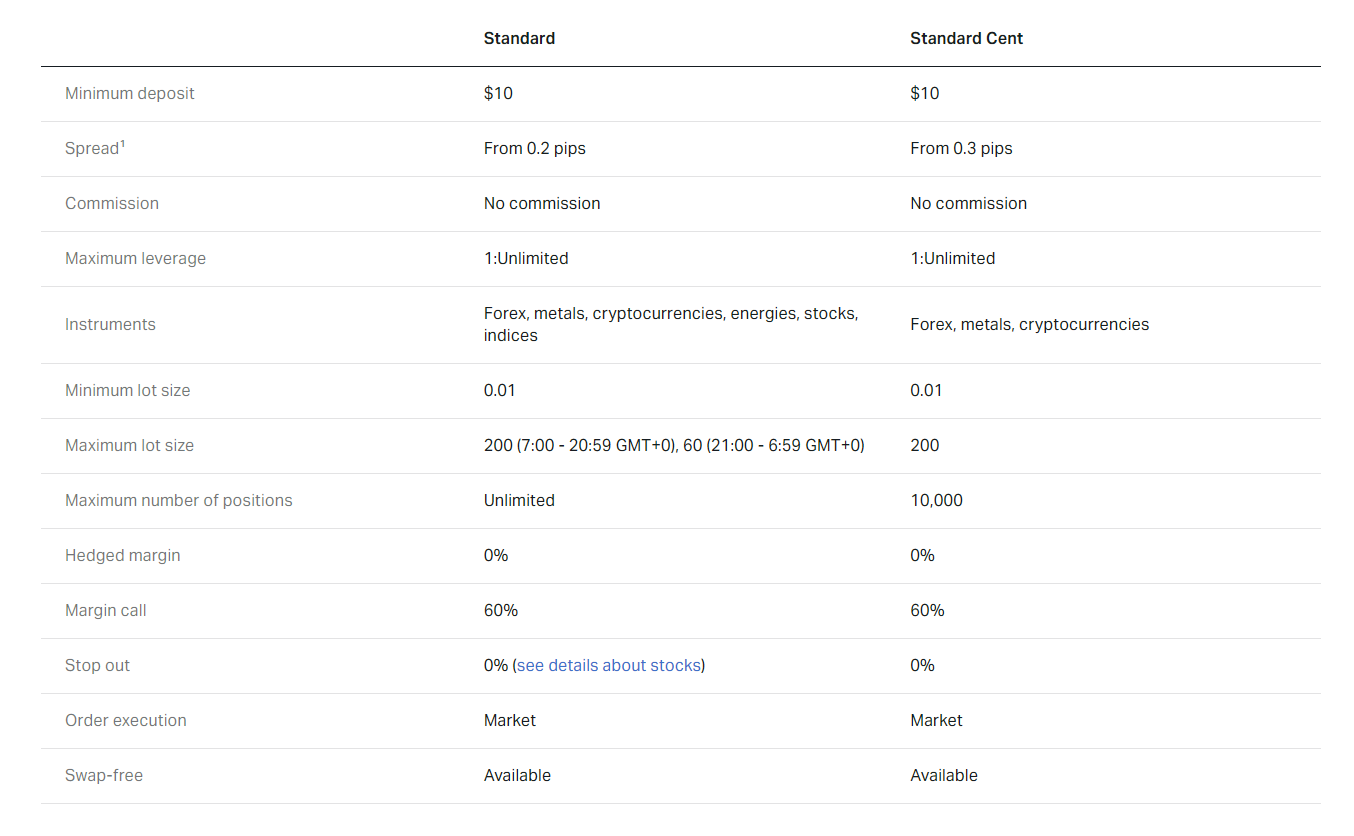

The Standard account is often the first choice for many traders, and for good reason. It offers a straightforward trading environment with competitive conditions, making it an excellent entry point into the forex and CFD markets. * **Standard Account:** This is Exness’s most popular account, known for its simplicity and accessibility. It requires a low minimum deposit, making it ideal for beginner traders who want to start with a smaller capital outlay. You benefit from stable spreads and no commission on trades. The execution is market-based, ensuring transparent pricing. It supports a wide range of trading instruments, including forex pairs, cryptocurrencies, stocks, and indices. The flexibility and ease of use make it a fantastic option for those learning the ropes or testing new strategies without high financial commitment. * **Standard Cent Account:** Specifically designed for new traders looking to manage risk effectively, the Standard Cent account operates in cents instead of dollars. This means if you deposit $10, your account balance will show 1000 cents. It’s a perfect practice ground for live trading, allowing you to get a feel for the market dynamics and execution without exposing significant capital. It shares similar features with the Standard account regarding spreads and execution, providing a realistic yet low-risk training environment. Choosing a Standard account offers several advantages:- Low entry barrier with minimal initial deposit.

- No commission charges, simplifying cost calculations.

- Stable and competitive spreads.

- Suitable for all trading styles, especially for those who prefer straightforward trading conditions.

Professional Accounts: Tailored for Advanced Strategies

For traders who demand tighter spreads, lower commissions, and specific execution models, Exness offers a suite of Professional accounts. These are generally preferred by experienced traders, scalpers, and those running expert advisors (EAs) due to their optimized trading conditions. Let’s look at the key Professional account types:- Raw Spread Account

- This account is built for traders seeking the tightest possible spreads, often as low as 0.0 pips on major currency pairs. While spreads are minimal, there is a small, fixed commission per lot per side. This model is highly beneficial for scalping strategies and high-frequency trading where every pip counts. The Raw Spread account provides direct market pricing with lightning-fast execution, ensuring you get the best available prices.

- Zero Account

- As its name suggests, the Zero account aims to offer zero spreads on the top 30 most popular trading instruments for 95% of the trading day. Like the Raw Spread account, it involves a small commission per lot per side. This account is particularly attractive for traders who require absolute certainty regarding their trading costs and value ultra-low spreads on their frequently traded assets. It offers exceptional trading conditions for active day traders and those employing automated systems.

- Pro Account

- The Pro account strikes a balance between the Standard and the more specialized Raw Spread/Zero accounts. It features incredibly tight spreads, starting from 0.1 pips on major pairs, with no commission charged on most instruments. This account is known for its instant execution, which is highly beneficial for news trading and strategies that depend on quick order placement. It offers a premium trading experience without the per-lot commission of the Raw Spread or Zero accounts, making it a favorite among experienced discretionary traders.

| Feature | Raw Spread Account | Zero Account | Pro Account |

|---|---|---|---|

| Spreads | From 0.0 pips | From 0.0 pips (top 30 instruments) | From 0.1 pips |

| Commission | Yes (small, fixed per lot) | Yes (small, fixed per lot) | No |

| Execution | Market Execution | Market Execution | Instant Execution |

| Ideal For | Scalpers, High-Volume EAs | Zero-spread seekers, High-Volume EAs | Experienced discretionary traders, News traders |

How to Choose Your Perfect Match

Selecting the right Exness account type boils down to understanding your own trading needs and preferences. Consider the following:- **Your Trading Experience:** Are you a beginner, intermediate, or advanced trader? Standard accounts are excellent for beginners, while Professional accounts cater to those with more experience.

- **Your Trading Strategy:** Do you scalp, day trade, swing trade, or use expert advisors? Scalpers and EA users often benefit most from Raw Spread or Zero accounts due to their tight spreads. Swing traders might find the Pro or Standard accounts perfectly adequate.

- **Your Capital:** While Exness generally has low minimum deposits, some Professional accounts might require a slightly higher initial deposit to fully benefit from their optimized conditions.

- **Cost Structure Preference:** Do you prefer no commission and slightly wider spreads (Standard, Pro), or ultra-tight spreads with a small per-lot commission (Raw Spread, Zero)?

- **Execution Speed:** Do you require instant execution for specific strategies like news trading, or is market execution sufficient?

Standard Accounts

Diving into the world of forex trading often starts with a Standard Account. Think of it as your most common entry point, perfectly balancing accessibility with a robust set of trading features. These accounts are designed for the vast majority of retail traders, offering a straightforward and reliable environment to execute your strategies.

A Standard Account typically provides access to a wide range of currency pairs, commodities, and sometimes indices. You’ll find competitive spreads, usually floating, and often the ability to trade with leverage that suits your risk appetite. It’s the go-to choice for traders looking for a solid foundation without the complexities or limitations of micro or ECN accounts.

Key Characteristics of a Standard Account:

- Typical Lot Sizes: Standard accounts generally allow trading in standard lots (100,000 units of base currency), but often also support mini (10,000 units) and micro (1,000 units) lots, offering flexibility.

- Spread Type: Most commonly, you’ll encounter variable or floating spreads, meaning they fluctuate based on market volatility and liquidity.

- Commission Structure: Often commission-free, with the broker’s compensation built into the spread.

- Minimum Deposit: Varies significantly by broker, but usually ranges from a few hundred to a few thousand dollars, making it accessible for many traders.

- Available Instruments: Access to a broad spectrum of forex majors, minors, exotics, and often other CFDs like metals, energies, and indices.

Why Choose a Standard Account?

Many traders gravitate towards Standard Accounts for their balanced offerings. They provide sufficient trading capital exposure for meaningful gains while still allowing for reasonable risk management. If you’re past the very initial stages of learning with a demo account and are ready to commit real capital without going for high-volume specialist accounts, a standard option is likely your best bet.

It strikes an excellent balance between cost-efficiency and robust trading conditions, making it a popular choice among both budding and seasoned traders alike. The trading environment is generally stable, offering good execution speeds and reliable connectivity, which are crucial for consistent performance in the fast-paced forex market.

Professional Accounts

Stepping up your trading game often means exploring options beyond standard retail accounts. For serious traders who meet specific criteria, professional accounts offer a distinct advantage, designed to elevate your trading experience and potentially enhance your profitability. These accounts aren’t just a label; they come with a suite of features tailored for high-volume traders and those with significant trading capital and experience. It’s about getting access to tools and conditions that align with a more sophisticated approach to the market.

So, what exactly sets a professional account apart? Imagine a trading environment optimized for your advanced strategies and execution needs. Here’s a breakdown of common characteristics:

- Higher Leverage Options: While retail leverage has regulatory caps, professional accounts often provide significantly higher leverage, allowing you to control larger positions with a smaller capital outlay. This can amplify both profits and losses, so managing risk remains paramount.

- Tighter Spreads and Lower Commissions: Many professional setups offer raw spreads, meaning you get direct market prices with minimal markup, often combined with competitive commission structures. This can lead to substantial savings on transaction costs over time, particularly for frequent traders.

- Dedicated Account Management: Expect personalized support from an account manager who understands the needs of advanced traders. This often includes priority service, direct lines of communication, and tailored assistance.

- Access to Advanced Tools and Platforms: Sometimes, professional accounts unlock premium features within trading platforms, advanced analytical tools, or exclusive market insights not available to standard clients.

- Exemption from ESMA Retail Restrictions: For traders in certain regions, qualifying as a professional client often means bypassing restrictions like negative balance protection limits or specific marketing constraints applied to retail clients.

Qualifying for a professional account isn’t automatic. Brokers typically assess traders based on criteria such as trading experience, portfolio size, and trading frequency. They want to ensure you possess the necessary understanding of the risks involved with the increased flexibility these accounts offer. If you consistently trade large volumes, have a substantial trading portfolio, or possess relevant financial work experience, a professional account could be your next logical step in the forex market.

Trading Platforms Offered by Exness

Navigating the forex market requires powerful tools, and at Exness, we understand that every trader has unique preferences. That’s why we offer a suite of robust trading platforms designed to provide flexibility, advanced features, and a seamless trading experience. Whether you’re a seasoned professional or just starting, you’ll find the right environment to execute your strategies with precision.

Our commitment is to empower you with choices, ensuring you have access to industry-leading technology that supports your trading journey. We focus on reliability, speed, and comprehensive functionality, so you can concentrate on what matters most: your trades.

MetaTrader 4 (MT4)

MetaTrader 4 remains the gold standard for many forex traders worldwide, and it’s a core offering at Exness. MT4 is celebrated for its user-friendly interface, powerful charting tools, and extensive customization options. It provides a stable and reliable environment, perfect for both manual and automated trading strategies.

- Intuitive Interface: Easy to navigate, even for beginners.

- Advanced Charting: Multiple timeframes, analytical objects, and indicators for in-depth market analysis.

- Expert Advisors (EAs): Full support for automated trading through EAs, allowing you to implement sophisticated strategies without constant monitoring.

- Customization: Develop and use custom indicators and scripts to tailor the platform to your needs.

- Robust Security: Encrypted data transmission ensures your trading activities remain secure.

MetaTrader 5 (MT5)

For traders seeking even more advanced features and greater market access, MetaTrader 5 is the natural progression. MT5 builds upon the strengths of MT4, offering expanded capabilities and a broader range of financial instruments beyond just forex. It’s a multi-asset platform designed for the modern trader.

Here’s what makes MT5 an exceptional choice:

| Feature | Benefit for Traders |

|---|---|

| More Timeframes | 21 timeframes for deeper market analysis compared to MT4’s 9. |

| Expanded Order Types | Includes buy stop limit and sell stop limit orders for greater control. |

| Economic Calendar | Integrated calendar helps you stay informed about crucial market-moving events. |

| Depth of Market (DOM) | Provides real-time information on bid and ask prices and volumes. |

| Strategy Tester Improvements | More advanced and faster backtesting capabilities for EAs. |

Exness Terminal (WebTrader)

For those who prefer trading directly through a web browser without any downloads, the Exness Terminal offers a convenient and powerful solution. This web-based platform is designed with user experience in mind, ensuring you have access to your account and the markets anytime, anywhere, with just an internet connection.

“Our Exness Terminal embodies convenience and accessibility. We built it from the ground up to be intuitive, fast, and feature-rich, giving you an excellent trading experience right in your browser.”

The Exness Terminal includes essential tools like advanced charts, technical indicators, and seamless order execution. It’s perfect for quick trades or for managing your positions when you’re away from your desktop MT4/MT5 setup.

Mobile Trading Apps

Trade on the go with our dedicated mobile applications for both iOS and Android devices. Our mobile apps provide full trading functionality, allowing you to open and close positions, manage your accounts, analyze charts, and stay updated on market movements from the palm of your hand. Experience the freedom of trading without being tied to your desk.

Each platform choice at Exness aims to enhance your trading journey, providing you with the necessary tools to navigate the dynamic world of forex and beyond. Choose the platform that best fits your trading style and start experiencing the difference.

MetaTrader 4 (MT4)

Dive into the world of trading with MetaTrader 4, widely known as MT4. This legendary platform has been a cornerstone for forex traders globally for years, and for good reason. It offers an incredibly powerful yet intuitive environment, perfect for both newcomers and seasoned market veterans. If you are serious about navigating the financial markets, mastering MT4 is a crucial step.

Why Traders Choose MT4

MT4 isn’t just a trading terminal; it’s a comprehensive ecosystem designed to empower your trading decisions. Here are some of the standout reasons why so many traders rely on it daily:

- Advanced Charting Tools: Visualize market movements with a vast array of timeframes and chart types. You get crisp, clear charts that help you spot trends and patterns with precision.

- Extensive Technical Analysis: Access over 30 built-in technical indicators and a massive library of custom indicators. This allows you to perform in-depth market analysis and refine your trading strategies.

- Automated Trading with Expert Advisors (EAs): Harness the power of algorithmic trading. MT4 supports Expert Advisors, which are programs that can automate your trading based on predefined rules. This means your trades execute even when you’re away from your screen.

- Customization and Personalization: Tailor the platform to your exact needs. Create custom indicators, scripts, and EAs using the MQL4 programming language. Your trading setup can be as unique as your trading style.

- Mobile Trading Capability: Stay connected to the markets no matter where you are. The MT4 mobile application provides full trading functionality on your smartphone or tablet, ensuring you never miss an opportunity.

- Secure and Reliable Execution: Trade with confidence knowing that MT4 prioritizes security and efficient order execution. Your data and transactions are protected, giving you peace of mind.

From one-click trading to comprehensive historical data, MT4 puts an incredible amount of power at your fingertips. It truly offers a robust solution for managing your trades and analyzing the complex dynamics of the forex market. Join the countless traders who trust MT4 to execute their strategies effectively.

MetaTrader 5 (MT5)

MetaTrader 5, or MT5, stands as a cornerstone in the modern trading world. This powerful platform isn’t just an upgrade from its predecessor; it’s a comprehensive trading environment designed to meet the demands of today’s dynamic financial markets. Whether you’re deeply involved in forex trading, exploring stocks, or diversifying into futures and commodities, MT5 offers an integrated solution to manage all your trading activities efficiently.

What makes MT5 a preferred choice for countless traders globally? It’s the platform’s unique blend of advanced features, superior analytical tools, and unparalleled versatility. Let’s explore some of the reasons why traders are making the move to MT5:

- Expanded Market Access: Unlike previous versions, MT5 provides access to a wider range of financial instruments, including forex, stocks, indices, commodities, and even cryptocurrencies, all from a single interface. This multi-asset capability simplifies portfolio diversification and management.

- Advanced Charting & Analysis: MT5 offers an impressive array of charting tools with 21 timeframes and an extensive collection of over 80 built-in technical indicators and analytical objects. You can customize charts, add various drawing tools, and conduct in-depth market analysis with precision.

- Enhanced Algorithmic Trading: For those who rely on automated strategies, MT5 supports Expert Advisors (EAs) developed in MQL5, a more advanced programming language. The platform includes an integrated development environment and a strategy tester for optimizing your EAs, giving you a significant edge in automated trading.

- Improved Order Management: You gain access to a wider range of order types, including buy stop limit and sell stop limit orders, offering greater flexibility and control over your trade execution. The Depth of Market (DOM) feature also provides valuable insights into market liquidity and price levels.

- Economic Calendar Integration: Stay ahead of market-moving events with the integrated economic calendar, directly accessible within the platform. This feature helps you plan your trades around key economic releases, reducing unexpected market volatility.

MT5 is more than just a trading terminal; it’s a complete ecosystem built for serious traders. Its robust architecture ensures stable performance, while its intuitive interface makes navigating complex market data surprisingly straightforward. If you haven’t yet explored the capabilities of MetaTrader 5, now is the perfect time to experience its potential. Embrace the future of trading and elevate your strategies with this industry-leading platform.

Exness Terminal: Your Trading Hub

Welcome to the nerve center of your trading operations – the Exness Terminal. This isn’t just another platform; it’s a meticulously designed trading environment built with the active trader in mind. Forget clunky interfaces and slow executions. The Exness Terminal empowers you with a seamless and intuitive experience, right from your web browser. You don’t need to download heavy software, which means you can access your account and the markets from virtually any device, anywhere. It’s all about giving you control and flexibility.

Why Traders Choose the Exness Terminal:

- Browser-Based Convenience: Trade directly from your web browser without any downloads or installations. Get instant access to your account with a simple login.

- Intuitive Interface: Even if you’re new to the platform, you’ll find the layout logical and easy to navigate. Everything you need is just a few clicks away.

- Fast Execution Speeds: In the fast-paced world of forex, every millisecond counts. The Exness Terminal is optimized for rapid order execution, helping you capitalize on market movements quickly.

- Comprehensive Charting Tools: Analyze market trends with a rich suite of charting options, indicators, and drawing tools. Make informed decisions based on solid technical analysis.

- One-Click Trading: Execute trades with a single click, perfect for scalpers and those who demand precision and speed in their entries and exits.

- Real-Time Market Data: Stay on top of market prices with live, streaming quotes. Never miss an opportunity due to delayed information.

- Robust Security: Your funds and personal data are protected with advanced security protocols, giving you peace of mind while you trade.

“The Exness Terminal transforms how I trade. The speed and simplicity mean I can focus on my strategy, not on struggling with the platform. It truly puts the power back in the trader’s hands.”

Whether you’re executing complex strategies or making quick scalping moves, the Exness Terminal provides the stable, reliable, and feature-rich environment you need to thrive. It’s an essential tool for serious traders looking for a competitive edge. Dive in, explore its capabilities, and elevate your trading journey.

Tradable Instruments on Exness Broker

Are you ready to explore the vast opportunities available with Exness? As traders, we always look for a broker that offers a wide array of tradable instruments, giving us the flexibility to diversify our portfolios and seize various market opportunities. Exness doesn’t just meet this expectation; it exceeds it, providing access to a diverse range of assets that cater to every trading style and strategy.

Whether you’re a seasoned pro or just starting your trading journey, understanding the breadth of instruments at your disposal is crucial. With Exness, you’re not limited to just one market. You can navigate through multiple asset classes, allowing you to react to global economic events and market trends effectively. This extensive selection means more potential entry points and more ways to build a robust trading strategy.

Here’s a glimpse into the diverse trading instruments you can find on Exness:

- Forex Majors and Minors: Dive into the world’s largest financial market with a comprehensive selection of currency pairs. Trade popular pairs like EUR/USD, GBP/JPY, and USD/CAD, or explore less common but potentially lucrative crosses.

- Energies: Tap into the highly volatile and exciting energy markets. Trade crude oil and natural gas, instruments often driven by global supply and demand dynamics, geopolitical events, and economic indicators.

- Metals: Discover the stability and potential growth offered by precious metals. Gold and silver, for instance, often serve as safe-haven assets during economic uncertainty, providing unique trading opportunities.

- Cryptocurrencies: Embrace the future of finance with a growing list of digital assets. Trade popular cryptocurrencies against traditional currencies, capitalizing on their significant price movements and innovative technology.

- Indices: Gain exposure to broader market movements by trading major stock indices. These instruments allow you to speculate on the performance of entire economies or specific sectors without buying individual stocks.

- Stocks: Access a selection of the world’s most prominent company stocks. Whether you’re interested in tech giants or established blue-chip companies, you can trade shares of leading global corporations.

This variety ensures that you can always find an instrument that aligns with your market outlook and risk tolerance. Expand your horizons and make the most of the diverse opportunities Exness offers. It’s all about empowering you to build a resilient and profitable trading journey.

Forex and Cryptocurrencies

As a seasoned trader, I often hear the question: which market offers more opportunity, Forex or cryptocurrencies? Both are dynamic and offer immense potential, but they operate on very different principles. Understanding these differences is key to making informed trading decisions and knowing where your strategies best fit.

The foreign exchange market, or Forex, is the largest financial market globally, dealing with national currencies. It’s mature, highly liquid, and regulated. Cryptocurrencies, on the other hand, are digital or virtual currencies secured by cryptography, making them nearly impossible to counterfeit or double-spend. This newer asset class is known for its extreme volatility and decentralization.

Key Differences and Similarities for Traders

Let’s break down some critical aspects:

- Volatility: Crypto markets are famous for their wild price swings. A 10-20% move in a day is not uncommon. Forex tends to be less volatile, with currency pairs moving in smaller, more predictable increments, making it suitable for strategies focused on minor price changes.

- Market Hours: Forex operates 24 hours a day, five days a week, from Monday morning in Asia to Friday evening in New York. Crypto markets are truly 24/7, never closing, which offers constant trading opportunities but also demands constant vigilance.

- Regulation: Forex is a highly regulated market, with central banks and government bodies overseeing operations. This provides a layer of security and standardization. Crypto markets are far less regulated, varying significantly by region, which can lead to higher risks but also unique opportunities not found in traditional finance.

- Liquidity: Forex boasts unparalleled liquidity, meaning you can always easily enter or exit trades without significant price impact. While major cryptocurrencies like Bitcoin and Ethereum have high liquidity, many altcoins can suffer from thin markets, leading to wider spreads and slippage.

Many traders today choose to diversify, engaging in both Forex and crypto trading. The skills learned in technical analysis and risk management are highly transferable. However, the psychological demands of trading each market can differ significantly, requiring tailored approaches to mental discipline and emotional control.

Stocks, Indices, and Commodities: Diversify Your Trading Horizons

While currency pairs often steal the spotlight in the world of online trading, a vast universe of other assets offers exciting opportunities. Expanding your focus to include stocks, market indices, and commodities can significantly diversify your trading portfolio and open up new avenues for profit. Each of these asset classes possesses unique characteristics and responds to different market forces, making them compelling choices for various trading strategies.

Unlock the Potential of Individual Companies with Stocks

Trading stocks means buying and selling shares of individual companies. When you trade stocks, you are essentially speculating on the future performance and valuation of a specific business. Company-specific news, earnings reports, product launches, or even industry trends can dramatically impact a stock’s price. This direct connection to business fundamentals makes stock trading incredibly dynamic and potentially rewarding for those who research thoroughly. Imagine riding the wave of a tech giant’s new innovation or a pharmaceutical company’s breakthrough drug approval. Stocks allow you to pinpoint growth opportunities and capitalize on individual company success stories.

Ride Market Waves with Indices

Market indices, like the S&P 500, NASDAQ 100, or FTSE 100, represent a basket of leading stocks from a particular region or sector. Instead of focusing on one company, trading an index allows you to speculate on the overall health and direction of an entire market or industry. This approach offers a natural form of diversification, as the performance of one struggling company in the index might be offset by the strong performance of another. Indices are often less volatile than individual stocks, making them attractive for traders who prefer to capture broader market sentiment rather than specific company movements. They provide a powerful way to gain exposure to the economic pulse of a nation or a global industry with a single trade.

Tap into Global Supply and Demand with Commodities

Commodities are fundamental raw materials, the building blocks of the global economy. This category includes everything from precious metals like gold and silver, energy products such as crude oil and natural gas, to agricultural goods like wheat and corn. Commodity prices are largely driven by global supply and demand dynamics, geopolitical events, weather patterns, and economic growth forecasts. Trading commodities offers a unique way to hedge against inflation, react to global events, and speculate on the fundamental needs of humanity. For instance, a disruption in oil supply can send energy prices soaring, creating a prime trading opportunity. Gold, often seen as a safe-haven asset, can shine during times of economic uncertainty. Understanding these underlying drivers is key to successfully navigating the commodity markets.

Exness Spreads, Commissions, and Fees Structure

Every savvy forex trader knows that understanding your broker’s cost structure is key to long-term success. While profit opportunities often grab the headlines, the fees you pay directly impact your net gains. Exness is renowned for its transparent and competitive pricing, offering a clear view of what you pay for your trades. Let’s dive into how Exness structures its spreads, commissions, and other fees, helping you make informed decisions.

First, let’s talk about Exness spreads. A spread is simply the difference between the bid and ask price of a currency pair, essentially your cost to enter a trade. Exness offers various account types, each designed to suit different trading styles, and their spread characteristics vary accordingly:

- Standard Accounts: Ideal for most traders, these accounts feature stable spreads with no trading commissions. Exness aims to keep these spreads tight, even during volatile market conditions, making your trading costs predictable. You get excellent execution and generally low spreads on major currency pairs, gold, and other popular instruments.

- Raw Spread Accounts: If you seek the absolute lowest possible spreads, often starting from 0.0 pips, the Raw Spread account is your go-to. Here, the raw, market-derived spread is passed directly to you, and a small, fixed commission applies per lot per side. This model is perfect for scalpers and high-volume traders who prioritize minimal spread costs.

- Zero Accounts: As the name suggests, the Zero account offers zero spreads on the top 30 most popular trading instruments for 95% of the trading day. This means you often pay no spread at all on these pairs, with a variable commission applied based on the instrument. It’s an excellent choice for traders who want to minimize spread impact on frequently traded pairs.

- Pro Accounts: Designed for professional traders, Pro accounts offer super-tight spreads, often starting from 0.1 pips, with no commissions on most instruments. This account combines tight spreads with simplicity, catering to experienced traders who need excellent execution and competitive pricing without the added layer of commission calculation.

Now, let’s address Exness commissions. While Standard and Pro accounts are typically commission-free on most instruments, commission-based models exist for traders seeking ultra-low spreads. On Raw Spread accounts, you pay a fixed commission, usually around $3.5 per lot per side, which is among the lowest in the industry for such tight spreads. For Zero accounts, commissions are also applied, but they vary slightly depending on the specific instrument you trade, reflecting the unique advantage of often zero-pip spreads. This transparent commission structure ensures you know exactly what you pay for accessing those incredibly tight spreads, allowing for precise cost calculation in your trading strategy.

Beyond spreads and commissions, it’s vital to consider other Exness fees. The good news here is Exness strives to keep these minimal, or even non-existent, for a seamless trading experience:

- Swap Fees (Overnight Fees): These are interest charges or credits applied when you hold a position open overnight. Exness clearly lists swap rates for all instruments on its website, allowing you to easily calculate potential overnight costs. Importantly, Exness offers swap-free options on many account types, especially for clients in specific regions or those trading certain assets like cryptocurrencies and select indices. This is a significant advantage for long-term traders or those with specific religious requirements.

- Deposit and Withdrawal Fees: Exness prides itself on offering fee-free deposits and withdrawals across a wide range of payment methods. This means you won’t incur additional charges from Exness when funding your account or taking out your profits. While Exness doesn’t charge these, always be aware that your chosen third-party payment provider (like a bank or e-wallet service) might have their own transaction fees.

- Inactivity Fees: Many brokers charge a fee if your account remains dormant for an extended period. Exness stands out by not charging any inactivity fees, giving you peace of mind if you need to step away from trading for a while without worrying about your balance being eroded by hidden charges.

Understanding these elements of the Exness fee structure empowers you to choose the account type that best aligns with your trading strategy and volume. Whether you prioritize zero commissions, razor-thin spreads, or a balanced approach, Exness offers a clear, competitive, and transparent pricing model designed to help you maximize your trading potential.

Deposit and Withdrawal Methods: Fast and Flexible

Getting started in the forex market means you need to fund your account quickly and easily. Likewise, when you achieve your trading goals, accessing your profits should be just as straightforward. We know how important fast deposits and quick withdrawals are for traders like you. That’s why we offer a robust selection of secure transaction methods, designed for both speed and your peace of mind.

We support a diverse range of payment solutions to ensure you can manage your capital with absolute flexibility. Here are some of the popular methods available for funding your account and accessing your profits:

- Credit and Debit Cards: Instantly fund your account using major cards like Visa and Mastercard. This method is incredibly convenient for fast deposits, getting you into the market without delay.

- Bank Transfers: For larger transactions, traditional bank transfers offer a secure and reliable way to move your funds. While withdrawals via bank transfer might take a little longer, they are highly dependable for accessing profits securely.

- E-Wallets: Services like Neteller, Skrill, and others provide a rapid and efficient way to deposit and withdraw. E-wallets are excellent for traders who prioritize speed and discretion in their financial operations.

- Local Payment Solutions: Depending on your region, we may offer additional localized options to make funding even more accessible and convenient for your specific needs.

Our commitment goes beyond just offering options. We focus on making the entire process as smooth as possible. You benefit from:

- Speed: Most deposit methods are instant, getting you into the market without delay. Withdrawal processing is quick, ensuring you receive your funds promptly.

- Security: We employ advanced encryption and security protocols to protect your financial information during every transaction, giving you peace of mind.

- Flexibility: Choose the method that best fits your needs, whether you prefer the rapid pace of an e-wallet or the robust security of a bank transfer.

- Clarity: Our transparent fee structure means no hidden surprises when you fund your account or make a withdrawal.

Managing your money should never be a hurdle. With our array of deposit and withdrawal methods, you can focus on what truly matters: your trading strategy. Join us and experience seamless financial operations, letting you concentrate on seizing market opportunities.

Exness Customer Support and Service Quality

In the fast-paced world of forex trading, reliable customer support isn’t just a luxury; it’s an absolute necessity. When you’re managing trades, monitoring markets, and navigating platforms, quick and effective assistance can make all the difference. Exness understands this critical need, striving to offer a support system designed to be responsive, knowledgeable, and readily available for traders around the globe.

Unwavering Availability: Your Trading Companion

One of the standout features of Exness support is its commitment to around-the-clock availability. Whether you’re an early bird catching the Asian session or a night owl trading the New York close, assistance is just a click or call away. This 24/7 service ensures that no matter your time zone or trading schedule, you can always get the help you need, precisely when you need it. This continuous presence is a significant advantage, providing peace of mind to traders facing urgent queries or technical hiccups.

Multiple Channels for Seamless Communication

Exness offers a variety of channels to connect with their support team, ensuring you can choose the method most convenient for you:

- Live Chat: For instant responses to immediate questions, the live chat feature on the Exness website is a highly efficient option. You get real-time assistance, often resolving issues within minutes.

- Email Support: If your query is more complex or requires detailed explanations and attachments, email support provides a comprehensive way to communicate. The team typically responds promptly with thorough answers.

- Phone Support: For those who prefer direct conversation, Exness offers phone lines in multiple languages. This allows for a more personalized interaction and can be particularly helpful for intricate account or trading-related discussions.

The Caliber of Service: Professionalism and Expertise

Beyond availability and accessibility, the true measure of customer support lies in the quality of the service provided. Exness prides itself on having a team of highly trained professionals. They possess a deep understanding of the financial markets, trading platforms, and technical aspects of forex trading. This expertise means that when you reach out, you’re not just getting a generic response; you’re receiving informed, relevant, and actionable advice.

Traders frequently commend the team for their:

- Problem-Solving Skills: Representatives are adept at quickly diagnosing issues and guiding users to effective solutions, whether it’s a deposit problem, a platform query, or a trade execution concern.

- Clarity and Patience: They explain complex concepts in an easy-to-understand manner, ensuring that every trader, regardless of experience level, feels comfortable and fully supported.

- Multilingual Support: Catering to a global audience, the support team communicates in a wide array of languages, breaking down communication barriers and fostering a more inclusive trading environment.

Ultimately, the Exness customer support structure is built with the trader in mind. It aims to empower you to focus on your trading strategies, knowing that a robust, professional, and accessible support system stands ready to assist you every step of the way.

Exness Mobile Trading Experience

In today’s fast-paced world, staying connected to the financial markets is no longer a luxury—it’s a necessity. The Exness mobile trading experience empowers traders like us to seize opportunities anytime, anywhere. Imagine managing your trades while commuting, monitoring real-time quotes during a lunch break, or making quick adjustments from the comfort of your home. The Exness app makes this not just possible, but incredibly convenient.

Key Features of the Exness Mobile Platform

The Exness mobile trading platform is more than just a trading app; it’s a comprehensive tool designed with the active trader in mind. Its user-friendly interface ensures that both new and experienced traders can navigate the markets with ease. You get immediate access to a full suite of functionalities right in your pocket.

- Intuitive Navigation: Find what you need quickly with a clean, well-organized layout.

- Real-Time Data: Stay updated with live prices, charts, and market news.

- Full Trading Functionality: Open, close, and modify orders directly from your device.

- Advanced Charting Tools: Perform technical analysis with various indicators and drawing tools.

- Secure Account Management: Handle deposits, withdrawals, and profile settings safely.

- Customizable Watchlists: Keep an eye on your preferred assets without hassle.

Why Trade on the Go with Exness?

Mobile trading with Exness offers distinct advantages that can truly enhance your trading journey. We understand that market conditions can shift in an instant, and being able to react swiftly is critical. This capability is precisely what the Exness mobile platform delivers.

Advantages:

- Unmatched Flexibility: Trade from any location with an internet connection. Your office is wherever you are.

- Instant Access: No need to be tied to a desktop. Get immediate market access and execute trades rapidly.

- Stay Informed: Receive push notifications for price alerts, margin calls, and order execution statuses, ensuring you never miss a beat.

- Seamless Transition: The mobile experience mirrors the desktop platform, making the switch between devices smooth and effortless.

- Enhanced Security: Exness prioritizes your security with robust encryption and verification protocols for all mobile transactions.

A Quick Look at What You Can Do

The mobile trading experience on Exness extends beyond just placing trades. It’s a holistic solution for managing your entire trading operation efficiently.

| Feature Category | What You Can Do |

|---|---|

| Trading Operations | Place market orders, pending orders, set stop loss and take profit, close positions. |

| Account Management | Deposit funds, withdraw profits, transfer between accounts, manage personal profile. |

| Market Analysis | View interactive charts, apply technical indicators, analyze historical data. |

| Notifications | Receive custom price alerts, margin level warnings, news updates. |

Ultimately, the Exness mobile trading experience is about empowering you with control and convenience. It allows you to transform every moment into a potential trading opportunity, ensuring you remain agile and responsive in the dynamic forex market. Download the Exness app today and discover the freedom of on-the-go trading!

Exness Partnership Programs

Are you looking to expand your reach in the forex market and generate additional income? Exness offers a range of partnership programs designed to help individuals and businesses leverage their networks and earn attractive commissions. Becoming an Exness partner means aligning with a globally recognized broker known for its reliable trading conditions, transparent operations, and excellent customer service. This is your chance to turn your connections into a profitable venture.

Exness understands that every partner’s needs are unique. That’s why they provide different models to suit various business strategies, whether you’re an experienced marketer, a community leader, or a professional looking to diversify your income streams. The goal is simple: empower partners with the tools and support they need to succeed.

Types of Partnership Opportunities

Exness typically offers two main types of partnership programs, each with its own advantages:

- Introducing Broker (IB) Program: This program is perfect for those who have direct contact with traders or an established network within the trading community. As an IB, you refer clients to Exness, and in return, you earn a commission based on their trading activity. It’s a direct way to benefit from the trading volume generated by your referrals. Exness provides comprehensive support, marketing materials, and competitive commission structures to help you grow your client base and maximize your earnings.

- Affiliate Program: If you’re a content creator, website owner, social media influencer, or have a strong online presence, the Affiliate Program might be your ideal fit. You promote Exness through various online channels using unique tracking links. When users click your link, register, and start trading, you earn a commission. This model focuses on digital marketing and wide-reaching promotional efforts, offering flexibility and scalability for your online ventures.

Why Partner with Exness?

Choosing Exness as your partner brings a host of benefits that set their programs apart. It’s more than just earning commissions; it’s about building a sustainable and mutually beneficial relationship.

- Competitive Commissions: Exness is known for its attractive and flexible commission plans, ensuring you get generously rewarded for your efforts.

- Reliable Payments: Enjoy timely and transparent commission payouts, giving you peace of mind and consistent income.

- Extensive Marketing Resources: Access a library of high-quality banners, landing pages, educational materials, and other promotional tools to help you effectively attract and convert clients.

- Dedicated Partner Support: Receive personalized assistance from a professional support team ready to help you with any questions or challenges you face.

- Advanced Reporting Tools: Monitor your performance in real-time with detailed statistics and analytics, allowing you to optimize your strategies and track your earnings effortlessly.

- Trusted Brand: Partnering with a reputable and globally recognized broker like Exness enhances your credibility and makes it easier to attract new clients.

Joining an Exness partnership program opens the door to a world of opportunity. It’s a clear path to generating substantial income by leveraging your network and the strong brand reputation of one of the leading brokers in the industry. Ready to take the next step and elevate your financial journey?

Educational Resources and Trading Tools for Exness Users

Stepping into the vast world of forex trading requires more than just capital; it demands knowledge and the right instruments. At Exness, we believe in empowering our traders, ensuring you have every advantage to navigate the markets successfully. That’s why we pour significant effort into providing a robust suite of educational materials and cutting-edge trading tools, designed for both newcomers and seasoned professionals.

Mastering the market begins with understanding its intricacies. Our educational hub offers a comprehensive pathway to elevate your trading acumen. You can delve into:

- Interactive Video Tutorials: These engaging, bite-sized videos break down complex topics, from basic platform navigation to advanced technical analysis. Learn at your own pace and revisit concepts whenever you need a refresher.

- Live Webinars with Experts: Participate in live online sessions hosted by experienced market analysts. These interactive events provide real-time market insights, strategy discussions, and direct Q&A opportunities, helping you stay current with market trends.

- In-depth Articles and Guides: Explore an extensive library of written content covering every aspect of trading. From fundamental analysis and economic indicators to risk management and trading psychology, our guides are your go-to resource for expanding your knowledge base.

- Comprehensive Forex Glossary: Never feel lost in industry jargon again. Our easy-to-understand glossary demystifies complex terms, building your confidence in trading discussions and analysis.

Beyond theoretical knowledge, practical tools are indispensable for effective trading. Exness provides a powerful arsenal to help you make informed decisions, analyze markets, and execute trades with precision. Here are some of the essential tools available to you:

| Tool Name | How It Helps You Trade |

|---|---|

| Economic Calendar | Track upcoming global economic events, news releases, and data announcements that significantly impact currency valuations. Use it to anticipate market volatility and plan your trading strategy around key events. |

| Market Analysis & News Feed | Receive daily market summaries, expert commentary, and real-time news updates directly relevant to the financial instruments you trade. This keeps you informed about major market drivers and potential trading opportunities. |

| Trader’s Calculators | Precisely determine crucial trade parameters like margin requirements, pip values, and swap costs for any instrument. These calculators are vital for accurate risk management and position sizing before you enter a trade. |

| Tick History Data | Access detailed historical tick-by-tick data to rigorously backtest and refine your trading strategies. Analyze past market behavior to optimize your entry and exit points and improve your system’s profitability. |

Embrace continuous learning and leverage these robust tools. They are designed to simplify your trading journey, enhance your analytical capabilities, and ultimately, help you achieve your financial goals with Exness. Your path to becoming a more confident and successful trader is well-supported here.

Is Exness Broker a Reliable and Trustworthy Choice?

When you venture into the exciting world of forex trading, selecting the right broker is one of your most critical decisions. The question “Is Exness broker a reliable and trustworthy choice?” naturally arises for many traders, whether they are just starting out or have years of experience. Your capital, your strategies, and ultimately your trading success depend heavily on the integrity and performance of your chosen broker.

Reliability in a forex broker goes far beyond just offering appealing platforms or tight spreads. It is fundamentally about security, transparency, and a consistent, smooth trading experience. For any broker to truly earn your trust, they must consistently adhere to industry best practices and demonstrate a genuine commitment to their clients’ financial well-being.

Let’s delve into the core pillars that define a truly reliable forex broker and how Exness measures up against these vital criteria:

Regulation and Licensing

A top-tier broker operates under strict regulatory oversight from reputable financial authorities. These bodies ensure brokers follow fair practices, maintain sufficient capital, and, most importantly, protect client funds. Exness holds licenses from various global regulatory bodies, which provides a significant layer of confidence for its users. This multi-jurisdictional regulation is often a strong indicator of a broker’s dedication to compliance and client safety.Fund Security

How does a broker safeguard your money? Reputable brokers segregate client funds from their own operational capital. This means your trading capital resides in separate bank accounts, shielded from any potential company insolvency. Exness employs segregated accounts, a standard practice among trustworthy financial institutions, ensuring your deposits remain secure.Execution Speed and Slippage

In fast-moving financial markets, quick order execution is absolutely vital. Delays or significant slippage can directly impact your potential profits. Many traders praise Exness for its impressive execution speeds, especially during volatile market conditions. This helps minimize negative slippage, ensuring your trades go through at or very close to your desired price.Withdrawal Process

Getting your money out quickly and without hassle is a cornerstone of trust in any financial relationship. A reliable broker offers a straightforward, transparent, and prompt withdrawal process. Exness is highly regarded for its remarkably fast withdrawals, often processing requests instantly or within a very short timeframe. This efficiency significantly boosts a trader’s confidence.Customer Support

When issues arise, having access to responsive and knowledgeable support is critical. A reliable broker provides multi-channel customer service, available precisely when you need it. Exness offers 24/7 multilingual support, allowing traders from various time zones to get immediate assistance, which is invaluable in a dynamic global market.Platform Stability and User Experience

Your trading platform is your primary gateway to the market. It needs to be stable, intuitive, and rich in features. Exness provides access to popular platforms like MetaTrader 4 and 5, known for their robustness and wide array of analytical tools. They also offer their own user-friendly web and mobile applications, creating a seamless trading environment across different devices.

Considering these critical aspects, Exness has firmly established itself as a significant and respected player in the online trading space. Their consistent commitment to regulatory compliance, robust client fund security measures, efficient trade execution, rapid withdrawals, and comprehensive customer support collectively contribute to a strong reputation for reliability and trustworthiness within the global trading community. While every trader’s individual experience can vary, the foundational elements that define a truly trustworthy broker are clearly and consistently present with Exness.

How to Open and Verify Your Exness Account

Ready to dive into the exciting world of forex trading? Choosing a reliable broker is your first crucial step, and Exness offers a robust, user-friendly platform. Getting your account up and running is designed to be quick and secure, ensuring you can focus on what truly matters: your trading strategy. Let’s walk through the essential stages to open and verify your Exness account, getting you market-ready without a hitch.

Setting Up Your Trading Profile

Opening your account with Exness is a breeze. You’ll navigate a simple online registration form, which only takes a few minutes to complete. Follow these quick steps:

- Visit the Official Website: Head over to the Exness official site. Look for the “Open Account” or “Register” button, usually prominent on the homepage.

- Enter Your Details: You’ll need to provide basic information like your country of residence, email address, and a strong password. Choose your region carefully, as this impacts the available account types and verification requirements.

- Create Your Trading Account: After filling in your details, click to create your account. Exness will then prompt you to choose your preferred trading account type (e.g., Standard, Pro, Raw Spread) and platform (MetaTrader 4 or MetaTrader 5). Don’t worry, you can always open additional accounts later.

Why Verification is Non-Negotiable

Account verification isn’t just a formality; it’s a vital security measure. It protects your funds, prevents fraud, and ensures Exness complies with international financial regulations. Completing this step unlocks full functionality, including unlimited deposits and withdrawals, giving you complete control over your trading capital. Consider it your passport to unrestricted trading.

The Seamless Verification Process

Exness makes the verification process straightforward, typically requiring two main types of documents:

- Proof of Identity (POI): This confirms who you are. Acceptable documents often include:

- A clear scan or photo of your valid international passport.

- Your national ID card (both front and back).

- A government-issued driving license.

- Proof of Residency (POR): This verifies your physical address. Examples of accepted documents are:

- A utility bill (electricity, water, gas, internet) issued within the last six months.

- A bank statement or credit card statement from the last six months.

- A tax statement or government-issued residency certificate.

To submit your documents, simply upload them through your Personal Area on the Exness website. The dedicated verification team typically reviews these documents quickly, often within a few hours to a few business days.

Tips for a Speedy Verification

To ensure your verification goes smoothly and quickly, keep these pointers in mind:

- Clear Photos: Take high-quality, clear, and well-lit photos of your documents. All four corners should be visible.

- Match Details: Double-check that the name and address on your documents exactly match the information you entered during registration. Even minor discrepancies can cause delays.

- Recent Documents: For Proof of Residency, always use documents issued within the last six months. Older documents will likely be rejected.

- Follow Instructions: Pay close attention to any specific instructions provided by Exness regarding file formats or size limits.

Once verified, you’re all set to fund your account and begin your trading journey with confidence. Welcome to the Exness community!

Exness Broker: Key Advantages and Disadvantages

Stepping into the fast-paced world of forex trading requires choosing the right partner. Exness stands as a prominent name, attracting traders globally with its diverse offerings. But like any major player, it comes with its unique set of pros and cons. Understanding these can significantly impact your trading experience. Let’s dive deep into what makes Exness a strong contender and where it might not perfectly fit every trader’s needs.

Many experienced traders flock to Exness for specific reasons that genuinely enhance their daily operations. Here’s a look at what often stands out:

- Ultra-Competitive Spreads: Exness is renowned for its incredibly tight spreads, especially on major currency pairs. This means lower trading costs for you, potentially boosting your profitability over time. Think about the savings accumulating from every trade you make – it adds up significantly.

- Instant Withdrawals:

One of the most celebrated features is the lightning-fast withdrawal processing. You don’t have to wait days to access your funds. This level of liquidity and convenience offers immense peace of mind, knowing your capital is accessible when you need it.

- Flexible Account Types: Whether you’re a beginner or a seasoned professional, Exness offers a range of account types like Standard, Raw Spread, and Zero accounts. Each caters to different trading styles and capital sizes, allowing you to pick the one that aligns best with your strategy.

- Low Minimum Deposits: Accessibility is key. Exness allows you to start trading with a relatively low minimum deposit, making it an attractive option for those looking to enter the market without a substantial initial investment.

- Reliable Customer Support: Their 24/7 multilingual customer support is a big plus. Getting prompt and professional assistance, no matter your location or time zone, can be crucial when dealing with live market situations.

While Exness offers a robust trading environment, it’s also important to consider aspects that might not be ideal for every trader. Being aware of these points helps you set realistic expectations:

- Limited Instrument Variety: While Exness excels in forex pairs, its range of other trading instruments, such as stocks or a broader selection of commodities, might be less extensive compared to some multi-asset brokers. If you plan to diversify heavily beyond FX, you might need to look elsewhere.

- Less Focus on Educational Content for Beginners: Exness primarily targets traders who already have some foundational knowledge. While they offer some resources, absolute beginners seeking extensive step-by-step educational materials might find other brokers more tailored to their learning journey.

- Geographical Restrictions: Like many brokers, Exness has certain geographical restrictions based on regulatory compliance. Ensure that services are available in your region before you commit.

“For many active traders, the combination of tight spreads and rapid withdrawals at Exness makes it an undeniable front-runner. This operational efficiency truly sets a benchmark in the online trading space.”

Ultimately, your choice hinges on your individual trading goals and preferences. Exness presents a compelling package for many, particularly those prioritizing cost-efficiency and swift transactions. Weigh these advantages and disadvantages carefully to decide if Exness aligns with your trading aspirations.

Exness Broker: Final Thoughts and Recommendations

After diving deep into what Exness offers, it’s time to consolidate our findings and provide a clear perspective for any trader considering this broker. Exness has carved out a significant niche in the competitive forex market, attracting a diverse range of participants from novice traders to seasoned professionals.

Our overall impression highlights Exness as a robust and reliable choice, particularly for those who prioritize excellent trading conditions and flexible account options. The platform consistently demonstrates its commitment to providing an optimal trading environment.

Key Strengths We Observed

- Competitive Spreads: Exness is renowned for its tight spreads, especially on major currency pairs, which can significantly reduce trading costs over time. This directly impacts your profitability.

- Fast Execution: Trade execution speed is critical in volatile markets, and Exness delivers on this front. Their low latency ensures your orders get filled quickly and efficiently.

- Diverse Account Types: Whether you’re a beginner or an experienced high-volume trader, Exness offers a range of account types designed to meet specific needs, from Standard to Raw Spread and Zero accounts.

- Reliable Customer Support: Access to responsive, multilingual customer support twenty-four hours a day, five days a week, adds a layer of confidence. Getting quick answers to your questions is invaluable.

- Regulatory Standing: Operating under multiple reputable regulatory bodies enhances trust and ensures a secure trading environment for your funds.

Considerations for Traders

While Exness stands out in many areas, a balanced view requires acknowledging some points that might influence your decision:

- Instrument Variety: Although Exness offers a solid selection of forex pairs, cryptocurrencies, metals, and indices, traders looking for an extremely broad range of less common instruments might find the selection slightly less extensive compared to some multi-asset brokers.

- Educational Resources: For absolute beginners, while adequate, the educational materials might not be as exhaustive or hand-holding as those offered by brokers specifically targeting only new traders. However, experienced traders often find the available resources sufficient.

Who Is Exness Best Suited For?

Based on our analysis, Exness particularly appeals to:

- Active Traders: Those who execute frequent trades will benefit immensely from the tight spreads and reliable execution.

- Scalpers and Day Traders: The low latency and precise order execution are ideal for these high-frequency trading styles.

- Traders Seeking Flexibility: With various account types and customizable trading conditions, Exness accommodates different trading strategies and capital sizes.

- Traders Prioritizing Cost-Efficiency: The competitive pricing model makes Exness an attractive option for optimizing trading expenses.

Our Final Recommendation

Exness solidifies its position as a strong contender in the online brokerage space. For traders prioritizing excellent trading conditions, robust execution, and reliable support, Exness presents a compelling choice. Their dedication to a user-friendly experience, combined with a strong regulatory framework, makes them a highly recommendable broker for most trading styles. If you are serious about your forex trading journey and value performance and transparency, taking a closer look at Exness is definitely worthwhile.

Frequently Asked Questions

What account types does Exness offer?

Exness provides a range of accounts for different traders, including Standard and Standard Cent accounts for beginners, and Professional accounts like Raw Spread, Zero, and Pro for experienced traders seeking lower spreads and specific execution models.

Is Exness a regulated and secure broker?

Yes, Exness is regulated by multiple leading financial authorities worldwide. They ensure fund security through segregated client accounts and employ advanced security protocols like data encryption and negative balance protection.

What trading platforms are available on Exness?

Exness offers the globally popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as the browser-based Exness Terminal and dedicated mobile trading apps for iOS and Android.

How fast are withdrawals on Exness?

Exness is known for its exceptionally fast withdrawal processing. Many payment methods support instant withdrawals, allowing traders to access their profits quickly and conveniently.

What instruments can I trade with Exness?

Exness offers a diverse range of tradable instruments, including major and minor Forex pairs, cryptocurrencies, precious metals, energies, global stock indices, and shares of major companies.